On July 27, 2021 Delta Resources (DLTA.V) released assay results from its April 2021 drilling program at the Delta-1 Gold Property, 50 kilometres west of Thunder Bay, Ontario.

Delta Resources is developing two high-potential gold and base-metal projects in Canada.

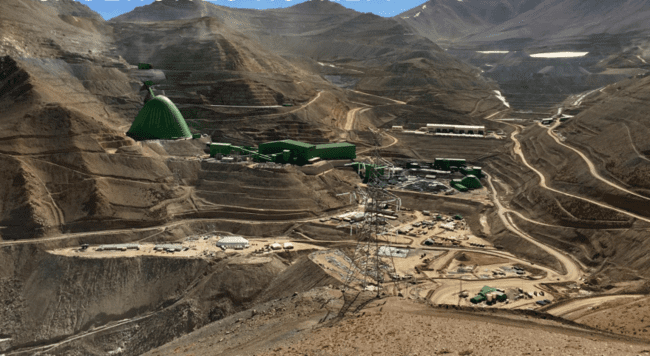

DELTA-1, 45 km2 located 50km west of Thunder Bay, Ontario where an extremely high gold-in-till anomaly and kilometre-scale gold-bearing alteration halo point to a never-tested regional structure.

DELTA-2 GOLD and DELTA-2 VMS, 170 km2 in the prolific Chibougamau District of Quebec, with a potential for hydrothermal-gold and gold-rich VMS deposits.

“Delta has two highly prospective properties in its project pipeline: Delta-1 and Delta-2,” confirmed Equity Guru’s Greg Nolan earlier this year.

Although the gold-price is oscillating around USD $1,800/ounce, from a wide-angle financial and political lens, this is good time to be developing gold (and poly-metallic) projects.

“The COVID pandemic has added $24 trillion to the global debt mountain over the last year, a new study has shown, leaving it at a record $281 trillion and the worldwide debt-to-GDP ratio at over 355%,” reported Reuters.

“Rising stocks and financial assets helped U.S. household wealth grow by $19 trillion during the pandemic to $137 trillion, but wealth inequality has gotten worse, according to a new report,” stated Market watch.

“U.S. asset-backed bonds tied to things like autos, credit cards and student loans has reached $163 billion already this year,” continued Market Watch, “a 61% jump from the same stretch of 2020, and 11% higher than the same period in 2019, according to BofA Global Research,” continued Market Watch.

The world is drowning in debt.

If the global debt bubble pops, there will be a stampede to hard assets like real estate, art and gold.

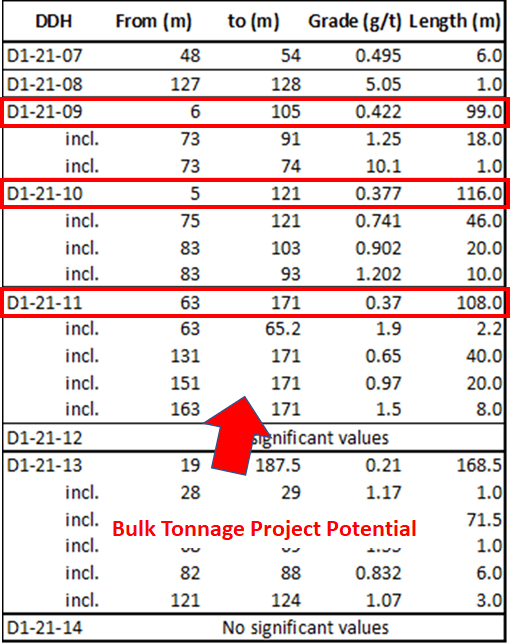

DLTA completed a total of 1,376 metres in eight drill holes during this April, 2021 drill program.

“We’re now seeing wide intercepts of economic-grade gold mineralization reminiscent of Gold Shore’s Moss Lake deposit, which is located to the west on the same structure,” stated André Tessier, President and CEO of DLTA.

The Moss Lake Deposit outcrops at surface. Historic drill hole highlights from the Moss Lake Deposit include 11.3 g/t Au over 70.4 meters, 2.55 g/t Au over 71.3 meters, and 1.19 g/t Au over 163.1 meters.

“The grades and style of mineralization we have encountered at Eureka are very similar to those found at other significant gold deposits in the Abitibi such as the Detour, Rainy River and Côté deposits,” continued Tessier, “We believe that these results indicate that we are onto something significant and that we are just getting started. We anxiously await to commence our next drilling program.”

Selected results from this phase of drilling are shown in the table below (reported lengths are believed to be very close to true widths):

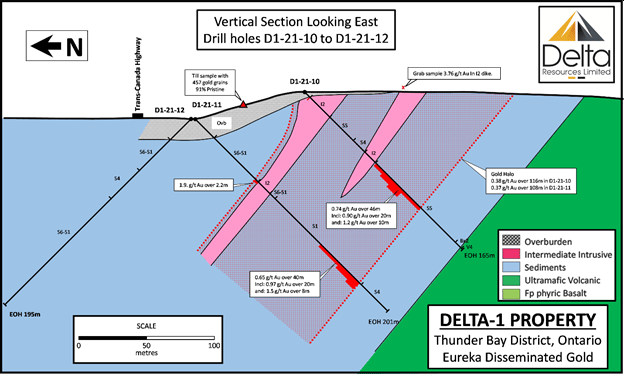

“Drill holes D1-21-07, 09, 10, 11 and 13 all intersected a wide zone of disseminated gold mineralization trending roughly EW and dipping 50° to 55° towards the north,” reported DLTA.

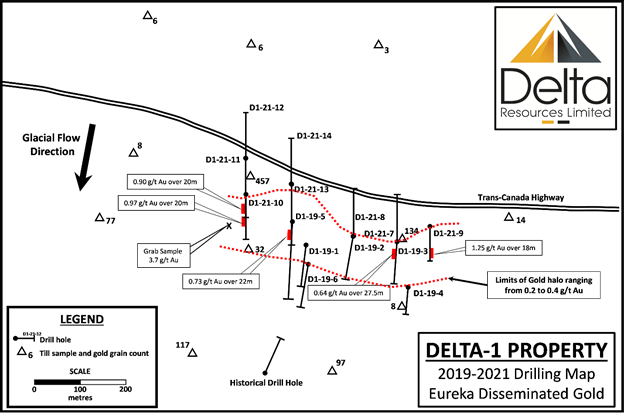

The mineralized zone has now been traced for over 400m of strike length and extends from surface to a vertical depth of 150 metres, with the zone open along strike and to depth (see map and section attached. Current results suggest the mineralization is becoming higher grade and wider towards the west.

DLTA Discussion of Results

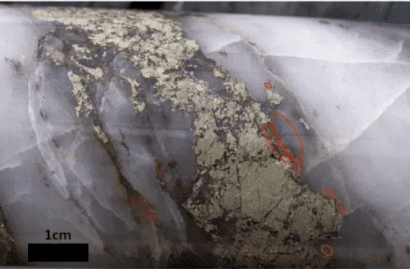

The gold mineralization is hosted within a sandstone that is intensely altered with ankerite, silica flooding and sericite. The sandstone is crosscut by amphibole-feldspar-phyric intermediate dikes, also altered by similar mineralogy. All units are cut by a network of quartz-ankerite-pyrite veinlets locally with disseminated grains of visible gold.

This new phase of drilling strengthened Delta’s understanding of the geometry of the deposit, and it is believed now that drill holes D1-21-7, 8, 12 and 14 were drilled down-dip and may have missed additional mineralized zones. Furthermore, considering the depth at which drill holes D1-21-11 and 12, intersected bedrock, it is likely that the source of the high gold-in-till anomaly remains untested.

The objective of the drilling was to test a one-kilometer-long gold target believed to coincide with the Shebandowan Shear Zone; a deep seated structure that marks the northern boundary of the Shebandowan greenstone belt.

The target is located at the north apex of a gold dispersion trail where till samples returned up to 457 gold grains in a 10kg sample (see press release dated March 11, 2021 and August 12, 2020). Depending on access, up to 14 drill holes were planned but for logistics purposes, Delta elected to remain south of the Trans-Canada Highway. qq

Map of the Delta-1 Eureka area drilling showing the vertical projection of the disseminated-gold mineralized zone.

Vertical section looking east (090° azimuth) showing the mineralized zone in drill holes D1-21-10 and 11. The zone remains open in all directions and appears to become higher grade towards the west.

In this May 23, 2021 video Tessier give an overview of the DELTA-1 and DELTA-2 projects.

On July 11, 2021 Greg Nolan wrote about Delta’s Delta-2 VMS project in Quebec.

Delta-2 VMS project in Chibougamau, Quebec:

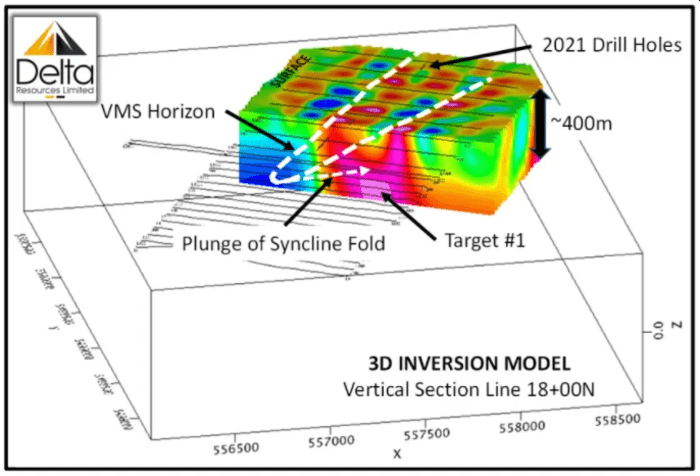

“On June 22nd, the Company announced that a gravimetric geophysical survey along the VMS section of its Delta-2 project located a number of highly prospective anomalies down-dip from a VMS horizon at depths greater than 300 meters,” wrote Nolan.

“The gravimetric survey consisted of 29.9 line kilometres, covering an area of 4.25 square kilometres, in the south-east portion of the Delta-2 VMS property. The survey area covered approximately four kilometres of strike length of a sulphidic horizon believed to be the stratigraphic horizon that hosts the Lemoine past-producing mine located north of the property.”

3D-Block diagram of the unconstrained inversion from the gravimetric survey from surface to ~400m vertical and cut at section 18N. The diagram shows the same dips as observed from surface and suggests the gravity anomalies are located at the fold hinge of the interpreted syncline.

Regarding the significance of these geophysical anomalies, Delta’s CEO, André Tessier:

“These gravimetric anomalies couldn’t possibly be better located; down-dip from our target horizon, potentially in the fold hinge of a syncline, and within a package of highly altered rocks. These are very exciting gravimetric signatures, typical of buried VMS deposits. Preparations underway to drill test these targets.”

Drilling is planned to test three high-priority gravity anomalies in the south-eastern portion of the property. Additional high-priority VTEM conductors will also receive a proper probe with the drill bit—targets that couldn’t be drilled in the spring due to an early thaw.

Further, gravity and VTEM geophysical surveys are planned to cover the newly acquired Dollier-Cartier property which is contiguous to the Delta-2 VMS claims.

These high-priority drill targets are believed to be located on the same stratigraphic horizon as the past-producing Lemoine Mine. Lemoine goes down as one of the richest mines in Canadian history (757 585 tonnes @ 9.52% Zn, 4.18% Cu, 4.56 g/t Au and 82.26 g/t Ag).

We’re big fans of VMS settings here at Equity Guru. Spawned by volcanic hydrothermal events in submarine environments, they almost always occur in clusters—where there is one deposit (or lens), there are often others. And though they vary in scale—ranging from one million all the way to 100 million tons—these polymetallic orebodies can hold huge concentrations of metals due to their rich nature.

Being a VMS deposit, Lemoine is likely NOT a one-off. It’s possible that an entire VMS camp remains to be discovered in Delta-2’s subsurface stratum.” – End of Nolan.

Delta has 36 million shares outstanding has a fully funded exploration for 2021 and in addition, is set to receive $1 million in scaled payments, starting August 1st 2021, through the sale of its Bellechasse-Timmins gold project in SE Quebec.

Full Disclosure: DLTA is not currently an Equity Guru client.