Mackie Research Capital is one of Canada’s largest independent full-service investment firms and published a bullish equity research report on FansUnite a few months back with the title FansUnite – Betting on A Winner! This title is followed by these opening remarks:

“We are initiating coverage of FansUnite Entertainment Inc. (“FansUnite”) with a SPECULATIVE BUY recommendation and a target price of $0.55 per share. Potential catalysts include expansion of B2B contracts and B2C platforms, the award of new licenses, revenue growth, and M&A activity.”

Starting in September 2020 the stock did nothing for almost three months until in November experienced high trading volume and the stock shot up by +240% from a low of $0.22 on November 6, 2020, to a high of $0.75 at the end of the month.

From that point the stock did what all would expect from a penny stock, it skyrocketed to the moon. With this momentum the stock reached a peak of $2.20 going up by another +193% in a few months.

Since then, the stock has slowly lost 63% of its value from its peak and is trading in the 0.6 to 0.8 price range.

After seeing such a poor performance from the stock one can’t help but wonder if the underlying business is performing just as badly.

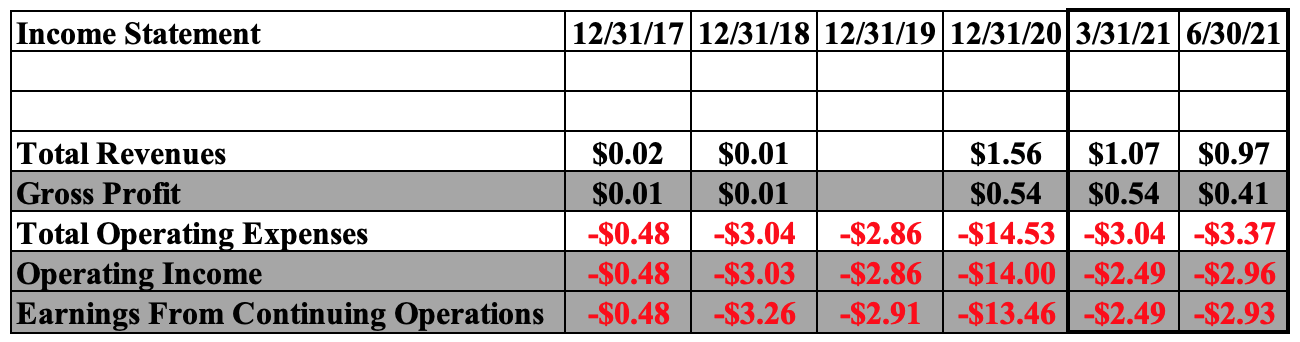

On the contrary, the business seems to have improved over time and is generating more sales than it did at the end of 2020 compared to 2017. Sales have gone from a measly $20,000 to $1.56 million at the end of 2020. This trend has continued into 2021, and in the first quarter of the year, they generated $1.07 million in sales and $970,000 in sales in the second quarter of 2021.

Although they are generating sales since they are still in the beginning stage of development, they do spend the majority of their sales proceeds on selling and administrative expenses. The bulk of which goes to the sales and marketing initiatives that will help propel the company to generate even more sales volume as they continue to scale.

Now that Scott Burton is the CEO of FANS, he was previously a Chartered Accountant by trade and the CEO of Askott Entertainment, the day-to-day operations are now in his hands. Mr. Darius Eghdami who is the former CEO and current President of FANS moved into the role to focus on financing, M&A, and business development.

They have both leveraged their skills to scale the business whilst maintaining the integrity of the business model of improving the user experience for online sports bettors and E-sports bettors. They are attempting to create an ecosystem that will allow their white label brand to be leveraged globally to create platforms that make it easier for end-users.

This sort of initiative will take large amounts of initial investment as they build up the book of business and they must sacrifice short-term profitability for future cashflows. The big question on a lot of investors’ minds is are they able to contain the rapid growth and scale.

Their business, like most software businesses, is operating leverage heavy. This means when sales are growing fast their fixed costs will stay around the same or grow just a little bit allowing them to reap high gross profit margins, but if sales were to drop those fixed costs from the scale would continue to stay put as gross margins and operating margins are squeezed.

This sort of variability in profitability usually scares investors when they see large deficits in the companies earnings on a quarterly basis and can cause the stock to ebb and flow very rapidly.

Others who sit back and enjoy the business for what it’s worth will usually make more money than their speculative counterparts. Although Mackie Research was right about the undervaluation initially the optimism in the stock has died down and its future seems more uncertain and unpredictable.

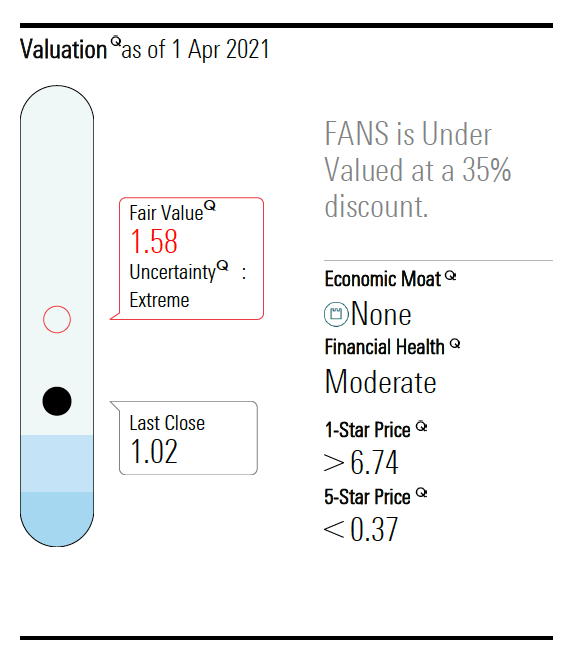

But there is light at the end of the tunnel. As recently as April 2021 Morningstar an American financial services firm headquartered in Chicago that provides investment research and investment management services has set a price target of $1.58 per share. It should be noted that at the time of their valuation the stock was trading just above the $1 mark.

It still holds that there might be room for the stock but that is now more dependent on what the experienced operators at FansUnite will do with shareholders’ funds in the near future.