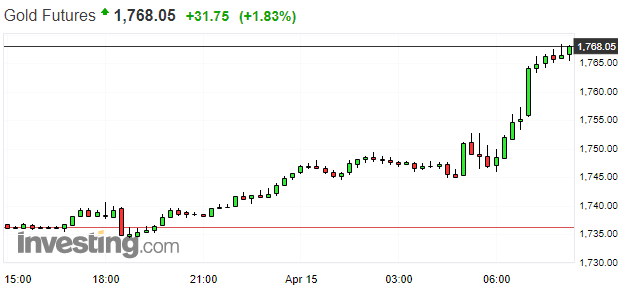

Gold is trading with some real conviction as I type this piece in the early session hours of April 15th, taking out key resistance at $1750, tagging multi-week highs…

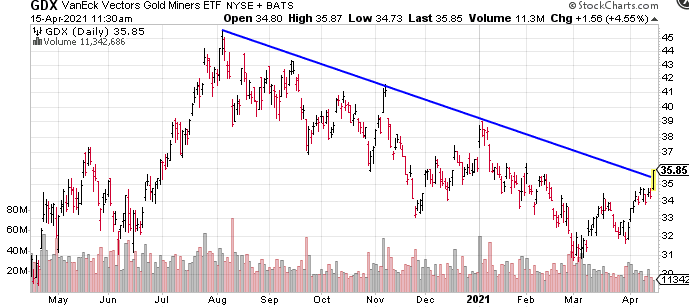

Looking at the Sr. gold stocks, there also appears to be a breakout in the works…

Looking at the Sr. gold stocks, there also appears to be a breakout in the works…

Though a select group of companies in the Junior space are trading firm to up, reflecting this recent strength in the metal, a large contingent is still trading sideways to down. This sets up an opportunity for those companies that are currently flying under the radar—those with compelling fundamentals backstopping their lowly valuations.

Delta Resources (DLTA.V) fits neatly into the Junior’s-with-latent-potential category (IMO).

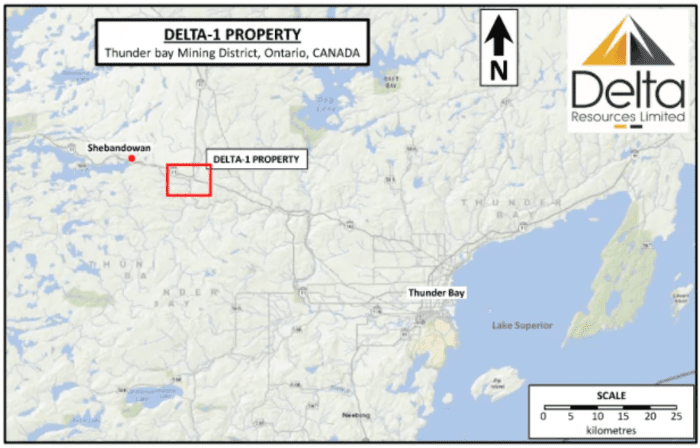

Yesterday, on April 14, Delta dropped a headline relating to its 4,495-hectare Delta-1 project in the Thunder Bay region of mining-friendly Ontario.

First, a brief D-1 summary…

Project Access is an important and often overlooked consideration when sizing up an opportunity in this arena. If your project is super remote, lacking a proper network of roads throughout, helicopter hours and Jet-A fuel can add hundreds of dollars to each meter drilled, making exploration and development an extravagant affair.

Traveling to the heart of the Delta-1 project is a simple matter of hooking up with the Trans-Canada highway on your way out of Thunder Bay Ontario, and driving straight on through.

The property straddles the Trans-Canada for 16 kilometers. Beyond that, a series of logging roads probe the guts of the project, making access a walk in the park.

Fantastically, a significant discovery may be waiting to be tapped directly underneath the Trans Cda highway itself.

To that end, Delta has secured an encroachment permit that allows it to drill adjacent to and directly underneath this major thoroughfare.

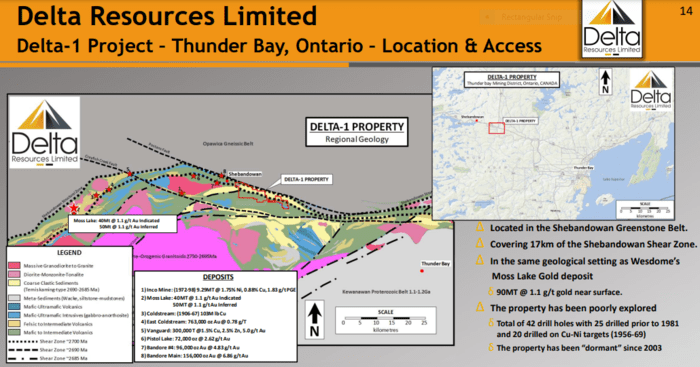

Delta-1 is located in the Shebandowan Greenstone Belt and covers 17-kilometers of strike along the Shebandowan Structural Zone, host to Wesdome’s (WDO.T) low-grade—high-tonnage Moss Lake gold deposit 50 kilometers to the west.

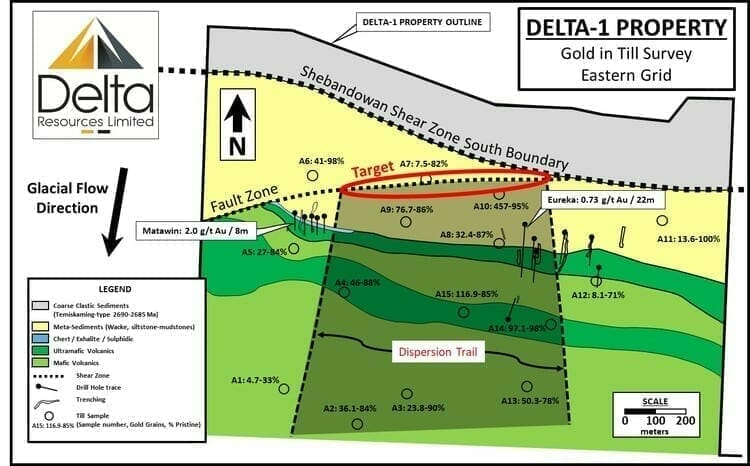

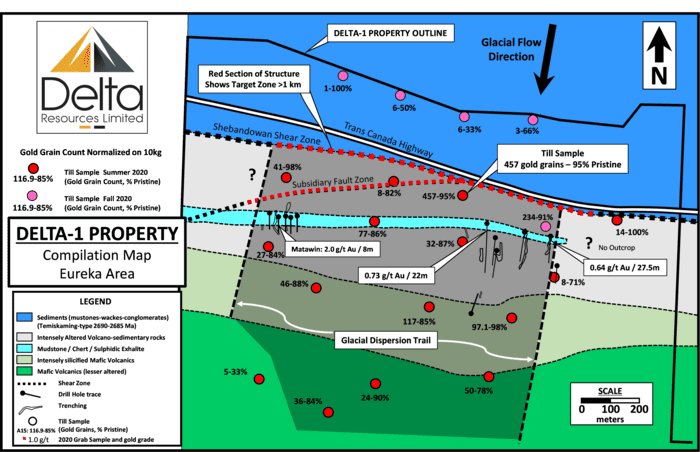

The property straddles the Shebandowan structure (follow the black dots – map below), and like the Cadillac Break in the Abitibi, it’s a structure that separates large geological domains—a deep-seated structure that transferred large volumes of fluid from the depths.

The project offers a number of compelling fundamentals for speculators—a limited 2019 drilling campaign at the Eureka zone that tagged broad, highly anomalous values, for example.

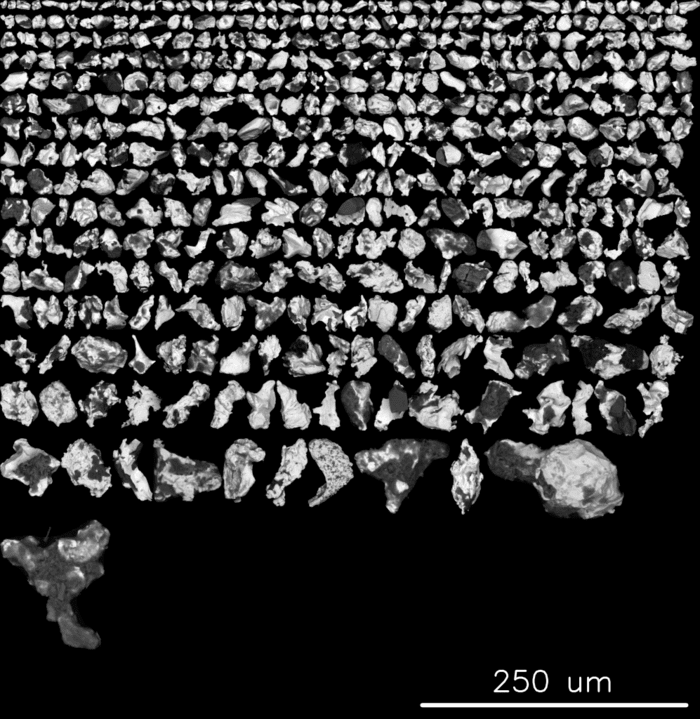

What really turns my crank is a large gold-in-soil anomaly discovered during a till-sampling campaign last summer.

Eight of the samples returned between 41 and 457 gold grains (on a normalized 10kg fraction-size sample), with pristine grains accounting for 78% to 99% of the total grains encountered.

“The pristine character of the gold grains indicates that there has been very little transport and hence these samples are interpreted to be proximal to a bedrock source for the gold.”

In the sample that returned 457 gold grains, 95% were pristine.

“Pristine gold grains”—this is a hugely important consideration when sizing up the discovery potential at Delta-1.

I’m reluctant to quote past personal musings, but this December 2020 cogitation is worthy of a repeat…

The pristine nature of these gold grains speaks volumes…

“The pristine character of the gold grains indicates that there has been very little transport and hence these samples are interpreted to be proximal to a bedrock source for the gold.“

These gold grain counts remind me of the Borden Gold project (Probe Mines), a project that ultimately provoked a $526M takeover bid from Goldcorp back in 2015.

The red oval outline on the map below may hold the key to the bedrock source of these gold grains (note the scale on the map below—the target is some 800 meters long).

Then, on March 11th of this year, the Company released results from a Phase-2 till sampling campaign carried out on the property last October.

Delta Till Survey Confirms the Source of Gold at Delta-1, Thunder Bay, Ontario

This bold headline is supported by good science—the fulfillment of a thorough and methodical sampling campaign.

With large concentrations of pristine gold grains located along the gold dispersion trail to the south, and negligible gold grain counts along the northern boundary, the Company has effectively encircled the bedrock source of these pristine grains and defined its limits.

The source of all these pristine grains has to be buried in Delta-1’d subsurface layers.

As previously reported in a press release dated August 12, 2020, a preliminary till survey in the Eureka area of the Delta-1 property outlined a gold dispersion trail that pointed to a source of gold believed to coincide with a one-kilometre-long segment of the Shebandowan Shear Zone. The most recent gold in till survey completed by Delta in October 2020, confirms that the source of gold from that dispersion trail is located on the Delta-1 property.

An additional (noteworthy) highlight from this Phase-2 till sampling survey:

One sample from the October 2020 survey extends the dispersion trail to the east by approximately 250m with a count of 234 gold grains with 91% pristine grains (on a normalized 10kg fraction-size sample).

Yesterdays (April 14th) Delta-1 headline

Delta Starts Drilling at Its Delta-1 Gold Property, Thunder Bay, Ontario

The Company has mobilized a drill rig to Delta-1 and it’s currently spinning on the first of many high-priority targets on the property.

The objective of the drilling is to test a one-kilometer long gold target believed to coincide with the Shebandowan Shear Zone; a deep seated structure that marks the northern boundary of the Shebandowan greenstone belt. The target is located at the north apex of a gold dispersion trail where till samples returned up to 457 gold grains in a 10kg sample (see press release dated March 11, 2021 and August 12, 2020).

Up to 14 drill holes for a total of 2,000 meters are planned for this Phase-1 campaign.

This press release went on to reiterate…

Two till surveys, carried out during the summer and fall of 2020, defined a gold grain dispersion trail of one kilometre in the east-west direction and at least one kilometre in the north-south direction, that remains open towards the south. The gold dispersion trail appears to end abruptly at the Shebandowan Shear Zone; believed to be the bedrock source of the gold grains. Within the dispersion trail, 12 of 13 till samples returned between 41 and 457 gold grains (on a normalized 10kg fraction-size sample). With pristine grains accounting for 78% to 99% of the total gold grains. The pristine character of the gold grains indicates that there has been very little transport and hence these samples are interpreted to be proximal to a bedrock source for the gold.

André Tessier, Delta’s CEO:

“We’re extremely happy to have secured a drill and crew from Chibougamau Diamond Drilling for this work, and we’re just as excited to be testing this truly fantastic target at Delta-1.”

This press release also went on to update progress at the Delta-2 Gold Project in Chibougamau, Quebec…

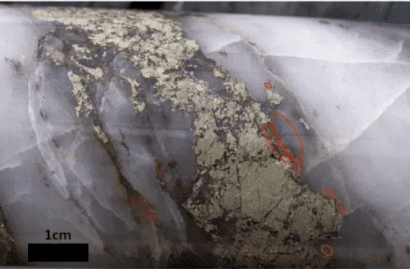

Delta has completed seven drill holes for a total of 1,056 metres. All drill holes were aimed at Delta’s new gold discovery as announced March 4, 2021. The mineralized zone was intersected in six of the seven drill holes and varies in width from 25cm to 3.8m; suggesting the vein is boudinaged (pinches and swells).

All assay results are pending. Samples of the mineralized zones were sent to the laboratory for rushed metallic sieve analyses. Results from these rushed samples are expected shortly and will be released as soon as available. Assay results for the remainder of the drill holes are expected within regular delays of four to six weeks.

If you’re unfamiliar with this 170 km2 project currently being teed up for its hydrothermal-gold and (gold-rich) VMS potential, tap the following link…

Delta tags high-grade gold – up to 50.75 g/t Au in a new discovery in mining-friendly Quebec

If you find a certain level of intrigue in the above, this very recent Guru roundup adds additional character to the story…

Both of these projects—Delta-1 and Delta-2—are worthy of flagship status.

Final thoughts

These 2021 drilling campaigns are fully funded.

In this capital-intensive business, it’s good to know that the Company has roughly $1-mill in the till, and is set to receive another $1.3M in scaled payments before September 2021—proceeds stemming from the sale of a non-core asset in 2020. There are also 5-plus million (in-the-money) warrants priced between $0.12 and $0.30.

Delta has a current market cap of $11.95M based on its 36.22 million shares outstanding and recent $0.33 close.

END

—Greg Nolan

Full disclosure: Delta is an Equity Guru marketing client.