Eight more sleeps until the U.S. Federal election.

For gold investors, this is a non-event.

Neither Trump nor Biden will have any significant effect on the medium or long-term price of gold.

The forces pushing gold higher are bigger than these two men (one an ass-clown, the other past his due date).

Gold is priced in U.S. dollars. When the U.S. dollar weakens – gold goes up.

“The end of US dollar dominance and the beginning of some new form of global monetary system will soon be upon us,” states investment legend Frank Guistra in a recent Kitco Op-ed.

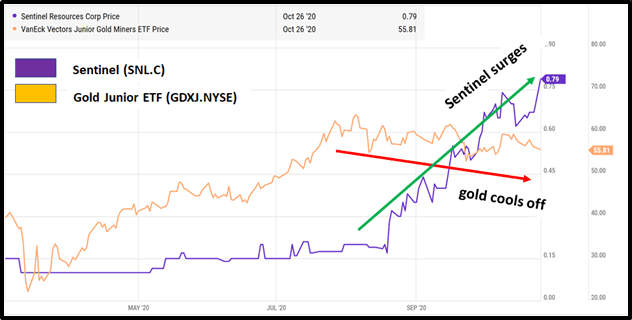

Historically, when the spot price of gold goes up, junior explorers explode to the upside.

Conversely, when the spot price of gold swoons, the juniors typically slump in unison.

Occasionally, a precious metal junior will buck the trend – the share price will keep appreciating despite the inclement weather.

Sentinel Resources (SNL.C) is an example of such a company.

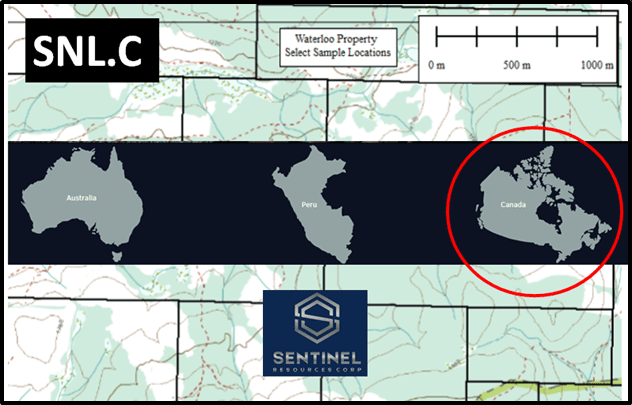

SNL is a brand-new venture developing precious metals projects in New South Wales, Australia, Peru and British Columbia, Canada.

SNL guiding principles:

- Acquisition of strategic exploration properties

- Mining-friendly jurisdictions

- Mature mining industries

- Low-cost of entry

- Easy access to infrastructure

- Minimize capital and operational explorational costs

SNL share price is up 700% since its IPO in March, 2020.

Why does the SNL share-price continue to defy gravity?

Because they’re sticking to their “guiding principles” making good deals – and aggressively advancing the exploration properties.

Today’s news is a case in point.

On October 26, 2020 Sentinel published an initial review of its eight gold-focused exploration licenses located in New South Wales, Australia.

The exploration licenses are known as Star of Hope, Golden Bar, Alliance Reef, Stanleys, Lady Mary, Waddery West, Wittagoona Reef and Toolom South (collectively, the “Gold Projects”).

The review was prepared by Dr. Peter Pollard, Director and Chief Geologist of Sentinel, and Dr. Christopher Wilson, senior advisor to Sentinel.

“A first pass review of available historic data for the Gold Projects indicates that Alliance Reef and Wittagoona Reef on the Peel-Manning fault system, and Toolom South in the Mount Carrington gold camp, host extremely robust exploration targets,” states SNL, “The licenses are located within the New England Orogenic Terrane”.

Highlights:

Alliance Reef (ELA 6057)

- Located on the 350 km long Peel-Manning Fault — a crustal-scale fault zone that hosts variably quartz-carbonate altered serpentinites (otherwise known as listwanites).

- A 102 km2 licences hosting 28 historic gold mines with reported production grades of up to 15 g/t Au.

- Along strike, and immediately adjacent to the historic Nundle alluvial gold field that produced more than 225,000 ounces of gold.

- Includes the historic Marquis of Lorne gold mine with a cited historic resource estimate of 336,000 tonnes at 4.75 g/t Au for 51,000 ounces of gold. The Company is not treating the historical estimate as current mineral resources or mineral reserves.

- Analogous deposits include the Californian Motherlode, Bralorne in British Columbia, and large high-grade gold deposits in the shield area of Saudi Arabia.

- Unlike quartz-dominant orogenic deposits (such as the Abitibi, West Africa and Western Australia) which are characterized by obvious quartz vein targets, listwanite-hosted systems are often subtle and under-explored.

- The Peel-Manning system is noted for extensive, historic alluvial deposits, indicating that listwanites are gold mineralized.

Toolom South (ELA 6061)

- Located within the historic Toolom alluvial goldfield with reported production of more than 1 million ounces of gold.

- Over 60 historic gold mines — some with reported multi-ounce grades.

- The Phoenix deposit is situated approximately 5 km NW of the concession, classified as an intrusion related gold rich breccia pipe, highlight intercepts from initial drilling include 48 m @ 2.21 g/t Au.

Golden Bar (ELA 6061)

- A 198 km2 licence with at least 50 historic gold mines and showings, most likely of a low- sulphidation type.

- Historic mines and showings define two structural corridors with a cumulative strike length of over 20 km. Historic production grades regularly above 50 g/t Au.

Stanleys (ELA 6062)

- A 90 km2 licence located within a prolific gold camp comprising deposits such as Commonwealth, Copper Hill (1 Moz Au), Hill End (0.7 Moz Au), Cadia (43 Moz Au) and McPillamys (2 Moz Au). Readers should note that mineralization contained on these projects is not necessarily indicative of mineralization contained at Stanleys.

- At least 17 historic small-scale gold mines and prospects with cited historic production grades of up to 185 g/t Au.

Proposed Work Program:

- Sentinel is planning an aggressive field program initially focused on the 4 highest priority targets outlined above.

- Field work will concentrate on rapid reconnaissance mapping and geochemical sampling of historic workings and showings, in order to ground truth the tenor and styles of mineralization present.

- Review of regional geophysical and topographic datasets is ongoing, which in conjunction with the results of first pass field mapping, will allow deposit models and key controls on mineralization to be developed, and high value drill targets to be identified.

- Review of the remaining gold licences — Wittagoona Reef, Star of Hope, Lady Mary and Waddaderry West — is ongoing. Sentinel will announce results of this study shortly.

Two weeks ago, SNL announced that it has acquired seven, silver-focused exploration concessions totaling approximately 38,600 hectares (386 km 2 ), located in located in New South Wales, Australia.

The 7 concessions will be 100% owned with no royalties or back-in rights upon completion of acquisition process.

“Though Sentinel Resources has barely been trading for eight weeks, its price pattern shows impressive trajectory marked by steady, determined accumulation,” wrote Equity Guru’s Nolan on September 9, 2020, who analysed SNL’s precious metal portfolio in depth here.

“In a short period of time, our seasoned exploration team has completed a review and analysis of our highly prospective gold projects in New South Wales,” stated Rob Gamley, CEO of Sentinel on October 26, 2020, “Our focus will now be to immediately carry out exploration work on the Peel-Manning fault system due to the potential for listwanite hosted gold. We are excited with the potential of these two exploration licenses.”

True to form – in a sea of red gold juniors – SNL is up 12% today to .73 by mid-morning.

With only 18 million shares out, the company still has a market cap under $15 million.

- Lukas Kane

Full Disclosure: Sentinel Resources is an Equity Guru marketing client.