On September 9, 2021 Manganese X (MN.V) released a 133-page Technical Report summarizing all exploration work on the property including historical and recent diamond drilling by Manganese X.

The report forms the basis of the Mineral Resource Estimate (MRE), and makes recommendations for further exploration and development work on the Project.

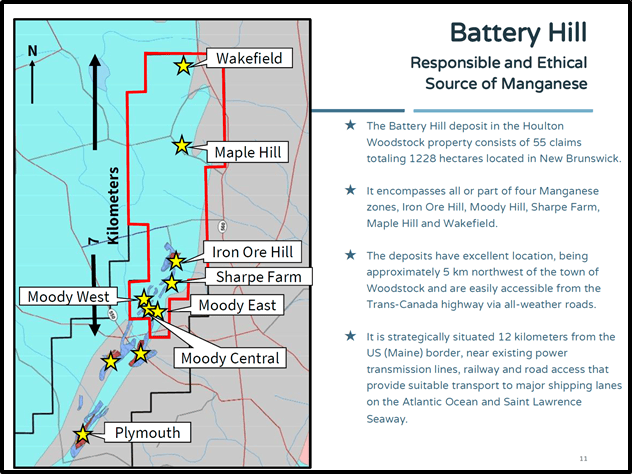

The Battery Hill Project includes Mineral Claim 5816, which consists of 55 mineral claim units (1,228 hectares) located near Woodstock, New Brunswick, and Mineral Claim 5745, consisting of 8 mineral claim units (179 hectares) located 10 km to the southwest. Both titles are 100% owned by Manganese X.

In terms of investor awareness, manganese is a poor cousin to gold, silver, copper and lithium.

But it’s a vital ingredient in the steel industry and The Electrification of Everything.

“This brittle, silvery-gray metal was recently added to a list of 23 elements critical to the US economy,” reports Greg Nolan, “Manganese X appears to hold significant tonnage potential in the subsurface layers of its 1,228-hectare flagship Battery Hill Project in mining-friendly New Brunswick.”

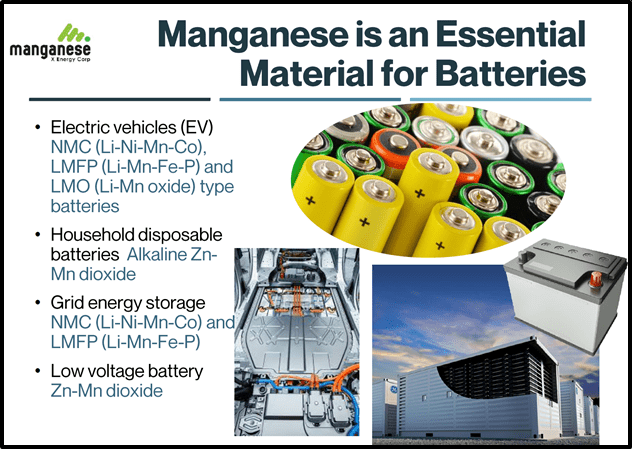

Manganese Demand Drivers

- Manganese is an essential and irreplaceable element used in steel production.

- The steel industry projects a 2% growth per annum.

- Manganese is a significant, essential component of the rapidly growing electric vehicle market

- Manganese’s clean energy applications are an upside and makes it preferable to Cobalt and it’s ethically challenged sourcing issues.

- Manganese enhanced batteries are more robust, higher density and much less toxic than Cobalt

- Manganese is far less expensive per ton to produce than Cobalt.

- The forward momentum of manganese will be driven by integrated companies that are disrupting the currently saturated vertical market segments. Key material for integrating solar and wind renewable energy.

Manganese prices are surging in China after Guangxi province ordered restrictions at production plants.

“The European manganese alloys markets, currently trading around 13-year price highs, were likely to rise further – at least in the short term,” stated Fast Markets on September 6, 2021, “due to firm fundamentals of tight availability and strong demand.”

“Other factors such as an acute shortage of shipping containers and record high freight rates were also making replacement costs very expensive,” added Fast Markets, “While manganese metal prices at near-25-year peaks were seen to be cementing market strength in steel manganese alloys.”

“The completion of the Technical Report and Mineral Resource Estimate for our Battery Hill property confirming a significant Mineral Resource is a major step in the development of this deposit and is highly supportive of our confidence in this project. The MRE will serve well as a key component of our Preliminary Economic Assessment, and we look forward to the completion of that next important step”

- Perry Mackinnon VP of Exploration for MN.

Highlights:

- Battery Hill project mineral resource estimate consists of 34.86 million tonnes of Measured and Indicated mineral resources grading 6.42% Mn, plus an additional 25.91 million tonnes of Inferred mineral resources grading 6.66% Mn utilizing a 2.5% Mn cut-off grade that reflects total operating costs having “reasonable prospects for economic extraction.”

- Sensitivity analysis of the Battery Hill deposit to cut-off grade indicates 12.25 million tonnes of Measured and Indicated mineral resources at 8.77% Mn and 10.61 million tonnes of Inferred mineral resources grading 9.05% Mn utilizing a cut-off grade of 7% Mn.

- The PEA will evaluate the economic and commercial viability of the Project to produce premium ultrahigh-purity battery-grade manganese products for the burgeoning North American electric vehicle and energy storage sectors.

- Project economics will be maximized by optimizing production schedules and starter pit outlines towards higher grade material such as indicated above.

- The very large mineral resource base underlines the Project’s potential to sustain long term production.

Within the Technical Report, Mercator recommends preparation of a Pre-Feasibility Study for the Battery Hill project upon receipt of a positive economic evaluation from the Preliminary Economic Assessment (PEA) currently in progress.

A PEA answers the question, “How best can this deposit be exploited to maximize its profits for investors?” Unlike more advanced studies, a PEA can use inferred resources for its operational and financial modeling.

A positive PEA will typically create an upward re-valuation of the company.

“With a positive outcome from the PEA, there appears to be sufficient tonnage of Measured and Indicated mineral resources to potentially sustain long term production while we explore the potential of the other Mn mineralization on our 1228-hectare property,” added Kepman.

“Manganese is a significant modern metal,” wrote Kepman in June, 2021, “More than 90% of worldwide utilization is attached to the steel and development industries, with China being a substantial buyer of the world’s fourth most widely used metal: Manganese.”

“Despite its strong base of interest, the costs of acquiring manganese have in the last few years continued to be volatile, due to its problematic sourcing either from its ethically challenged mining practices in Africa or producing a high-quality manganese by utilizing toxic selenium in Electrolytic Manganese Metal (EMM) process”.

“We foresee greater demand for manganese arising from electric vehicle EV expansion, resulting in an upward price for manganese,” explains CEO Martin Kepman:

1) Tesla’s projected to put into operation 5 new Gigafactories around the world in the next 5 years

2) 6 new Gigafactories planned by Volkswagen by 2030

3) Ford is using its signature 150 pickup truck series and launching their lightning EV 150 truck, which also converts into a generator, to lead the charge. Ford is forecast to invest 22 billion through 2025 into their Hybrid EV vehicle projects.

4) GM is investing 10 billion dollars in developing 25 EV models

5) China is planning to phase out the internal combustion engine by 2035.

“Manganese is beginning to play a critical role in the evolution of new off-grid power storage systems, and cutting edge solar energy (storage) technologies,” wrote Equity Guru’s Greg Nolan on September 2, 2020.

“Manganese continues to be spotlighted as a greener and more ethically friendly metal that could replace cobalt,” stated Kepman, “We are making excellent progress towards our goal of producing ultrahigh-purity battery-grade manganese products for the growing electric vehicle and energy storage sectors.”

“There is no manganese production in North America and there is 100% reliance on foreign imports,” added Kepman, “Manganese X is well positioned to capitalize on this geo gap in the North American supply chain and we are looking forward to continue our discussions for potential offtake agreements.”

The purpose of the 133-page Technical Report published September 9, 2021 is to provide technical disclosure in support of the Company’s first MRE for the Battery Hill Project.

- Lukas Kane

Full Disclosure: Manganese X is an Equity Guru marketing client.