Here’s a simple and effective investment strategy: invest in companies that sell products with growing inelastic demand.

Let’s unpack what that means.

The price elasticity of demand for a product is the degree of responsiveness to which the demand for a product changes with respect to price. If the total demand falls/rises 20% for a price increase of only 5%, the product is price elastic. Think of travel or luxury items in this category, because their consumption rises if their price falls to a greater degree than the proportionate change in price.

But if the demand for a good is price inelastic, then the change in proportionate demand is much lesser than the proportionate change in price. So wild swings in price changes do not translate to wild swings in the demand for the product. This means two things:

1. Producers can charge whatever they want

If demand is going to fall 2% when you raise prices by 20%, you can maximize profits by charging a much higher price.

2. The product is a necessary good

For instance, oil. Oil prices crashed over the past four weeks, and when they went negative, you could’ve been paid to accept delivery of oil barrels. Just because it’s cheap didn’t mean everyone wanted more of it. Similarly, if oil prices suddenly rise too much in a day, all else being equal,

we won’t suddenly be reducing our consumption, and hence the demand, for oil.

To invest in companies that produce these types of products would seem like a smart investment thesis. The consumers need the product, so firms can charge higher prices and boost profit margins. If that market is growing, it means these firms make profits while adding value to everyone.

Of course, it’s hard to create products that will be necessarily important to everyone, so that you may charge a premium for it. If and when you do create such a thing, there’s usually a major upside lurking around somewhere.

A clear industry that demonstrates it: biotech and pharmaceutical companies.

Here’s why:

Better and more sophisticated solutions to existing problems are always needed. When these solutions occur, they change everybody’s lives for the better.

Say there’s a drug that extends an individual’s life by 5 years who has a disease X. But disease X is rare and genetic so very few people get it. Even if only 10,000 people EVER need this drug, the innovation has added 10,000 x 5 = 50,000 years to human productive capacity.

Once this innovation is made, you’ve created a product that 10,000 people per year will definitely need. Intellectual property rights will ensure that you can charge a premium for your product. The firm is better off. So is the general population.

Sure, this is exactly why pharma companies spent billions in R&D. Once, or twice, it gives us people like Martin Shkreli who will take things too far. But that’s the exception, not the rule.

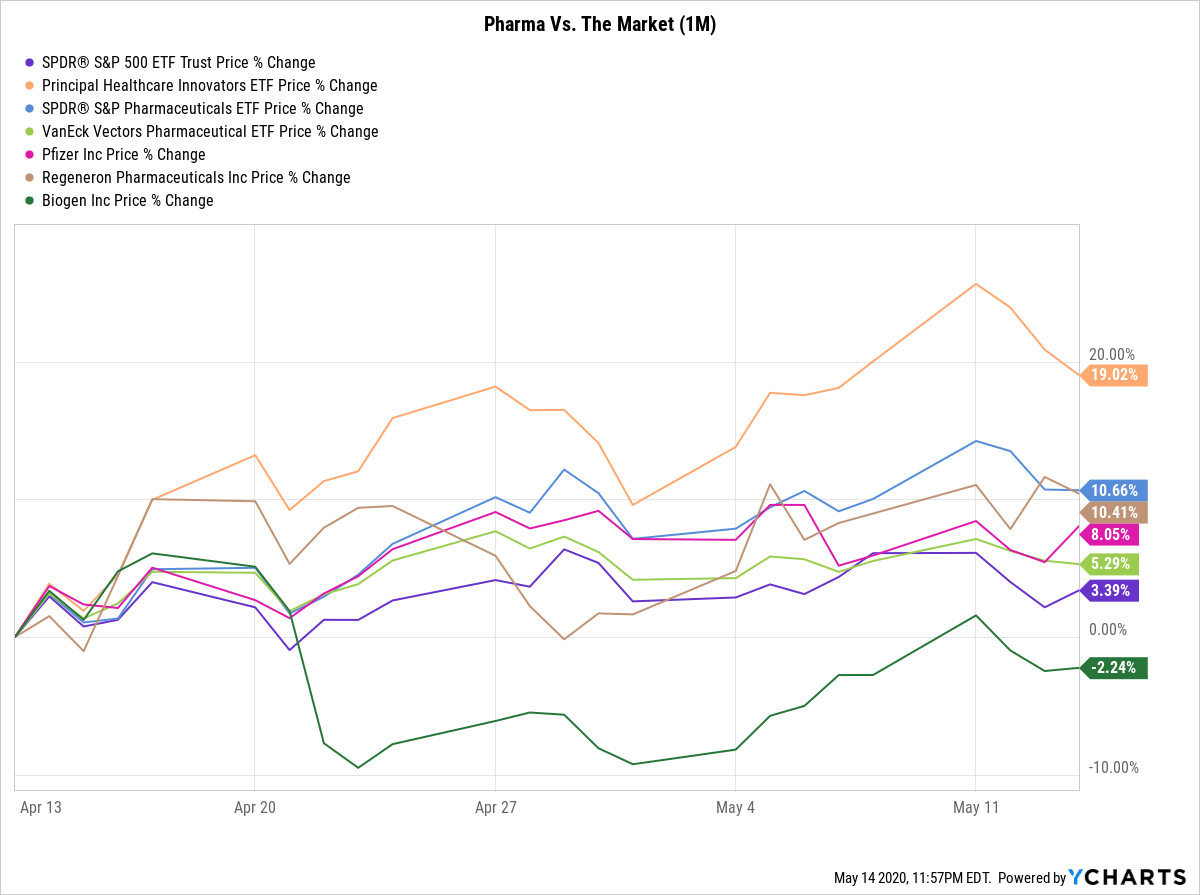

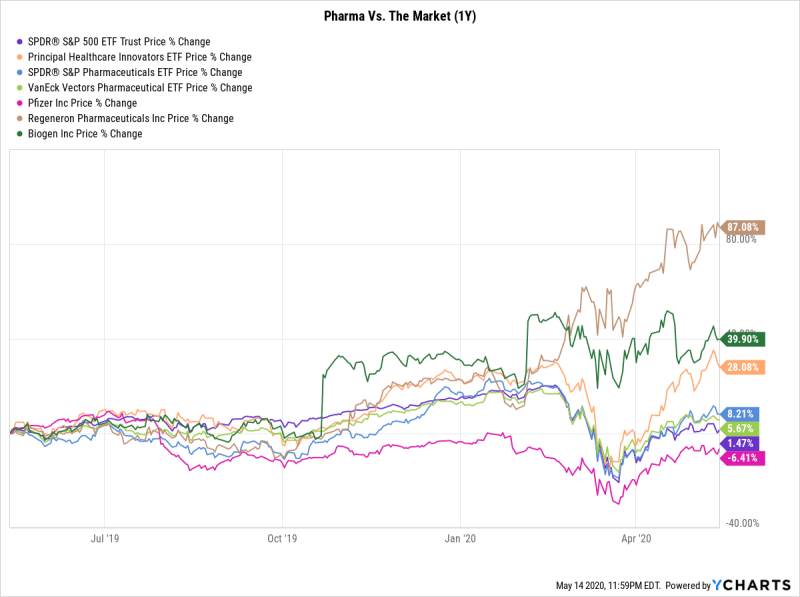

So let’s see how some Pharma companies or ETFs compare to the rest of the market. Here are the contenders:

- Principal Healthcare Innovators Index ETF (NASDAQ.BTEC)

- VanEck Vectors Pharmaceutical ETF (NASDAQ.PPH)

- SPDR S&P Pharmaceuticals ETF (NYSE.XPH)

- SPDR S&P 500 ETF Trust (NYSE.SPY)

- Regeneron Pharmaceuticals Inc (NASDAQ.REGN)

- Pfizer Inc (NYSE.PFE)

- Biogen Inc (NASDAQ.BIIB)

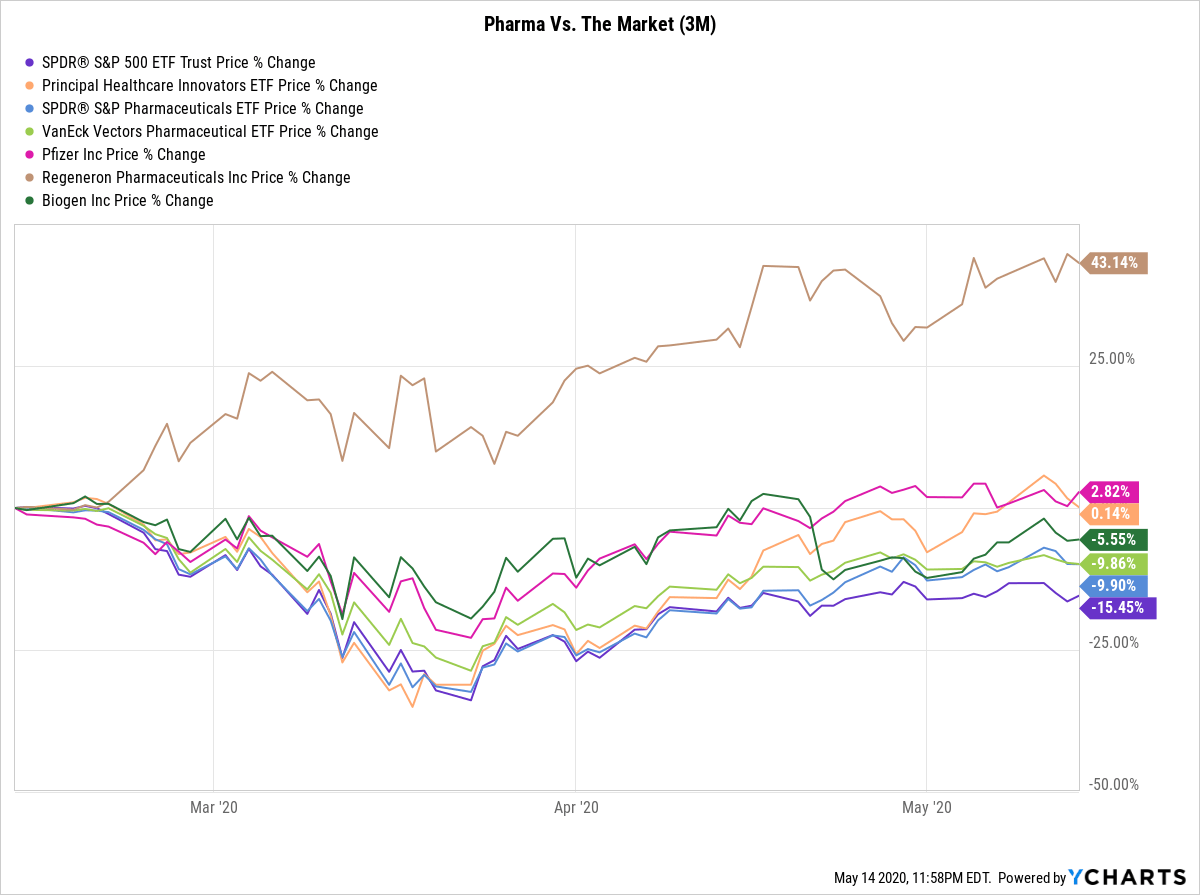

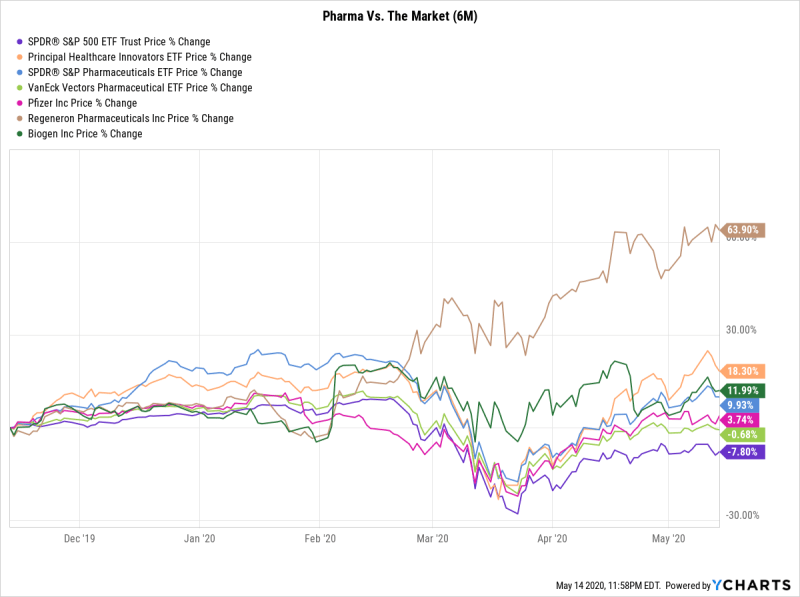

In the past one month, three months, six months, and one year, Pharma companies or ETFs have largely outperformed the market.

Proof:

One Month

Three Months

Six Months

One Year

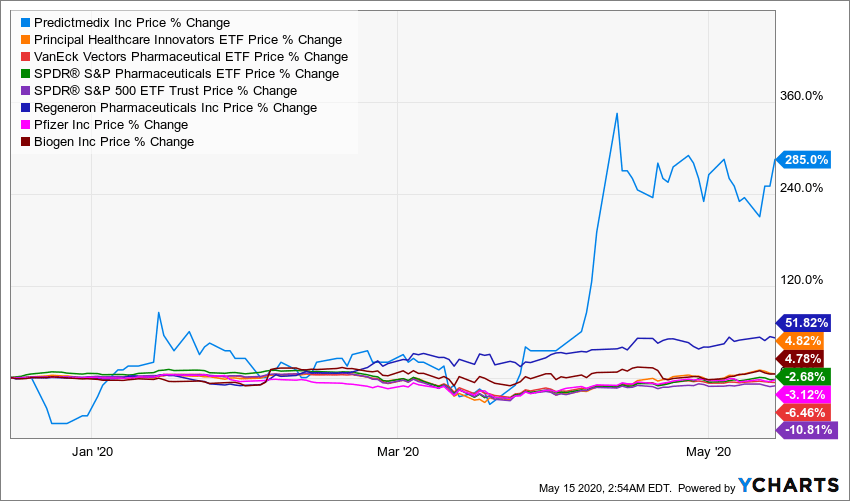

So the data backed my intuition and thesis. But are there any current companies that are developing products with inelastic demand? PredictMedix (CSE.PMED) intrigued me.

If there’s one thing that the current pandemic has made me realize, it’s that we are pretty bad at preparing for things we could have, or rather should have prepared for.

COVID-19 has exposed some pretty gaping flaws in the way we approach healthcare as a society. Despite being close to a vaccine, and maybe a cure, we still need rapid resting, data gathering, and early detection for everyone if we are to even begin thinking about returning to “normal”.

PredictMedix is an intriguing company. Primarily because the firm has the growth potential of a tech startup, and the monopoly benefits of a pharmaceutical company.

Here’s what they do really well: artificial intelligence.

It’s a buzz word.

But it also means this: they take and process large amounts of data related to infectious diseases, healthcare impairments, and even mental illnesses. They process this data at scale to screen for abnormalities or early detection of medically relevant issues.

Here’s what it is: a software that is screening datasets for a certain set of criteria.

It can also screen many large data sets, and it can also screen for many criteria at the same time.

The more it goes through the data, the better the software becomes at going through the data.

In simple terms, PredictMedix’s AI is a magnet that becomes stronger the more it looks for a needle in a haystack. The more it searches, the stronger it becomes. The stronger it becomes, the easier it is to search for other similar needles.

Here’s the traditional model of self-directed medical intervention:

Imagine you have the flu. You know this because you’re not “feeling it”. You go to the doctor and they take your blood sample, your temperature, and a bunch of other details. Then, they screen this data for the criteria that can confirm the diagnosis for flu. If they find the data that fits the criteria, great! You’ve got a confirmed diagnosis. You get the medicine, go home, and complete your treatment.

If they don’t find such data, they repeat the process for other illnesses until they find something that fits to explain your symptoms.

But here’s the thing. You’re carrying the flu well before you know you’re carrying the flu. There is a point in time when you’re the carrier. Without symptoms, without signs of any change. If you can be diagnosed

at this stage, not only are you healthier and safer before time, but you have also prevented the further spread of the flu for the rest of the community.

THAT’s what PredictMedix is doing when it comes to COVID-19.

Their product offering is software. So where does the hardware come from? Well, the thermal imaging or audio video camera equipment that might ever be needed, is already at most hospitals, offices, and other departments in need.

So essentially, the firm has a core technology that it offers to the marketplace like a saas (software-as-a-service) product. Not only does it mean recurring subscription revenue, it also means that the technology can be deployed at scale.

Equipment doesn’t scale. Software does.

With a cash burn of ~$45K/month, the current cash on hand gives them ~38 months of runway. You’d think it’d be run like a bad startup that went public too early. Except:

- Product market fit: PredictMedix’s technology is already deployed for COVID-19 testing at hospitals

- The “AI” thing: the reason you know it’s not a buzzword is because Microsoft’s (NASDAQ.MSFT) director for Business Development just joined their advisory board

- Path to Profitability: They just closed a deal with Hindalco. A publicly traded Indian multinational company that brings in close to $19 billion in annual revenue

- They have some big alliances

If your product is software, it can scale. As it scales, it gets better at doing what it’s supposed to do.

PredictMetix has done the smart thing by not going big. They’re not claiming to solve COVID-19. They’re not claiming to eliminate, contain, or cure any type of disease either.

They’re simply making it easier and faster to detect problems (if any) in a)drug impairment, b) Infectious disease, and c) mental illness.

The growth of a tech startup. The innovation of a healthcare company.

The cash burn of a bootstrapped startup. The profit potential of big pharma.

PredictMedix: Pharma monopoly meets tech growth.

Oh, and in case you were wondering.

– Arth Gupta

Pingback: PredictMedix: Pharma Monopoly Meets Tech Growth - Predictmedix