Plus Products (PLUS.C) has grown its revenue 617 percent to $2.56 million in Q3, the company revealed via its quarterly financial statements earlier this week.

We started writing about Plus back in late October, wherein Equity Guru’s very own Chris Parry said: “When you start from scratch and work your way up to one of the most respected brands in the state, with hundreds of dispensaries taking your product and sales growing month after month, you’re no longer a startup. Now you’re a growth opportunity.”

Q3 2018 financial highlights:

- Record Q3 2018 revenue of $2.56-million representing a 617 percent increase over the three months ended Sept. 30, 2017, and a 60-percent increase over the previous quarter (Q2 2018);

- Retail sales of Plus grew 104 percent quarter over quarter to $8.0-million in Q3, as measured and reported by BDS analytics;

- Q3 2018 gross margin of $380,000 (15 percent) compared with negative $170,000 (minus 48 percent) in Q3 2017;

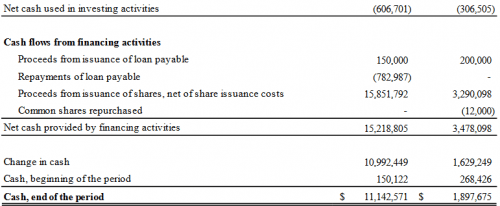

- Strong cash position of $11.1-million at end of Q3, prior to the closing of $20-million (Canadian) initial public offering on Oct. 26, 2018.

A strong cash position is correct, and, given that they’re operating presently at only a $3 million loss per quarter, it means they will have another three quarters within which to hone their business, iron out the details and get their ship in order before they start taking regular hits.

The company issued shares for cash to cover outstanding debts and give them a cushion to let them coast through into Q3, and give them some extra cash on hand in case they wanted to do some Christmas shopping. Like, for example, when they bought Good Co-op on Monday for $2.03 million.

Good is a cannabis edibles company that specializes in low-dose products. Their primary product is the Good Brownie, a pot brownie made with high-quality ingredients that possesses a uniform product consistency.

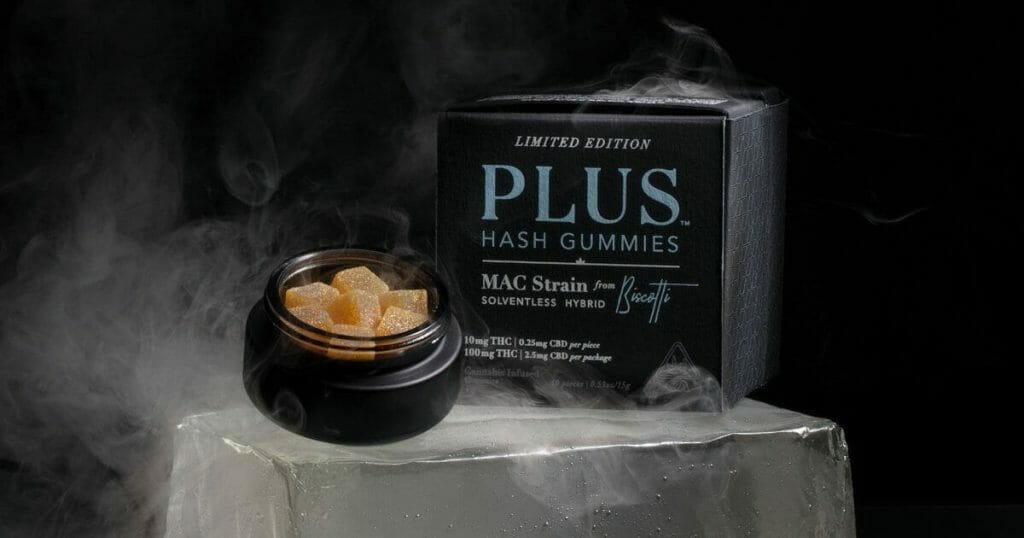

Prior to this acquisition Plus had focused primarily on making gummies. Now they can go onto the more traditional uses for pot edibles, brownies and other baked goods, allowing for diversification and growth in the edibles market. According to market research firm BDS Analytics, overall, in 2018, the baked goods category yielded up 13 percent of the overall edibles market, excluding tinctures.

Highlights:

- Represents a strategic entry for Plus into the third-largest edibles category, baked goods, after having reached the top position in edibles with only four full-time products;

- Acquisition is valued at approximately $2.03-million, to be satisfied through the issuance of 357,464 restricted subordinate voting shares of Plus;

- Approximately 90 percent of the deal consideration is subject to an earnout against quarterly baked goods revenue targets, which total to approximately $5.9-million (U.S.) in 2019 and $19.8-million in 2020;

- Plus has secured an additional 4,800 square feet of manufacturing space and associated equipment in northern California, which bolsters the company’s current 12,000-square-foot manufacturing facility in Southern California.

“Plus is a different kind of cannabis company. One hundred per cent of our revenue is from wholesale edible branded product sales. We believe branded edible market share is difficult to earn, yet is one of the most important metrics of long-term shareholder value. We are pleased that as measured by retail sales in Q3, the Plus brand is now the leading edibles brand in the largest and most competitive cannabis market in the world, and we look forward to extending the brand beyond California in 2019,” says Jake Heimark, CEO of Plus.

The entirety of Good’s management team will be joining Plus. It consists of co-founders Pete Cervantes and Mike Appezzato. Cervantes doubles as head baker and brings with him over a decade of experience in food research and development, including a stint with PepsiCo (PEP.Q). Mike Appezzato has operations experience with tech companies including Optimizely and Salesforce (CRM.Z).

“When Pete and I started Good, our mission was to make the best cannabis baked goods products in the world. Manufacturing consistent cannabis food products at scale is challenging, and few companies do it well. After talking to several companies in the space, it was clear to our team that only Plus has the operational know-how to help us scale across California and throughout the United States,” said Mike Appezzato, CEO and co-founder of Good.

The acquisition is still subject to regulatory procedures, but should be completed by December 14th.

Full disclosure: Plus Products is an Equity Guru marketing client.