Where is gold going? Where will the gold price settle as 2019 draws to a close? And where will it trade a year from now?

If some renegade time-looper handed me an envelope with the answers to these questions, I’m confident I’d be able to convert mere tip jar coinage into a retirement fund that would spill over into the lives of everyone around me (gold can be leveraged in any number of ways).

But without intel from a time-riding tipster, my guess is we’re on the cusp of something extraordinary. This based on having witnessed golds behavior over several bull cycles.

Most people don’t watch the trade in gold. They don’t see the potential, the coiled spring that could could launch it signicantly higher.

Indulge me for a minute or two whilst I highlight a few underlying dynamics shaping recent trade in the metal:

- Global markets appear to be a crossroads, maybe even on the verge of a paradigm shift.

- The Fed cut interest rates a quarter-point last week, a move that comes after a three-year cycle of raising rates from near-zero levels.

- Since the financial crisis of 2007-2008, the Fed and many of its global counterparts have been holding interest rates low and deploying currency devaluing strategies like quantitative easing (QE) – the purchase of government bonds and other financial assets from the market with funds created out of thin air. This kind of prank increases the money supply and is supposed to encourage lending and investment.

Some view this form of aggressive central bank monetary policy as reckless and unsustainable. The following video captures the essence of QE. Prepare to laugh hard (set down all hot beverages).

A consequence of all this loose money sloshing around the planet is a staggering surge in corporate and government debt. This puts central banks in the precarious position of needing to keep interest rates low, indefinitely.

This aberrant and madcap behavior by the Fed coils the spring under gold, ever tighter, with each passing day.

The herd

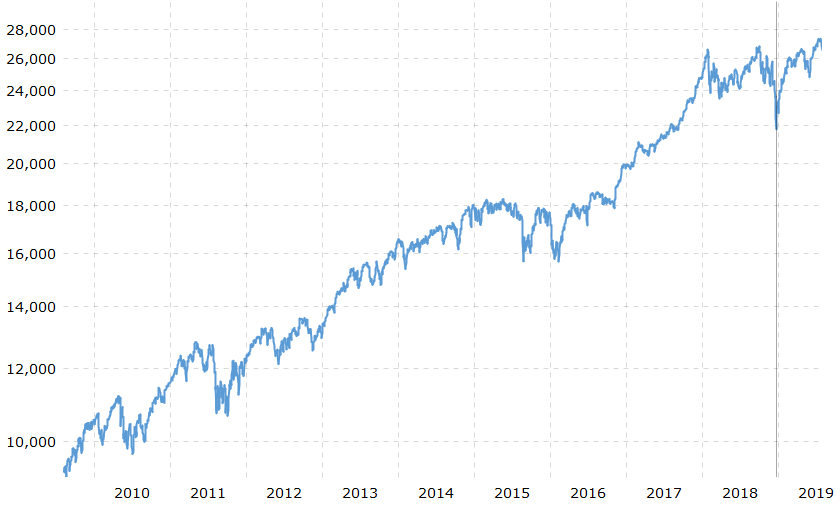

Investors around the globe have developed a herd-like instinct in the allocation of their investment funds. The vast majority are over-weighted in equities – stocks unlikely to continue to perform as in years past.

The major indices are at crazy nosebleed levels. And all the while, the currencies underlying these overinflated equities continue along a path of unending debasement.

It’s my humble opinion that the average investor is about to experience a rude wake-up call. To put it delicately, they’re entering a season of diminishing returns. Less delicately: this uptrend in general equities is not sustainable and can only end one way… badly.

Have I used the ‘coiled spring’ analogy yet?

A marco look at gold

Hedge fund kingpin Ray Dalio’s recent comments re paradigm shifts:

“In paradigm shifts, most people get caught overextended doing something overly popular and get really hurt. On the other hand, if you’re astute enough to understand these shifts, you can navigate them well or at least protect yourself against them.”

The reasons to own gold are many.

Gold is probably the ultimate safe haven asset. It’s the only globally recognized currency that cannot be rammed through a printing press. As Doug Casey was oft heard to say, “gold is the only financial asset that’s not simultaneously someone else’s liability.”

Equity.Guru’s own Lukas Kane on the subject:

Because 100% of the debt is based on fiat currency (paper money), and it is very easy to manipulate supply. The U.S. – for instance – just fires up the printing presses when it can’t make an interest payment.

Gold supply is finite. No act of Congress can magically make a tonne of gold appear on the lawn of the White House.

In times of rampant currency debasement, geopolitical uncertainty (twitchy chest-puffing politicians instigating trade wars via Twitter), gold belongs in a balanced portfolio in order to reduce risk.

Not only is gold a great hedge against uncertainty, when the uptrend is locked in, the price trajectory can be spectacular, particularly in the stocks of companies that mine, develop and explore for the stuff.

Currently, the average dart tossing Shmoe is waaaay under-weighted in gold. This represents an intriguing setup for those having the foresight to position themselves early, especially considering the fact that the combined value of every gold mining company on the planet is far less than the current market cap of Apple (AAPL.NAS). Think about that for a moment.

If all of a sudden investors around the globe decide to add gold to their portfolio as a hedge, the run-up in mining equities would be epic. Even if only a fraction of investors shifted, say, 5% of their portfolio into gold, it would be like “trying to push the contents of Hoover Dam through a garden hose,” to quote Doug Casey. That’s how small the gold universe is.

These are the reasons why I’m invested in the sector.

Zooming in on golds underlying dynamics

Paul Tudor Jones, billionaire, fund manager and founder of Tudor Investment Corp chimed in on the subject recently:

“We’ve had 75 years of expanding globalization and trade… and now all of a sudden it’s stopped,” he said. “That would make one think that it’s possible we go into a recession; it would make one think that rates in the United States go back down to the zero bound level; gold in that situation is going to scream. [Gold] will be the antidote for people with equity portfolios.”

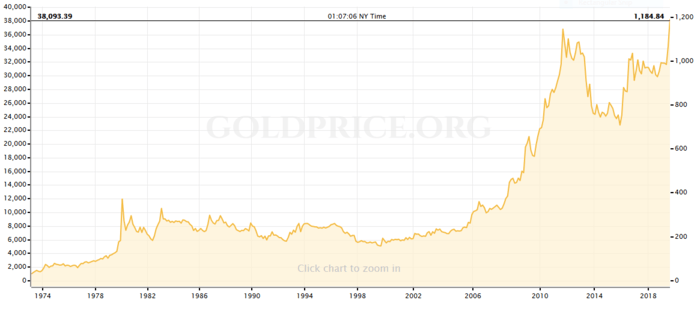

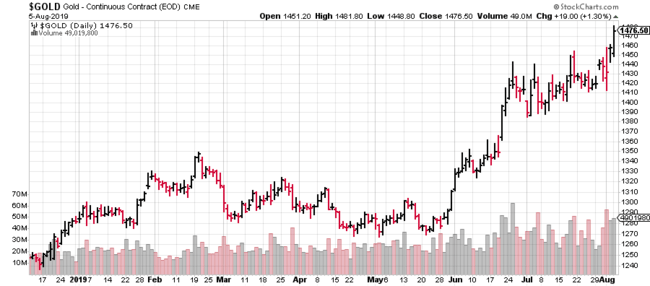

Gold, in US dollar terms, is currently trading roughly $500 shy of its all-time high tagged in August of 2011 when it tested the $1,900.00 level. Since then it’s has tested the $1,000 level and is now mid-range, trading at $1,440.00 (spot price).

You might be wondering, ‘Yo, wtf… if times are so damn precarious, why isn’t gold screaming higher; why isn’t testing all-time highs?’ Fair question.

But you need to understand that gold trades in currencies other than the $USD. It trades in every conceivable currency on the planet.

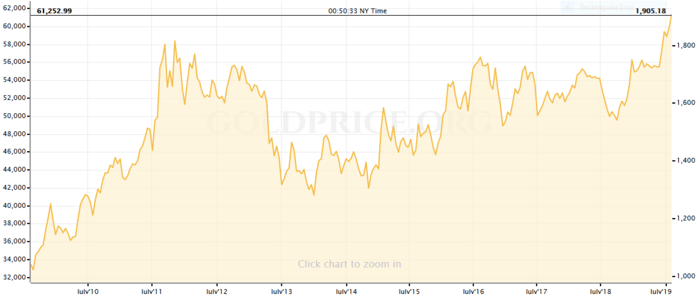

Just a few days back it traded at all time highs – $1,910.40 – in Canadian dollar terms:

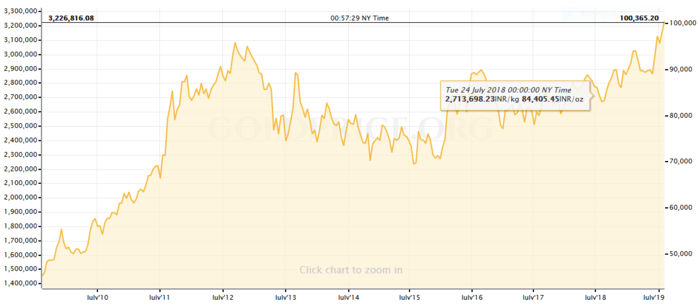

Same goes with the second largest consumer of the precious metal on the planet – India… all time highs:

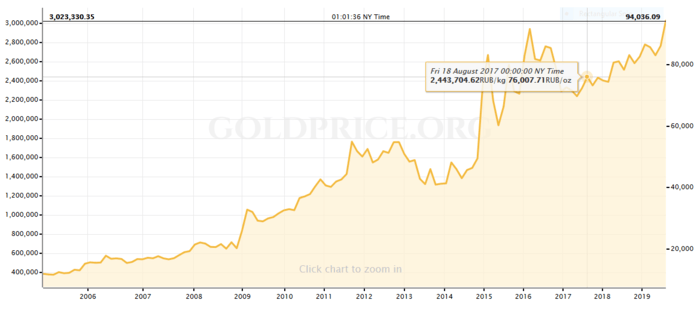

Russia, a noted hoarder of the precious metal in recent years, you ask? All time highs.

The Pound Sterling, the official currency of the United Kingdom, Jersey, Guernsey, the Isle of Man, South Georgia, the South Sandwich Islands, the British Antarctic Territory, and Tristan da Cunha?

Same damn thing. All-time highs.

Same damn thing. All-time highs.

I could probably do this for hours, but you get the idea. Gold fever is taking hold, nations are embracing the precious metal. This may qualify as one of the greatest stealth moves in the history of money.

Zooming in even closer

Nicky Shiels, commodity strategist at Scotiabank:

“Gold’s price in every major currency seems to be at record highs, and that is a big statement indicator that we are in the middle of some sort of currency war.”

Central banks are buying hand over fist.

In the second-quarter of this year, the World Gold Council said that central banks bought a total of 224 tonnes of gold. That’s 900 tonnes annualized and nearly a quarter of all the gold available on the market today.

Exchange Traded Funds (ETFs) are also piling into the precious metal having bought 126 tonnes in June alone.

Just for shits ‘n giggles, if you annualized that net new buying coming into ETFs, the number would be 1,500 tonnes in a market that is becoming increasingly thin.

The analyst community will tell you, “geopolitical uncertainty, dovish posturing by the Fed, and a rising bullion price” are among the factors driving this demand.

Cross-currents

There are definitely forces opposed to golds upward trajectory. There are disbelievers, those who insist gold has no role – NO PLACE! – in today’s global economic system.

The Oracle of Omaha, Warren Buffet’s take the precious metal:

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

There are fund managers fond of shorting the archaic relic every time it threatens to break out. There are central banks who will continue to sell their gold reserves into any hint of strength.

And then there’s this, something I was exploring while donning my tin nine months back:

I’ve been tracking gold for longer than I care to admit – since high school. If you’ve followed gold for any length of time, you’re likely well acquainted with all of the gold price manipulation theories floating around out there. Some of these theories are backed by compelling evidence, like the massive not-for-profit gold dumps during illiquid market hours. ‘Not-for-profit’ in the sense that there’s no logical reason for initiating such a trade.

This is what I mean…

Moving along…

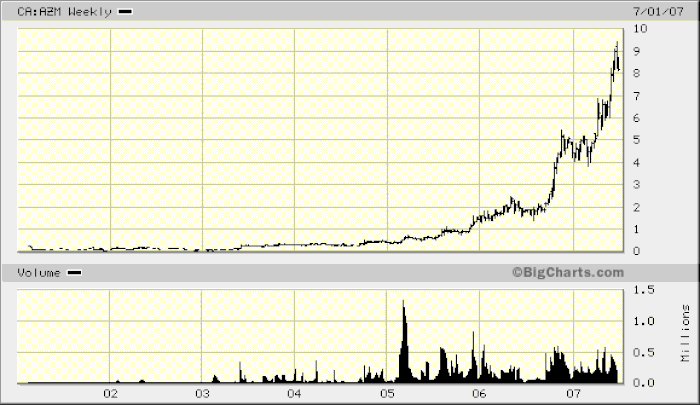

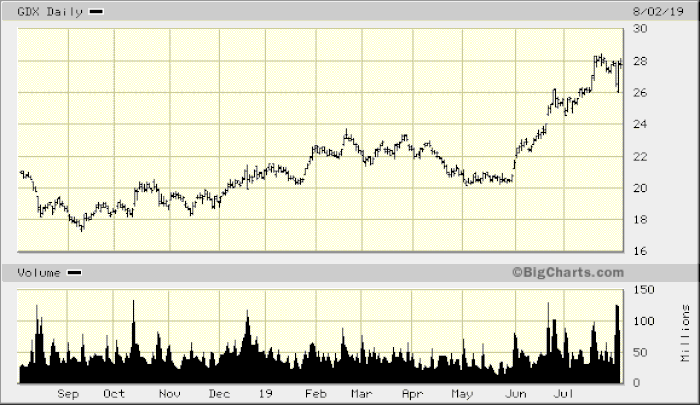

The large and mid sized gold producers have been on a serious tear in recent weeks. That’s no surprise. The GDX – an ETF holding the top names in the gold mining arena – has delivered some nice, rapid gains to early investors:

The junior exploration companies, with a few very notable exceptions, are only now beginning to get some love.

There are roughly 900 juniors listed on the venture exchange that are mining related. For most of this year they’ve been scrounging, desperate in their attempts to raise capital to move their projects forward. It’s been a tough slog.

But retail optimism in the ExplorerCo arena has picked up in recent weeks evidenced by the number of financings that have come to market.

Over the past three to four weeks we’ve seen roughly CAD $500M in successful junior equity financings. Silver has seen a pickup too. This is a potent signal that it’s go time.

If you’re holding a junior gold stock expecting a fat takeover offer from a resource hungry producer, there is one crosscurrent which could temporarily put the kibosh on any such transaction. The mega-mergers we witnessed in recent months – Barrick Gold wedding Randgold, Newmont hooking up with Goldcorp – have put a large number of producing assets on the auction block.

Both of these mega-merged entities have committed to major divestment programs in order to improve their balance sheets.

Newmont alone has committed to selling between $1 billion and $1.5 billion worth of non-core assets over the next two years (non-core to a mining behemoth but significant to a small to mid-sized producer).

Pan American Silver is also looking to divest its Ontario assets after taking out Tahoe Resources last year.

A small to mid-sized producing company targeting near term growth is more likely to pursue one of these divestitures over an unpermitted development asset. In most cases, these mega-merger discards will be fully permitted producing mines – turnkey operations.

I liken all of these cross-currents to a maverick kayak trip I made along Kauai’s NaPali coast a few years back. A hurricane that narrowly missed the island offered what I hoped would be fantastic paddling conditions for the 27-kilometer journey.

As expected, the enormous swells encountered at the beginning of the journey were great fun, but the moment we began paralleling the steep cliffs along the NaPali coastline, we knew we were in trouble.

The violent wind gusts that collided with the vertical rock faces that defined the NaPali coast were redirected back offshore, creating their own sets of swells (cross-currents) turning the sea into a swirling mass of chaotic H20, much like the agitation cycle in a washing machine.

The journey – the end result – was well worthwhile though.

Don’t let these cross-currents dissuade you. The longer-term fundamentals underpinning the metal are powerful and compelling. It’s only a matter of time before these mega-merger divestments are scooped up. Mergers and acquisitions (M&A) will continue to drive much of the action in this space going forward. Here too, the end result should be well worth your while.

Keep an eye on Oz

Australian gold producers suddenly find themselves with healthy balance sheets as their producing assets are spinning off heaps of profits. Here’s why:

That’s right, gold is trading at an all time high in Australian dollar terms. Australian gold producers are flush with cash and are on the prowl.

Earlier this year Oz miner Newcrest Mining (NCM.AX) grabbed a 70% interest in Imperial Metals‘ (III.T) Red Chris mine in northern BC.

A few years back OceanaGold (OGC.T) took out Romarco Minerals for its Haile Gold Mine in South Carolina in a deal worth $856 million.

More recently, Northern Star Resources (NST.AX) took out Sumitomo Metal Mining’s Pogo gold project in Alaska.

And just a few months back St Barbara (SBM.AX) snapped up Atlantic Gold’s (AGB.V) Moose River mine in Nova Scotia for a cool $722 million.

A selection of junior ExplorerCos to keep an eye on

We’ve talked at length about the opportunities that exist in the junior gold exploration arena.

We have, as clients, several solid companies with excellent underlying fundamentals. These are, in alphabetical order:

We’ve defined a list of preferred gold mining jurisdictions, casting a wide net and highlighting an extensive list of prospective plays:

- Gold opportunities in the Abitibi Greenstone Belt: 13 dirt-cheap ExplorerCo’s for your consideration

- Gold opportunities in the Abitibi Greenstone Belt: an UPDATE on our list of dirt-cheap ExplorerCo’s

- Updating our dirt-cheap Abitibi Greenstone Belt ExplorerCos

- A potential breakout in gold and 11 dirt cheap ExplorerCo’s in the Yukon

- BC’s prolific Golden Triangle: a selection of ExplorerCo’s for your consideration (Part I)

- BC’s prolific Golden Triangle: a selection of ExplorerCo’s for your consideration (Part 2)

- Gold opportunities in the mother of all mining jurisdictions: 21 Nevada ExplorerCo’s for your consideration

We’ve also taken a close look at West Africa, South America, Mexico and parts of Europe.

One desirable jurisdiction that we haven’t explored, and perhaps it’s overdue, is Japan.

Japan doesn’t have much of a mining industry, but its mining laws were rejigged recently opening the country up to exploration and development.

The country is highly prospective for porphyry and epithermal type deposits.

Aside from its largely untapped geological potential, the country boasts 1st-world status and all the necessary infrastructure, through and through.

Two Japanese ExplorerCos that boast first-mover status are Irving Resources (IRV.CN) and Japan Gold (JG.V). Both companies are in the midst of aggressive exploration campaigns.

Closing thoughts

What asset class will go to work after the longest bull market run in Wall Street history has run its course?

What asset class will serve as a hedge if general equities were to suddenly discover gravity?

During a period of such madness, what asset class stands the best chance of tacking on significant price gains, rewarding those with the foresight to spot the trouble ahead?

All y’alls knows the answer.

We stand to watch.

— Greg Nolan

Postscript: the general indices reeled today (the Dow closed off > 700 points). Gold ripped higher, living up to its rep as a hedge.

Bravo.

Post postscript: Overseas, gold continues its push to higher ground, tacking another ten dollar bill onto the earlier sessions gains.

Full disclosure: of the companies highlighted above, Aben, Barrian and Nexus are Equity.Guru marketing clients.

Go gold go, and OMG that QE easing video DID make me laugh!

We sliced through the $1500 level like a hot knife through room temp butter. We could consolidate here, both sides of $1500 for a while, but the uptrend appears to have been established. Best advice: buy co’s with ounces-in-the-ground and hang on tight. Sames goes with silver. Y’all.