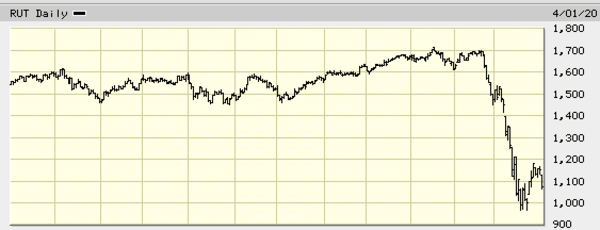

Now that the first quarter of 2020 is in the rearview mirror, we can reflect on this recent history. Q1 2020 was THE worst first-quarter EVER for the U.S. stock market. It was darker than even the darkest dark of the Great Depression.

Peter Schiff, in a live podcast aired earlier today (April 1), noted that while the Dow 30 was down 4.4% on the session, the Russel 2000—the best measure we have of the U.S. economy—was down a whopping 7%.

Today’s close on the Russel 2000 represents nearly a 40% drop from its recent peak.

It’s crazy to think about the amount of ground, the value lost, in the space of only a month. We certainly had our suspicions that the jig was nearly up…

January 12, 2020 – A “skies the limit” stock market = a house of cards?

There’s a popular belief that there’s a mountain of funds sitting on the sidelines, waiting to re-enter the market. But it’s possible that the psychology of the market has turned.

It’s possible that the trillions of dollars about to be printed will not be pushed back into stocks.

It’s possible that investors are beginning to understand the ruin the market is capable of unleashing.

It’s possible that share buybacks, a major driver of yesterday’s bull, are a thing of the past—companies receiving bailout packages from the gov’t will be in no position to continue loading up on their own stock.

There’s plenty of meaningful insights in this Schiff podcast. His take on the economy’s central planners—Powell and Mnuchin—is worth the price of admission alone…

Gold

In this era of broken economies, difficult-to-comprehend global debt, rampant currency debasement, and artificially low (negative) interest rates, gold is more of a no-brainer than it’s ever been.

The ultimate Fed Put, soaring precious metals prices – not enough gold and silver coins to go around

Examining gold from a purely technical standpoint, an interesting pattern is playing out on the charts…

This chart depicts an inverse head and shoulders pattern. Note the neckline of this continuation pattern (red line, top of the chart). A breakout above said neckline could lead to a test of golds historic high at $1,900+, a level we haven’t visited since the summer of 2011.

I was heavily invested in gold and silver stocks that summer—it was a fine time.

Gold stocks

Today, people wonder if the market will ever develop an appetite for junior gold and silver stocks. If pressed, “Yes” would be my emphatic reply.

The fact that Senior Producers dramatically scaled back exploration spending during the bear market years means that project pipelines—reserves and resources—are not nearly as robust as they should be.

Every day a gold producer digs ore out of the ground—every day they’re open for business—they reduce their inventory.

If a Producer wants to keep pumping out gold bars well into the future, they’ll need to replace the ounces they mine. The easiest way of bulking up their project pipeline is taking a run at a smaller company—one with significant resources on its books.

Put another way, they need to hunt.

It can be a fun and lucrative pursuit, aligning yourself with resource-rich prey. I was positioned in several Juniors that were taken out by resource-hungry predators during the previous cycle. The takeover premiums were quite satisfactory.

There’s also a little theory called Peak Gold that could conceivably turn the junior exploration arena into a theatre of (bidding) wars…

Despite a setback in valuations, some of the juniors we follow here at Guru Central are pushing ahead, with full market support. Two examples…

Skeena Resources (SKE.V)

- 124.45 million shares outstanding;

- $104.54M market cap based on its recent $0.84 close;

- > $40M in cash.

Skeena’s Eskay Creek Project—some four million open-pittable ounces (4.4 g/t AuEq) with compelling preliminary economics—is attracting a lot of attention.

A March 10, fully subscribed non-brokered $20M private placement (17,316,000 flow-through shares priced at $1.155) was just upsized 50% to $30M.

“Due to strong demand for flow-through shares from outside of British Columbia, the Company has upsized the offering to C$30 million and has added a National flow-through component at $1.05 per share. The Company expects to close the balance of the Offering in mid-April.”

Importantly, this deal got done without any dilutive bells n whistles (warrants).

With the broader market indices in a downward spiral, Skeena common shares were up 5% to $0.84 today.

Clearly, the market has an appetite for this one.

Alexco Resources (AXU.V)

- $124.05 million shares outstanding;

- $204.68M market cap based on its recent $1.62 close;

- $22.5M in working capital + a US$15 M Indicative Term Sheet available.

This Keno Hill explorer and developer is moving towards production with multiple high-grade orebodies.

Current reserves stand at 1.2 million tonnes grading 800 g/t silver plus a further 7% combined lead and zinc.

Current resources, both Indicated and Inferred, stand at more than 107 million ounces of silver, plus significant zinc and lead credits.

A 2019 PFS demonstrated an after-tax NPV (5%) of $101.2M and an IRR of 74%. CapEx is extremely modest at < $24M.

Like everything else, Alexco was hit hard on March 16—the day the stock market crashed—but bounced back with impressive price trajectory.

Shrugging off the market malaise, the company announced a $7.5M Common Share Public Offering on March 25, and closed the deal two days later with its over-allotment option fully subscribed—a total of 4,662,675 shares priced at $1.85—for gross proceeds of $8,625,948.75.

Once again, straight shares—no dilutive bells n whistles.

The company now has ample funds to move into production.

My point in highlighting these two stories: money is stealthily moving into the junior arena.

END

—Greg Nolan

Full disclosure: We currently have no marketing relationship with either Skeena or Alexco.