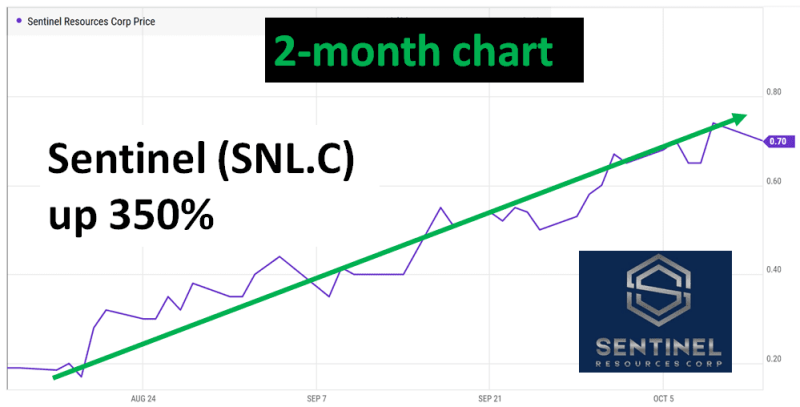

On Friday October 9, 2020 – in his analysis of Sentinel Resources (SNL.C), Equity Guru’s Greg Nolan stated, “I’m told that there may be additional acquisitions in the not too distant future.”

That not-too-distant-future turned out to be the very next Canadian trading day, October 13, 2020.

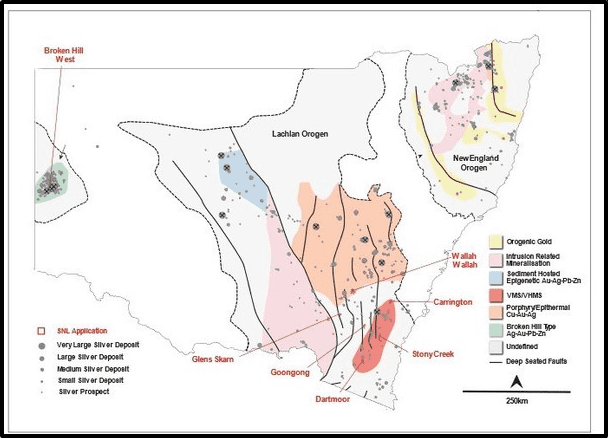

On October 13th, 2020 Sentinel Resources (SNL.C) announced that it has acquired seven, silver-focused exploration concessions totaling approximately 38,600 hectares (386 km 2 ), located in located in New South Wales, Australia.

That’s a big chunk of land – 94 X the size of Stanley Park.

The 7 concessions will be 100% owned with no royalties or back-in rights upon completion of acquisition process.

Sentinel will be required to post a refundable performance bond of CAD $9,400 per concession and spend exploration and associated expenses on each concession of CAD $23,500 in Year One and CAD $47,000 in Year Two.

To comprehend how SNL could bag such a big chunk of land for such modest terms, we must recall that Australia has 70% the land mass of the USA, but only 7% of the population [Namibia, Western Sahara, Mongolia and Greenland do have a lower population density].

For godssake, Australia has 20 million more Kangaroos than people.

The concessions are known as; Wallah Wallah, Stony Creek, Carrington, Dartmoor, Glens Skarn, Broken Hill West and Goongong (collectively, the “Silver Projects”)

Silver Project Acquisition Highlights:

- 23 historic silver and 3 historic gold mines and exploration prospects

- Historic production records indicate high-grade silver, sometimes exceeded 1 kg/t Ag

- Six of the licences are strategically located within the well-mineralized Lachlan orogenic terrane.

- One licence is located in the world class Broken Hill region of the Curnamona Province.

Note: the “historic production records” cited in the bullet list above were sourced from the News South Wales Department of Planning, Industry and Environment. These records do not meet Canadian 43-101 standards.

“The acquisition of seven strategically located silver projects, within the prolifically mineralized Lachlan orogenic terrane and the world famous Broken Hill Block, provides an excellent complement to the Company’s gold projects,” stated Rob Gamley, President & CEO of Sentinel, “A significant historic database (held by the New South Wales Department of Planning, Industry and Environment) provides a robust foundation on which to rapidly advance projects and generate high-value drill-ready targets.”

“The seven silver-focused concessions encompass a range of deposit types including skarn mineralization associated with porphyry intrusions, volcanic massive sulphide deposits, orogenic vein deposits, and Broken Hill Type,” stated Gamley who believes that “targeting different styles of mineralization significantly reduces exploration risk.”

Sentinel’s technical team is currently reviewing historic data in order to fast track reconnaissance follow-up and definition of high-grade drill ready targets.

“Though Sentinel Resources has barely been trading for eight weeks, its price pattern shows impressive trajectory marked by steady, determined accumulation,” writes Nolan, who analysed SNL’s precious metal portfolio in depth here.

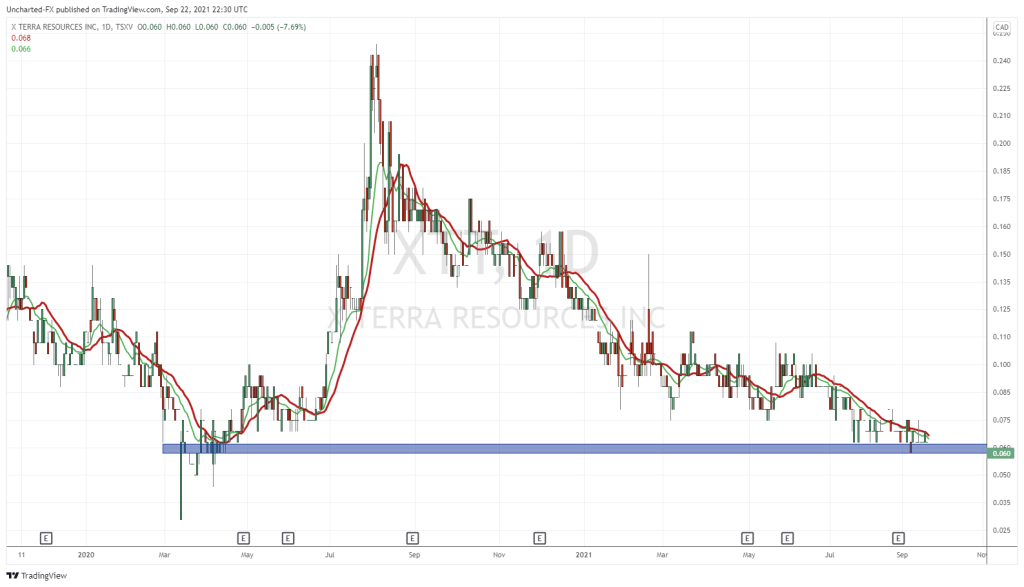

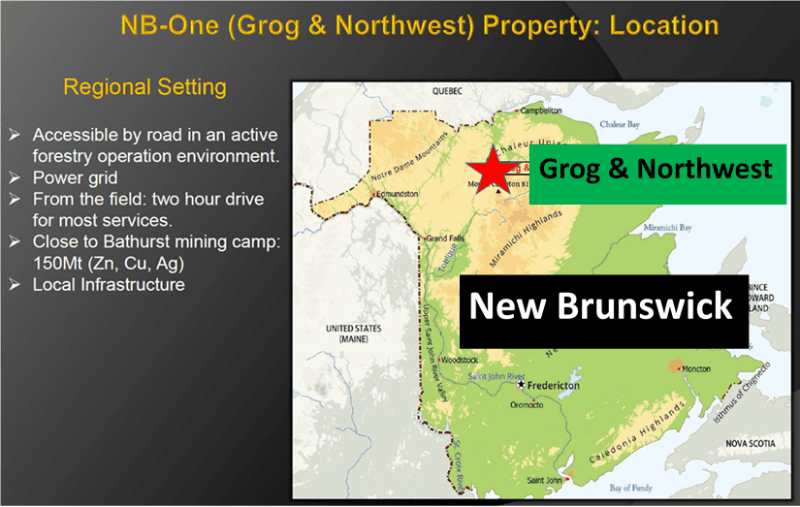

On October 13, 2020, X-Terra Resources (XTT.V) announced that it has started drilling the Rim Vein target on the Northwest property and the Grog target on the Grog property using two drills.

Additional data obtained from the ground IP geophysics as well as the geochemical sampling has strongly contributed to the final planning of this drill program.

The drill section planned over the Rim vein target covers approximately 500 metres following a west north-west orientation cross cutting the main structural orientation. Gold bearing veins are believed to be concordant or parallel to the sedimentary bedding.

“X-Terra’s exploration team and drilling crews are excited to be drilling the Rim vein target which has never been drill tested,” stated Michael Ferreira, President and CEO of X-Terra, “given the additional gold-in-soil anomalies, it highlights the compelling possibility of a stacking of gold bearing veins below.”

Ferreira points out that The Rim vein target has yielded gold grades from 4.5 g/t Au to 1,205 g/t Au with visible gold – (See X-Terra’s press release dated December 5, 2018).

“We were able to secure a second drill to begin drilling the Grog target at the same time,” stated Ferreira, “this should reduce the wait time for the first batch of results. Furthermore, this will be X-Terra’s largest drill program completed on any of its properties to date”.

In additional news, X-Terra has mandated ExploLab of Val d’Or, Quebec to carry out a bench scale metallurgical test using 129 kilograms of material originating from the Rim vein to evaluate the recovery model by gravimetric analysis.

The goal of this metallurgical test at this early stage is to determine how the material will respond to this conventional process and how much metal (gold) can be recovered.

“X-Terra’s 280 square kilometer Grog and Northwest projects, located along the McKenzie Gulch Fault in Northeastern New Brunswick, delivered a new gold discovery in recent weeks from an 11-hole drilling campaign staged earlier this year,” wrote Equity Guru’s Greg Nolan on June 22, 2020.

“The discovery at Grog is in hole GRG-20-012 which tagged 0.41 g/t Au over 36 meters (including 0.46 g/t Au over 31 meters and 7.59 g/t Au over 0.6 meters) at a vertical depth of 81 meters,” continued Nolan.

“No, the grade isn’t especially fat or sexy, but it’s a broad intercept of mineralization suggesting a (potentially) large mineralized system lurking in the project’s subsurface layers.

Thus far, GRG-20-012 is the only hole drilled into this newly identified structure.

It’s important to understand that epithermal systems are often defined by sub-one-gram material. It’s the scale and near-surface nature of the mineralization that moves the needle for these types of deposits.” – End of Nolan

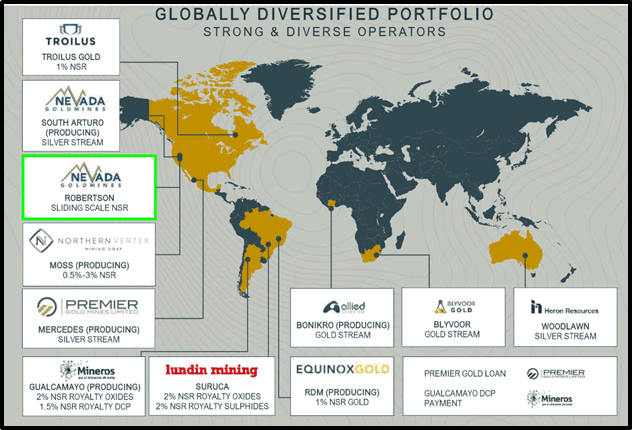

Nomad Royalty (NSR.T) owns a portfolio of 11 royalty, stream, and gold loan assets, of which 5 are on currently producing mines.

When Nomad recently launched, it stated that it “plans to grow and diversify its low-cost production profile through the acquisition of additional producing and near-term producing gold & silver streams and royalties.”

Two months ago, Nomad entered into a definitive Arrangement Agreement to acquire all of the outstanding common shares of Coral Gold.

Acquisition Highlights

- Premier, uncapped sliding-scale 1.00% to 2.25% net smelter return (NSR) royalty on Robertson property which forms part of the greater Cortez & Pipeline mining complex.

- Premier gold mining operator in the world on the tier 1 Cortez & Pipeline mine complex

- The Robertson development project contains an historical Inferred mineral resource estimate (MRE) in excess of 2.7 million ounces Au in total oxide and sulphide materials.

“When we created Nomad, we set the objective to become a catalyst for sector consolidation,” stated Nomad CEO Vincent Metcalf, “Today’s announcement marks the first step of our consolidation strategy and follows our desire to become the best global acquisition-driven precious metals royalty company in the sector.”

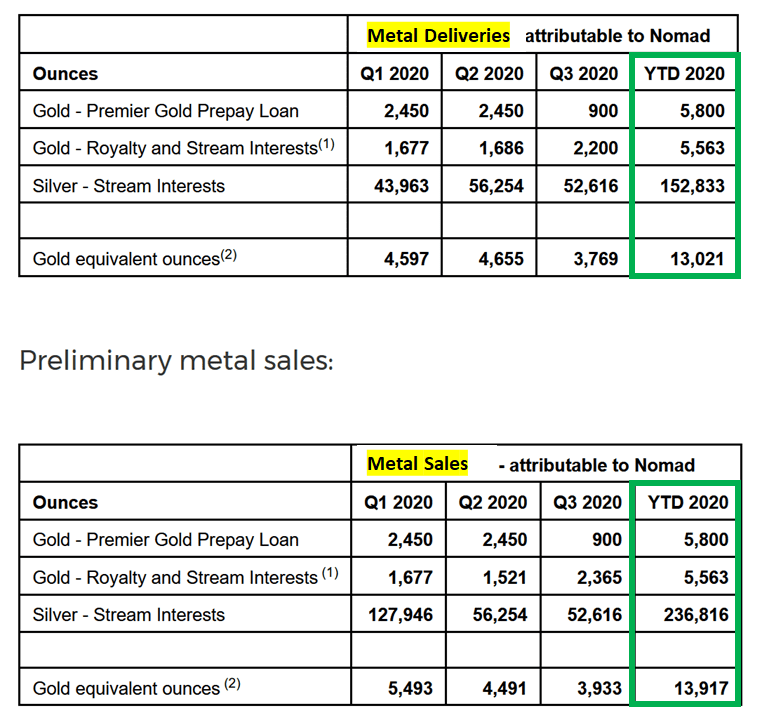

On October 13, Nomad Royalty announced its Q3, 2020 preliminary gold and silver deliveries from its royalty, stream and gold loan interests:

Nomad realized preliminary revenues of $7.6 million during the three-month period ended September 30, 2020 resulting from 3,933 gold equivalent ounces sold.

As per the vend-in transactions closed on May 27, 2020, Nomad was entitled to payments made in respect of the acquired assets since January 1, 2020.

As such, the preliminary gold and silver deliveries and sales above for the three-month periods ended March 31, 2020, June 30, 2020 and nine-month period ended September 30, 2020 include payment received on the closing of the vend-in transactions.

With royalty agreements in Mexico, Quebec, South Africa, Argentina, The Ivory Coast and Brazil – there is a high likelihood of some COVID-19 related production challenges.

In the near future, Equity Guru will be talking to Nomad CEO Vincent Metcalfe to get more context on these Q3, 2020 financials, and the milestones for the next quarter.

- Lukas Kane

Full Disclosure: Sentinel, X-Terra and Nomad are Equity Guru marketing clients.