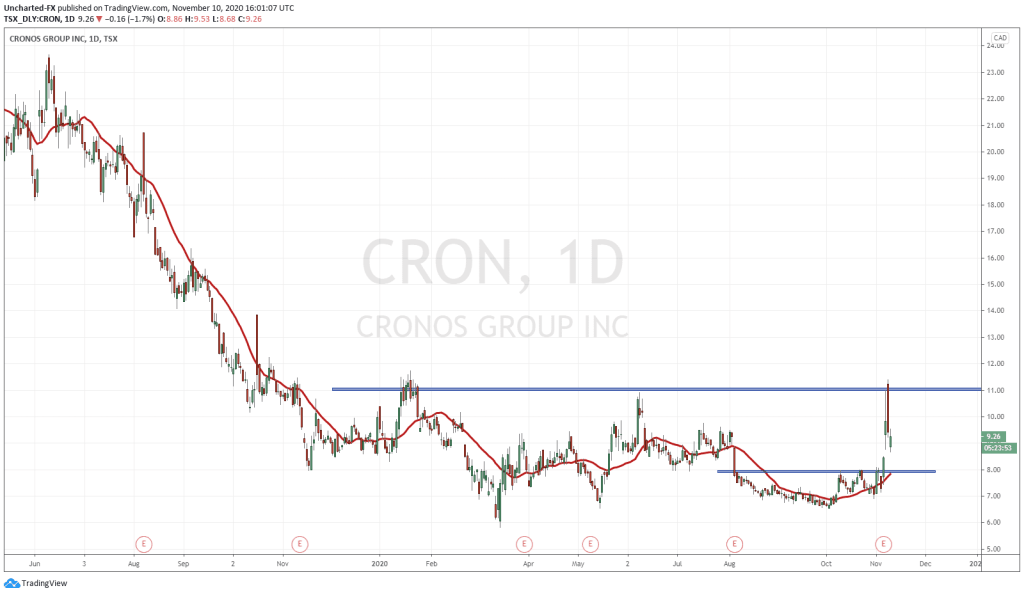

Cannabis has been on the list of all the “Best stocks to own during a Biden Presidency” financial articles, and this week will be another major week for the sector. Cannabis sector is coming in hot! The US House is scheduled to debate and then vote on the Marijuana Opportunity, Reinvestment, and Expungement (MORE) Act either on Thursday or Friday of this week. A few weeks back, I listed some nice looking cannabis chart set ups to keep an eye on. Aphria got the breakout from $8.00 and hit $11.00 recently. Cronos Group remains on breakout watch alongside Plus Products. Canadian Marijuana ETF HMMJ has recently been discussed on Equity Guru’s Free Discord Trading Room, and the breakout was just confirmed on Friday. Looking forward to see the momentum carry on it. Finally, Village Farms has been a big winner with the breakout highlighted above $10, and price hitting recent highs of $14.75. What I want to talk about today is the chart of Isracann (IPOT.C).

While the majority are focused on the Cannabis sector in the US, not many are paying attention to Israel. Israel has planned to legalize Marijuana within 9 months, and the exciting play becomes a pathway into Western Europe.

Chris Parry discussed the upside in Isracann:

- LOW PRODUCTION COST: Isracann estimates per gram costs as likely to be around $0.40 per gram.”

- THE DOMESTIC PLAY: An estimated 27% of Israelis use cannabis. Nobody producing cannabis is going to ship the stuff currently because the local market is, amazingly, so under-served by legal product.

- PATHWAY TO EUROPE: Isracann plans to make their facilities IMC-GAP/GSP certified, which means their products will be export-ready. Israel’s proximity to Europe, and its established trading partnerships and shipping routes could be an important component of Isracann’s future revenue streams.

- MORE SUN = MORE HARVESTS: “Cannabis likes warm weather. While cannabis will grow in temperatures sub-20 degrees Celsius, sugars will not move around the plant as well, and taste and yield will suffer. Cannabis doesn’t just want sun, it likes humidity, so a hybrid grow allows you to keep things just right.”

And just recently, Chris states Isracann has a year of runway:

There’s currently a $37 million valuation on IPOT, which is thriving, while iAnthus (IAN.C), which is more or less a private company after its lenders devoured its soul, comes in at $36m. MedMen (MMEN.C), which is buried in debt and has no feasible way forward, is valued at three times IPOT’s market cap. Meanwhile, those that don’t suck at the act of existence, like Green Thumb Industries (GTII.C) and Trulieve (TRUL.C), sit at multi-billion dollar valuations ($4.5 billion and $2.1 billion respectively) that make it hard to double your money in the short term.

IPOT hasn’t been dropping golden eggs for the past several months, but that doesn’t mean it hasn’t been doing the work. As Israel’s regulators continue to evolve that industry locally, players are beginning to emerge, with IPOT among them. COVID did see some regulations tighten, which slowed IPOT’s road to planting, but their financials show a steady hand that has reduced expenses, kept pre-launch losses low, and which leaves the company a solid year-plus of runway before they need to go find more money. The company expects to be bringing in revenues long before that.

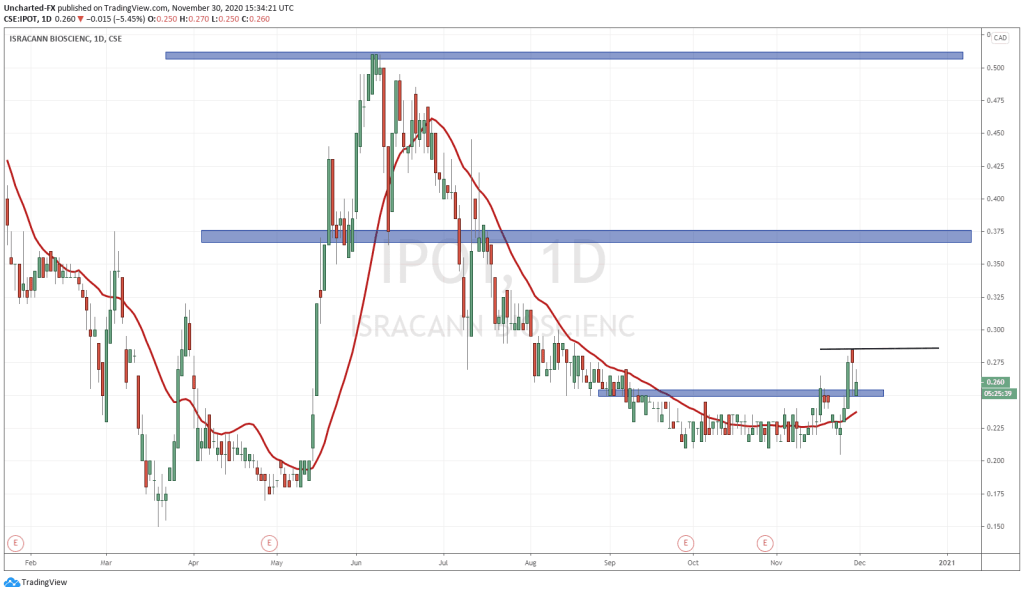

Chart wise, or technically, Isracann (IPOT) confirmed a breakout last week Thursday. Once again, this chart pre-breakout was mentioned in a recent Cannabis post. We have been expecting this.

My readers know that all markets move in three ways: downtrend, range and an uptrend. Isracann has had a downtrend, and then price began to range at a major support (price floor) zone. The breakout is what will now trigger the uptrend.

$0.25 was the resistance zone that we needed to break above. This happened. As you can see, the following day, price fell back to 0.25, but the large candle wick indicates that the buyers have defended the zone. Buyers stepped in to purchase shares. Once again, this is normal price action. Price tends to pullback to retest breakout (and breakdown in a downtrend) zones. The only danger is if price closes back BELOW the breakout zone. In that case, we have what is called a false breakout, or a fake out.

Currently, we are seeing buyers step in and defend $0.25 once again, just confirming how important this zone is now.

With the fundamentals of Isracann, and the catalyst for the Cannabis sector which is the House vote, the risk to reward is superb. I really dig the chart of Isracann.

An entry is possible currently. For those who want to play it more safe, they can await for price to breakout and make new recent higher highs (a break above my black line at $0.285). The next resistance target comes in at the $0.375 zone.

If Isracann gets above that, then above $0.50 are the next targets.

So in summary, a company with great fundamentals, a major sector catalyst approaching, and a technical chart breakout pointing towards an uptrend…just a really great set up. Definitely worth putting on your radar.

FULL DISCLOSURE: Isracann is an Equty.Guru marketing client