Supreme Cannabis’ (FIRE.T) portfolio of marijuana producers has a new addition after Blissco (BLIS.C) shareholders approved a CAD$48 million takeover today.

The deal, nearly two months in the making, gives Supreme strong inroads into the fast-growing marijuana wellness market.

In an official press release, Blissco Cannabis Corp announced it has received 99.28% shareholder approval to merge with Supreme Cannabis. When Supreme first announced its plan to acquire Blissco back in May, support from shareholders was roughly 52%, well below the 66% majority approval needed to finalize the deal.

Clearly, there has been a lot of dialogue going on behind the scenes.

The $48 million deal is an all-stock transaction and Blissco is expected to apply for a final order of the Supreme Court of British Columbia on July 11. If all goes according to plan, the deal will be finalized as early as Friday.

Blissco shareholders are getting a pretty damn good deal. They will receive Supreme common shares at an exchange rate of 0.24, which gives them exposure to a portfolio of leading marijuana producers.

When the deal was first announced back in May, Blissco CEO, Damian Kettlewell, said shareholders will “benefit from the combined expertise of both companies in growing premium cannabis brands, producing and procuring high-quality inputs, commercializing new products, and ensuring regulatory compliance.”

Read: The Supreme Cannabis Company (FIRE.T) finds their bliss with latest acquisition

Why Blissco?

The acquisition of Blissco is part of Supreme’s wider ambition to build a diversified portfolio of leading marijuana brands. It also feeds into Supreme’s plan to expand the Canadian market for marijuana extracts and wellness products.

As we reported last month, the extracts industry is worth billions in pent-up demand alone. Extracts will become a reality on Oct. 17, 2019 when three new classes of legal cannabis products are phased in. It’ll take at least another 60 days before anything hits the market.

CBD – one of the leading segments of the wellness market – is expected to hit $22 billion in sales in just three years, according to Brightfield Group.

Blissco gives Supreme one of Canada’s leading wellness brands, not to mention 18,000 square feet of extraction and processing space. The company has supply agreements already in place with British Columbia, Alberta, Saskatchewan and New Brunswick.

Much like Supreme, Blissco has already eyed global expansion by starting the good manufacturing practice (GMP) certification process in the European Union.

Supreme and the Canadian Marijuana Index

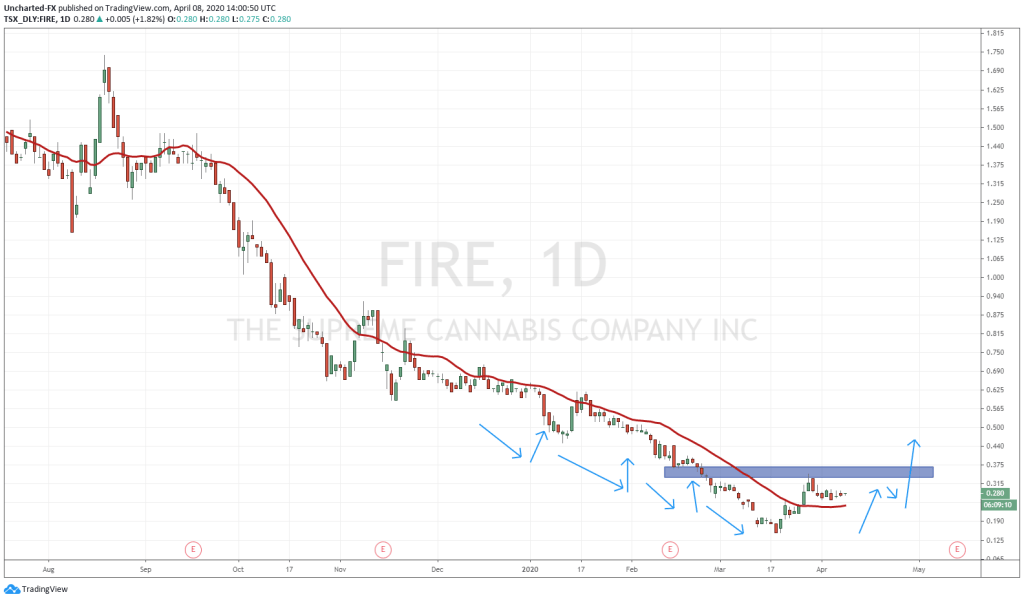

Supreme’s share price experienced an impressive run to the north in the first quarter thanks to a virtuous news cycle and surging revenues. Net sales spiked 382% in the most recent quarter, with revenues from recreational markets gaining 63%.

Since peaking at $2.30 back in March, Supreme’s share price has corrected lower by around 37%. It now trades at almost break-even for the year.

Despite the reversal, Supreme has a total market cap of $413 million, where it ranks among the most valuable Canadian marijuana plays. For that reason, it is part of a select group of companies to be included in the Canadian Marijuana Index.

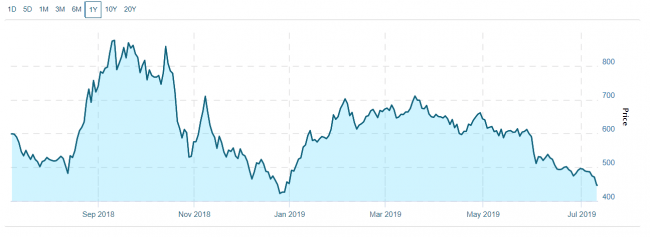

Only 23 Canadian marijuana plays are part of the index, including the likes of Canopy Growth (WEED.T), Aurora Cannabis (ACB.T) and Tilray (TLRY.Q).

As the following chart illustrates, Supreme’s trajectory is not unlike that of its index peers.

Supreme remains one of the most active marijuana companies as far as investments go. It wasn’t that long ago that the company launched Cambium Plant Sciences and invested $14 million to build a 34,000 square-foot research facility.

Current share prices may not reflect Supreme’s full potential. Check back on the stock once the extracts market begins to heat up later this year.

— Sam Bourgi

Full disclosure: Supreme Cannabis is an Equity.Guru marketing client.