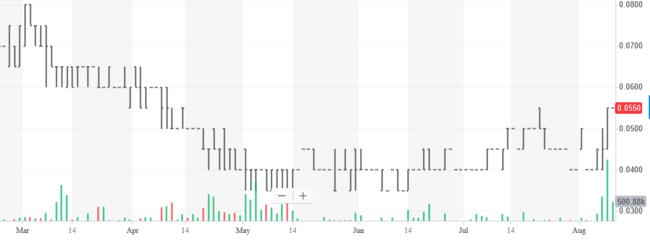

On August 12, CopperBank (CBK.C) tabled a non-brokered $0.06 private placement (PP). This represented a 10% premium to its previous (pre-PP) close at $0.055.

Now, if you’re thinking: “whoop-de-freaking-doo… a whole half cent more than its previous close”, consider this: it’s the same percentage premium as a $0.60 PP on a $0.55 stock, or a $6.00 PP on a stock that last traded at $5.50. Same percentage premium. Don’t knock it.

Not impressed? Chew on this: today’s PP is roughly 30% higher than CopperBank’s average trading price over the past three months. Check the above price chart – the $0.055 level is a recent event.

Still not impressed? today’s PP comes without any dilutive bells and whistles. There are no warrants attached to this raise. Zip, Zero, Nada.

Now, how do you like them apples?

A price premium with no warrants? Almost unheard of in this arena.

CopperBank is about as shareholder-friendly they come in this sector that might best be described as ‘The Wild West’.

CopperBank’s management team have aligned their interests right alongside me and you – small retail shareholders.

Inside ownership, according to the company’s investor deck, is pegged at roughly 25%. That’s a moving target, what with all the accumulation going on by CEO Gianni Kovacevic. Check out the SEDI files over on the CopperBank channel at Tommy Humphreys ceo.ca. Kovacevic’s appetite for his own stock is insatiable.

When a CEO opens his wallet and systematically accumulates his own company’s common on the open market, take note.

With this recent PP, the company intends to use the net proceeds, some $960,000, to keep its project portfolio in good standing. Some will also be set aside as general working capital.

We’ve covered the fundamentals underlying the CopperBank’s project portfolio in previous Guru offerings in some detail.

Read: CopperBank (CBK.C): a copper consolidator on a mission to create shareholder value

It’s worth reviewing the company’s project page every once in a while, if for no other reason than to keep tabs on on the mother of all copper land banks.

The CopperBank story is a good one. It’s compelling. It’s is difficult to overstate just how remarkable the copper story is in general, with the supply dynamics as precarious as they presently are.

The substratum of the CopperBank story is this: Governments around the world, with a few notable exceptions, are in the throes of an epic paradigm shift – a quantum leap forward into a cleaner, greener, and in many respects, downright futuristic world.

And this leap won’t take place without mountains of copper metal.

Perhaps the greatest changes will come in the way we navigate the fast lane.

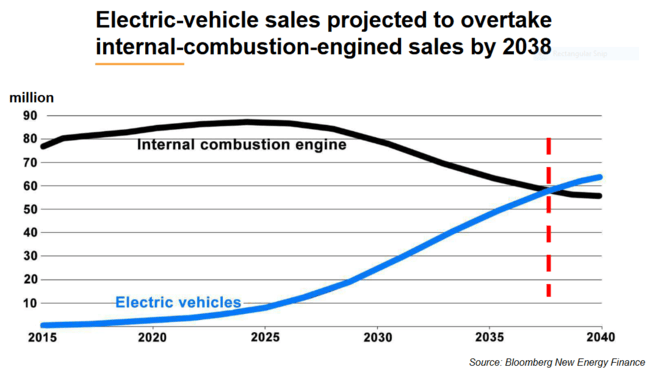

I’m talking about the E-Mobility (electro mobility) supercycle. I’m talking about a day that is fast approaching when electric vehicles (EVs) will overtake those with internal combustion engines.

To refresh your memory, EVs require a lot of copper (Cu):

- hybrid electric cars require 85 lbs of Cu.

- EVs require 183 lbs of Cu.

- electric buses require between 500 and 800 lbs of Cu.

And the charging points that’ll put and keep it all in motion? Scottish consultancy firm Wood Mackenzie estimates there will be more than 20 million EV charging stations around the world by 2030.

Read: EV sector will need 250% more copper by 2030 just for charging stations

To stress the increasingly critical role copper will play as we enter the next few decades, we offered the following insights and figures in the aforelinked articles:

As our species attempts to sustain the urbanization of our planet – there will be eight billion of us tripping over one another in only four more years – the demand for green metals, like copper, will go through the roof.

More examples of the role copper will play in a greener world:

- Flywheels (pumped hydro) will require .3 to 4 tonnes of Cu per megawatt (MW).

- Wind turbines will require 3.6 tonnes of Cu per MW.

- Solar panels will require 4 to 5 tonnes of Cu per MW.

According to the International Energy Agency, worldwide demand for air conditioning is expected to triple over the next 30 years. Sticking with that theme:

- 52 lbs of Cu go into each cool air unit.

- 8 billion cool air units are expected to be in use worldwide by 2050.

- China, India and Indonesia will account for roughly half of the global increase in electricity demand.

With all of these global initiatives in the works, the SUPPLY side of the equation needs to be addressed and examined closely. Someone’s examine it – the market doesn’t appear to give a flying f*ck (judging by the recent trade in copper).

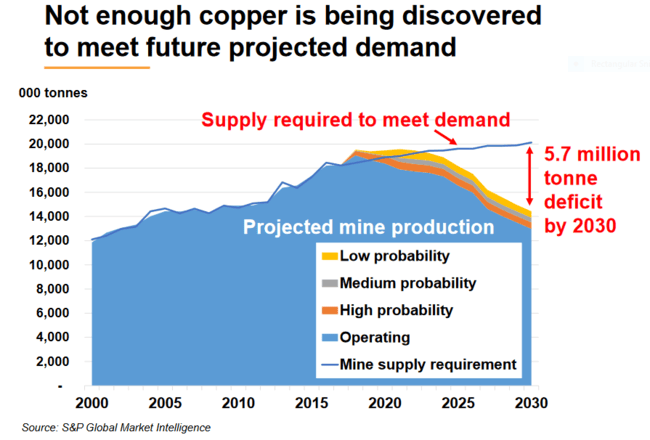

It’s on the supply side of things where a great opportunity lies, completely hidden in plain sight: we don’t have enough copper reserves – not nearly enough – to power our way into this brave new world.

Copper, specifically the ExplorerCos boasting billions of pounds in the ground, could be the sleeper trade of our generation.

As a supply-side refresher, real quick:

The current supply deficit we’ll be facing in the not-too-distant future is a bit of a shocker:

- 45% of the worlds primary Cu supply comes from only 20 mines.

- The world has less than 20 years worth of (economic) copper reserves remaining.

- The 14 largest producers show an average reserve grade of .62% (large deposits running grades north of 1% are exceedingly rare).

- Future copper projects – the 19 largest development projects on deck – run grades averaging roughly 0.5% (barely economic at current Cu prices).

- Further down the foodchain, for the next group of large development projects, 0.4% will be the average grade (NOT economic at current Cu prices).

- A lot of money has been spent searching for the metal – very little in the way of large, economic ore bodies have been discovered.

I’d be remiss in not throwing this chart at you while I’m at it – a pic is worth a thousand… more or less.

Equity Guru’s Lukas Kane had the very good fortune of sitting down with CopperBank’s Kovacevic recently. During this podcast Lukas explored the copper world through the eyes of a man who lives and breaths the soft, malleable metal – the soft, malleable metal with tremendous thermal and electrical conductivity properties, I might add.

Listen: Equity.Guru podcast: CopperBank Resources (CBK.V) – a bet on higher copper prices

A few points Lukas dug up while preparing for this podcast:

Last week, the International Copper Study Group stated that copper demand had exceeded supply by 155,000 metric tons in the first four months of this year.

At USD $2.60/lb, Goldman Sachs states that the market “has not priced in the tight supply story yet.”

A further 5.5% (1.2 million tons) of copper supply disruption is anticipated in 2019. Combined with a “relatively empty global project pipeline”, this may catalyze significantly higher copper prices.

The above numbers alone should be enough to get the speculative juices going.

Once again, copper is a compelling story.

Final thoughts

Most people who follow the resource sector think they know whole story behind copper. My best guess is that most people don’t have a clue.

The potential for supply crunches and price shocks are a very real threat. Even a minor supply disruption could wreak havoc.

In the above podcast, Kovacevic isn’t just giving his best CopperBank pitch. He lays it all out, examining copper from every angle.

Two quotes I took away from the Lukas-Kovacevic podcast:

“In the next one, two, three, four years, this (copper) is something that’s going be on the front page of every publication because it’s the great enabler of electrification – you cannot decarbonize the global energy mix no matter how you create, transfer or utilize energy… without electrification. And it’s only possible with copper.”

“Never invest in the story on page one – that’s the efficient market. Invest in the story on page 16 that’s heading to page one.”

– Greg Nolan

Postscript: buying a stock when the vast majority of the market couldn’t care less is one of the most profitable strategies I know of. To paraphrase the serially successful Rick Rule, you are either a contrarian or you will be a victim.

Full disclosure: CopperBank Resources is an Equity.Guru marketing client.