Last month, the International Copper Study Group stated that copper demand has exceeded supply by 155,000 metric tons in the first four months of this year.

CopperBank Resources (CBK.C) controls four copper projects:

- Copper Creek, in Arizona

- The Contact Copper Project located in Elko Nevada

- The Pyramid project on the Alaska Peninsula.

- San Diego Bay, also in Alaska

CBK is a penny stock, trading at .04, with a market cap of $12 million. We figure the downside is about a penny, and the potential upside is a buck.

China’s July, 2019 copper imports jumped 29% from the previous month, while “copper concentrate imports hit a record high.”

More on the copper wealth-creation-opportunity in a minute, but first – this – hot off the press:

U.S.-China trade tensions are escalating!

“Last week President Donald Trump threatened to raise duties on $250 billion in Chinese goods to 30% from 25%,” stated CNBC, “and increase tariffs on another $300 billion in products to 15% from 10%. It came the same day China announced new tariffs on $75 billion in U.S. goods.”

But Beijing appeared to soften its stance Thursday when a foreign ministry spokesman said China was willing to resolve the trade war with a “calm attitude” and indicated it won’t retaliate immediately.

“Did China just blink?” was the collective rhetorical response from American financial punditry.

Dear Stateside Peepz, the answer is “no”.

China did not blink.

China is not going to blink.

You are going to blink.

How do I know?

Because you are a broke-ass country.

You owe about $22 trillion, most of it to other governments. China is your biggest foreign creditor. You owe them $1.12 trillion. If the Chinese economy is “hurting” – as you so desperately hope – China could just sell that debt. Which would cause U.S. interest rates to surge, dampening enthusiasm for American’s most vibrant activity: shopping.

In truth, that outcome would not be helpful to China – but the injury to U.S. would be severe.

On the global stage, the U.S. is the illiterate Great Uncle who drives a lime-green Corvette, lives off his credit cards, and spouts off about “Mexican rapists” at Thanksgiving.

You elected a reality TV star to run your country who tweeted this:

Early today, Trump on Friday tweeted that “badly run and weak companies” have blamed his trade war with China for declining profits in order to hide their “bad management.”

His tweet comes as more companies from a range of industries have started to slam his tariffs on about $550 billion in Chinese goods,” stated CNBC, “Earlier this week, more than 160 industry groups criticized Trump’s latest move to slap duties on Chinese products.

Did you catch that?

Not 160 companies.

160 American industry groups think that the trade war with China is a bad idea.

But – as always – the preening failed businessman – knows best.

While Trump has a temper tantrum, China’s President Xi put on his big-boy pants and forged new trade routes into Russia, Turkey, Pakistan, Africa and India.

The “One Belt, One Road” is the largest mega-project in history, covering more than 68 countries that contain 65% of the world’s population and drive 40% of the global GDP.

The Belt and Road initiative opens up 7 corridors.

- New Eurasian Land Bridge – Western China to Western Russia

- China–Mongolia–Russia Corridor -Northern China to Eastern Russia

- China–Central Asia – Western China to Turkey

- China–Indochina Peninsula – Southern China to Singapore

- China-Bangladesh–India Corridor – Southern China to Myanmar

- China–Pakistan Corridor – South-Western China to Pakistan

- Maritime Silk Road – Chinese Coast to Mediterranean

All this infrastructure requires a shit-tonne of copper.

Arrivals of unwrought copper, including anode, refined and semi-finished copper products into China, the world’s top copper consumer, stood at 420,000 tonnes in July, 2019, the General Administration of China Customs said, up from 326,000 tonnes in June, 2019.

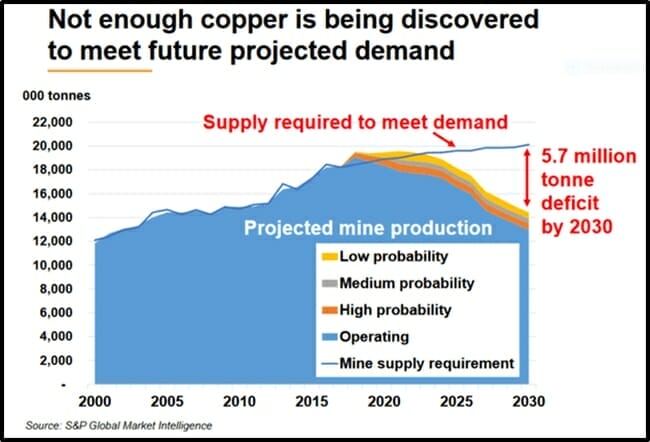

“Copper, specifically the ExplorerCos boasting billions of pounds in the ground, could be the sleeper trade of our generation,” wrote Equity Guru’s Greg Nolan in an August 14, 2019 article, “The current supply deficit we’ll be facing in the not-too-distant future is a bit of a shocker:

- 45% of the worlds primary Cu supply comes from only 20 mines.

- The world has less than 20 years worth of (economic) copper reserves remaining.

- The 14 largest producers show an average reserve grade of .62% (large deposits running grades north of 1% are exceedingly rare).

- Future copper projects – the 19 largest development projects on deck – run grades averaging roughly 0.5% (barely economic at current Cu prices).

- Further down the foodchain, for the next group of large development projects, 0.4% will be the average grade (NOT economic at current Cu prices).

- A lot of money has been spent searching for the metal – very little in the way of large, economic ore bodies have been discovered.

“I’d be remiss in not throwing this chart at you while I’m at it,” added Nolan, “a pic is worth a thousand… more or less.”

At USD $2.60/lb Goldman Sachs states that the market “has not priced in the tight supply story yet.”

A further 5.5% (1.2 million tons) of copper supply disruption is anticipated in 2019. Combined with a “relatively empty global project pipeline”, this may catalyse significantly higher copper prices.

Equity Guru’s Greg Nolan calls CopperBank “a long term call option on the price of copper”.

Gianni Kovacevic – the Director and CEO of CopperBank spoke with Equity.Guru’s Guy Bennett about the wealth-creation opportunity in “the electrification of everything” and his philosophy of “buying from pessimists and selling to optimists.”

If you’re wondering how the U.S.-China trade war will play out, I refer you to the North American Free Trade Agreement (NAFTA) which Trump said was “perhaps the worst trade deal ever made.”

After much strutting and barking, he tweaked a couple of numbers, dotted some “I”s and signed a “a revamped version of NAFTA with new branding.”

The re-branded NAFTA “is a classically Trumpian accomplishment,” stated The New Yorker, “a relatively minor change that he will use to claim a sweeping victory.”

The trade war with china will end same way.

Nothing much gained for the U.S.

Possibly down a couple of Panda Bears.

In the meantime.

Copper.

– Lukas Kane

Full Disclosure: CopperBank is an Equity Guru marketing client. The writer is married to a dues-paying member of the Chinese Communist Party.