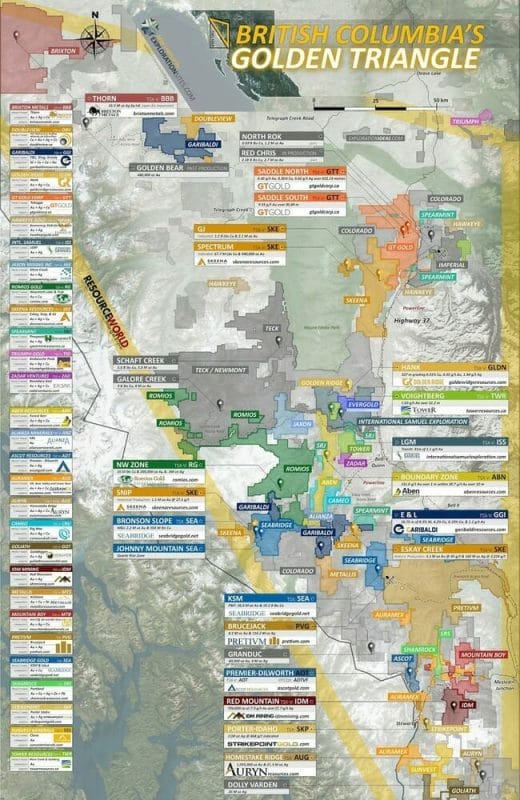

The Golden Triangle of northern British Columbia – rugged, beautiful, forbidding – is a world-class destination for precious and base metals. Though the region has already given up some of the richest and largest mineral deposits on the planet, significant discovery potential remains.

The exploration window in this prolific mining region is generally, depending on your elevation, four to five months.

The rest of the year, except for the most hardcore and intrepid prospector, the Triangle’s subsurface riches are in winter lockdown.

ExplorerCo’s holding a stake in Triangle are, for the most part, riding out the winter much further south and much closer to sea level, in the climate-controlled security of their Howe Street HQs. They’re in data compilation mode, developing their discovery models, crunching resource numbers, laying out logistics for their next foray into the Triangle.

Those new to the Triangle will be scrutinizing the discovery models of their neighbors, champing at the bit to hit the ground running as soon as the spring thaw kicks in, intent on making the next big discovery, perhaps one that’ll rival the likes of:

Eskay Creek – 3.3 million ounces of gold and 160 million ounces of silver mined at average grades of 45 g/t Au and 2,224 g/t Ag. This high-grade extravaganza went on for 14 years, beginning in 1994.

Brucejack – a relatively new mine on the Triangle sporting crazy high-grade reserves of some 8.7 million ounces of gold.

KSM – aside from massive copper, silver, and moly values, it stands as one of the worlds largest undeveloped gold deposits boasting over 106 million ounces in all three resource categories.

Red Chris – sporting resources of 13 billion pounds of copper, nearly 20 million ounces of gold, and 64 million ounces of silver. Project operator, Imperial Metals (III.T) recently made headlines selling 70% of Red Chris to Australia’s Newcrest Mining Limited (NCM.ASX) for a paltry US$806.5 million in cash.

Schaft Creek – proven and probable reserves currently stand at 5.6 billion pounds of copper, 6 million ounces of gold, 372 million pounds of molybdenum, and 52 million ounces of silver.

The Golden Triangle ExplorerCo’s

As with previous sweeping jurisdictional guru offerings, this isn’t intended to be a comprehensive list. If you feel I am being derelict in my duty and deserve a smack upside the head, drop me a private message and I’ll take a look.TIA.

Also, I’m tossing everything into the fray: ExplorerCo’s, DevelopmentCo’s, Producers’. The latter will be dealt with separately, in a sequel of sorts.

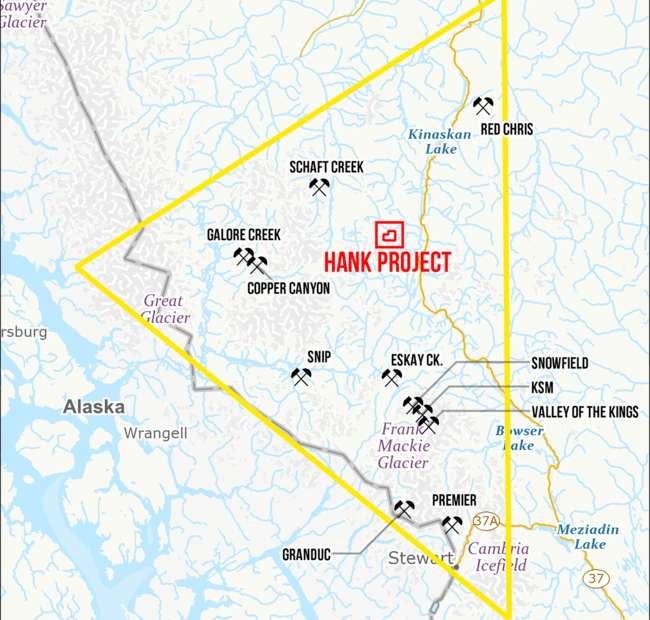

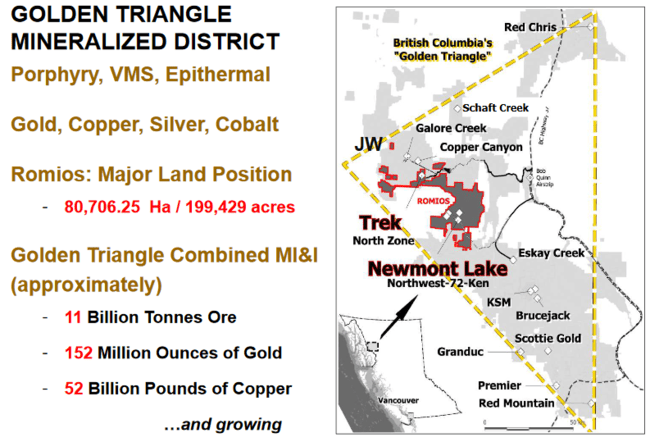

This is a great map I found over on Tommy Humphreys’ ceo.ca:

Aben Resources (ABN.V)

- 111.46 million shares outstanding

- $19.51M market cap based on its recent closing price of $0.175

This company that has been featured prominently in the pages here at Equity Guru. We like it, and no, it’s not just because they’re a Guru client.

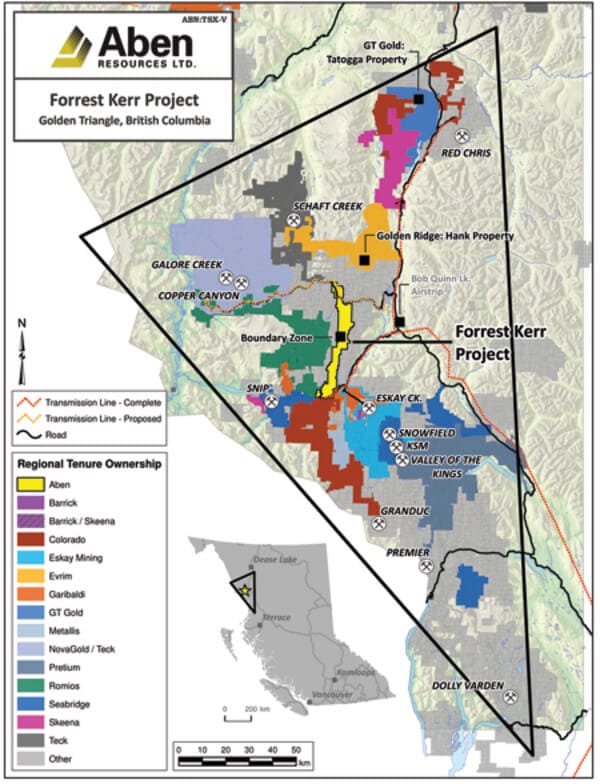

Aben has three solid plays in its project portfolio, any one of which has company-maker potential. Their 23,000 hectare Forrest Kerr Gold Project, located in the heart of the Golden Triangle, is their flagship property, and it’s a standout.

Discovery hole FK18-10 created a flurry of excitement last summer:

- Four separate high-grade zones intersected all within 190 meters downhole.

- Highest-grade zone consisted of 331.0 g/t gold (9.65 oz/t) over 1.0 meter within a broader zone averaging 38.7 g/t gold (1.12 oz/t) over 10.0 meters from 114.0 to 124.0 meters. This included an interval of 62.4 g/t gold over 6.0 meters (true thicknesses undetermined).

- Additional high-grade zones in FK18-10 included 22.0 g/t gold, 22.4 g/t silver over 4.0 meters; 3.9 g/t gold, 4.0 g/t silver over 13.0 meters; and 8.2 g/t gold, 1.4 g/t silver over 6.0 meters.

FK18-10 was enough to attract the likes of Eric Sprott, a man who knows his rocks.

The company is currently plotting a strategy to aggressively follow-up on last years impressive results. It’s worth noting that even with last years drill pad restrictions, the company delivered a series of intriguing high-grade hits at North Boundary, outlining good continuity in an area measuring 100 by 300 meters.

Two weeks back we emphasized the following:

“With a structurally controlled project like Forrest Kerr, with its proximity to the major fault and the sub-faults it created, there’s a lot of overprinting, that is, there were numerous mineralizing events that had all kinds of fluids pushing their way in over time. Having the flexibility to position your drill bit just so, to cut through the noise and home in on the meatiest targets, is critical, especially after tagging a discovery like FK18-10.”

The company, fully permitted for drill pad construction at Forrest Kerr, has $6-mill in the till and the resolve to hit the Boundary zones hard this year. Adding to the excitement, they’ll be kicking off their 2019 field season at Justin, their highly prospective Yukon project, in only a few weeks time:

There’s a lot going on and a lot to like here. If you’re not already positioned, this is one to keep an eye on.

Benchmark Metals (BNCH.V)

- 42.23 million shares outstanding

- $8.23M market cap based on its recent $0.195 close

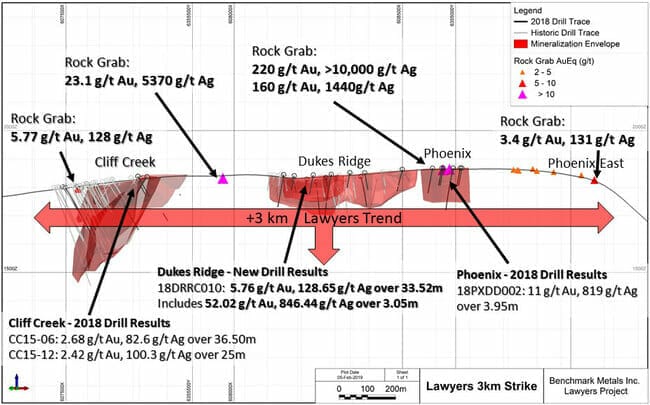

Benchmark is focused on its 9,860-hectare Lawyers Property, claims that capture the former Lawyers underground gold-silver mine and the Silver Pond group of prospects consisting of over 16 gold-silver mineral occurrences.

Exploration in the area began in the late 1960s. Numerous showings were identified culminating in the development of the Lawyers Mine in the late 1980s. 171,200 oz’s of gold and 3.6 million oz’s of silver were produced over a period of four years.

Five underground developments remain in place. Historical resources and several new targets are spread-out over a cluster of prospective zones. High-grade results from recent and historic drilling include:

- 3.95 meters grading 11 g/t gold and 819 g/t silver.

- 36.50 meters grading 2.68 g/t gold and 82.6 g/t silver.

- 26 meters grading 2.42 g/t gold and 100.3 g/t silver.

- 2.4 meters grading 87 g/t gold and 2,407 g/t silver.

The venerable Bob Moriarty follows this one closely:

Worth a closer look, this one.

Colorado Resources (CXO.V)

- 125.14 million shares outstanding

- $6.88M market cap based on its recent $0.055 close

Colorado has a large portfolio of projects in the Triangle. The company’s 30,504-hectare KSP Project lies roughly 15 kilometers southeast of the past producing Snip Mine (one million ounces grading 24.5 g/t Au).

The company has an option to acquire up to 80% in KSP from SnipGold Corp (acquired by Seabridge Gold in 2016).

Like the Snip Mine and Pretium’s Brucejack Mine, the target here is high-grade gold, as well as bulk-tonnage copper-gold mineralization similar to Seabridge’s KSM Project.

The company’s 21.18K hectare North ROK Property lies 15 kilometers northwest of Imperial Metals’ Red Chris Mine.

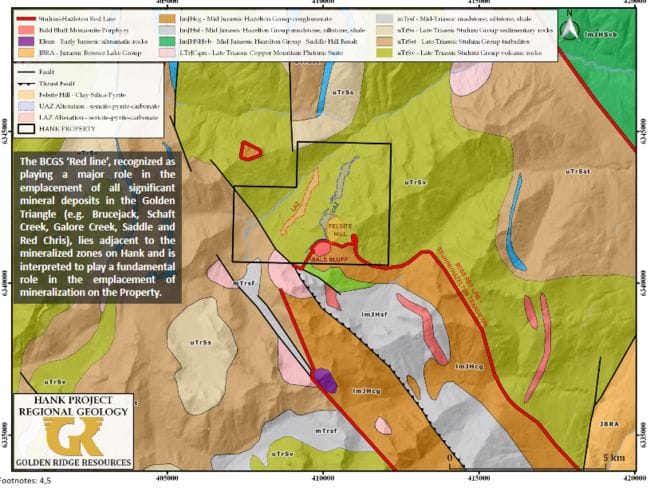

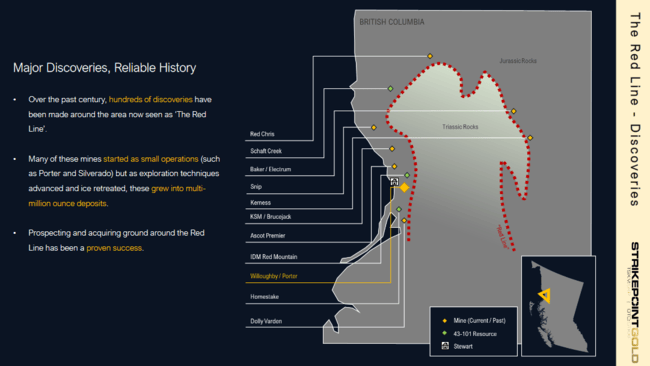

The geological setting underlying North ROK is your classic Upper Triassic Stuhini Group volcanic rocks intruded by early Jurassic monzonite. This prolific structural setting – dubbed the “Kyba Red Line” – is a subject we tackled last year along with our coverage of Aben Resources:

Jeff Kyba hypothesized that the geologic contact between the regions Triassic age Stuhini rocks and Jurassic age Hazelton rocks plays host to many of the world-class copper-gold deposits in the Triangle. Curiously, Kyba’s research revealed that the majority of these deposits lie within two kilometers of this regional stratigraphic contact point.

Two kilometers from this regional stratigraphic contact – the Kyba Red Line – is the Golden Triangle’s sweet spot.

An appreciation and understanding of this Red Line now allows companies actively exploring the region to more effectively hone in on undiscovered mineralized potential.

Inferred resources at North ROK currently stand at 142.3 million tonnes averaging 0.22% copper and 0.26 g/t gold for 690.3 million lbs of Cu and 1.189 million oz’s of Au.

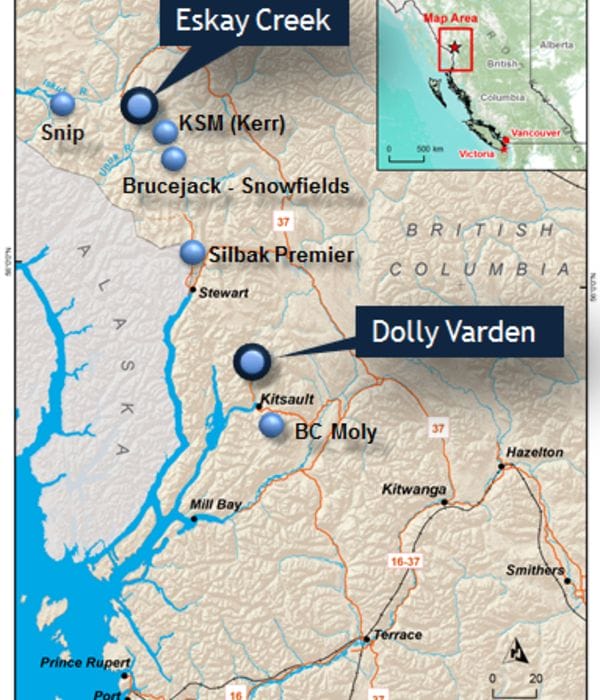

Dolly Varden Silver (DV.V)

- 57.37 million shares outstanding

- $23.52M market cap base on its recent close at $0.41

Dolly Varden owns a 100% interest in the historic advanced-exploration-stage Dolly Varden Mines silver property.

This is a high-grade silver project – the rock formations and style of mineralization are similar to the Eskay Creek deposit located 100 kilometers to the north.

Key attributes of this 8,800-hectare property:

- 100% owned

- Four historically active mines

- Under-explored terrain – only 3% of the property probed with any degree of conviction

- Well understood targets

- 20 million ounces of historic silver production

The project boasts an Indicated resource of 3,073,000 tonnes grading 321.6 g/t silver for 31,778,000 ounces, PLUS, an Inferred resource of 898,500 tonnes grading 373.3 g/t silver for an additional 10,784,000 ounces.

The company’s 2018 drilling campaign yielded impressive results. Highlights can be viewed via the following link:

Summary of Field Activities for Dolly Varden Silver Corp’s 2018-19 Exploration Program

This is one to watch due to its high-grade nature and untapped potential.

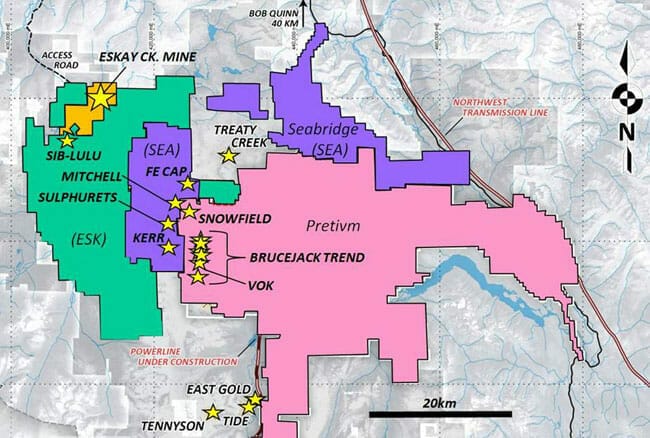

Eskay Mining (ESK.V)

- 112.25 million shares outstanding

- $10.66M market cap based on its recent $0.095 closing price

This company’s 52.6K Gldn-Tri hectares surround the historic Eskay Creek Mine.

Two of the Triangle’s more prominent projects share a border with ESK – Pretium’s Brucejack mine to the southeast, and Seabridge’s KSM project to the direct east (we’ll take a peek at Seabridge in part two of our Gldn-Tri coverage).

The company’s flagship SIB property, and adjacent Corey property, feature vast undrilled tracts of Eskay-like stratigraphy.

SSR Mining (SSRM.T) held an option on the SIB project which was recently dropped. This type of news, though negative on the surface, can sometimes be a blessing in disguise for the junior involved. SSRM poured $7.7 million into the property. ESK, now with a much better grasp of the underlying geology, regains 100% control of the project.

The company has yet to announce its 2019 plans for SIB and Cory. Hopefully they have the gumption to move the project forward.

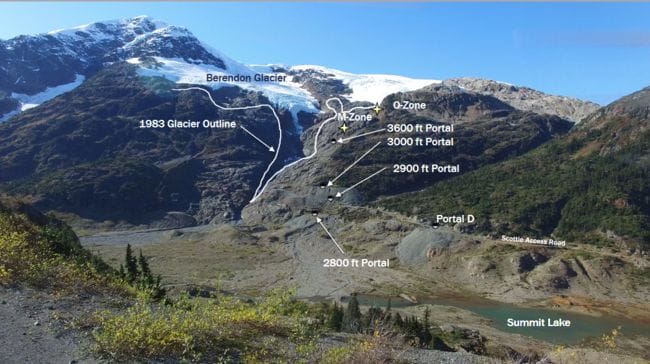

The following image might be one of the better examples of how a receding glacier, though troubling in every respect, is a boon a Gldn-Tri ExplorerCo like ESK (it opens up the landscape revealing surface features never before seen).

Golden Ridge Resources (GLDN.V)

- 79.19 million shares outstanding

- $10.29M market cap based on its recent $0.13 closing price

Golden Ridge’s 1,700 hectare Au-Ag Hank Project is its flagship asset.

The company is targeting two types of mineralization at Hank:

- High-grade epithermal style gold-silver veins surrounded by bulk tonnage Au-Ag-Pb-Zn mineralization in altered host rocks.

- Bulk tonnage alkalic porphyry copper-gold mineralization similar to the producing Red Chris mine.

We talked about the proximity of GLDN to the celebrated “Kyba Red Line” in a previous offering – a geological feature that’s worth brushing up on when shortlisting investment prospects in the Triangle:

Aben Resources (ABN.V), Golden Ridge (GLDN.V): a red line and an accumulation groundswell

“Geology: All mineralized zones on the Property are hosted within Stuhini Group volcanic and volcaniclastic strata, as well as alkaline stocks and dykes which intrude into the volcanic package and show a clear spatial association with the mineralized zones. Geological studies have suggested the intrusions were the likely source of hydrothermal fluids and gold-silver-lead-zinc mineralization on the Property. The Upper Alteration Zone is adjacent to an important unconformable contact between the Upper Triassic Stuhini Group and Lower Jurassic Hazelton Group. The unconformity, referred to as the “red line” was recently recognized by Joanne Nelson and Jeff Kyba of the BC Geological Survey (BCGS) as playing a major role in the emplacement of all significant mineral deposits within the Golden Triangle district including Brucejack, KSM, Schaft Creek, Galore Creek, Spectrum, Saddle (GT Gold) and Red Chris. The Stuhini-Hazelton transition cuts the southwest portion of the Property as indicated by the thick red line in the regional geology figure below. A feldspar megacrystic stock, known as the Bald Bluff Porphyry intrudes along its northern edge and was interpreted by Kaip (1997) as the source of the mineralizing fluids at Hank. 2017 drilling in the Lower Alteration Zone intersected intrusive rocks similar in texture and composition to the Bald Bluff Porphyry, which have a clear spatial association with high-grade gold-silver mineralization. 2018 work will be focused on mapping the intrusive rocks on the Property and refining the current drill targets.”

I’m looking forward to news outlining the company’s 2019 exploration plans. 2018 produced a nice discovery with intriguing follow-up results.

GT Gold (GTT.V)

- 112.93 million shares outstanding

- $101.64M market cap based on its recent $0.90 closing price

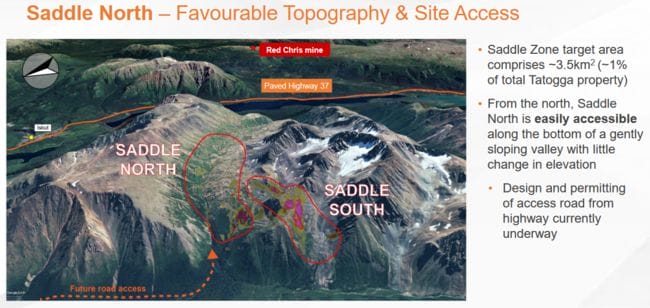

GT Gold’s flagship asset is its 100% owned Tatogga property where it’s currently delineating a high-grade gold-silver zone at Saddle South, AND, a significant new porphyry discovery with strong gold-copper-silver grades at nearby Saddle North.

Both Saddle discoveries prompted the company to drill more than 20 kilometers of core in 2018. It was an extremely active season with exceptionally strong newsflow.

What really rocked the market was this October 2018 news drop:

That’s about as good as it gets with a porphyry discovery. The market responded accordingly with the kind of share price trajectory we all yearn for in this arena.

The high-grade Saddle South project was also active for newsflow in 2018, though it took a back seat to the excitement next door.

The 2019 field season promises to be an active one.

I’d be remiss in not mentioning that there are rumors floating around that GTT is considering a joint venture with a deep pocketed senior entity for its northern Saddle. It would make sense, especially if the company is successful in demonstrating serious scale.

One to watch.

International Samuel Exploration (ISS.V)

- 50.83 million shares outstanding

- $1.52M market cap based on its sub nickel ($0.03) share price

When you examine this one’s market cap and strategic Gldn-Tri land position, you’ll understand why I include it.

The company’s 26.77K hectare LGM Property is right in the thick of things. Note its proximity to the likes of HANK, Forrest Kerr, Ball Creek, etc.

This one has seen only a few cursory pokes with the drill bit. It’s largely unexplored.

Continued exploration success by its neighbors alone might be enough to trigger significant share price trajectory here, based on its extremely modest valuation (modest by Gldn-Tri standards), though I suspect the company has plans for 2019.

I wouldn’t be surprised if the company brought in a partner with deeper pockets to really open this one up.

The company also has a strategic land position 70 kilometers NW of Kemess called Williams.

The Williams gold property hosts two large targets: mesothermal gold with two metres of 24.8 g/t gold and two metres of 35 g/t gold and a porphyry copper-gold-molybdenum prospect. Widespread alteration zone coincident with a large 1,200-metre-by-2,300-metre gold-in-soil anomaly. Historical drilling on a small segment of the anomaly (300 metres by 300 metres) intercepted 11 separate two-metre intervals with greater than 12 g/t gold.

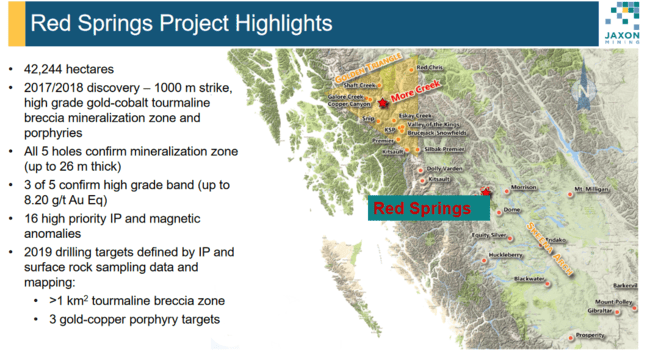

Jaxon Mining (JAX.V)

- 100.48 million shares outstanding

- $5.53M market cap based on its recent $0.055 closing price

Jaxon’s 42,244 hectare Red Springs Project, as per the company’s website, is prospective for world-class high-grade gold/cobalt tourmaline breccia mineralization and associated copper/gold porphyry targets.

The mineralization type at Red Springs is similar to other known world class tourmaline breccia porphyry copper deposits such as the Giant Copper porphyry copper deposit in British Columbia, Canada; the Kharmagtan porphyry copper/gold deposit in Mongolia; the super large EI Teniente porphyry copper deposit in Chile; and the Soledad porphyry copper/gold deposit in Peru. All are distinguished by their distal and well developed tourmaline breccia pipes or veins. Field work at Red Springs, conducted in 2017 and 2018, identified two distal areas with distinct mineralization.

JAX’s first area of interest is an extensive tourmaline breccia setting which includes the Backbone gold-bearing tourmaline breccia zone, the North Cirque tourmaline breccia zone, the North West Cirque tourmaline breccia zone, and three additional copper porphyry targets.

Area of interest number two is a high-grade antimony-silver discovery. Assays from a 2018 surface sampling program produced up to 5% antimony, 302 g/t silver, 2.94% zinc, and 1.70% lead.

Five holes from a 2018 drilling campaign tagged up to 8.2 g/t AuEq with 6.6 g/t gold, 0.1% cobalt, and 0.04% bismuth.

Cashed up, the company is set to hit the ground running as soon as the thaw kicks in:

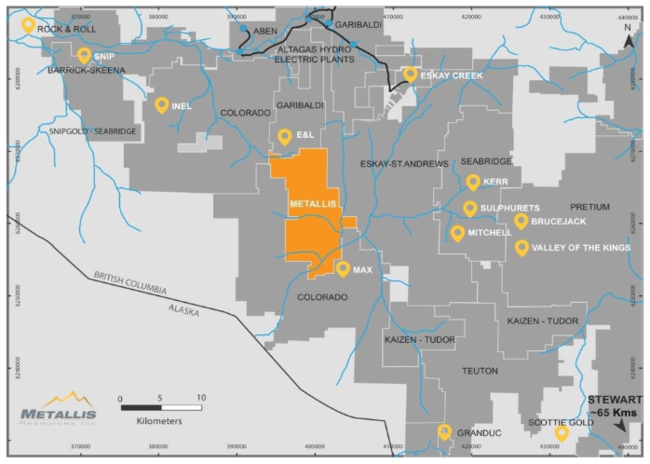

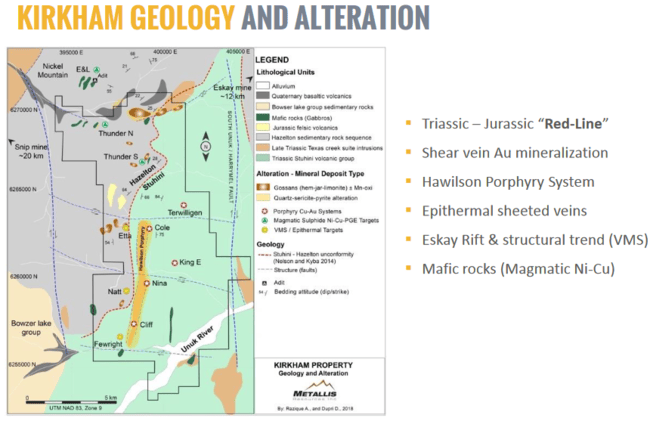

Metallis Resources (MTS.V)

- 32.99 million shares outstanding

- $16.82M market cap based on its recent $0.51 close

Metallis’ 10.6K hectare Kirkham Property has at least seven high priority targets, everything from porphyry, to epithermal, to VMS, to shear-vein-hosted deposit potential.

Once again, we have a project with significant alteration that lies in proximity to the lauded “Kyba Red Line”:

Geology: The Kirkham property lies within the Stikine Terrane, near the boundary between the Intermontane and Coast Tectonic Belts of the Canadian Cordillera. Locally, the Kirkham property lies on the western margin of the Eskay Rift with trans-tensional structures host to several metallic ore deposits in the district. It is underlain by volcanic and sedimentary rocks of the Upper Triassic Stuhini Group and the Lower to Middle Jurassic Hazelton Group. According to Kyba and Nelson (2016), the contact between these two rock formations is a key geological marker for copper-gold mineralization in the Golden Triangle. Also referred to as the “Red Line”, this marker has been traced over a strike length of 10km (north-south) on the Kirkham Property.

Results from the company’s Cole target, released last Nov., returned an intercept of 11.18 g/t gold over 7.7 meters (including 137 g/t gold over 0.6 meters).

Things have been quiet on the Metallis news front of late. We look forward to seeing what the company has planned for this upcoming field season.

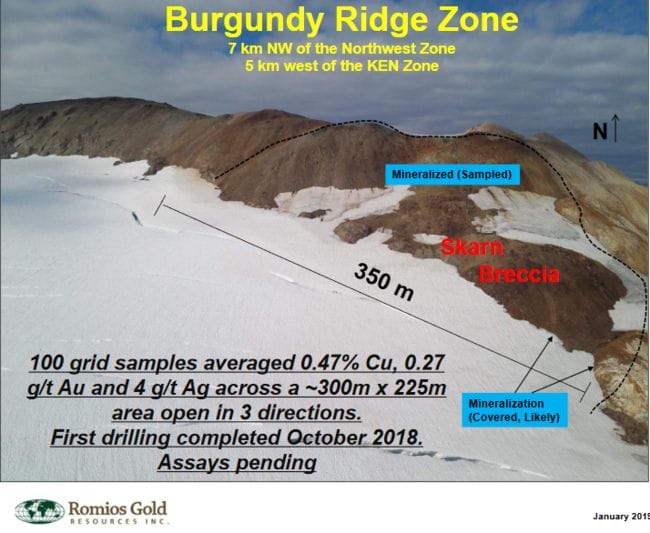

Romios Gold Resources (RG.V)

- 198.4 million shares outstanding

- $11.9M market cap based on its recent $0.06 close

Romios holds a strategic position in a group of claims that border a property that Newmont (NEM.NYSE) recently plunked down $270M to snag a piece of – Galore Creek (mining giant Teck holds the remaining 50%).

Galore is a massive system (note the gold ounce tally below):

Romios’ 73K hectare land package covers over 50 kilometers of surface and subsurface mineralization.

The company’s most advanced projects include Newmont Lake and Trek, with exploration targets being developed at Royce, Porc, and JW.

The Newmont Lake and Trek projects are located near developing infrastructure including: AltaGas’ under-construction McLymont River Hydropwer Project (Newmont Lake); NovaGold-Teck Resources’ proposed mill site (Trek); and, the provincially-funded extension of the existing power grid into the northwestern B.C area.

Newmont Lake’s Northwest zone sports an Inferred resource of 1,406,000 tonnes containing 200,000 ounces of gold at 4.43 g/t, 6,790,000 lbs of copper at 0.22%, and 291,000 ounces of silver at 6.4 g/t. Note the drill intercepts along the various zones, here.

The Trek zone also generated some interesting drill intercepts. Those results can be perused here.

It would appear Romios has plans for this upcoming field season – plans which include drilling off a number of zones.

Romios Provides Update on Its Newmont Lake Project Area in the Golden Triangle Area, BC

In the short term, assays are still pending for the company’s Burgundy Ridge Cu-Au-Ag Skarn zone:

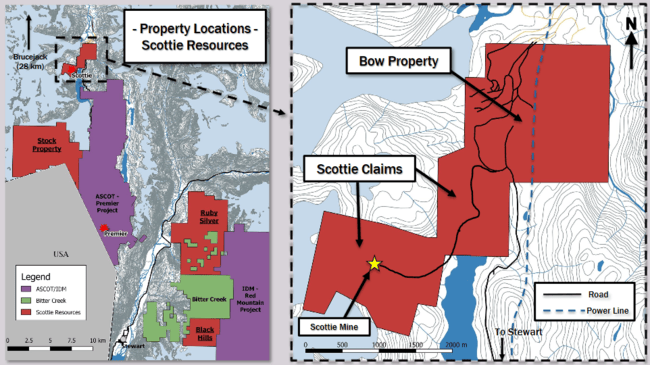

Scottie Resources (SCOT.V)

- 59.57 million shares outstanding

- $9.53M market cap based on its recent $0.16 closing price

Scottie holds a 100% interest in the past producing Scottie Gold Mine property, strategically located 20km north of the Premier Gold Mine and 27km south of the Brucejack Mine.

The company also has an option to acquire a 100% interest in the Bow Property right next door.

Decade Resources (DEC.V) explored Bow a few years back. Drilling highlights from the Big M zone and the Sixties zone returned 15.25 g/t gold over 49.6 meters (including 56.7 g/t gold over 13.20 meters), and 27.54 g/t gold over 13.11 meters, respectively.

The Scottie Gold Mine operated from 1981 to 1985 and produced 95,426 ounces of gold from 183,147 tonnes of mineralization grading 16.2 g/t.

Property Highlights:

- Past gold producer with an active mine permit.

- Road accessible from the Salmon Glacier Road and is 1km west of the Brucejack Mine extension and Northwest Transmission Line.

- Existing underground 200 tonne/day mill on site.

- 6 portals, shafts, rail system, and 7km of drifts.

- Historic reserves are only within the immediate area of the mine workings (60,000 oz Au, non NI-43-101 compliant) – the deposit remains open along strike and at depth.

- Limited exploration – numerous high-grade mineralized veins have been identified but never tested with the drill bit.

- Excellent potential to significantly expand resources.

The deposit consists of a number of east-west to northwest trending, steeply dipping, shear veins, that are comprised of pyrrhotite > pyrite ± quartz ± calcite. The veins are hosted in a package of andesitic volcanics from the Unuk Rover Formation that are situated adjacent to the contact with the Summit Lake stock, part of the early Jurassic aged Texas Creek Plutonic Suite.

Regarding Scottie’s plans for the upcoming field season – a mid 2018 press release spells it out:

The proposed program includes approximately 5,400 meters of drilling of high quality targets, surface mapping with a particular focus on structural geology, re-logging of old drill core, underground mapping and surveying, and potentially geophysics.

Scottie is new on the scene. Newsflow, which could generate a good volume of high-grade assay data, should be robust this upcoming field season. Keep an eye on this one.

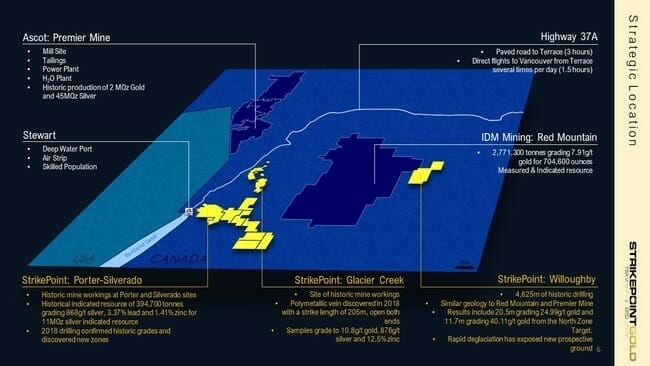

Strikepoint Gold (SKP.V)

- 74.09 million shares outstanding

- $9.63M market cap based on its recent $0.13 close

Strikepoint is a name that always gets mentioned when the Golden Triangle is discussed. It’s a well liked company. It’s also an extremely well positioned Gldn-Tri ExplorerCo.

The company boasts two significant projects in its portfolio: Porter Idaho and Willoughby.

There has been much discussion in these pages regarding the “Kyba Red Line”, the contact between Triassic-age “Stuhini Group” and Jurassic-age “Hazelton Group” rocks. The vast majority of the mineralization in Golden Triangle is found within 2-kilometers of this zone.

Slide #6 from Strikepoint’s investor-deck demonstrates this fascinating geological feature with greater clarity than anything else I’ve seen. Nice work folks.

A few choice highlights from historic drilling at Willoughby include the following high-grade hits:

- 20.5 meters grading 24.99 g/t gold and 184.22 g/t silver, and 2.9 meters grading 383 g/t gold and 213.6 g/t silver (North Zone target).

- 11.7 meters grading 40.11 g/t gold and 109.71 g/t silver (North Zone target).

- 13.0 meters grading 13.37 g/t gold and 63.43 g/t silver (Main Zone target).

Additional five target zones on the property have all returned significant gold and silver grades in drill core or channel samples at surface.

The site is “drill ready” and serviceable via our existing camp at the Porter Project. Exploration permits are underway, having been started by the previous property owners.

Willoughby is similar in many respects to the nearby Red Mountain deposit located 7 kilometers to the west (Red Mountain has a Measured and Indicated resource of 2,771,300 tonnes grading 7.91 g/t Au and 22.75 g/t Ag for 704,600 ounces of gold and 2,026,800 ounces of silver).

The company’s high-grade Porter Idaho Project has a historic Indicated resource of 394,700 tonnes grading 868 g/t silver, 3.37% lead, and 1.41% zinc for 11 million ounces of silver. 2018 drilling confirmed historic grades and turned up new zones. Note: Porter’s resource is historic, it does not conform to current NI 43-101 standards.

The upcoming field season should produce significant newsflow with Willoughby generating the lion’s share of attention.

Tudor Gold (TUD.V)

- 108.76 million shares outstanding

- $42.96M market cap based on its recent $0.395 close

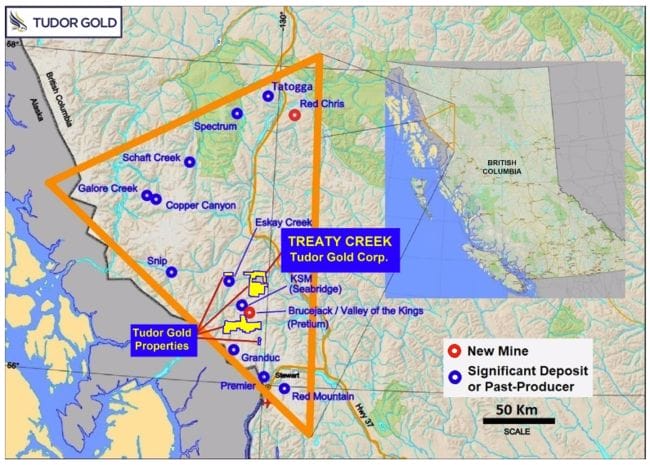

Tudor controls four properties in the Triangle, Treaty Creek being their flagship project.

A joint venture with partners American Creek and Teuton Resources (see below), TUD holds 60% in this 17,913 hectare project (American Creek and Teuton each hold 20% and are carried through to a production decision).

Treaty Creek is yet another highly prospective property near the Upper Triassic – Lower Jurassic contact, aka the “Kyba Red Line”. The project connects with Pretium’s Brucejack-Snowfield property and Seabridge’s KSM property to the north where it’s positioned along the same geological trend.

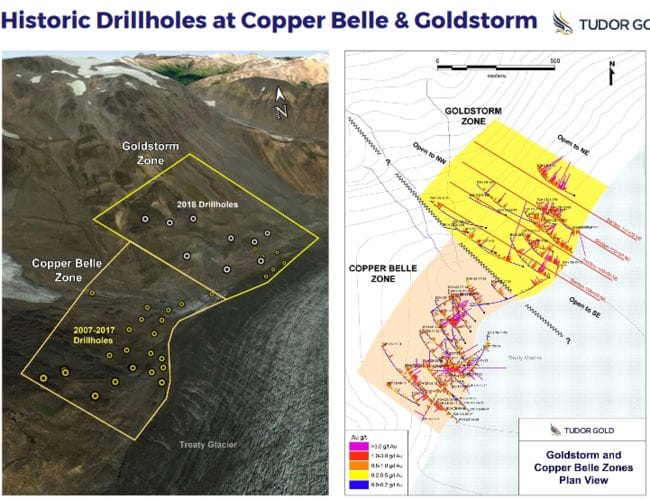

69 drill holes have been sunk into two zones – Goldstorm (love that name) and Copper Belle – establishing a mineralized footprint of some 1,200 meters.

The Goldstorm Zone

• Nineteen deep drill holes.

• Holes spaced 100 to 150 meters apart.

• Defined area of mineralization = 500 by 450 meters.

• Broad intercepts of mineralization:

- 0.801 g/t Au over 176.4 meters.

- 0.672 g/t Au over 410.0 meters.

- 0.686 g/t Au over 369.0 meters.

- 1.307 g/t Au over 115.5 meters.

- 0.762 g/t Au over 337.5 meters.

- 0.662 g/t Au over 337.8 meters.

- 0.486 g/t Au over 482.0 meters.

- 0.545 g/t Au over 146.5 meters

- 0.659 g/t Au over 169.5 meters.

- 0.981 g/t Au over 563.8 meters.

The Copper Belle Zone

• Fifty drill holes.

• Holes less than 100 meters apart.

• A 650 x 300-meter mineralized corridor.

• Gold intercepts of moderate length:

- 0.756 g/t Au over 82.6 meters.

- 0.810 g/t Au over 65.0 meters.

- 0.911 g/t Au over 93.0 meters.

- 1.006 g/t Au over 70.1 meters.

- 1.332 g/t Au over 45.0 meters.

- 1.784 g/t Au over 149.1 meters.

This is turning into a big system (we love big systems here at Equity Guru). Worth noting: the mineralized intervals at Goldstorm increase in thickness to the northeast.

And as it turns out, southeast Goldstorm is looking pretty fat too:

On Jan. 7th of this year, the company added Ken Konkin to the team. This is a huge hire for the company. If you look at projects around the Triangle, you’ll see there are at least a dozen named after the man: Honky Konkin; Konkin Gold, Konkin Silver, King Kongkin, etc.

Mr. Konkin will oversee exploration of Tudor Gold’s flagship property, Treaty Creek, as well as several other Tudor Gold properties located within the prolific Eskay-Sulphurets-Premier gold belt.

The company also holds a 60% interest in the Electrum, a 100% interest in Crown, and a 100% interest in Eskay North.

Definitely one to watch.

Teuton Resources (TUO.V)

Investor Videos (no corp presentation)

- 39.32 million shares outstanding

- $7.86M market cap based on its recent $0.20 close

The company has, if my arithmetic is correct and the company’s website isn’t too out of date, 31 projects in the Triangle. Most notable among them is the previously mentioned Treaty Creek Project it shares with partners Tudor and American Creek.

Teuton has properties to the south of Seabridge’s KSM and Pretium’s Brucejack-Snowfield projects – properties with titles like King Tut, Delta, Fairweather, Orion, High North, and Tuck.

It also holds a plethora of claims in the vicinity of the Red Mountain project, the Homestake Gold-Silver deposit, the Premier-Dilworth Gold property, the Eskay Creek mine, the Red Chris mine, and the town of Stewart itself.

American Creek Resources (AMK.V)

- 276.53 million shares outstanding.

- $8.3M market cap based on its recent $0.03 share price.

I’d be remiss in not adding this one to the list. As mentioned above, it holds a 20% carried interest in the highly prospective Treaty Creek property.

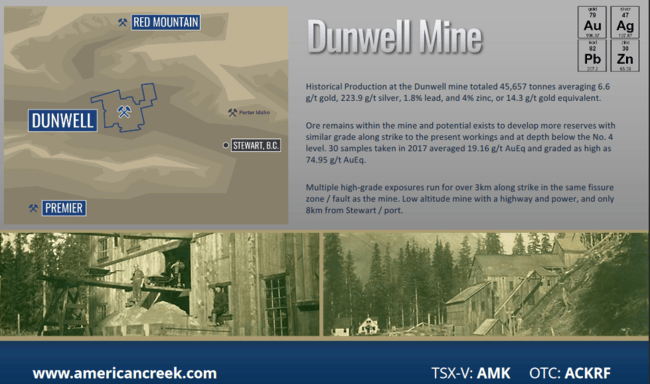

A very smart mining man I know also likes the potential in the company’s Dunwell Project.

Dunwell’s 1,665 hectares lie within the same geological trend as the Silbak Premier Mine and the Red Mountain deposit.

The historic Dunwell mine produced 45,657 tonnes averaging 14.3 g/t gold equivalent. Ore remains in the mine and recent drilling has shown potential to develop more reserves of similar grade below the existing mine. Large scale potential exists as multiple ultra-high-grade showings occur along strike (fault) for 3km. The near by Premier mine is reopening and is open to processing ore from other deposits such as the Dunwell Mine. The property boasts excellent logistics with a highway and power running through it and is located only 8km from shipping port in Stewart, BC.

INTERMISSION

There’s more to the Golden Triangle story – GT2 is on deck.

END

~ ~ Dirk Diggler

Postscript: the author would like to thank Rob McLeod, a third-generation miner with an impressive track record in the junior exploration arena, for answering my questions and offering insights into several of the co’s featured here.

Full disclosure: Aben has a marketing relationship with Equity Guru.

Great info. Lucky me I ran across your website by chance (stumbleupon).

I’ve saved it for later!

Thanks Jackson. Appreciate the feedback.

I enjoy reading an article that can make people think. Also, thanks for permitting me to

comment!