Golden Lake Exploration (GLM.C) is a fairly new entry in the junior exploration arena. It began trading last summer with no real fanfare, until November 2019 when a new acquisition set the stage for a very decent Carlin-type gold play…

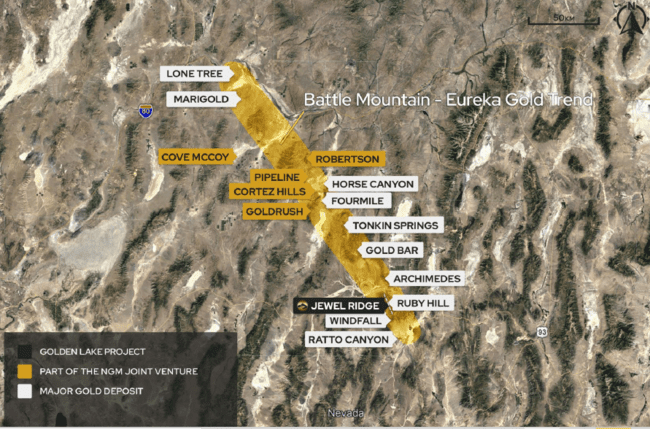

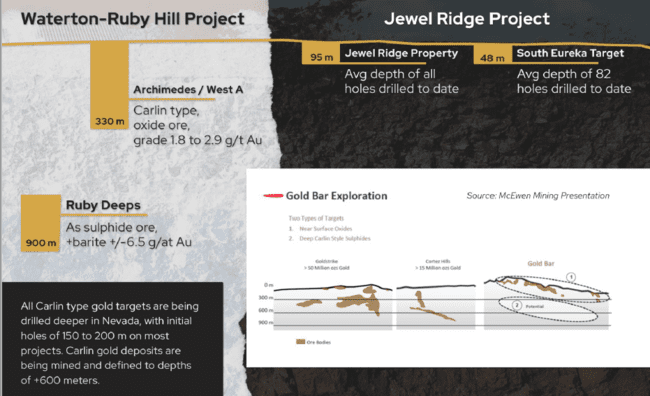

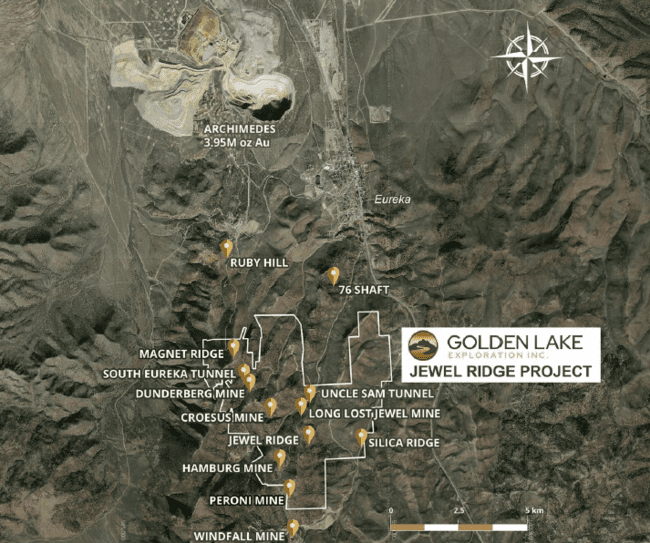

Jewel Ridge is located at the south end of Nevada’s prolific Battle Mountain—Eureka trend, strategically along strike and contiguous to the Barrick Gold’s (former) two million ounce Archimedes/Ruby Hill mine to the north, and Timberline Resources’ advanced-stage Lookout Mountain project to the south.

Mike England, Golden Lake president:

“This marquee property acquisition in the heart of a prolific gold trend in Nevada gives Golden Lake year-round drilling capability and exciting potential for discovery of significant Carlin-type gold deposits. Gold mineralization at Jewel Ridge is present in a variety of styles over many target areas. In addition, the Company is engaging an experience team of technical personnel, familiar with Nevada and Carlin-type deposits to aggressively advance the Jewel Ridge property.”

Management is everything in the junior exploration arena, particularly where Carlin-type deposits are concerned.

This top-shelf team of mining men (and women) is led by resource veteran Mike England.

Peter Mah, the current COO of McEwen Mining (MUX.TO), is a standout. During his tenure at Newmont, his early stage exploration leadership lead to the delineation of over 15M ounces of gold resources in Canada, Nevada, Ghana, and Peru (most notably the Leeville underground mine expansion in Nevada and the new Subika underground mine in Ghana).

Vic Bradley, Golden Lake’s COB, was at the helm of Yamana (YRI.TO) when it was an exploration company donning mere penny status (I was an early investor in Yamana back in the day). Vic also served as Osisko Mining’s chairman from November 2006 up to its $4.1 billion sale to Agnico Eagle (AEM.TO) and Yamana in June 2014. That transaction represented a tremendous wealth creation exit for early shareholders.

John Hiner, Director, has an exploration history of some 45 years, having served on a number of teams credited with eight discoveries of which five became mines that are still producing.

Robert Weicker, Chief Geologist, was on the ground at Hemlo from late exploration through to production. Bob has extensive exploration experience targeting VMS deposits along the Abitibi greenstone belt and has worked projects in every county in Nevada, in addition to Arizona, Utah, Idaho, Washington, New Mexico, and California.

The quality of the Jewel Ridge project also brought a key guy, a senior geologist with over 30 years in the mining business, out of retirement:

That was a smart hire—super smart.

Dick Reid‘s roles at Newmont included Nevada District Exploration Manager, Exploration Business Development Manager, and Chief Geologist for North America. Reid is also FROM Nevada…

“Mr. Reid has been involved with acquisitions of significant mining properties throughout his career including Newmont’s acquisition of Long Canyon from Fronteer Gold Inc., and the acquisition of the Buffalo Valley deposit, which was subsequently sold to SSR Mining. Richard has extensive experience with Carlin type gold deposits which will be directly applicable to the Company’s exploration focus on the Jewel Ridge gold property. He also was involved with epithermal hosted gold deposits on the Carlin and Battle Mountain-Eureka Trend, including significant discoveries at the Midas Mine and Florida Canyon Mine.”

The Golden Lake team is stacked deep with geological talent. And the primary reason they’re all here is because of what Jewel Ridge may ultimately hold in its subsurface layers.

The project – Jewel Ridge

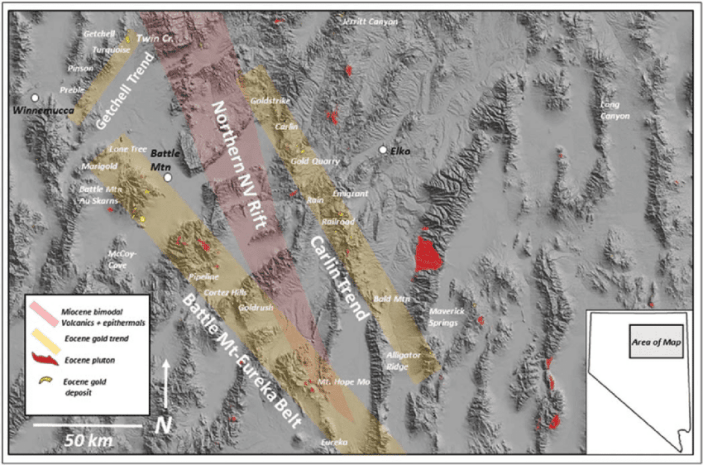

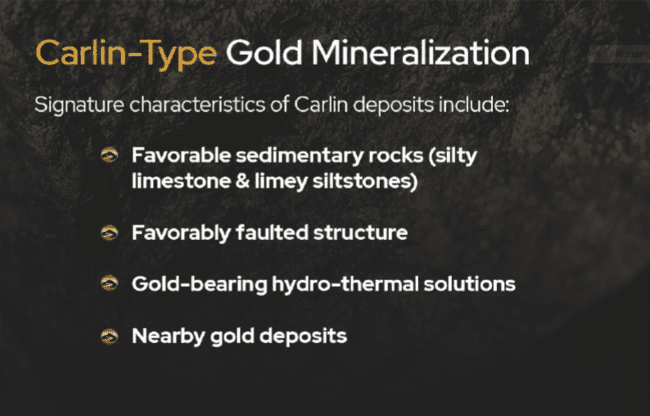

Nevada Carlin type gold deposits have a combined mineral endowment of more than 250 million ounces, all concentrated in four main trends: Carlin, Cortez (Battle Mountain-Eureka), Getchell, and Jerritt Canyon.

As noted further up the page, Jewel Ridge is located in the upper class neighborhood of Nevada’s prolific Battle Mountain—Eureka trend.

It’s difficult to imagine a better address for a junior exploration company.

Note the proximity of Jewel Ridge to Nevada Gold Mines’ Pipeline, Cortez Hills, and Goldrush deposits on the following map…

Nevada Gold Mines (NGM) is a partnership between mining behemoths Barrick Gold (61.5%) and Newmont-Goldcorp (38.5%).

Pipeline, Cortez Hills and Goldrush represent three of the largest Carlin-type gold deposits in the world. They make up NGM’s lowest-cost assets with over 50 million ounces of gold reserves & resources.

Did I mention that this is a good address?

The Carlin-type gold deposits Golden Lake is targeting at Jewel Ridge are of the large bulk tonnage kind.

“The deposit types of interest at Jewel Ridge are Carlin-type, sedimentary rock-hosted, gold deposits and carbonate replacement deposits. Carlin-type deposits include many deposits that occur in the Battle Mountain-Eureka Trend, Carlin Trend and other well-known mineral trends in north central Nevada. Jewel Ridge is located adjacent to, and south of, the former Ruby Hill gold property, which was operated by Homestake Mining Company from 1997 until 2002 and produced about 680,000 ounces of gold from the Archimedes open pit. In February 2007, Barrick Gold Corp. commenced production on a 1.1-million-ounce gold resource from the adjoining East Archimedes deposit. From 1976–2012, production from these Carlin-type deposits in the Eureka district was approximately 44.9 tonnes (1.38 million ounces) of gold (NBMG, 2014).”

Jewel Ridge is one of those rare projects tucked away in the heart of elephant country that has been on the back burner for decades due to tenure issues. It’s received only cursory (shallow) probes with the drill bit, and that’s about it. This is where the opportunity lies.

Jewel Ridge is one of those rare projects tucked away in the heart of elephant country that has been on the back burner for decades due to tenure issues. It’s received only cursory (shallow) probes with the drill bit, and that’s about it. This is where the opportunity lies.

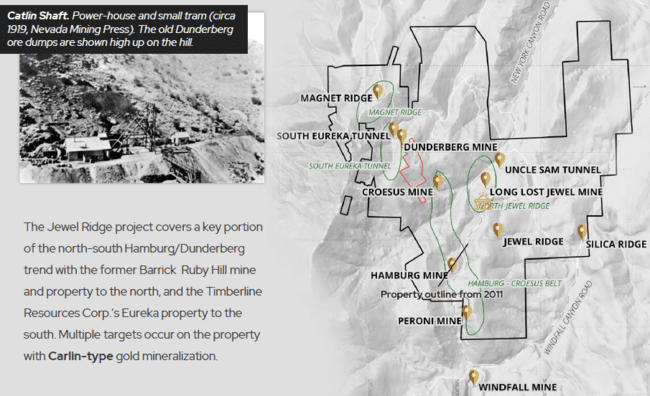

Jewel Ridge consists of 96 unpatented lode mining claims and 30 patented claims covering roughly 728 hectares of geologically prospective terra firma.

I know what some of you are thinking: “WTF is the difference between a patented and unpatented claim?” Fair enough.

Very simply, with a patented claim, you own the land as well as the subsurface mineral wealth.

With an unpatented claim, you are in a lease relationship with the government for the right to extract minerals. You do NOT own the land.

There is a 4-kilometer trend of historic mines on the property dating back to the 1800s. These early miners were chasing high-grade silver, lead, zinc, and gold.

“The Jewel Ridge property contains several historic small gold mines which align along a north-south-trending stratigraphic contact of Lower Paleozoic sedimentary rocks, as well as several other gold-mineralized zones with a variety of structural and lithological controls.”

“The Jewel Ridge property contains several historic small gold mines which align along a north-south-trending stratigraphic contact of Lower Paleozoic sedimentary rocks, as well as several other gold-mineralized zones with a variety of structural and lithological controls.”

Interestingly, Carlin-type gold mineralization in the region often flanks these historic high-grade mines. They may represent a good indicator.

The project did see some exploration back in the day. The company is in possession of a good data base consisting of extensive soil and rock geochemistry, excellent geological mapping, and over 360 shallow reverse circulation (RC) drill holes. The company was successful in generating a geological model for Jewel Ridge based on the quality of this historic data.

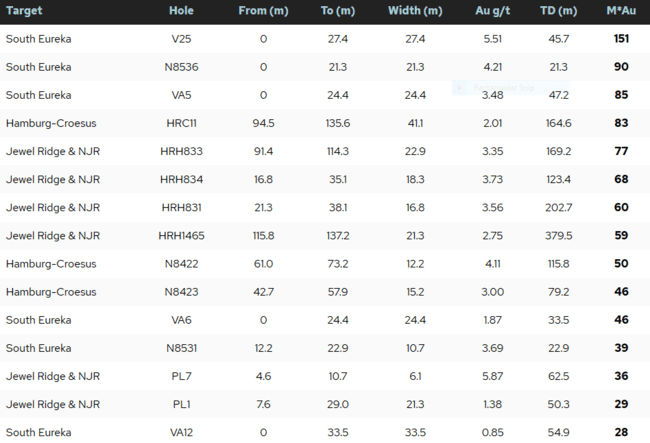

Historic drill results

Historic drilling highlights from the numerous zones across the project include:

Based on these historic hits, the company is looking for a premium grade Carlin-type deposit, somewhere in the range of 1.5 to 2.0 g/t Au (a grade of 0.5 g/t Au can be economic with these types of deposits).

The analog for Jewel Ridge is Newmont-Goldcorp’s Long Canyon deposit roughly 200 kilometers to the north-east. Long Canyon, acquired by Newmont for C$2.1B back in 2011, is the lowest cost mine in the U.S., the third lowest cost mine on the planet.

The South Eureka Tunnels zone, on patented ground, hasn’t been drilled since the 1980s. This zone is a high priority target and will be the first to get a probe with the drill bit.

82 holes were drilled at South Eureka Tunnels. The average depth was 47.5 meters.

50 of the 82 holes tagged mineralization. 20% of the holes end in (or near) mineralization.

The average of 50 holes = 17.1 meters @ 1.16 g/t Au.

At a 0.9 g/t Au cutoff, the average = 15.1 m @ 1.98 g/t Au

The drill program

Phase one drilling will consist of roughly 1,500 meters of RC drilling. A drill rig should be mobilized to the South Eureka Tunnel zone by late June.

In preparation for this drilling campaign, the company completed a high-resolution ground survey which is adding greater detail to the subsurface structures on the property…

May 7 press release: Geophysical Survey Complete on The Jewel Ridge Property, NV

While they’re drilling off South Eureka Tunnels, management will work on permitting the rest of the project.

With RC drilling, it can be a challenge determining whether or not you’re in the right rock. RC produces chips whereas diamond drilling (DD) produces good visuals in solid core. In this region, you don’t necessarily need core to guide your drill bit. If you’re in a reddish-brown material, that’s all you need to know you’re in the right stuff.

When I asked company management during a recent call if they’d consider expanding phase one if the like what they see, the response was an emphatic “Yes, of course”.

The phase one campaign should lead directly into a phase two, which could see the drill bit turning until the end of the year. This would generate significant newsflow.

Jewel Ridge also has potential at depth, similar to a deep sulphide zone at the Ruby Hill mine further to the north with grades in the range of 6.5 g/t Au.

The other deposit type Golden Lake will be targeting on the property is the high-grade silver-lead-zinc-gold deposits pursued and mined by the old timers back in the day. The potential is still there. A 2012 drill hole tagged 601 g/t silver (21.2 ounces) over 3.0 meters from a depth of 15.2 meters. The market is beginning to take a shine to silver. A repeat of this kind of hit would be welcomed with open arms.

Access throughout the property is good. Though the property resides at 7,000 feet in elevation, and is covered in a thin layer of snow for several months out of the year, it’s possible to drill year round.

The entire Battle Mountain—Eureka trend region is steeped in mining history. Nearby Elko is densely populated with drilling crews—this will guarantee a competitive bidding environment for the work that will be contracted out.

The company has everything within easy reach to run an efficient seamless drilling campaign.

The structure

The company has a little over 19.3 million shares out, making this a super-tight setup. Insiders hold 25% of the outstanding common.

Final thought

Golden Lake has a market cap of $3.22M based on its recent $0.165 close. Success with the drill bit could translate into a significant push higher from this extremely modest valuation.

END

Greg Nolan

Full disclosure: Golden Lake Exploration is an Equity Guru marketing client.