Trading activity in the junior exploration arena is currently dominated by short tempers, across-the-board selling (some of it profit taking), and transient bouts of cautious buying.

Should we have predicted this weakness, with the flurry of private placements from earlier this summer coming off hold?

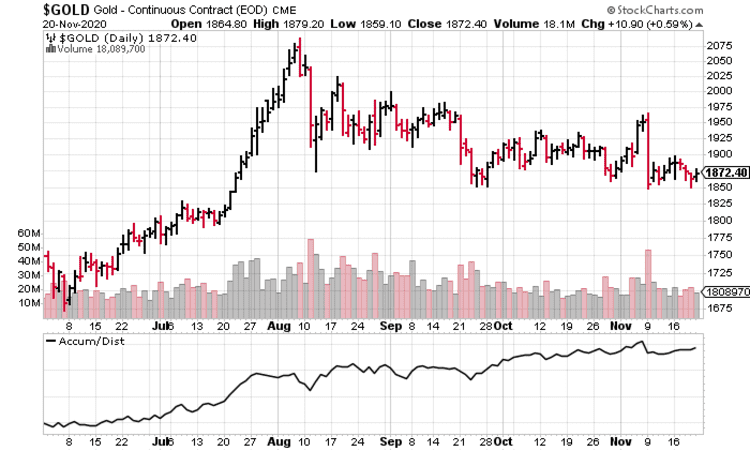

With the vorticity of economic and political uncertainty around the globe, many of us thought gold would continue its assault on higher ground, and maintain that steep trajectory.

Delays at the assay labs exacerbated the situation with the stocks we follow, testing the convictions of even the more ardent among us.

And of course, the opportunity was a ripe short sellers, those with a bearish bias who correctly gauged the risks.

The Shorts were right, but they were lucky the metal didn’t hold its record-high ground.

For the macro-view, I have my own opinions, but I like to defer to a small stable of ‘experts’—those I’ve been following over the years/decades. Serially successful types, if you will.

John Hathaway—portfolio manager at Sprott Hathaway Special Situations Strategy and co-portfolio manager of the Sprott Gold Equity Fund— has some good, well-considered insights regarding the metal and where it’s headed.

Hathaway believes that interest rates will need to stay low—that much is clear, considering the state of the global economy. He believes Bonds—widely used as a hedge against stock market uncertainty—can no longer be counted on. This will force large pools of capital to seek out a more effective hedge against equity risk, and gold is really the only asset that will offer such protection.

The other factor supporting gold is a weaker USD. The Fed doesn’t want a strong USD as it would put US exports further out of reach for foreign consumers. Hathaway states that many elite investors are calling for a 30% drop from here. Continued erosion in the USD would be an extremely friendly backdrop for the metal.

Hathaway estimates there’s roughly $100 trillion worth of assets currently under management—pension funds, mutual funds, sovereign wealth, private wealth—and gold does NOT factor into the equation in any meaningful way.

If a mere 1% of that total—$1 trillion—were to move into gold over the next few years, that would represent six years of new mine supply. That’s how under-owned gold is.

$1 trillion entering the gold space would push prices to levels difficult to imagine, to perhaps five times the metal’s current trading range.

There’s a lot of wisdom in this interview—it’s worth at least one go…

A good number of our clients tabled news last week. We’ll move down the list alphabetically as they all dropped headlines on the same day.

Arizona Metals (AMC.V)

- 64.81 million shares outstanding

- $40.18M market cap based on its recent $0.62 close

The Flagship Asset

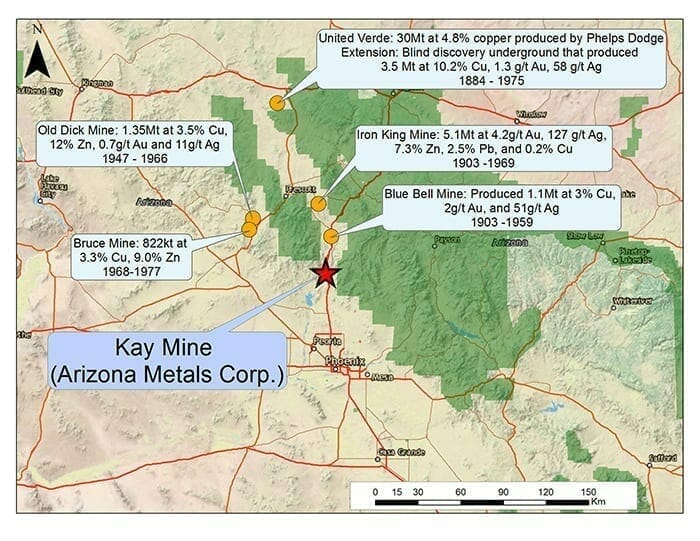

Arizona Metals’ Kay Mine project is located in a prolific mining district in Arizona, host to 60 past-producing underground Cu-Au-Zn VMS mines, all within a 150-kilometer radius of this flagship asset.

During its century-long run, the district produced roughly 4 billion pounds of copper at an average grade of 3.5%.

During its century-long run, the district produced roughly 4 billion pounds of copper at an average grade of 3.5%.

The Company has a current (historic) resource of 5.8 million tonnes grading 2.2% Cu, 3.03% Zn, 55 g/t Ag, and importantly… 2.8 g/t Au for a CuEq grade of 5.8% at its Kay project.

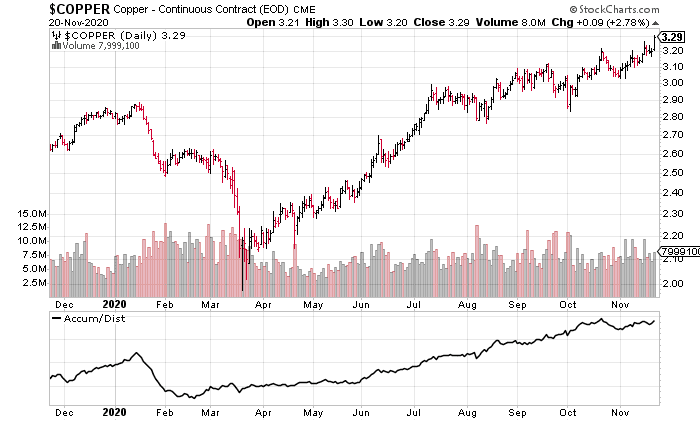

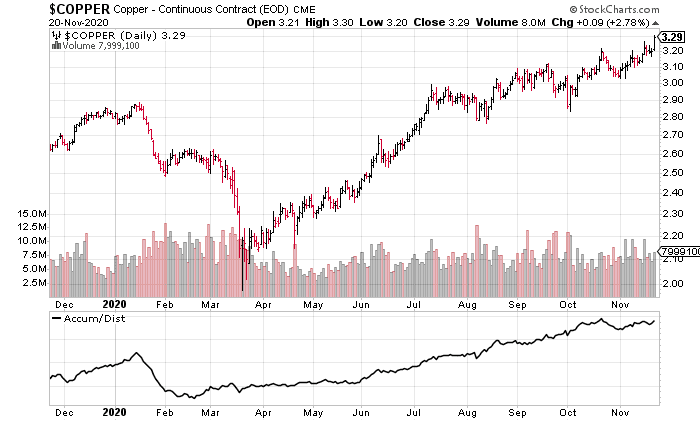

Kay—a gold-silver rich VMS deposit—also has a high-grade copper kicker. And copper is on a bit of a tear, taking out multi-year highs in recent sessions.

According to a Nov. 9th press release, permitting is underway to test high-priority targets on strike 500 meters to the north, and 300 meters to the south of the Kay deposit. The Company also has the never-been-probed-with-the-drill-bit Central and Western targets in its crosshairs.

According to a Nov. 9th press release, permitting is underway to test high-priority targets on strike 500 meters to the north, and 300 meters to the south of the Kay deposit. The Company also has the never-been-probed-with-the-drill-bit Central and Western targets in its crosshairs.

This Phase-2 drilling campaign is an aggressive push along the curve—up to 11,000 meters in 29 core holes.

Another significant asset in the project pipeline

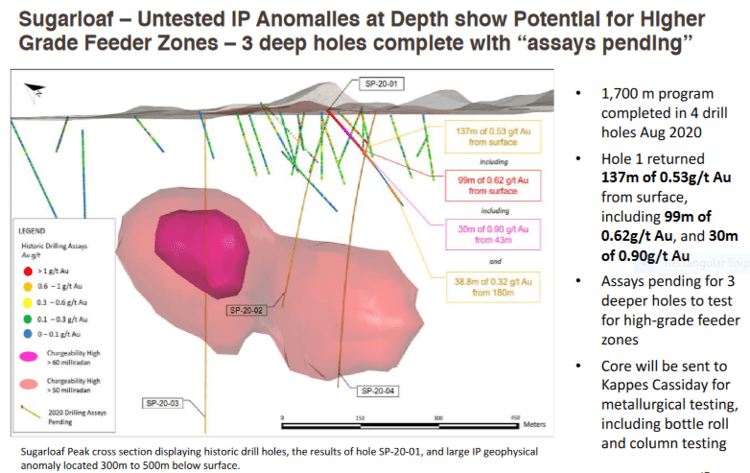

The Company’s 4 x 6 kilometer Sugarloaf Peak Gold Project, located in La Paz County, Arizona, has a historical resource of 1.5M ounces of gold at a grade of 0.5 g/t.

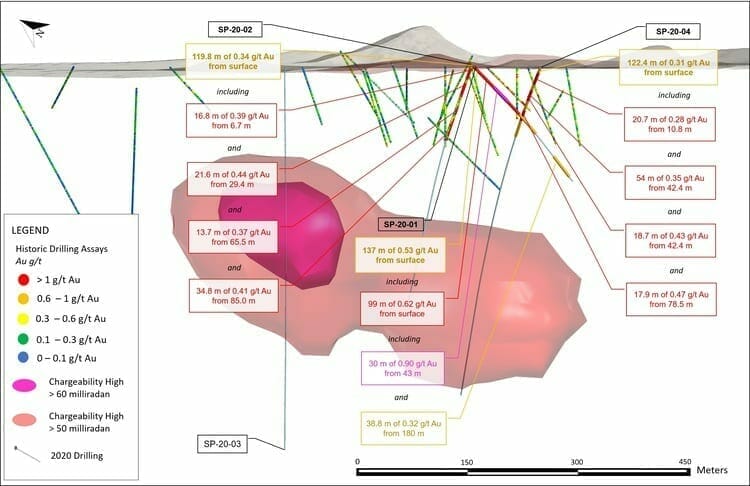

The above slide notes that 3 deep holes are pending. The following November 19th press release delivers those assays and intervals…

The above slide notes that 3 deep holes are pending. The following November 19th press release delivers those assays and intervals…

These final three holes from a 1,748 meter phase-1 program were drilled primarily for metallurgical test work (a key consideration with this sub-one-gram deposit), to probe geophysical targets at depth, and to provide infill data that will advance the project towards a NI 43-101 compliant resource estimate.

- Drill hole SP-20-02 intersected 119.8 meters of 0.34 g/t gold (Au) from surface, including 21.6 meters of 0.44 g/t Au, and 34.8 meters of 0.41 g/t Au.

- Drill hole SP-20-03 was extended to a depth of 547 meters to test a geophysical anomaly starting at a depth of approximately 270 meters. This hole encountered low grade mineralization from 11.3 metes to 178 meters (166.7 meters of 0.12 g/t Au) but did not encounter significant mineralization at depth.

- Drill hole SP-20-04 intersected 122.4 meters of 0.31 g/t Au from a depth of 3.1 meters, including 18.7 meters of 0.43 g/t Au and 17.9 meters of 0.47 g/t Au. This interval was a part of a larger mineralized halo, starting at a depth of 3.1 meters and extending to 396.5 meters for a total of 393.5 meters of 0.22 g/t Au.

As previously reported, drill hole SP-20-01 intersected 137 meters of 0.53 g/t Au from surface, including, 99 meters of 0.62 g/t Au, and 30 meters of 0.90 g/t Au. From 179.7 meters to the end of the hole at 218.5 meters, 38.8 meters of 0.32 g/t Au was encountered. The hole ended in anomalous gold, intersecting mineralization approximately 45 meters below holes drilled by previous operators.

With an aggressive 11,000 meter drilling campaign on deck at the Company’s Kay Mine Project, expect strong newsflow as we advance on the new year.

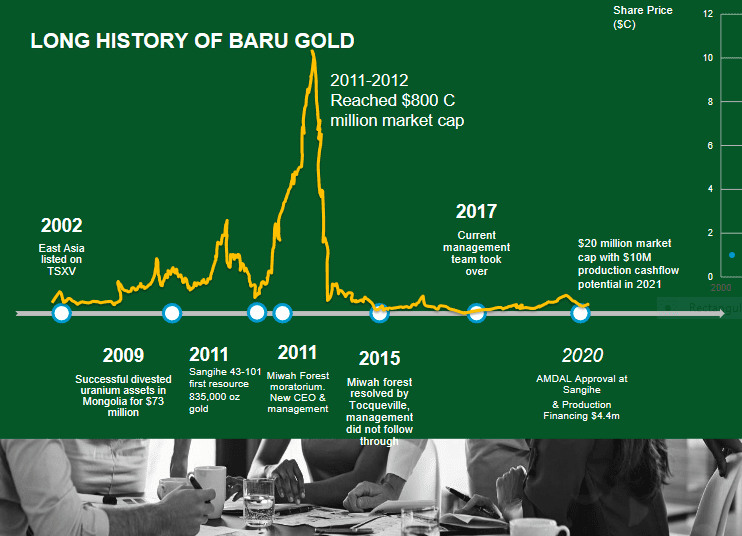

Baru Gold (BARU.V)

- 173.73 million shares outstanding

- $23.45M market cap based on its recent $0.135 close

The flagship asset

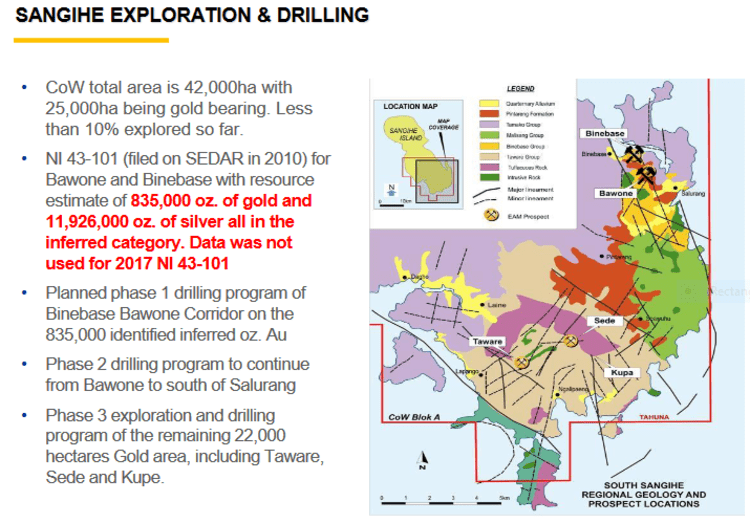

The Sangihe Gold Project—two large blocks of ground covering the Taluad and Sangihe Islands located between the northern tip of Sulawesi Island (Indonesia) and south tip of Mindanao (Philippines)—currently garners flagship status.

This 42,000-hectare land package consists of three main target areas: the Bawone and Binebase prospects on the eastern side of the island, and the Taware prospect further to the south.

Importantly, for investors seeking a cash-flowing asset, Sangihe is being fast-tracked to production.

Importantly, for investors seeking a cash-flowing asset, Sangihe is being fast-tracked to production.

EAS management has its sights set on a modest heap leach production scenario.

The Company, despite delays brought on by the pandemic, is pushing Sangihe aggressively along the development curve.

Estimated all-in costs for the Sangihe deposit = roughly $700 per ounce.

At current prices, Sangihe should cash-flow approx $1,150 per ounce or $1.15M per month.

$1M-plus monthly free cash-flow will fund a lot of exploration across the Company’s extensive land base, with the potential to augment Sangihe’s ounce count.

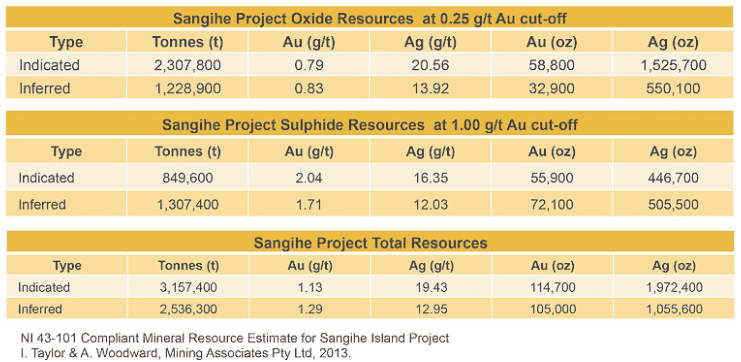

Sangihe’s resources slated for production…

The above resource represents only a fraction of what lies in Sangihe’s subsurface layers.

The above resource represents only a fraction of what lies in Sangihe’s subsurface layers.

Located between Binebase and Bawone (bottom right, map below) is an Inferred resource of some 835,000 oz. of gold and 11,926,000 oz. of silver.

A phase-1 drilling campaign along the Binebase-Bawone Corridor is being considered. This should bring these additional ounces into play.

A phase-1 drilling campaign along the Binebase-Bawone Corridor is being considered. This should bring these additional ounces into play.

In a September 3rd press release the Company announced the receipt of its AMDAL environmental permit for Sangihe. This was a watershed event.

On November 19th, the Company dropped the following headline:

The payment of this mining claims tax—Dead Rent, as it were—is yet another box checked as management pushes Sangihe one step closer to breaking ground.

Total funds paid to satisfy this obligation = $356,000 (approximately 3.8 billion Indonesia Rupia).

“The tax was paid to the Central representative office of the Ministry of Energy and Mineral Resources. The mining asset tax, colloquially referred to as “dead-rent tax”, is a fee due annually to the government. This payment brings us current with all our financial obligations for the project.”

With the AMDAL environmental assessment in the bag and the dead-rent settled, the Operation License is the only remaining item outstanding before the Company breaks ground at Sangihe.

Regarding this highly anticipated final detail, the November 19th press release went on to state…

“The Company expects the Operational Production License to be granted within the next few months and the goal is to move towards construction and purchase of equipment for the Sangihe gold heap leach project immediately after issuance. The Company has been actively taking steps to ensure we move smoothly and quickly into construction once this licence is issued.”

I suspect Baru management is being conservative with its timelines. It wouldn’t surprise me to see the Operational Production License drop before year-end.

The other highly prospective property in East Asia’s project portfolio—the 3.4 million ounce Miwah Gold Project—is one that appears destined for a comeback.

The following slide from the Company’s recently updated investor-deck tells part of the Miwah story (the violent price spike in the center of the slide was all Miwah)…

We’ll offer our in-depth take on Baru, and both of these key assets, the moment the Indonesian gov’t delivers Sangihe’s Operational Production License.

We’ll offer our in-depth take on Baru, and both of these key assets, the moment the Indonesian gov’t delivers Sangihe’s Operational Production License.

Golden Lake (GLM.C)

- 32.6 million shares outstanding

- $4.73M market cap based on its recent $0.145 close

The flagship asset

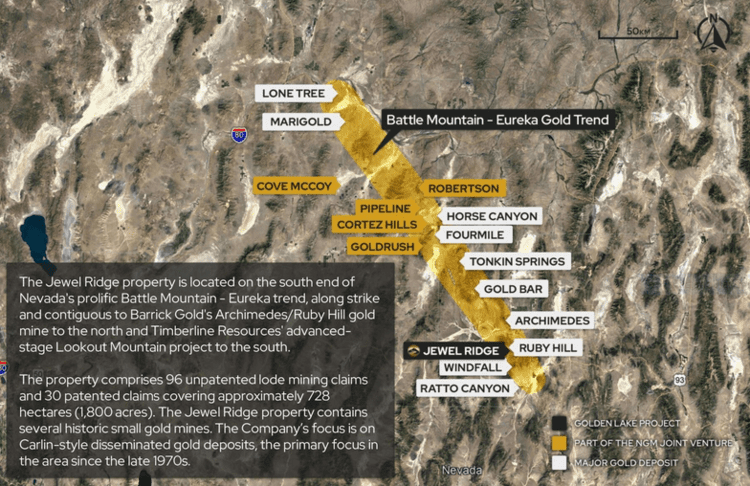

Golden Lake’s flagship asset—Jewel Ridge—is located at the south end of Nevada’s prolific Battle Mountain—Eureka trend. The property is strategically located along strike and contiguous to Barrick Gold’s past-producing (two million ounce) Archimedes/Ruby Hill mine to the north, and Timberline Resources’ (TBR.V) advanced-stage Lookout Mountain project to the south.

The target at Jewel Ridge is a Carlin-type deposit.

The target at Jewel Ridge is a Carlin-type deposit.

Nevada Carlin-type gold deposits have a combined mineral endowment of more than 250 million ounces, all concentrated along four main trends—Carlin, Cortez (Battle Mountain-Eureka), Getchell, and Jerritt Canyon.

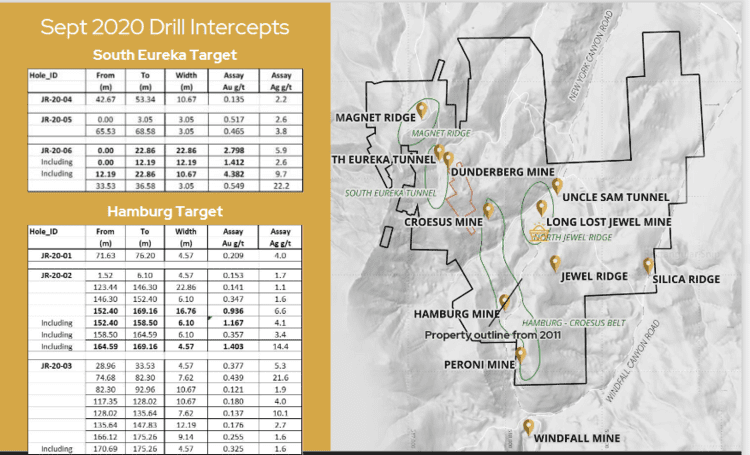

The Company initiated a drilling campaign at Jewel Ridge earlier this summer. The highlight interval from this phase-1 campaign—2.80 g/t au over 22.9 meters, including 4.38 g/t au over 12.2 meters—was delivered via a September 24th press release.

On October 20th, the Company announced the commencement of a phase-2 drilling campaign at Jewel Ridge.

On November 19th, we received the final four holes, wrapping up phase-1.

Highlights:

The Eureka Tunnel mine target is located along the northwest corner of the Jewel Ridge property, with the “Oxide Zone” aka the “Viking Zone” located east and north-east of the main portal.

A new, deeper mineralized zone was encountered at Eureka at a depth of 160.0 meters in a hole that tagged 1.48 g/t Au and 1.3 g/t Ag over a length of 10.67 meters.

A new, deeper mineralized zone was encountered at Eureka at a depth of 160.0 meters in a hole that tagged 1.48 g/t Au and 1.3 g/t Ag over a length of 10.67 meters.

This represents a second mineralized horizon hosted in dolomite, in addition to the “Upper Mineralized Zone” that returned 1.25 g/t Au and 5.5 g/t Ag over 16.76 meters.

“The Lower Mineralized Zone (“LMZ”) intersection supports the geological model of a series of stacked, oxide, Carlin-type gold zones with a halo of mineralized material (above a projected 0.2-gram cut-off grade, 0.2 to 0.5 g/t Au range), in the Eureka Tunnel area, on the Jewel Ridge Property. Discovery of a stacked component of oxide gold mineralized horizons represents an attractive target for future drilling and significantly enhances the tonnage potential.”

Mike England, Golden Lake CEO:

“We are very pleased with the results to date on the Jewel Ridge project and look forward to results yet to come from the current drill program. These results are giving us a good understanding of the geology and mineralization in place and will help guide us in future programs. Permitting is ongoing on the BLM parcels of land within Jewel Ridge that will be subject to future drill programs in 2021.”

These four holes wrap up the summer program—assays are now pending from the most recent program announced on October 20.

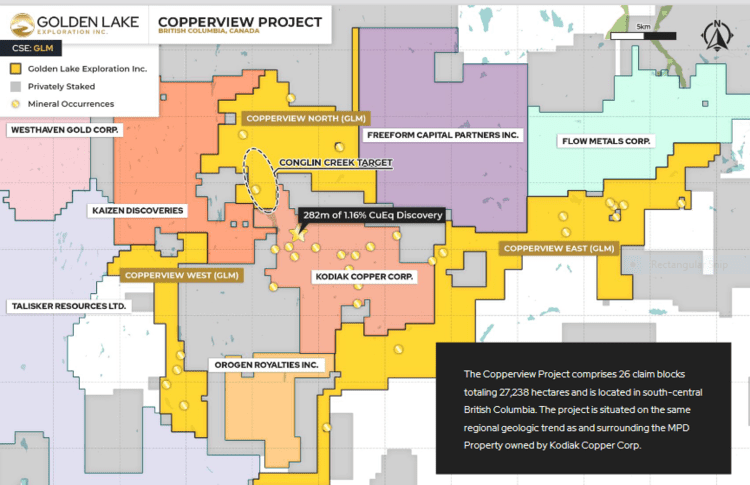

The Company is also exploring its Copperview Project where neighbor Kodiak Copper (KDK.V) tagged an impressive 282 meters of .70% Cu and .49 g/t Au.

The Copperview Project is located along the Quesnel trough, host to numerous producing, past-producing, and advanced development stage copper-gold porphyry projects.

Nomad Royalty (NSR.T)

- 524.53 million shares outstanding

- $665.15M market cap based on its recent $1.27 close

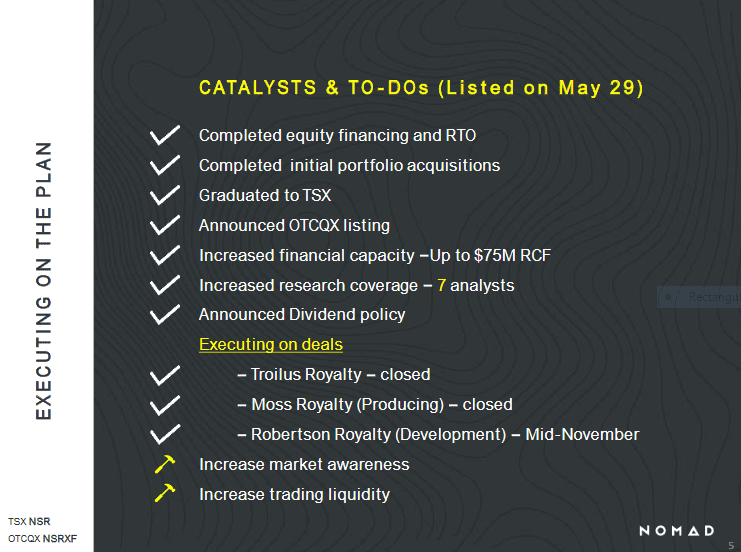

Since its debut on the TSX on May 29th, Nomad (NSR.T) management has done everything it said it would do, and in only a few months time.

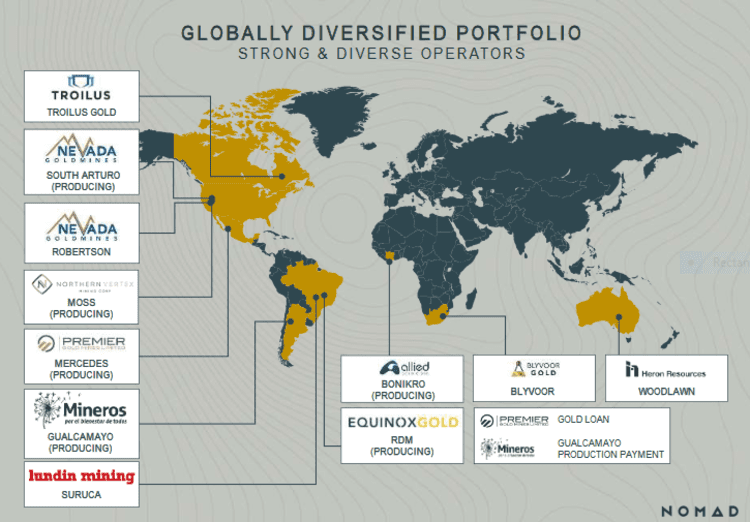

From the get-go, the Company set out to acquire high-quality assets, adding to an already robust project portfolio of producing and advanced-stage assets.

From the get-go, the Company set out to acquire high-quality assets, adding to an already robust project portfolio of producing and advanced-stage assets.

A recent example of this deal making prowess is the July 27th acquisition of a 1% net smelter return royalty (NSR) on the 8.11 million gold equivalent ounce Troilus Gold Project located along the Frotet-Evans Greenstone Belt in northern Québec.

A recent example of this deal making prowess is the July 27th acquisition of a 1% net smelter return royalty (NSR) on the 8.11 million gold equivalent ounce Troilus Gold Project located along the Frotet-Evans Greenstone Belt in northern Québec.

More recently, on August 24th, the company announced two key acquisitions, the larger of the two generating the following headline:

Nomad Royalty Company to Acquire Coral Gold, Marking the Start of Its Sector Consolidation Strategy

A comment I posted regarding the Coral Gold acquisition last August…

We haven’t seen much in the way of M & A activity in the royalty space in recent years. But this is a good one. And the asset at the center of this acquisition is one I’ve studied closely (Coral Gold is one of my Top Three Picks for 2020 over at HighballerStocks).

The highlights of this important acquisition…

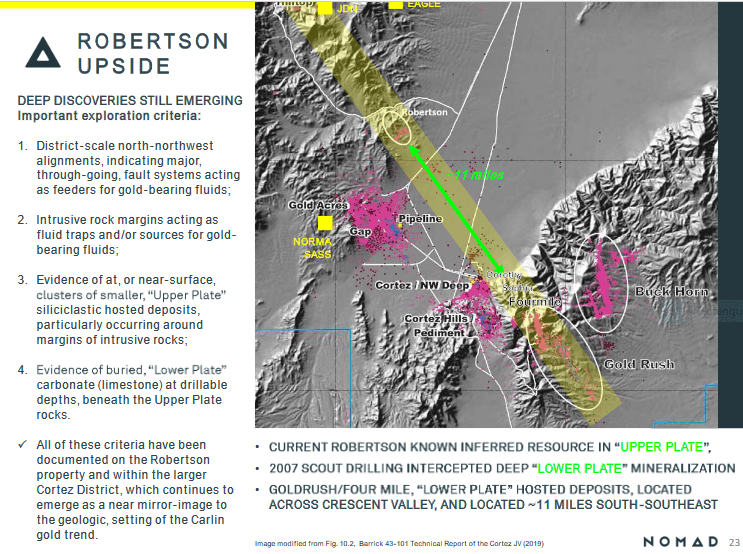

Coral holds an uncapped sliding scale NSR (1% to 2.25%) on over 2.7 million ounces at Nevada Gold Mines (NGM) Robertson Property located along the prolific Cortez Gold Trend of northern Nevada. Note: this resource is currently deemed ‘historic’.

The Robertson Property is a joint venture between mining behemoths Barrick (61.5%) and Newmont-Goldcorp (38.5%).

Based on the current US$1,850-plus spot price, the applicable NSR royalty rate on Robertson’s 2.7 million ounces of oxide material is a weighty 2.00%.

When spot gold takes out $2k, the royalty tops out at 2.25%.

The Robertson asset would garner flagship status in any ExplorerCos project pipeline.

The (deep) latent exploration potential at Robertson is compelling. With a proper, well-designed drilling campaign, we could see Robertson evolve into a world-class, Tier-1 asset.

On November 19th, Nomad completed the acquisition of Coral…

On November 19th, Nomad completed the acquisition of Coral…

Nomad Royalty Company Completes Acquisition of Coral Gold

“Pursuant to the Transaction, Nomad acquired all of the outstanding shares of Coral (“Coral Shares”). Coral shareholders received, for each Coral Share held, consideration consisting of C$0.05 in cash and 0.80 of a unit (a “Unit”) of Nomad (collectively, the “Consideration”). Each whole Unit is comprised of one Nomad common share (a “Nomad Share) and one-half of a common share purchase warrant (a “Warrant”). Each full Warrant entitles the holder thereof to purchase one additional Nomad Share at a price of C$1.71 for a period of two years following the date hereof. If the daily volume-weighted average trading price of Nomad Shares on the Toronto Stock Exchange exceeds the Warrant exercise price by at least 25% for any period of 20 consecutive trading days after one year from the date hereof, Nomad will have the right to give notice in writing to the holders of the Warrants that the Warrants will expire 30 days following such notice, unless exercised prior thereto.”

Earlier this month, on November 9th, Nomad released its third qtr results. It was a strong quarter with record revenue of $7.6 million. Revenue from its streams and royalties rang in at $5.9 million, representing an increase of 100% quarter over quarter—a clear demonstration of the strength in Nomad’s diversified portfolio.

Equity Guru’s Lukas Kane covered these Q3 numbers via the following Guru article…

Nomad Royalty (NSR.T) releases a beefy set of numbers

Sentinel Resources (SNL.C)

- 25.3 million shares outstanding

- $12.39M market cap based on its recent $0.49 close

The flagship assets

Sentinel’s project pipeline spans three continents. All are highly prospective for precious metals.

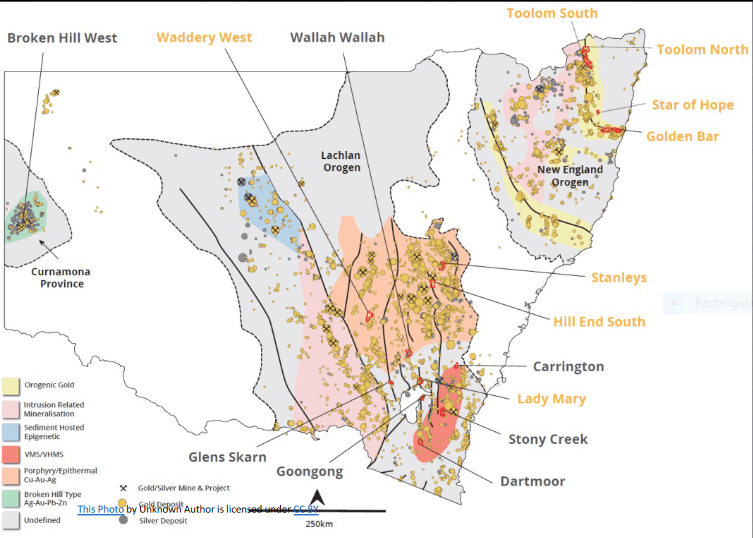

It was an October 6th headline that drew the curtain on a weighty acquisition in the New South Wales region of Australia, an acquisition that immediately took on flagship status:

SENTINEL ACQUIRES EIGHT GOLD EXPLORATION CONCESSIONS IN NEW SOUTH WALES, AUSTRALIA

Acquisition highlights:

- At least 198 historic gold mines and gold exploration prospects are present across 8 separate projects;

- Historic production records indicate that gold grades were often multi-ounce (see News South Wales Department of Planning, Industry and Environment);

- The licences are strategically located within the prolifically mineralized Lachlan and New England orogenic terranes;

- Sentinel applied to the Manager of Minerals Titles, New South Wales Department of Mining, Exploration and Geosciences for the concessions. The concessions will be 100% owned with no royalties or back-in rights, upon completion of the acquisition process.

- Sentinel has engaged a highly experienced exploration team to commence a reconnaissance work program on high-grade historic mines and showings this November 2020. The objective: to identify high-grade drill ready targets.

A 2nd acquisition, following fast on the heels of the 1st, bulked-up the Company’s project portfolio considerably.

A 2nd acquisition, following fast on the heels of the 1st, bulked-up the Company’s project portfolio considerably.

SENTINEL ACQUIRES SEVEN SILVER EXPLORATION CONCESSIONS IN NEW SOUTH WALES, AUSTRALIA

Acquisition highlights:

- At least 23 historic silver and 3 historic gold mines and exploration prospects are present across the project areas;

- Historic production records indicate that silver grades were generally high-grade, and in some instances, exceeded 1 kg/t Ag (see News South Wales Department of Planning, Industry and Environment);

- Six of the licences are strategically located within the well-mineralized Lachlan orogenic terrane. One licence is located in the world-class Broken Hill region of Curnamona Province;

- Sentinel applied to the Manager of Minerals Titles, New South Wales Department of Mining, Exploration, and Geosciences for the concessions;

- The concessions will be 100% owned with no royalties or back-in rights upon completion of acquisition process. Sentinel will be required to post a refundable performance bond of AU$10,000 per concession and spend exploration and associated expenses on each concession of AU$ 25,000 in Year One and AU$50,000 in Year Two;

- Sentinel’s technical team is currently reviewing historic data in order to fast track a follow-up reconnaissance campaign to identify high-grade drill targets.

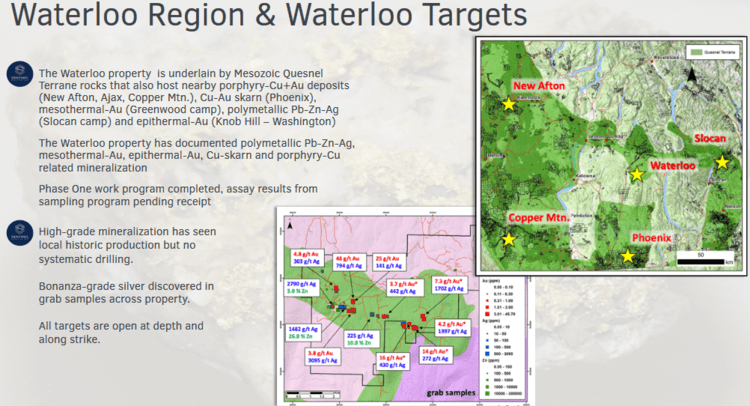

On November 19th, Sentinel dropped the following headline relating to a property on this side of the pond—a project boasting uber high-grade surface values…

On November 19th, Sentinel dropped the following headline relating to a property on this side of the pond—a project boasting uber high-grade surface values…

Highlights from this press release:

- 7,470 g/t Silver and 39.8 g/ Gold sample #B846266

- 4,840 g/t Silver and 9.9 g/t Gold sample #B846269

- 18.6 g/t Gold and 175 g/t Silver sample #B846252

- 12.4 g/t Gold and 237 g/t Silver sample #B846251

Keep in mind that these fat surface values do not necessarily represent what lies in Waterloo’s subsurface layers. Needless to say, if these high-grade values extend to depth… boom.

Equity Guru’s Lukas Kane covered this recent development a few days back via the following piece…

Equity Guru’s Lukas Kane covered this recent development a few days back via the following piece…

Sentinel (SNL.C) select grab samples return 7,470 g/t silver and 39 g/t gold

This just in…

Freeport Resources (FRI.V)

- 70.13 million shares outstanding

- $16.13M market cap based on its recent $0.23 close

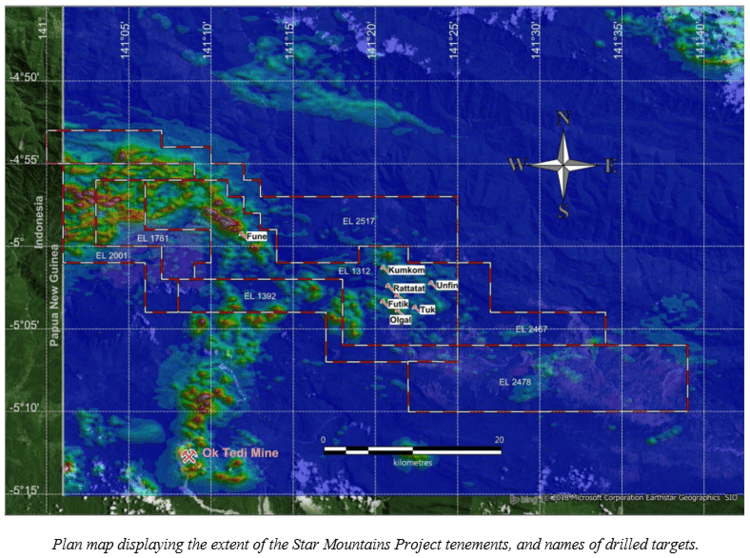

Freeport’s sights are set on a potentially massive copper/gold porphyry project—its Star Mountains Project—in mining-friendly Papua New Guinea.

The Star Mountains tenements consist of 501 square kilometers in four leases.

Star Mountains is located in the highly prospective PNG Orogenic Belt, only 25 kilometers from the colossal Ok Tedi Mine, and in the same geological arc as Grasberg, Frieda River, Porgera & Ramu.

Elephant country, this.

More than $50 million has been spent on the project since the first discovery hole back in the early 1970s.

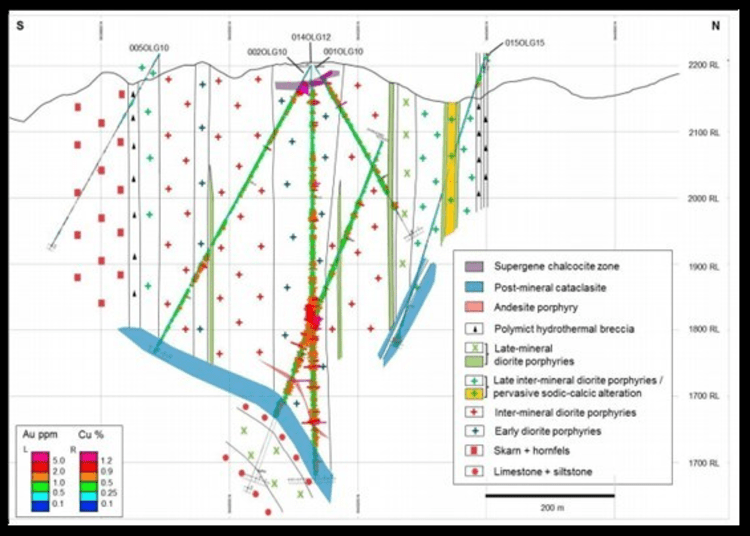

Of the five prospects drilled, the Olgal target produced some of the fattest intervals:

Of the five prospects drilled, the Olgal target produced some of the fattest intervals:

• 596 meters @ 0.61% Cu & 0.85 g/t Au from 24 meters downhole (Hole 14, 2012);

• 435 meters @ 0.52% Cu & 0.72 g/t Au from 76 meters downhole, including 100 meters @ 0.82% Cu & 1.39 g/t Au (Hole 17, 2016)

• 183 meters @ 0.53% Cu & 0.58 g/t Au from 168 meters downhole (Hole 19, 2016)

• 430 meters @ 0.39% Cu & 0.24 g/t Au from 168 meters downhole (Hole 20, 2016)

These fat hits helped lay the foundation for a maiden Olgal Inferred resource estimate of some 210 million tonnes grading 0.4% Cu and 0.4 g/t Au.

These numbers/values equate to 2.9 million ounces of gold and 840,000 tonnes (1.9 billion lbs) of copper.

Using current metals prices, this resource is equivalent to 5.9 million ounces of gold OR 3.7 billion lbs of copper.

Once again, the recent breakout in copper elevates the significance of these pounds-in-the-ground…

This resource estimate is based on 23 diamond drill holes (8,949 meters drilled) with a nominal spacing of 200 meters between holes.

This resource estimate is based on 23 diamond drill holes (8,949 meters drilled) with a nominal spacing of 200 meters between holes.

The Company is busy laying the groundwork in anticipation of an aggressive drilling campaign, one designed to push these Inferred ounces (and lbs) into a higher confidence resource category (Measured and Indicated).

Just moments ago (on November 23rd), Freeport tabled the following update for Star Mountains…

November 23rd news: Freeport to Apply Minerva Software Platform for Data Analysis at Star Mountains

The mark of a thorough and disciplined management team is its willingness (insistence) to pull out all the stops—to stack all available data both geochemical and geophysical—in advance of a costly drilling campaign.

Here, the Company announced having signed a contract with Minerva Intelligence (MVAI.V), an artificial intelligence company focused on “knowledge engineering”, for DRIVER, cutting-edge AI software for the evaluation of multi-element drilling data.

Freeport will be employing this technology in order to enhance the next phase of surface and sub-surface exploration across the Star Mountains property.

Nate Chutas, Freeport’s Senior VP of Operations :

“Freeport is committed to embracing new technologies to enhance the understanding of our portfolio of projects beginning with Star Mountains. We believe that the advances in technology that DRIVER brings will provide deep insights into our project data and provide a better understanding for the development and prioritization of high-quality exploration targets.”

According to this press release, “DRIVER delivers these insights by evaluating all the elements typically returned by modern laboratories, not simply the elements of direct economic interest.”

The Company states that this work is too time-consuming and complicated to be carried out by project geologists.

“Minerva’s cognitive reasoning platform then compares the identified geochemical exploration vectors to its database of hundreds of past and present mines around the world and identifies those most similar to the explored target using the Company’s proprietary AI technology. The resulting similarity rankings can then provide reliable, explainable models upon which geologists can build their exploration strategies.”

This is a positive step in advancing Star Mountains further along the exploration curve.

Gord Friesen, Freeport CEO:

“Despite having identified a very significant resource already, it is our assertion that Star Mountains is still vastly under-explored. We believe that utilizing AI-based, deep-thinking tools such as DRIVER will exponentially hasten our understanding of Star Mountains’ true potential.”

The scope of work

The data analysis will involve three phases, the first two are 3D studies focused on drill hole assays and intervals from the Olgal deposit itself.

“The third study will be a combined 2D and 3D analysis of data collected from the remainder of the Star Mountains claims. All of these studies will be integrated with interpretation of available airborne geophysics data. The first 3D study will be a geochemical cluster analysis to identify the lithogeochemical characteristics of the logged drill holes to use as a comparison against the interpreted logging, and for comparision with the lithogeochemistry of drilling results for other Star targets. The second 3D study will involve the use of Minerva’s DRIVER software to examine multi-element zonation patterns throughout the Olgal dataset. The third study will apply Minerva’s SOLACE workflow to a combination of the surface and drilling data available for the rest of the Star Mountains claims for incorporation into Minerva’s Target target generation system.”

“The third study will be a combined 2D and 3D analysis of data collected from the remainder of the Star Mountains claims. All of these studies will be integrated with interpretation of available airborne geophysics data. The first 3D study will be a geochemical cluster analysis to identify the lithogeochemical characteristics of the logged drill holes to use as a comparison against the interpreted logging, and for comparision with the lithogeochemistry of drilling results for other Star targets. The second 3D study will involve the use of Minerva’s DRIVER software to examine multi-element zonation patterns throughout the Olgal dataset. The third study will apply Minerva’s SOLACE workflow to a combination of the surface and drilling data available for the rest of the Star Mountains claims for incorporation into Minerva’s Target target generation system.”

A good primer for this one can be gained by clicking on the link below…

That’s it for this Guru ClientCo Resource Roundup.

END

—Greg Nolan

Full disclosure: ALL of the companies featured above are Equity Guru marketing clients (color me biased).