Sports betting is going to be hot. It already is, but the popularity will just increase. Do you all remember when WallStreetBets first became a thing? During the lockdowns, people were taking their government money and using it to play the US stock market. What isn’t told is the fact that some people took their checks and began betting on sports. DraftKings saw a surge in popularity. Young people are trying to make money any way they can. The stock market is a whole different beast, and takes time to learn the mechanisms etc. There is a bit of a learning curve involved. Sports betting doesn’t really have that barrier to entry. And a lot of young people are heavily invested in sports.

Esports betting is just beginning. Tens of thousands of people watch streamers play video games on twitch. Arena’s for e gaming events sell out. We are on the way where professional e games will be treated as celebrities here, just as they are in South Korea. As esports grows, so will esports betting.

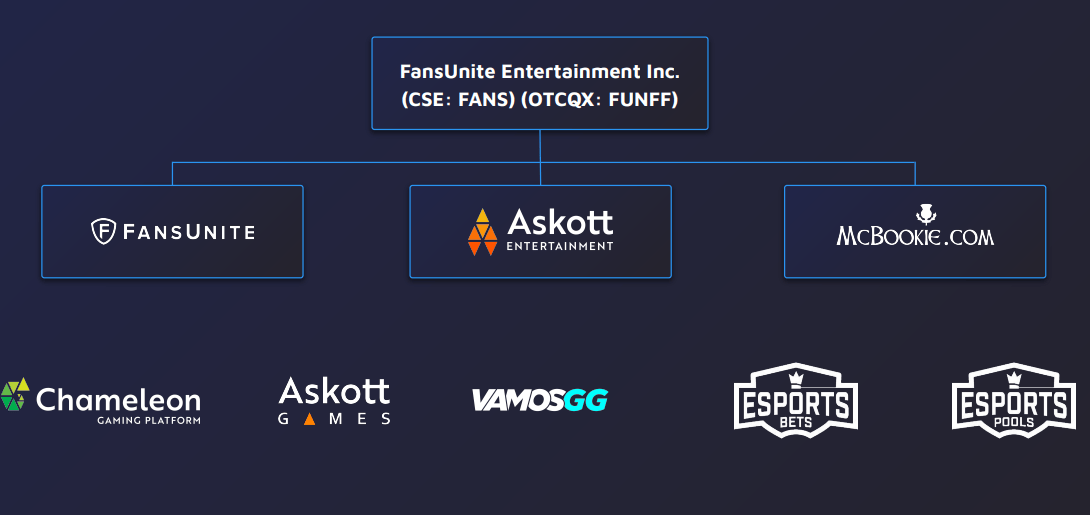

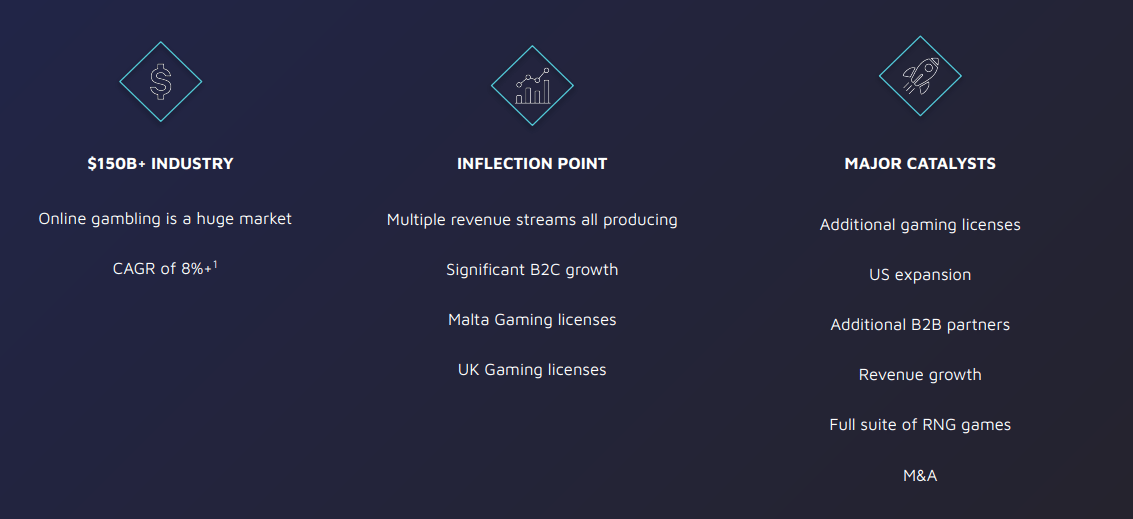

FansUnite (FANS.CN) focuses on technology related to regulated and lawful online sports betting, esports betting, casino and fantasy. And they already have a portfolio churning in revenues.

Experienced management has gotten licensing in Malta and the UK. Access to the US markets is a future catalysts, and FansUnite is well positioned to take advantage of the changes in Canada. I am talking about Canada recently legalizing single sports betting. Both are huge catalysts for FansUnite for growth and expansion to large markets.

I highly recommend you to watch our investor roundtable. Joseph Morton even called this a great play if lockdowns are imposed again. It seems like Delta and Mu variants are coming in hard, cases and hospitalizations are rising. If we go into another lockdown, then we have a repeat of what happened during the last lockdown: government checks will be used to play markets and betting on sports. We saw professional sports take a break during lockdowns before going back to empty stadiums. This won’t be an issue on the esports side of things. But again, this is just a hypothetical case.

In reality, FansUnite has a positive outlook regardless of new lockdowns. The company recently raised $24,792,390. That’s a good chunk of cash for management to create a catalyst for the company and the stock price.

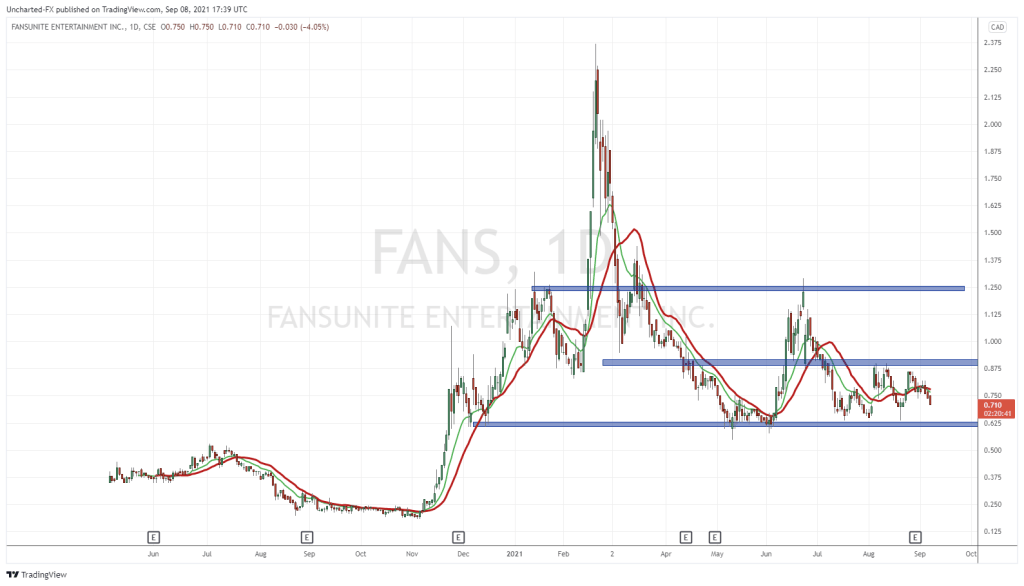

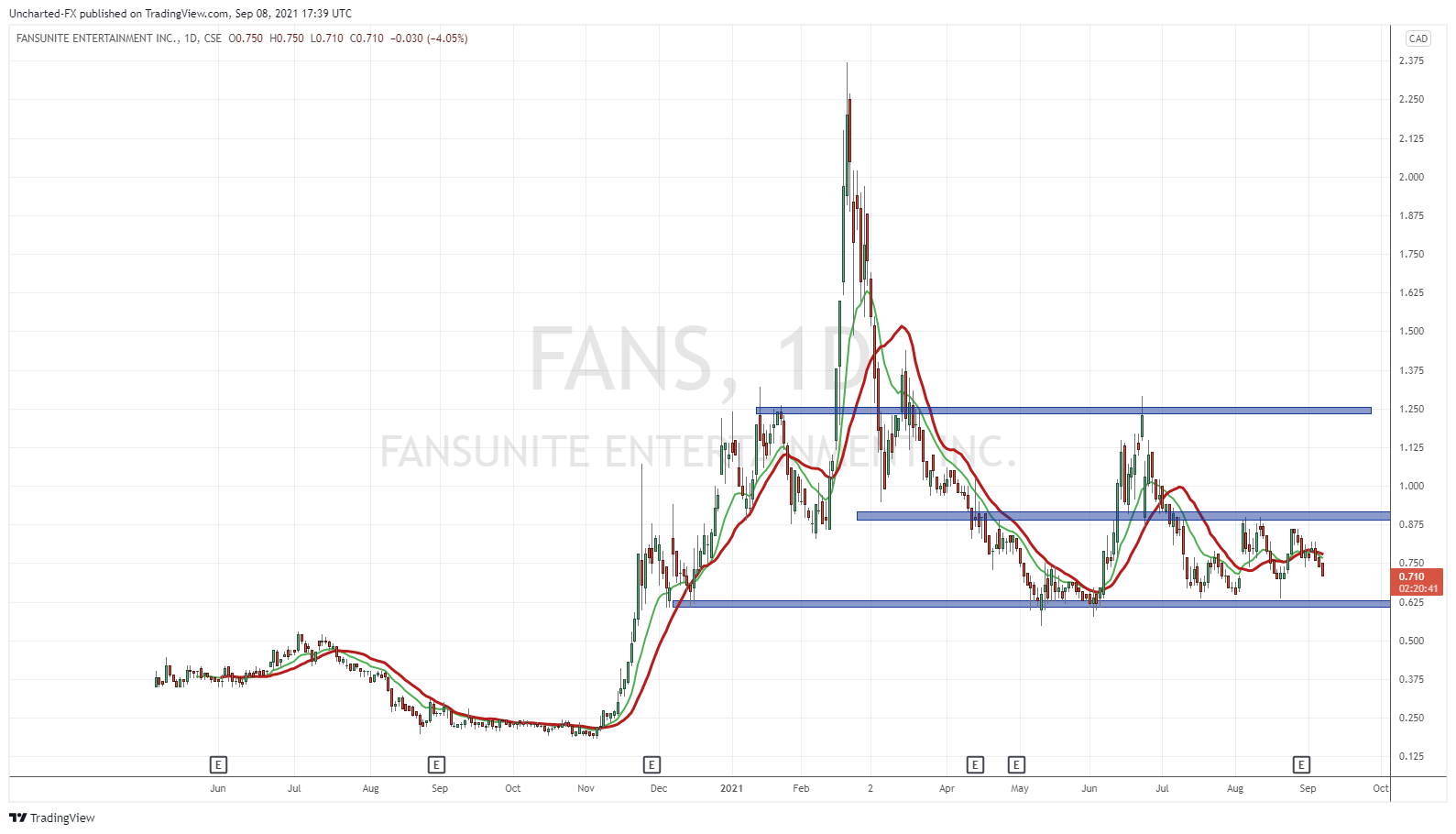

The chart of FansUnite is providing us with an enticing entry opportunity. But first, let’s go back to Fall of 2020. I remember getting a call from my co-worker here at Equity Guru. Telling me how this company is ready to take off. We were talking about it back when the stock was below $0.25. I took a look at the chart, and it was basing. The breakout even met the criteria I look for in order to go long. But I didn’t act. I missed out on the move. My co-worker said it’s not too late. FansUnite is on a roll and good news will be coming out. We got the McBookie deal and numbers as well as licenses. The stock hit highs of $2.37.

After that, the stock fell as people began taking profits. We bounced at $0.625 but found resistance at $1.25. These two zones remain key for us now and going forward.

$0.625 is a huge support zone. Buyers have bid up price at this zone 7 times in the past. I expect an eighth time sometime soon. This now is where we have scenario 1: buy on the retest of support. Since it held so many times, we should expect a wall of buyers there. What I would like to see is a retest and some sort of candle indicating buyers. Note the candle on the 20th of August when we last tested $0.625. A nice large wick. This, or a large green body candle, is what would tell us that buyers are stepping in.

Scenario 2 is awaiting the break of the range. We can see that price is contained between support at $0.625 and resistance at $0.875. This is called a range, or a rectangle style price action. Some traders love to play ranges for quick scalps and trades, but I prefer waiting for the breakout. Because you know momentum will follow.

If we break below $0.625, it would be bearish since it would mean a major support level being taken out. The stock could dump to $0.50 and even lower. This is why I prefer waiting for the breakout to the upside. A close above $0.875 would be bullish, and we would expect to see momentum follow. Sure, we might miss out on some of the move if we bought right at support, but we have a higher probability of the stock moving higher.

Scenario 1 for an entry is great if you are focusing for the long term. But there is a chance the stock continues to range, or worse, breaks down. Entry 2 allows for us to play with the momentum and a major technical break that will catch the eyes of many technical traders. A hot sector and the company has cash, I will be keeping FansUnite on my radar.