Yeah yeah, I’ve been banging on about AMPD Ventures (AMPD.C) for some time now. Though I’ve carried water for the company since it went public and been a long-time investor, I’ve also always suggested a long term investor approach to the high performance computing player.

“It’s going to take some time to be profitable,” I said. And it has.

“The story is technical and tough for a mainstream audience to follow,” I said. And it is.

“When you see sales ramping up, that’ll be your go point,” I said, “Even if it takes a while.” Today, evidence that sales have ramped up.

FY 2021 financial highlights:

- Consolidated revenues for the year ended May 31, 2021, increased by $400,00 to $1.54-million, compared with the year ended May 31, 2020;

- The company almost doubled its monthly-recurring revenue (MRR) to $1.1-million in FY 2021, as compared with $600,000 in FY 2020. Although the rate of increase was somewhat below expectations, due to a general economic slowdown as a result of COVID-19, combined with a global shortage of computing components and long cycles for MRR platform sales, market sentiment based on customer feedback suggests a return to greater economic activity in the sector in the coming period;

- Gross profit doubled to $1-million in FY 2021, from $500,000 in FY 2020. This change continues to validate the company’s strategy to focus on higher-margin MRR rather than one-time hardware sales;

- The company began the fiscal year with $900,000 of cash, raised $2.6-million, spent $1.6-million on operations and $100,000 on assets, closing the fiscal year with $1.6-million of cash;

- The company expects a sales increase in FY 2022, which would make the company EBITDA positive.

If you were hoping for 8-figure revenues, hey, settle down. What you’re looking at here is solid growth without going to a massive debt burden, you’re seeing monthly recurring revenues instead of one-off hardware sales, and you’re seeing actual research being done into their product and how they assist with customer needs, partnered up with some of the biggest names in technology.

The company continued to strengthen technology infrastructure collaborations with leading companies such as NVIDIA Corp., Intel Corp., Dell and Advanced Micro Devices Inc. The company was also selected as the first cloud service provider partner for Lightbits Labs Inc. AMPD and Lightbits, in conjunction with Intel, are in the process of developing a new high-performance storage system for digital content creators. Utilizing Intel Optane technology, the system is designed to be one of the fastest ever built to cater to digital media production-specific workloads;

That’s no small deal right there. Don’t get me wrong, a lot of bullshit tech companies claim Intel and AMD as ‘partners’ because they placed an order for crypto mining rigs, or say they’re Microsoft-approved because Beryl in the back office bought a copy of Excel.

This is not that. This is an actual product development collaboration.

And there are more.

The company released an independent case study conducted by AMD for its AMPD Render solution based on compute nodes with second-generation AMD EPYC processors, comparing the company’s solution against its customer, Bardel Entertainment’s previous render solution. The results of the case study highlighted that the AMD EPYC processor-powered compute nodes that comprise the AMPD Render platform have up to twice the processing power compared with the previous render solution, saving weeks of rendering time;

Worth noting here that not only is AMPD working with these companies, but that they’re seemingly permitted to mention them in news releases, a situation that isn’t always the case. Bardel was one of AMPD’s first clients, and the animation studio has a real obvious interest in lowering its time and cost spent rendering images. If AMD is involved in demonstrating the AMPD program does that, it’s a big deal for all concerned.

The company partnered with Equinix Inc., the world’s largest data centre and colocation infrastructure provider, for the establishment of its European data centre presence in Amsterdam, as well as in other key markets around the world. AMPD expects to roll out its base high-performance compute deployments, known as AMPD Pods, in Amsterdam, Los Angeles and Vancouver before the end of calendar 2021, with additional locations expected to come on-line during the first half of 2022;

I mean, hot damn.

Tell me about how you’re acquiring new customers, AMPD.

In June, 2021, the company acquired Cloud-A Computing Inc., an established self-service cloud computing infrastructure company, with points of presence in Ontario, Nova Scotia and British Columbia. The acquisition is expected to expand AMPD’s footprint across Canada, add over 250 customers to AMPD’s roster and accelerate AMPD’s technology development road map.

That’s a lot of customers joining in on those monthly recurring revenues.

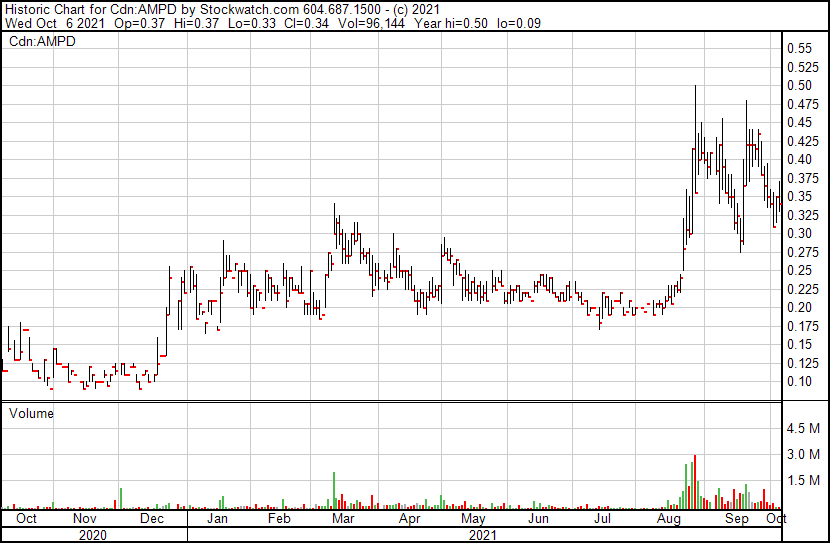

For a long time, AMPD was at the mercy of low trading volume, and one early investor who had a lot of stock to leak out. It appears the new issue is, whenever it runs, it hits a $0.45 line that another seller doesn’t want to cross.

This is understandable – a good number of AMPD investors churned in at $0.20-$0.25 over the last eight months, and a $0.40 sell-off is a nice profit claim for them.

The bigger question is, does AMPD’s newsflow look like it’ll push through that line at some point soon?

It’s tried twice recently, with stock running as high as $0.50 before backing off, and a third try looks like it’s building now.

My thinking is AMPD wants to be over $0.50, and the newsflow and finances are beginning to take flight, but the investor base is still just a littttttttle small to ram through the door.

I believe that situation will be corrected soon. Add it to your watchlist and be ready.

— Chris Parry

FULL DISCLOSURE: AMPD is not a client company, but Equity.Guru is an investor.