The Canadian Dollar, or the Loonie as we call it, has nearly given back all its gains for 2021 year to date, after a stellar move. This is occurring as investors flock to the US Dollar for safety. Much of the thought on the US Dollar has been that it would weaken due to the Fed’s monetary policy, and all the money printing. Yet it still remains the choice currency in a risk off environment and as a safe haven.

This is because there is nothing better in terms of safe haven fiat currency. Some would argue the Japanese Yen. In fact, there is a strong correlation between the Yen and markets. Whenever Stock Markets fall, the Japanese Yen appreciates. The Yen is seen as a safe haven due to the fact that the Japanese government is stable, and the people of Japan save a lot of money. The debt is backed by the high savings rate.

I will throw Gold in the mix too. I see it as a currency rather than a commodity. You know, just the classical economist in me. Well Gold is seen as a safe haven when everything goes FUBAR. And FUBAR is the key. When the Dollar strengthens, Gold falls. This negative correlation is quite strong. However, there are times when both the US Dollar and Gold move up together. Today’s price action is an example, but we had a major example in 2008. Gold and the US Dollar can move up together when there is a confidence crises: when people lost confidence in the government, the central banks and fiat money. To be completely honest, it seems a situation like this is upcoming in the not so distant future.

Some remember the Swiss Franc being a safe haven. The country is safe, has a lot of Gold, is neutral, has a lot of foreign money in Swiss banks, and never really has an political issue leading to instability. To be honest, not many people can name the current Swiss President…or past President’s. You just don’t hear about him too much. But the Swiss National Bank is notorious for its action back in 2015 when it broke the 1.20 Peg against the Euro. I remember. I was a trader who witnessed the insane volatility. Thank God I did not long EURCHF that night. With this type of interference from the central bank, the Swiss Franc lost a bit of its safe haven status.

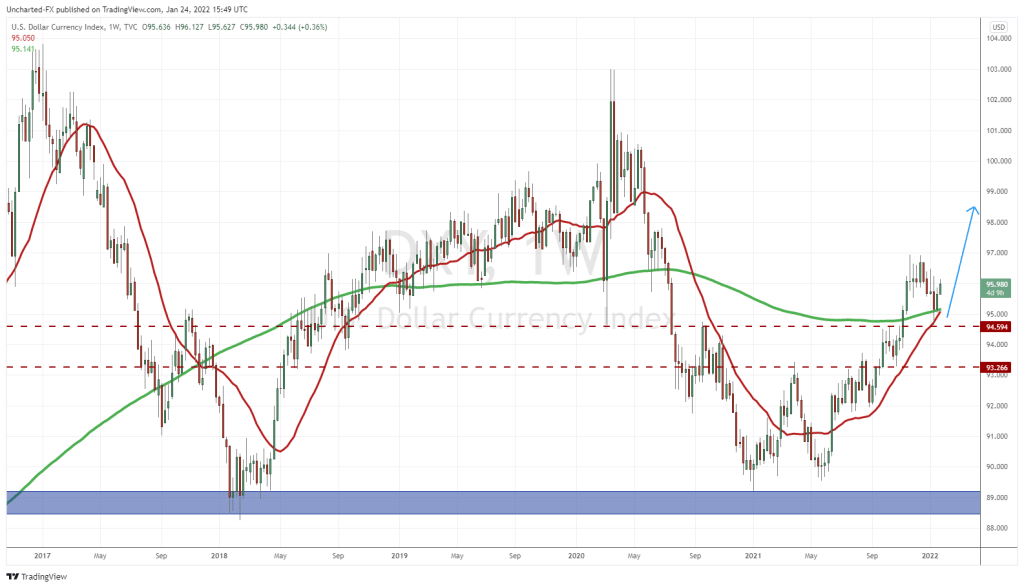

Then we come to the US Dollar. The pre-eminent safe haven currency. Although some shake their heads and say, “No! The Dollar is dying!”. They have a good case too. The US looks broken politically with all the division which probably gets worse going forward. The monetary policy from the Federal Reserve looks reckless, with easy money creating bubbles in all assets and markets and widening the inequality gap.

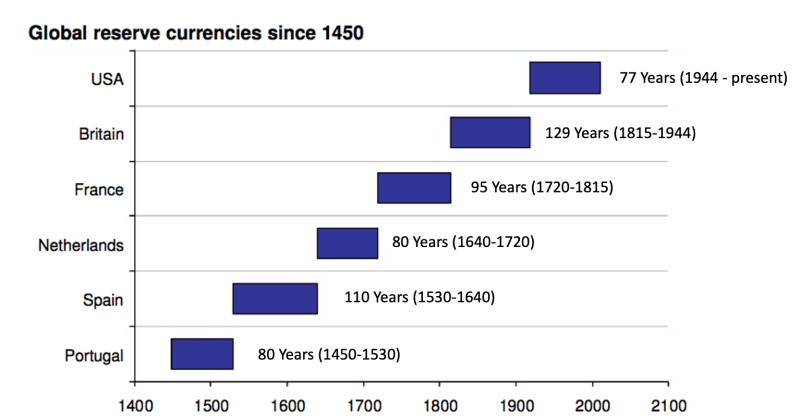

But the US remains the current hegemon with the strongest army and the most robust financial markets that anyone in the world can play. In terms of the Fed, they sort of are the central bank of central banks. Recently, the Fed has made steps to dollarize the world by opening Dollar swap lines with central banks all over the world. This is because the Fed can print US Dollars willy nilly without having to worry about the debt. Why? Because the US Dollar has reserve status meaning there is ALWAYS artificial demand for the Dollar. The French called this exorbitant privilege, and this has allowed the US to print more Dollars. Even in the Gold Standard days, the US would print excess Dollars and buy out European companies. The French called the Americans out for printing more Dollars than they ought to be, since the Dollars had to be backed by Gold reserves at the time. When the French called their bluff and demanded their Gold back, Nixon shut the Gold window and effectively took us off the Gold standard.

I didn’t want to get too into the safe haven history, but I believe it will be important in the upcoming months and maybe even years as central banks continue their currency war. But for now, the US Dollar is THE safe haven. Dollars are in demand even in countries where the local currency has hyperinflated.

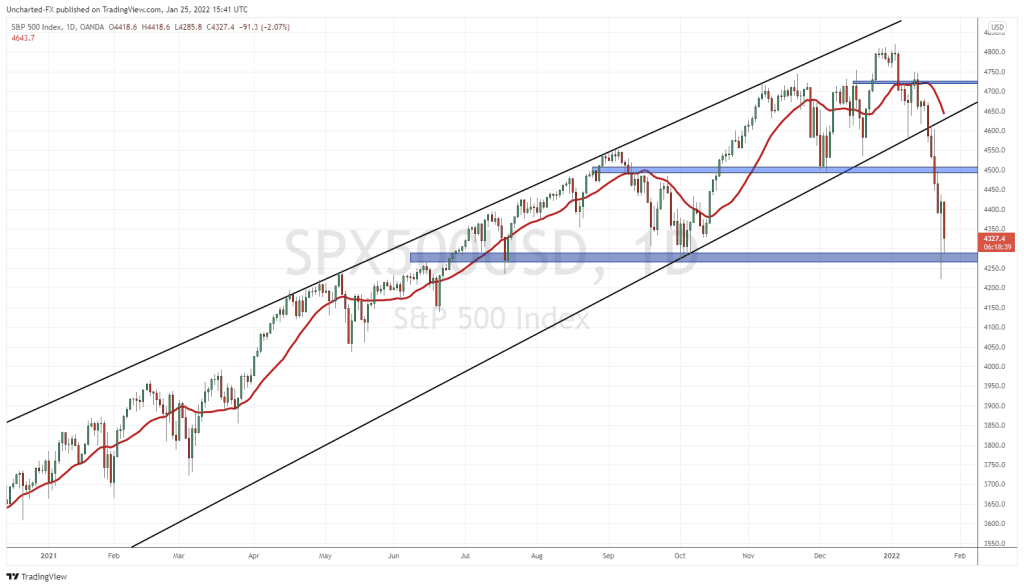

When we are in a risk off environment, or one where money is LEAVING stocks for bonds and the US Dollar, it is a sign of fear. Recently, the Stock Markets have been seeing this fear. Today we are up green, and big, but we still have to wait for candle closes to confirm we are in safety. But this is looking strong so far. Some attribute inflation headlines for this fear. However, the Delta variant and fears of new lockdowns is what is impacting the markets. The Delta variant now accounts for 83% of the cases in the US and is more transmissible. Covid deaths and cases have risen in US states for the first time in months. This is developing so we shall see what happens. Follow the UK, as Prime Minister Boris Johnson has dropped all restrictions at a time when cases were increasing. Leading medical experts have warned about opening too fast. If the UK were to go into another lockdown the Markets may not react well.

Technical Tactics

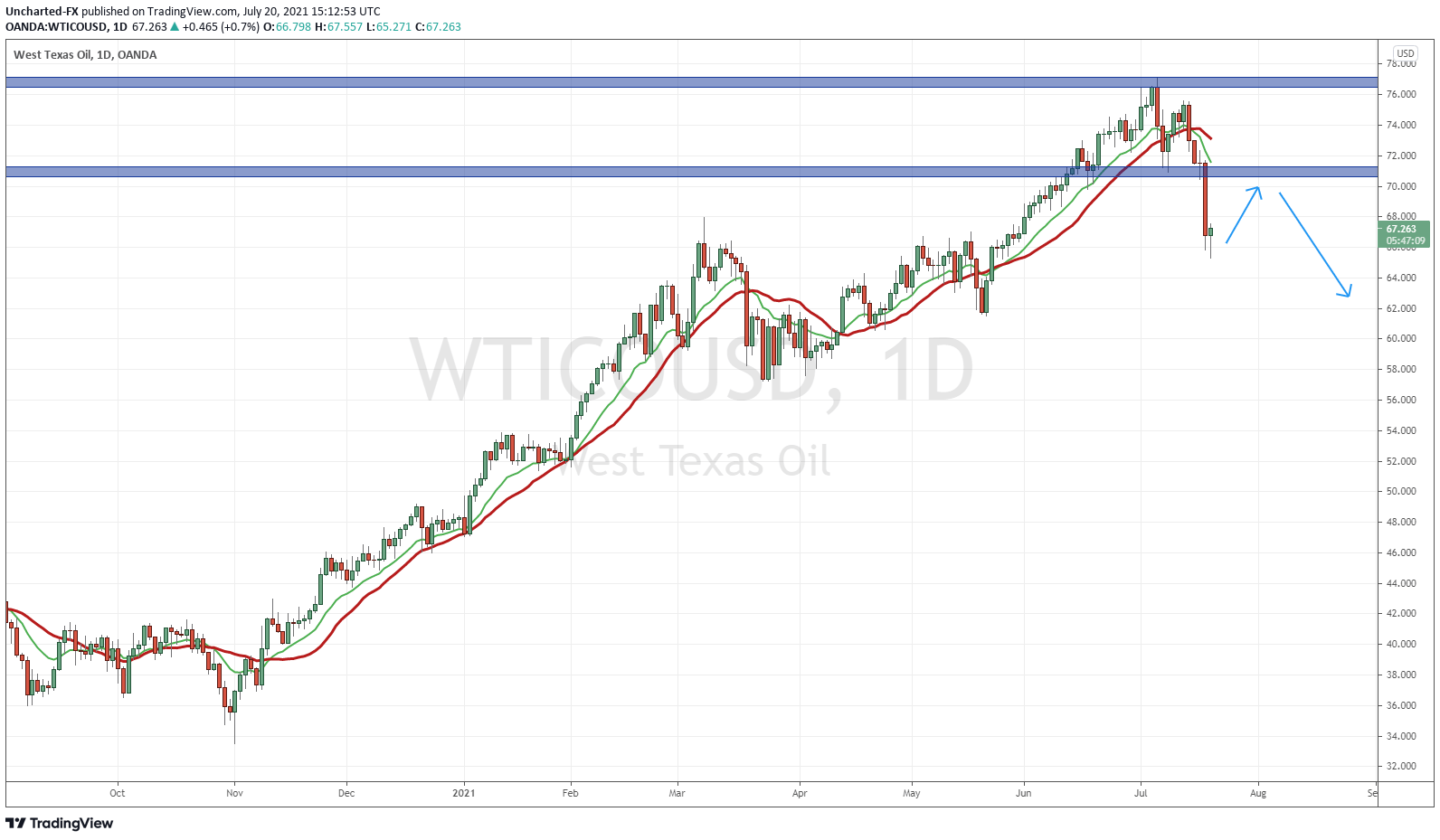

In this recent uncertainty, Oil has also been hit. In fact Oil has triggered an Equity Guru style reversal pattern. Oil is falling due to fears of fresh lockdowns. We remember what happened the last time…single digits and then negative Oil prices.

Why do I bring this up? Because the Canadian Dollar is highly correlated with Oil. The Loonie is a commodity currency, and just like the Russian Ruble and the Norwegian Krone, Oil plays a large impact.

If we see a case where the US Dollar strengthens and Oil weakens…the Loonie will weaken further and then give up all its 2021 gains. Sucks for us Canadians who were eager to finally cross the border for shopping just as they are about to re-open.

Interest Rate differentials plays a huge part in the currency market. Money tends to flow to the currency with higher interest rates. Between the USD and the CAD, the Fed has said that they will taper sometime at the end of 2023. Although other Fed Presidents say it will happen sooner due to inflation. The Bank of Canada is looking to raise rates in the second half of 2022. I recently covered the latest Bank of Canada Interest Rate decision. The statement was all central bank speak for pages, and then the end basically said we are uncertain. The Loonie depreciated after the Bank of Canada statement, so I think the majority of the markets saw what I saw: confusion.

But with Delta variant resurging, this uncertainty is warranted. Perhaps this variant disrupts and monetary policy remains the same for longer. More cheap money for longer. Good for stock markets…and likely a bid for the US Dollar if fear and uncertainty persists.

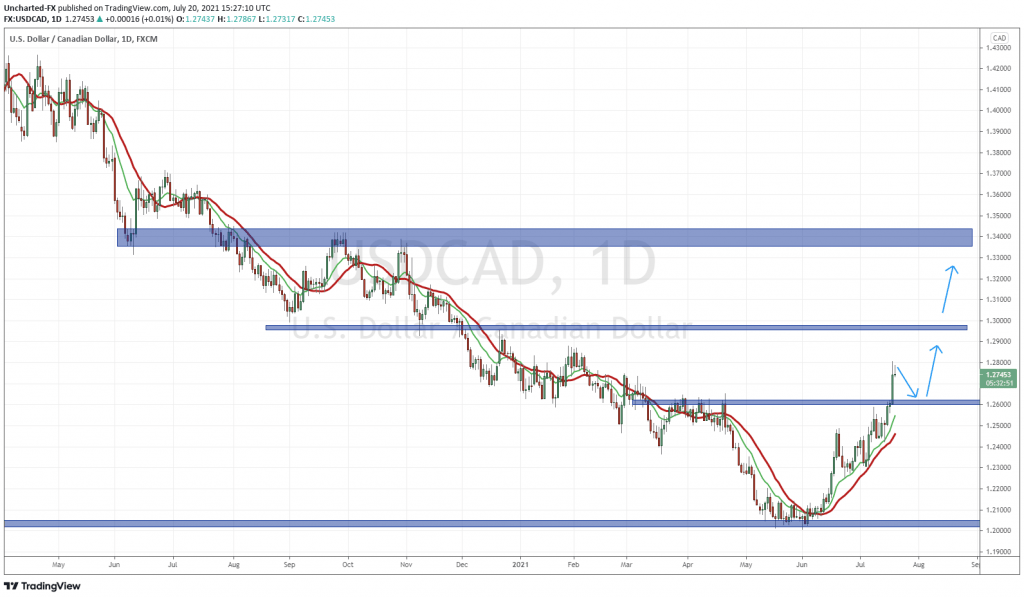

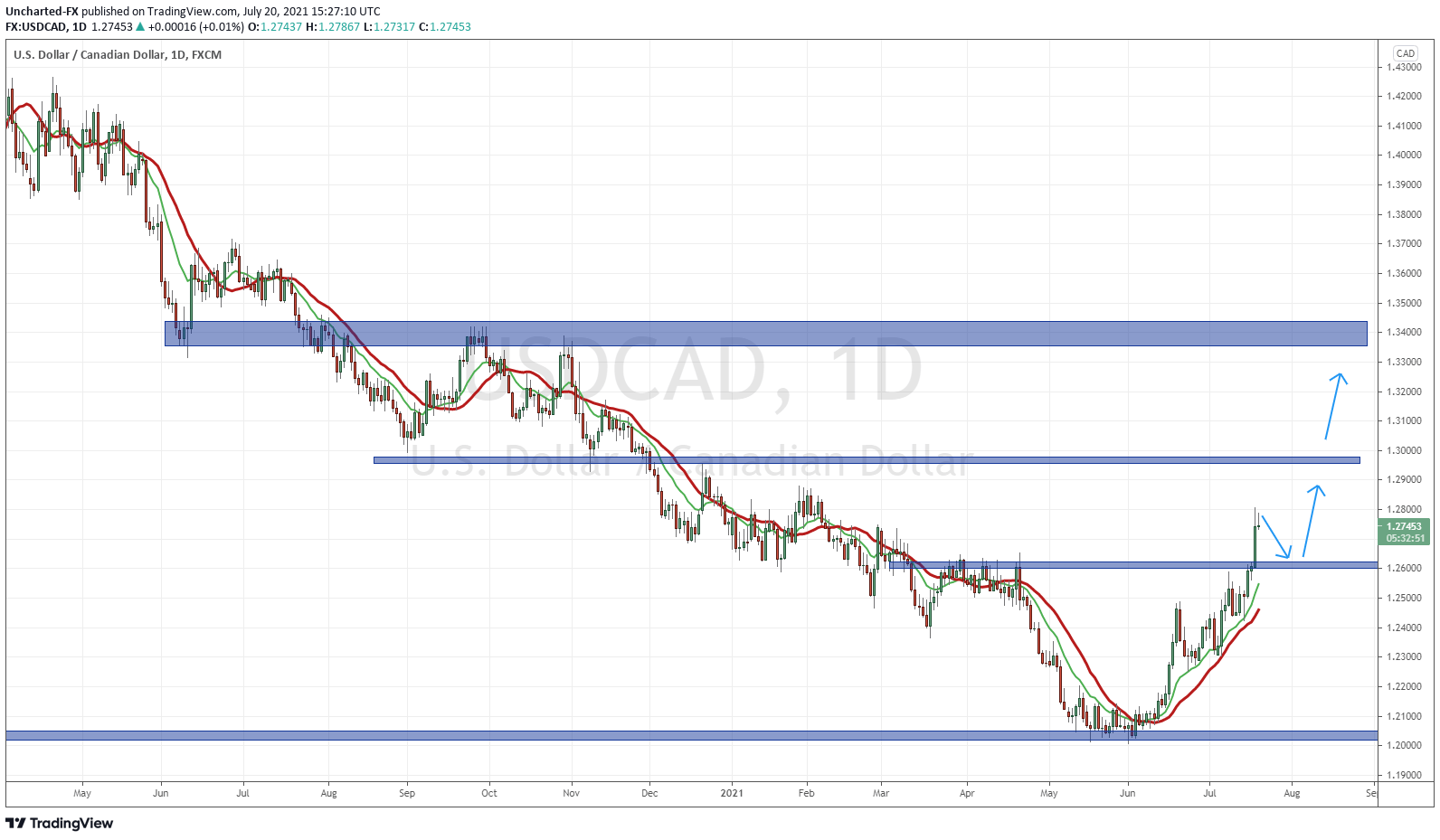

The chart of the USDCAD is showing a new US Dollar uptrend. A quick reminder: When the chart is moving up (green) the US Dollar is appreciating while the Canadian Dollar is depreciating. When the chart is moving down (red) the US Dollar is depreciating and the Canadian Dollar is appreciating.

You can see visually that the Canadian Dollar was strengthening for many months from 2020 and well into 2021. Prices then began to range at the 1.20-1.21 zone. That range was the beginning of a new trend. Since that breakout above 1.21, the US Dollar has carried on forward. Yesterday, we broke a major resistance zone of 1.26.

What I am looking for is a pullback to retest 1.26 as support before continuing higher. 1.30 and then 1.34 are my long term targets. If prices break below 1.26, then the US Dollar strength will be in question.

This pullback to retest 1.26 may even coincide with the stock markets moving higher, just as they are right now. But if this is just a dead cat bounce, and we continue to sell off the following day(s), the Dollar will be seeing some more safe haven strength.