Harborside (HBOR.C) announced today that it has purchased 100% of the issued and outstanding equity interest of Accucanna LLC.

“We are thrilled to add our Desert Hot Springs retail dispensary into our California retail store portfolio…As one of only two drive-through retail locations permitted in the state, and with our strategic location in the Coachella Valley near the freeway, we are well positioned to continue to service the local community and support the robust year-round tourism industry,” said Matt Hawkins, interim chief executive officer of Harborside.

Accucanna is the license holder of the Company’s Desert Hot Spring retail dispensary location (DHS). In addition to acquiring Accucanna, the Company will also obtain the real property associated with DHS for a total consideration of USD$4,918,263. Prior to the closing of this acquisition, Harborside had been operating the dispensary since December 2019, under a management services agreement. At the time, this represented the Company’s first retail locations outside of the Bay Area. This 4,800 square-foot facility is strategically located between Los Angeles and Coachella, and serves both medical and adult-use customers with a variety of cannabis products, including Harborside’s own key-branded line of cannabis flower.

This is California we are talking about here; the largest state economy in the US and the fifth-largest economy in the world. With this in mind, in 2020, California retail stores sold $4.4 billion worth of cannabis products indicating almost 50% growth year-over-year. In total, the Golden State represented approximately 27% of legal sales in the US while the combined sales in Colorado, Washington, and Oregon represented roughly 29% of US sales. Looking forward, California’s recreational cannabis market is expected to reach $5 billion, with legal recreational cannabis accounting for 61.5% of the overall market. Long story short, this is great news for a company like Harborside, which has an expansive presence in California.

Upon the closing of the acquisition, Harborside paid the aggregate purchase price consisting of approximately USD$1.5 million in 15,793.40 multiple voting shares, USD$784,646 in cash consideration for the transfer of the equity interest of Accucanna to the Company, and USD$2.6 million in cash for the property. Harborside expects to finance all, or a portion of the purchase price owned for the property after closing the acquisition.

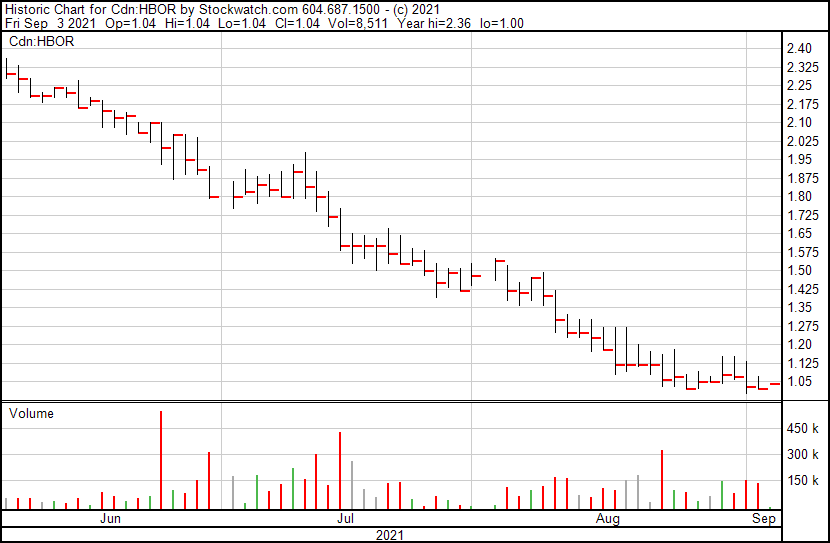

Harborside’s share price opened at $1.04, up from a previous close $1.02. The Company’s shares are up 1.96% and are currently trading $1.04.

Full Disclosure: Harborside is a marketing client of Equity Guru.