Harborside (HBOR.CN) is a company that operates three big dispensaries in the San Francisco Bay Area, a dispensary in the Palm Springs, a dispensary in Oregon, and a cultivation/production facility in Salinas, California.

The Market Cap today sits at $80,066,000.

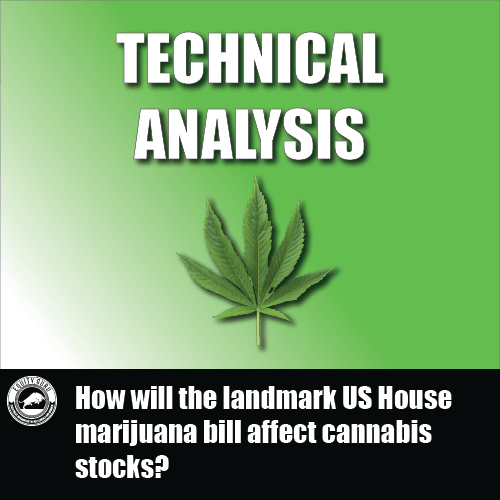

Yesterday, Harborside reported financial results for Q4 2020 and the year ending December 31st 2020. Lukas Kane covered the earnings in depth, and you can read the full breakdown here. I will quote some of numbers that stand out:

Harborside’s full year 2020 gross revenues expanded 29% year-over-year to $63.4 million.

The 2020 gross revenues are 130% of HBOR’s market cap.

HBOR also reported Q4, 2020 gross revenues of $13.1 million and positive adjusted EBITDA of $700.000.

Fourth Quarter Total Gross Margins improved from 22.1% to 49.9%.

Full year 2020 adjusted EBITDA grew to $7.4 million from an adjusted EBITDA loss of $8.9 million in 2019.

Tempering these robust numbers, HBOR reported a FY 2020 net loss of $11.9 million.

The improved margins were driven by “Improved Harvest Yields, Higher Wholesale Volumes, and Improved Operating Leverage Supported by Tight Expense Management.”

Some other highlights:

Q4 2020 Operational Highlights

- Completed the acquisition of a 21% interest in a San Francisco Dispensary in the historic Haight-Ashbury District

- Announced cultivation facility upgrades at the Company’s production campus in Salinas, CA and launched clones sales at all Harborside retail stores

- Received DTC eligibility

- Announced refreshed slate of Directors and appointed Matt Hawkins as Chairman

- Announced launch of new product lineup and initiative

Subsequent Events

- Secured a $12 million revolving credit facility

- Completed a $5 million strategic investment in Loudpack, a premier California cannabis company

- Recognized for exceptional curbside pickup and delivery services

- Announced Final Resolution in San Jose Wellness 280E Case

- Closed upsized private placement for gross proceeds of approximately C$35.1 million

[youtube https://www.youtube.com/watch?v=q1zXmci7IjA&w=560&h=315]

Technical Tactics

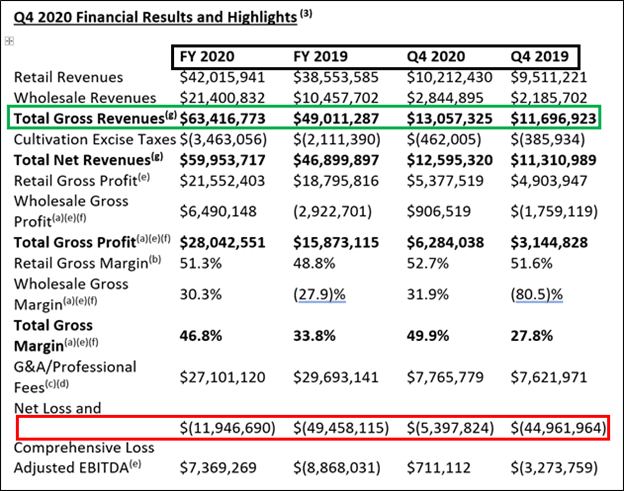

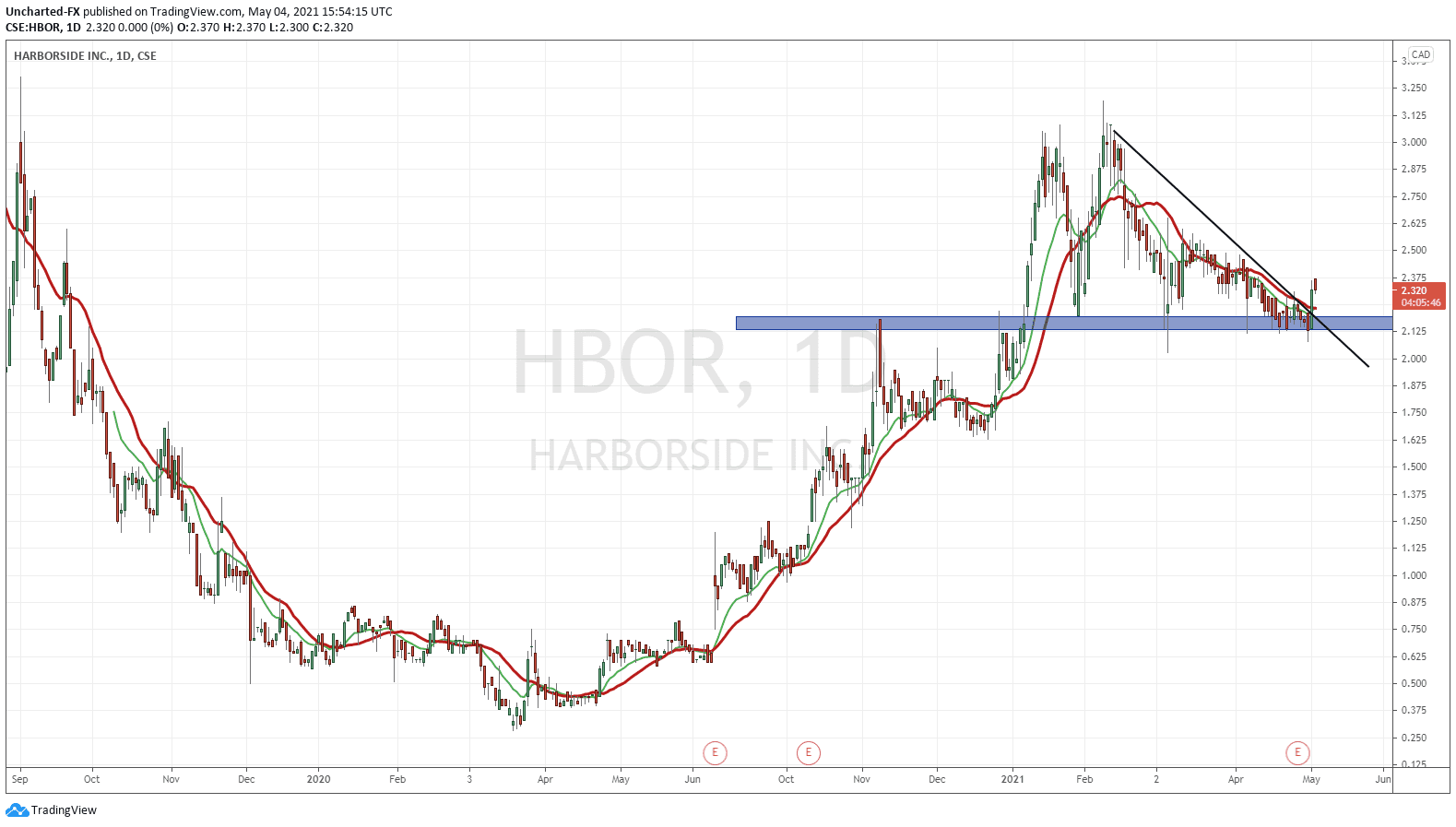

The last I looked at Harborside, we were breaking above $0.75, and then the break above $1.60. A nice 300% plus move if you held on the break of $0.75, and a 100% plus move if you took the plunge on the $1.60 break as detailed in those Market Moment articles.

Readers and members of our Discord Trading Group know the power of flip zones. What is a flip zone I hear you ask? A zone that has been BOTH support (price floor) and resistance (price ceiling) in the past. These are the perfect zones for trend reversals and take profit targets. We have just tested one on HBOR.

Price hit highs of $3.25 before drifting lower to reach and range at the major flip zone at $2.12. This zone is marked in blue. Notice how it has multiple touches as support and resistance.

A popular breakout pattern is known as the triangle. Very simple. It looks like a triangle. The key is the trendline. A downwards slope indicates a downtrend. A triangle connects price points on a downtrend, hence a break above the triangle trendline indicates a shift in a trend. This occurred and was confirmed on yesterday’s close on HBOR.

There is a chance price pulls back to retest the trendline breakout before continuing higher, but HBOR is bullish above $2.12. Next targets would be previous recent highs at $3.25, and then honestly, I don’t see a strong resistance level until $4.00.

This breakout has a combination of technicals and fundamentals. The triangle breakout plus revenues which hit 130% of HBOR’s market cap. The Cannabis sector has lost a bit of its mania feel due to crypto’s and Dogecoin, but legalization in the US still remains the large upcoming catalyst.

Full Disclosure: Harborside Inc. is an Equity Guru Marketing Client.