We have some 29 companies on our watchlist, all in a variety of sectors, that we’re covering at any one time. Some are clients, some not, some are on deaths door, some are skyrocketing, so we’ve decided to wrap them all up into one monthly wrap so you can keep track of everything at once.

Let’s run down ’em.

URANIUM:

The 101: Uranium stocks run hard when uranium commodity prices are running hard, and that’s the case right now, and likely to continue being the case going forward.

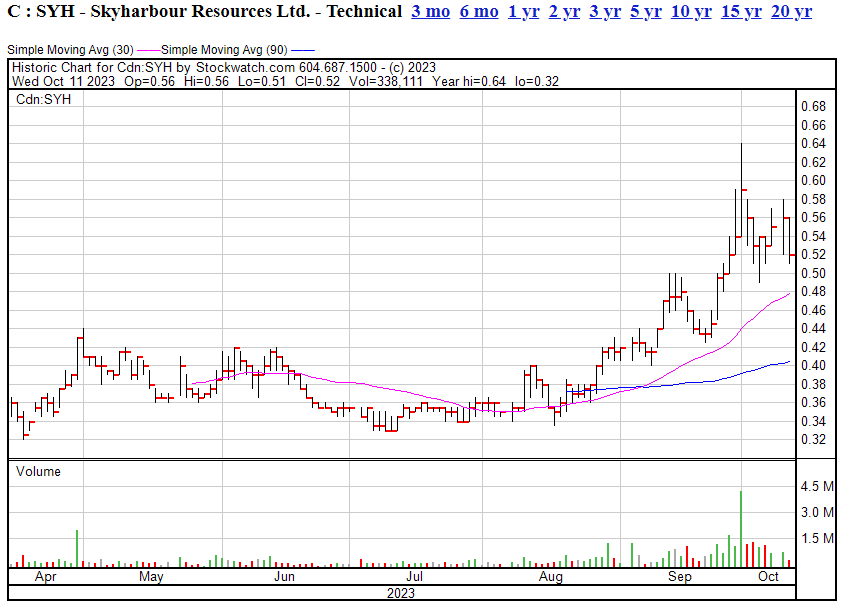

This has been the hot sector of the last month and home to our biggest winners of the period in SKYHARBOUR RESOURCES (SYH.V). Skydaddy went from $0.33 to $0.64 six weeks only to form a base after profit taking at the mid $0.50’s range. This is a solid outing for a company many view as the next big thing in the next big sector. Skyharbour has 24 oars in the water and a multitude of partners, JVs, earn-ins etc. Often companies call themselves prospect generators to hide that no work is being done, but SYH is showing how that model can be a short step beneath the royalty model that some have ridden to riches. If you like voting on the jockey more than the horse, this jockey is a stone cold killer.

Also in the sector, STANDARD URANIUM (STND.V) went on a big run from $0.02 to $0.08 in the space of a month. That too has drifted since on profit taking, and why not when you’re on a quadruple? The new $0.055 level looks like a new base, pegging the market cap at $10m, which I think is pretty fair. There will be some new money replacing the old which may tie things down to these levels for a bit, but the new Standard Uranium gameplan of spreading its bets across several properties instead of going all in on one is a winner, considering the quality of their geo team. That quality has led some competitors to try to headhunt the STND crew, but I’m hearing they’re staying put in the belief they’re onto something strong.

AZINCOURT ENERGY (AAZ.V) had its first stock ripples for some time this month when it announced it had completed exploration on one lithium property and received permits on a uranium property, leading those who have not being paying attention to mutter, “huh? Wha? Azincourt has a lithium property?” Yeah man, the ‘energy’ in their name is doing a little lifting here. Uranium exposure when that’s doing nicely, lithium exposure when that’s doing nicely, and a partnership with Skyharbour as a kicker. The struggle here may be long time investors who have withstood most of the year with no liquidity and are looking for a chance to get out, but Alex Klenman is working double hard and looking to give patient holders a leg up over the rest of the year.

Next sector: CANNABIS COUNTRY:

I continue to believe that the cannabis industry is, by and large, an absolute mess that offers few companies a way to profit, in both Canada and the US. But I do like a handful of smaller suppliers, those without the legacy Green Rush damage and debt attached, and with balance sheets that make sense to me.

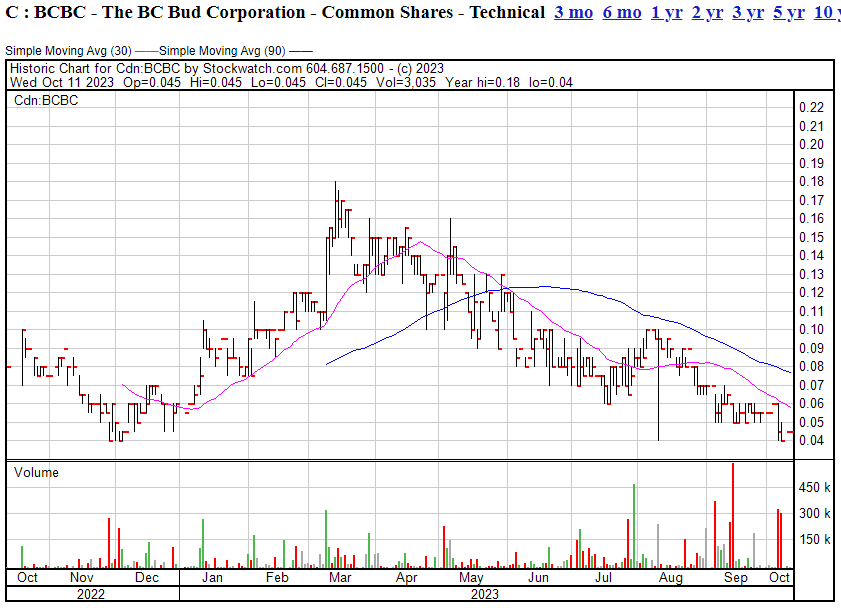

Primary among them is BC BUD CORP (BCBC.C), which serves as a middle man for suppliers depserately looking for consistent revenue for their farmed product, and dispensaries desperately looking for local, craft products with brands that make sense to a wider audience. I maintain that the ‘BC Bud’ brand is one of the best in the business before they spend a single marketing dollar, and that it would do REALLY WELL is licensed in the US.

This was one of our success stories six months back, when interest levels moved the stock up from $0.04 to $0.18 over four months. But the stock has taken a hit since after profit taking, some weak hands pulling out, and larger backers failing to step up. Everyone is in cash protection mode right now, but BCBC is one good financials drop away from a surge, IMO, so i’m looking for dips to grab more.

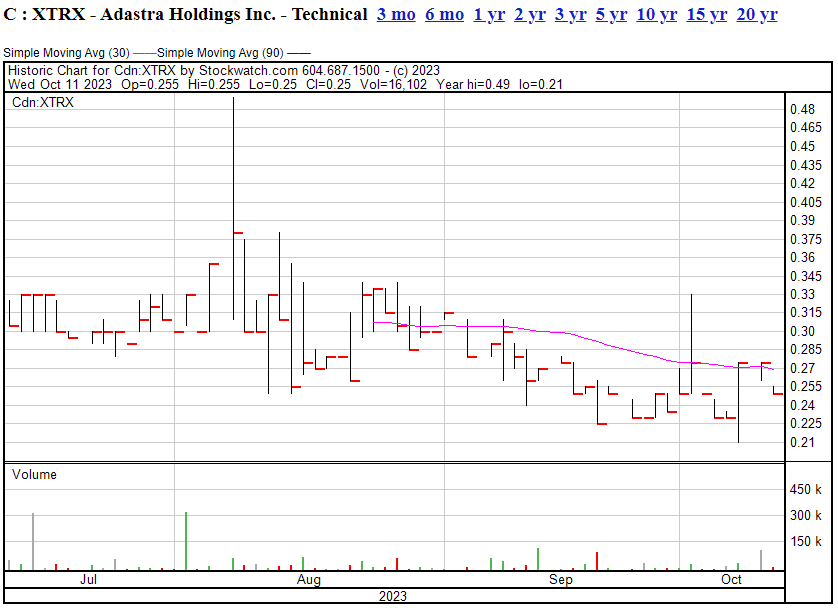

I’m going to toss out a name in this section that isn’t strictly a cannabis company – that is, isn’t ONLY a cannabis company. ADASTRA HOLDINGS (XTRX.C) – while it does do $10m in extractions and cannabis products, there’s a dealers license in the background that comes with a lot of other potential drugs attached, including cocaine (which we referenced recently and is going to be a big deal as 2024 nears based on the number of private companies loading up for an RTO).

We think the market cap on this is indefensively small, especially as they already have what the new companies on the block (such as SAFE SUPPLY STREAMING – SPLY.C) aim to have sometime soon.

Our recent piece on both companies mentioned in this section (among others) saw them both trade to nice gains, so watch this space.

CANADIAN TECH:

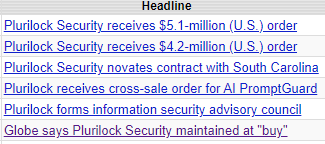

We’ve long enjoyed a working relationship with PLURILOCK SECURITY (PLUR.V), which uses AI to track keystrokes, tempo, tabs, and other indicators of a person’s computer usage to run ongoing ID checks instead of a single login/password to make sure the person at a given terminal is always who they should be. That business is good business, and it’s frequently government work, which ensures ongoing contracts, paid on time. That said, there’s long been a gap between what it costs to run the business and what’s coming in. A small gap, but a gap nonetheless, and that’s given investors the wriggles.

After a strong push to get this to above $0.20 in January, and another to get it over $0.15 in July, the dam broke in September to take it under $0.10.

Based on revenues and market cap, and newsflow, and analyst coverage averaging it as a buy at $0.55, this is scandalous.

iA Capital Markets analyst Neehal Upadhyaya says “the true test on [Plurilock] margin improvement will be in Q3, which is seasonally the company’s strongest quarter in terms of revenue as it coincides with the procurement cycle of U.S. Federal Agencies that are serviced by Plurilock’s subsidiary, Aurora Systems Consulting.”

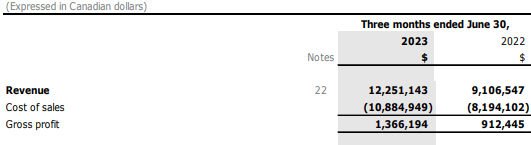

To me, this is the tale of the tape, from Q2 financials:

CAD 12m quarterly revenue, up 30% YOY, trading at a market cap of CAD 10m.

No solvent pubco should be valued at just 85% of their quarterly revenue. That’s madness.

Worth noting: Plurilock isn’t a client at the moment, but we’re still covering them because they’re good folks with a good business and deserve any help they can get and this too shall pass.

Also on the list under tech is Canadian audio hardware/software startup, BEACN WIZARDRY & MAGIC (BECN.V), which makes a line of microphones that are the best we’ve used, with super easy to use software that ramps up the quality of that hardware x10, with a load of little design tweaks that make them way easier to utilize (LED lights, mic-based headphone plugs, USB cabling instead of audio mic cables, in-mic audio processing). BECN has made an early stage shift from B2C to B2B sales that will make life far easier on the sales front going forward, but it has left a revenue gap that they’ve filled with a private placement recently.

We stopped covering them a month in so they could get this change underway without having to engage in short term panic plays to keep new investors happy. They’ve had their time to streamline and now it’s time to pedal down on the stock. Go time.

Really though, buy the mic. And the mixing board. They’re worth every penny.

An interesting deal we just woke up to is FENDX TECHNOLOGIES (FNDX.C), a nanotechnology deal that has used emerging tech developed by McMaster University and licensed to them that consists of a thin film or spray-applied product that fends off bacteria and virus, stopping them from settling on the protected surface. This would be massive for places where such things are a constant threat – hospitals, doctors clinics, transit vehicles, schools, theatres, sports arenas, restaurants and kitchens. Yeah sure, this is one ripe for the covid crowd, but covid is still among us and a lot of other pathogens are likely to land in the future.

They’re developing this tech quickly, pilot runs have already happened, and one huge manufacturing contract would have the product quietly in front of potentially millions of consumers without them needing to be individually sold to.

I got in pre-public markets debut through Aaron Chan at Cannacord and have done well out of it so far.

Early days, but an impressive CEO has done it in this sector before. Watchlist away.

3D MODELING:

I wouldn’t normally put this as its own sector, but we rep three great companies, including two sister subsidiaries of the main jam, Nextech3D.AI.

There’s been name changes to work in more of what this outfit does, but in essence the core company does business with those who want 3D models created, generally from CAD files but also, recently, using AI tools who can do the CADing for you.

TOGGLE3D.AI (TGGL.C) has a system that lets you upload your CAD and, in a few button pushes, provides you with a full on 3D spinnable model, usable for ecommerce or augmented reality, with a process so easy I did it myself inside three minutes from sign up with no prior knowledge.

ARWAY CORPORATION (ARWY.C) takes that to the next level by allowing you to turn a floormap into an AR platform, that can guide people through your facility, present them with options like coupons or things to purchase when they get there, and utilize those 3D models as avatars, characters, signs, whatever.

And NEXTECH3D.AI (NTAR.C) is the glue that holds it all together, the primary target that spun the others out when the company realized it could unlock a lot more value by giving what was once in-house tools a new life as standalone tech companies.

I’ve done stories and interviews on all three and, though the market is slow to realize the upside potential, these groups are deeply entrenched in the worlds of AI, 3D, the metaverse, Augmented reality and virtual reality, and their usability makes many businesses better, from game development, wayfinding, ecommerce, real estate, and more. When AMAZON (AMZN.Q) is using them with increasing regularity as a service provider, the due diligence has been done by better people than me. Go look.

In recent news, ARway has partnered with three agencies in bringing their wayfinding tools to the masses; AI Africa, a digital agency and marketing company specializing in retail and event organization, which has a monthly social media engagement of five million followers, Vraxa, one of the top international production houses specialized in 360 videos and augmented reality/virtual reality/extended reality solutions, and Brink Interactive, an agency of branding, customer experience, marketing technology, strategy and account services experts. My belief is the best way to spread the word on this tool suite is to have those already existing in the wayfinding and events space adding their services as a value add, and this seems to be the track.

TGGL is sliding in share price, which has Nextetch CEO Evan Gappelberg buying stock in bunches.

Next up: CANADIAN PHARMA/MED-TECH:

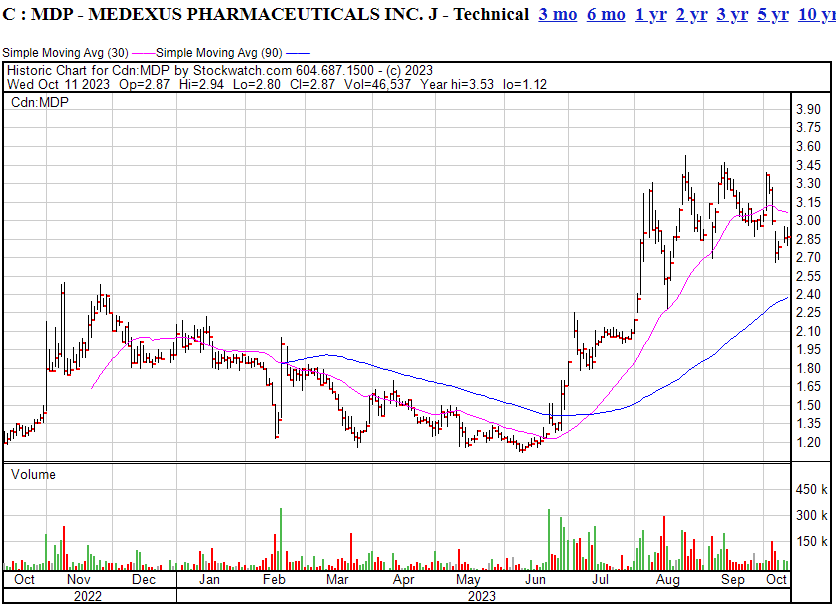

During the last couple of years, we’ve barked about MEDEXUS PHARMACEUTICALS (MDP.T) and how they were doing everything right and still fighting off traditional Canadian smallcap investors negativity, and for all that time we’ve been right.

A recent release about one of their SKUs, Treosulfan, which reinforced the understanding it may not get through FDA trials until later next year, saw the stock carved up again last week, undoing a multi month surge that had taken it deep into the $3 range.

That said, the company has multiple other drugs that are selling now, pointing to a US $120m year. Considering that, even after it tripled over two months fropm $1.10 to $3.50, the market cap is just US $50m, this should be another multibagger in the making.

Full disclosure: We took some profits offer the table when it hit $3.20 and let our original stake ride, but might go back in for more at the present $2.80 range. Also, the company ceased to be a client a few months back so, while we still have an interest, we consider this one a job well done for everyone from readers to the company proper, and we’ll be talking about it less going forward.

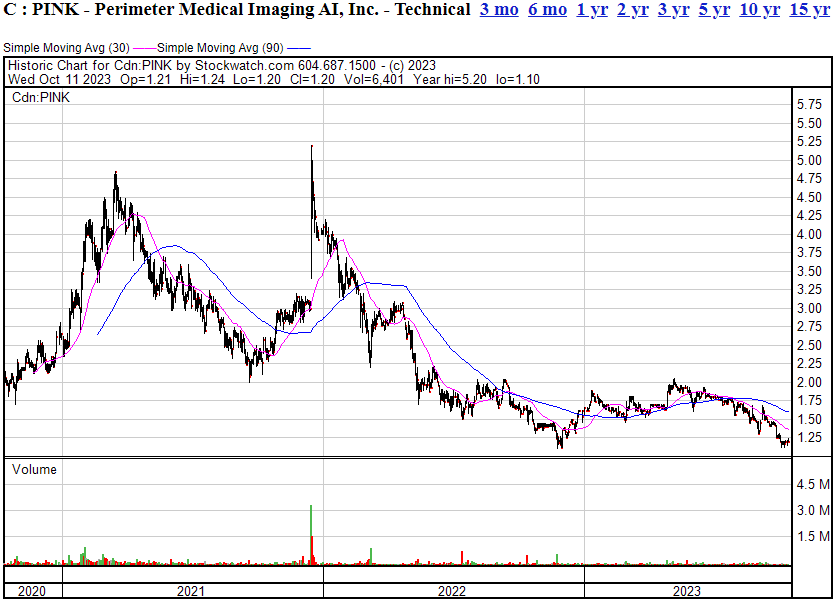

Also in this sector, a company that we talked about a lot nack in 2020, Perimeter Medical Imaging AI (PINK.V).

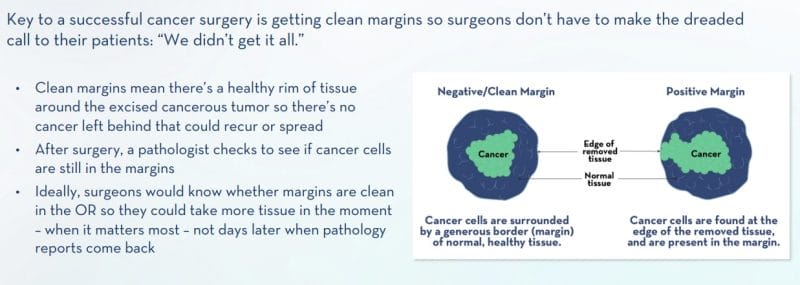

We really liked this company way back when, because it put paid to the old line, “We’re not curing cancer here..” While PINK doesn’t cure cancer directly, it has technology that allows a surgeon to see, in the OR, within 15 minutes, whether said surgeon has removed all the cancerous tissue they set out to remove, or whether more cutting needs to be done. Considering 23% of all breast cancer surgeries require the patient to go back for more surgery later, this is a money-saving, life-saving, time-saving, emotion-saving piece of tech that, it appears, end users really like.

The problem from a public markets perspective is, this is the exact same story that PINK was telling in 2020.

What PINK has to do now is show the US healthcare system that everyone will do well buying and using their tech. Such industry-wide sales cycles aren’t easy and, frankly, Perimeter have been in this part of their business model since we last talked about them, so you’d hope the rubber would hit the road soon. Adding AI to the end of their company name may have bought in a handful of new investors but something needs to happen to accelerate this thing soon – an acquisition, an FDA decision, a big contract – something.

The company, as things stand, loses $10m a year, which is fine when what you’re doing is refining your tech, getting regulators to okay it, and convincing hospitals to buy it – and you have two more years of runway before you need to go raise more dough. But at some point investors need to see a potential catalyst for profits coming up.

We were in back in 2020 when it ran from $1.50 to $3+ and, frankly, haven’t looked since. To see that, today, you can get it cheaper than it was back on its first day on the exchange is bonkers, but that’s what you get when you’re not actively telling your story to the market.

The recent slide to under $1.20 though has me considering going back in. I want to be part of saving the lives of thousands of women, and if I can make money while doing it, all the better.

Next up THE GULP SECTOR:

So-called because anyone holding these is thinking to themselves.. gulp:

AMPD VENTURES (AMPD.C) is halted by the CSE right now as it goes through a reorganization process and fights off winding up. The pity here is this company was maybe two months from everything coming together but a combo of executives bailing to save their own skin, sales agreements taking longer than expected to close, and a ‘take no prisoners’ market pushed them into a corner where the only sensible option was to give themselves a little breathing room. I still hold this stock, mores the pity with a $0.030 average, so am hoping to see them come crashing out of receivership with a wet sail, but also comfortable in the knowledge that nobody still there gave anything but their best efforts.

X1 ENTERTAINMENT (XONE.C) still exists, but from what I can see might not have any assets left. Late to the e-sports game, but those who got to e-sports early didn’t fare any better. As I said from day one of that sector’s existence, being in the business and making money in the business are two different things, and nobody has made money in e-sports, despite the billions of eyeballs it attracts. When the hot game changes from year over year, when the players retire at age 19 as girlfriends and school and jobs come calling, when sponsors are stretched across a hundred different entities, and when Big Tech already owns all the platforms those eyeballs are attracted to, there’s not much left.

BRASCAN RESOURCES (BRAS.C) changed its name to NORDIQUE RESOURCES (NORD.C) and announced a new CEO when former CEO Bal Johal clutched his ticker and said it was all too much. What’s different? Well, there are less properties in the group now, which isn’t much of a change since there was no way an undercapitalized resource explorer was going to do anything on three of the four properties they had. New CEO Jo Shearer is a longtime mining consultant, so he knows his stuff and will likely be better at focusing his company on where it should be focused. I haven’t talked to him since the changeover but still hold far more stock in this than I’d like. Until I hear a plan, we hold..

LIFEIST WELLNESS (LFST.C) continues to kick along in its effort to refocus itself as a wellness company over a cannabis company, and while that’s not bringing massive share price wins, but is at least giving itself a potential future. Meni Morem continues as CEO, a position he was thrown into after the former manbunned guy bought his company and bailed, and which he has, respectfully, continued in out of empathy with shareholders rather than personal opportunity. The wellness push is an improvement over the Cannmart business model of old but it’s not going to be easy work. Sales will be the metric LFST will be judged on, and quick.