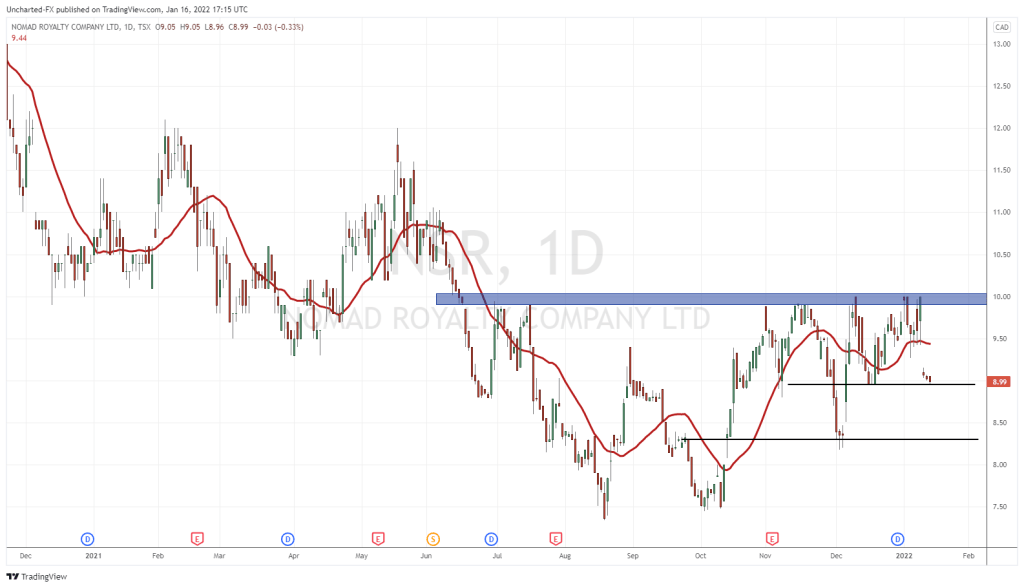

On November 9, 2020 Nomad Royalty (NSR.T) released its Q3, 2020 financial results, corporate update, asset update and news of a Q4, 2020 dividend (all figures in U.S. dollars unless otherwise noted).

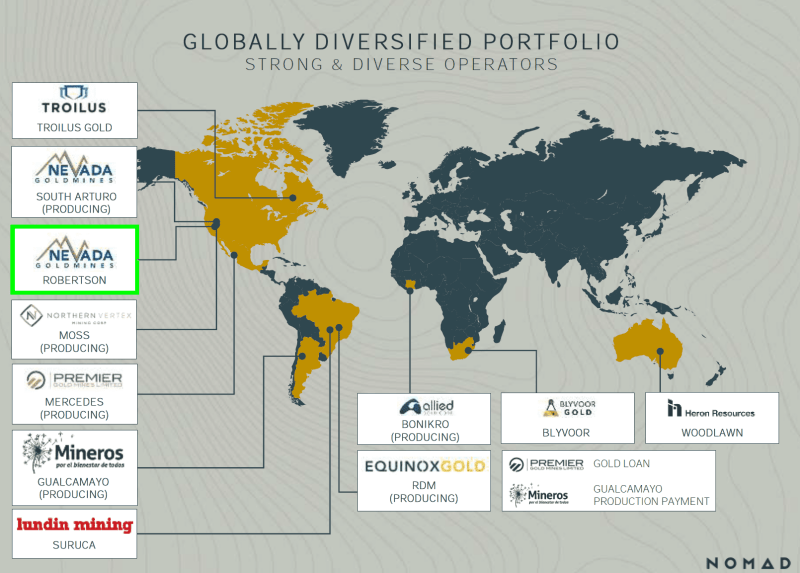

Nomad owns a portfolio of 12 royalty, stream and gold loan assets, of which six are on currently producing mines.

Its macro-business objective is “to grow and diversify its low-cost production profile through the acquisition of additional producing and near-term producing gold and silver streams and royalties”.

“We had a strong third quarter with record revenue of $7.6-million,” stated Vincent Metcalfe, Nomad CEO.

Revenue from NSR’s streams and royalties were $5.9-million, doubling quarter over quarter.

With a strong free cash flow outlook, Nomad announced its inaugural dividend policy.

A second quarterly dividend of 0.5 cent per common share is payable on Jan. 15, 2021, to Nomad shareholders.

Half a penny isn’t a lot, but fat dividends from resource companies are rare.

“More often than not, company boards sanction payouts as a fixed proportion of earnings,” reports Miningmx, “Complying with shareholder wishes requires a special dividend, or a payout policy adjustment. Such bold decisions may border on the irresponsible if the money can be used better internally by replenishing resources.”

If you’re hunting for a juicy dividend, you should buy shares in International Business Machines (IBM.NYSE) – not shares in a metal company.

As a Nomad stakeholder, I want NSR to keep making good investments in undervalued precious metals projects.

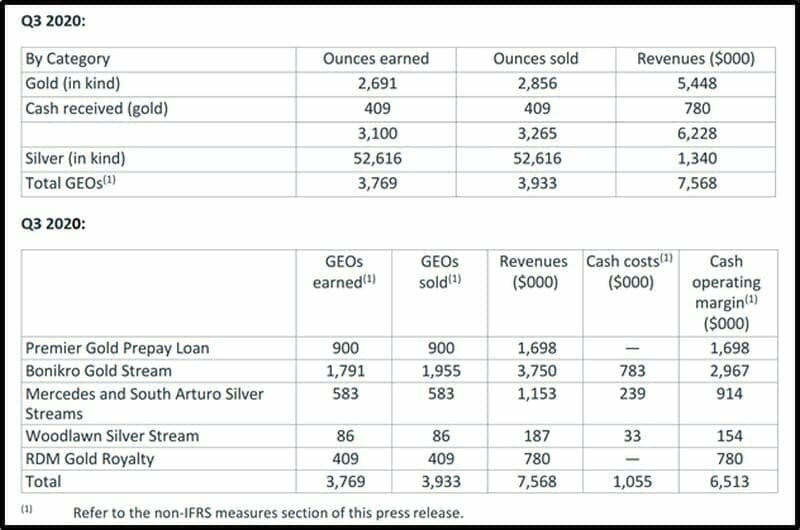

Q3, 2020 highlights:

- Gold ounces earned of 3,100 (2,450 for Q3 2019);

- Silver ounces earned of 52,616 (35,587 for Q3 2019);

- Revenues of $7.6-million ($4.3-million for Q3 2019);

- Net income of $500,000 ($400,000 for Q3 2019);

- Adjusted net income of $2.0-million ($3.1-million for Q3 2019);

- Gross profit of $1.9-million ($100,000 for Q3 2019);

- Cash operating margin of $6.5-million ($4.2-million for Q3 2019);

- Cash operating margin of 86 per cent (97 per cent for Q3 2019);

- $15.0-million of cash as at Sept. 30, 2020;

- Announced and declared first dividend payment of $2.0-million.

Q3, 2020 revenue was sourced 100% from gold and silver.

Q3, 2020 revenue was sourced 100% from gold and silver.

Management’s objective for the portfolio is “to maintain a focus on precious metals (primarily gold and silver) with a target of no more than 10% in revenue from other commodities”.

Music to our ears.

The U.S. government owes about $23 trillion itself (a lot of it to China), and is plunging another $1 trillion in debt in a normal year. This year wasn’t normal. The fed borrowed about $3 trillion.

No act of Congress can magically make a tonne of gold appear on the lawn of the White House. We anticipate a future where paper money will radically devalue and hard assets like gold will appreciate.

Geographically, NSR revenue was sourced 48% from the Americas, 50% from Africa and 2% from Australia.

Edited Corporate Update:

- On July 13, 2020, Nomad qualified and started to trade on the OTCQX Best Market under the ticker NSRXF.

- On July 31, 2020, Nomad closed the acquisition of a 1-per-cent net smelter return (NSR) royalty on the Troilus gold project located in Quebec

- On Aug. 17, 2020, Nomad closed a revolving credit facility agreement with a syndicate of banks for $50-million with the option to increase to $75-million.

- On Aug. 23, 2020, Nomad entered into a definitive arrangement agreement to purchase Coral Gold. The transaction is expected to close in November, 2020, subject to the approval of at least two-thirds of Coral’s shareholders.

- On Aug. 26, 2020, Nomad unveiled its dividend policy and declared its inaugural quarterly dividend which was paid on Oct. 15, 2020. Nomad adopted an annual dividend policy of two cents per share, payable quarterly.

- On Aug. 31, 2020, Nomad appointed Ms. Kudzman, a specialist in risk management and an actuary, to its board of directors.

- On Sept. 28, 2020, Nomad closed the acquisition of all the of the outstanding shares of Valkyrie Royalty, a private royalty company that owned an NSR royalty on the Moss gold mine located in Arizona, United States, for total share consideration of approximately $8.9-million.

- On Sept. 30, 2020, Nomad filed a short-form base shelf prospectus for a maximum of $300-million of securities offering in the next 25 months.

Edited Asset Update:

- Northern Vertex announced record production of 14,673 gold equivalent ounces and record revenues of $27-million for the three months ended Sept. 30, 2020.

- Equinox Gold sold 19,018 ounces of gold and realized revenue of $32.5-million for the three months ended June 30, 2020.

- Following the pandemic-related suspension of the Mercedes mine operations, Premier Gold announced that ore production and processing resumed in July, 2020, with 12,183 ounces of gold and 49,985 ounces of silver produced for the three months ended Sept. 30, 2020.

- Barrick Gold, through its subsidiary Nevada Gold Mines, produced 17,740 gold ounces (7,096 gold ounces reflecting Premier Gold’s 40-per-cent interest), from more than 650 tonnes of ore per day at the high-grade underground operation.

- Allied Gold has informed NSR that it has been producing from the Akissi-So, Chapelle and Chapelle West extension pits. During the month of September, 2020, six Caterpillar 777 haul trucks were fully commissioned.

- Troilus Gold filed a preliminary economic assessment (PEA) on the Troilus gold project on Oct. 14, 2020. The PEA supports a combined open-pit and underground mining scenario with low initial capital costs and high rate of return for a 35,000-tonne-per-day operation over a 22-year mine life with projected gold production of 220,000 ounces average per year for the first five years and 246,000 ounces average per year for the first 14 years.

- Gualcamayo gold royalty: Mineros S.A. has informed NSR that it is investing $8-million annually in near-mine exploration and infill drilling to increase mine life. Only 20 per cent of the 20,000-hectare land package has been explored.

- As a result of the suspension of the operations at the Woodlawn mine, Heron Resources was in default under its credit facilities. The Woodlawn mine will remain on care and maintenance until things are worked out.

- Blyvoor Gold received its final licence which will allow them to access the deeper mining levels. Blyvoor Gold is now fully permitted. It expects to complete the plant construction and begin processing operations in Q4, 2020. Sustainability program: third party mine operators.

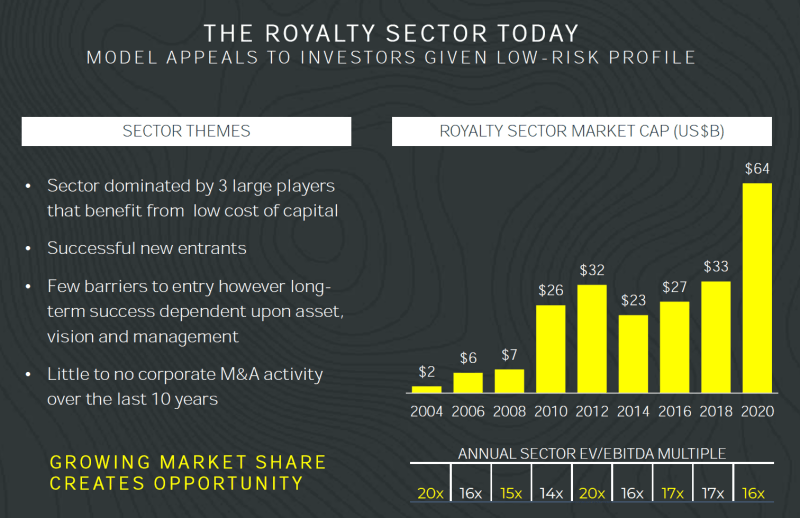

“There’s significant re-rating potential here [with Nomad] as the company continues bulking up its cash flowing, and advanced stage project base,” commented Equity Guru’s Greg Nolan on August 8, 2020, “Pushing for scale, with a goal of attaining a $3 to $5B market cap in the medium to long term, the company should begin commanding the multiples that the very largest entities in the space enjoy”.

“The strong gold environment will allow us to continue to generate strong free cash flow while reinvesting in new opportunities that will support further growth and returns to shareholders,” stated Metcalfe.

Full Disclosure: Nomad is an Equity Guru marketing client.