When I call up a CEO and hear their pitch, I mentally rank where that pitch sits in terms of intelligence, opportunity, trustworthiness, alongside all the pitches I’ve heard before.

Like a Top Gear leaderboard, it’s hard to crack that list alongside such all-time greats as CannaRoyalty (CRZ.C), iAnthus (IAN.C), and Green Organic Dutchman (TGOD.T).

Say what you will about your favourites, but even those that have gone on the biggest runs did so with some unanswered questions, or promises made and not yet kept, or in the hope that something would happen that would one day send them shooting upward.

But some pitches are just money. They grab you early, they hit you between the eyes, and they demand you take them seriously with as many doughbucks as you can muster. I heard one of these a month ago from a kid – a literal kid as far as I’m concerned – at the Extraordinary Future conference a few weeks back, who pitched me an e-sports deal that I duly walked around the room to smart people I know. Between us, we filled that kid’s entire raise because it’s a no doubter. I’ll let you know more when it’s ready but for now – mine.

When I first heard the pitch for what would become CannaRoyalty, the early promise was they were building something that the market didn’t realize it needed yet, and wouldn’t for 18 months, until CRZ had run past everyone with a rolled up collection of canna-assets that today just kills all comparables.

iAnthus management came in gentle, despite my initial cynicism, and answered every question I tossed at them with aplomb. Having shown they could make moves to add value to their stock in buying up US dispensary and grow assets in several states, they were notable for being un-notable, for not hyping where hype was justified, and for refusing to chase while others pivoted six times for breakfast. In an industry filled with children, they were clearly the adults in the room, and their results have proven that out.

iAnthus Capital (IAN.C) continues impressive rise despite industry woes

And TGOD, well, you don’t need to love that company to realize what it’s created is exactly what it set out to create; a large, diverse shareholder base, a multiple on what those shareholders bought in at, a beverage focus that is right on trend, and a market presence that demands attention.

Yes, TGOD is getting hit hard by sellers and shorters as we get near to the point where all of our readers who bought in at $1.15 and $1.65 pre-IPO will get a chance to cash out, but the fact that it hit $9 before that tells a lot of us that there’s likely to be a bounce back once the churn is done, and the pitch remains a solid one.

https://equity.guru/2018/05/07/green-organic-dutchman-tgod-t-plunders-exec-ranks-soda-giant/

But TGOD hasn’t just created one of the bigger stories in the cannabis space in Canada, they have also created a subsidiary. TGOD Ventures is where the company decided to put its US focus, separate from the main organization but unwilling to let the rise of US cannabis go unanswered, uninvested in, and unsecured.

TGOD Ventures looked at many US deals, searching for potential customers, partners, and acquisitions, should regulations one day allow them to take part in that market.

But the US continues to be a destination too far to just go snapping things up willy nilly, especially for a TSX listed company considering the TSX policy that US weed exposure is forbidden. So while TGOD remained busy in the US, it did so at arms length.

And that’s where it found Plus Products, over a year ago, building a formidable edibles business in California.

If you’re going to spend a year testing what products, branding, and business practices will work in an emerging market, making them work in California is a hell of a way to make your strategy bulletproof. When you start from scratch and work your way up to one of the most respected brands in the state, with hundreds of dispensaries taking your product and sales growing month after month, you’re no longer a startup. Now you’re a growth opportunity.

Canada is expected to see around $3 billion in weed sales next year.

California? That’s due to top $5 billion.

That comes with competition, obviously. California boasts over 250 cannabis edibles brands, but not so many that are run in a way that is scalable.

According to BDS analytics GreenEdge in their 2018 Q2 retail sales data, the PLUS ‘Uplift’ sour watermelon gummy was in the top 5 of all branded edibles sold. The Blackberry Lemon ‘Restore’ gummy SKU was in a top 10 spot.

And the top CBD-only edible product in the state? That was the PLUS CBD Relief pineapple coconut gummy.

Mind you, this growth has been happening at a time when PLUS still sees themselves as being in a Beta period where, rather than flattening the gas pedal, they’re still testing the scope of the market, the taste buds of consumers, and keeping their focus on on set of SKUs in gummies. They haven’t even cracked their knuckles in other verticals yet, haven’t made acquisitions that can jump start their revs, and haven’t pushed into other states.

But their beta period has been a big win. While they’re DESTROYING with their core products and building out their back end operations, they’re also tossing out limited edition flavours, both to give their customers some variety, but also to see what works beyond the big legacy products.

Here’s ‘rainbow sorbet’:

Madness. Now, you may be sitting there thinking, who gives a shit? There are a lot of edibles companies and Plus is just one of them.

Worse, it’s only been really actively selling product into the market since Q2 of 2017. Who cares?

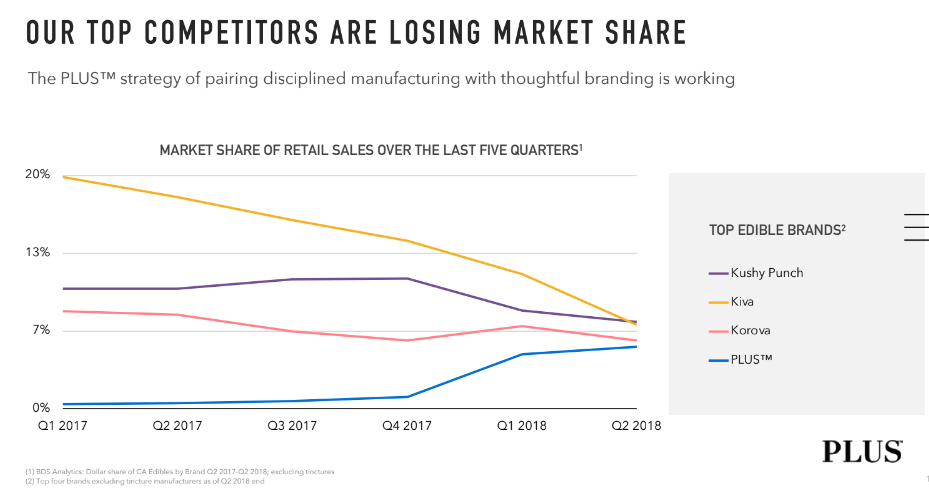

I do, because the market share of PLUS has moved from 0.43% of the edibles market in Q2 2017 to 5.31% a year later.

And, in that time, the top selling Kiva brand has gone from 20% market share down to 8%, good today for second place behind Kushy Punch, which is also sliding downward. Third place is Korova, which has shifted from 9% to 6%, then there’s PLUS, showing constant growth.

What’s behind that slide by the top bois?

Easy; consistency. California’s market is big and moving fast and supply is sometimes choked and sometimes, like now, during what’s known as ‘Croptober’, there’s a glut.

Finding consistent, clean feedstock for edibles is a nigh full time task, and manufacturing standards are often ‘the best we can’, rather than ‘streamlined and proven.’

At the heart of consistency problems is that CBD and THC come as oil, and oil wants to find more oil and cluster. So your ‘hand made’ edibles may have loads of CBD in one brownie and none in the other. It may crush your head with THC the second time you use it, but leave you annoyingly unstoned the first.

PLUS didn’t rush to market the moment it figured out how to make a gummy. Rather, it experimented, over and over, making sure that it got everything right, before products were shipped. With money sitting on the table, wanting to be taken, PLUS kept it under wraps, flew under the radar, and focused on repeatable, verifiable, top level quality, made not in commercial kitchens or commissaries, or someone’s garage, but in a commercial food production plant that is WAY more high level than their current capacity requires.

In short, they built the company with a distribution and development strategy good for 40% market share, long before they’d even hit 1% market share.

Why? Because it’s run by people who have been big before.

CEO Jake Heimark was one of the first 1000 employees at Facebook. His dad, exec chairman Craig Heimark, was CIO at UBS bank. Their Chief Risk Officer was the former legal director at Uber and counsel at Facebook. One of their directors was in branding at Quaker Oats, Kraft Foods, Polaroid and Gillette.

These aren’t the type of people who sell pot cookies because they dig baking. They’re not walking around with cannabis leaf-adorned clothing, and they’re not grey market enthusiasts.

These are professional corporate dominators who build things with the expectation that they’ll become worth billions, not millions. They ultimately want to sell to every state in the union, Canada, Europe, and the ancient hills of Cyprus, should people in Cyprus want to get their CBD on some day.

Their product manufacturing facility is 12,000 square feet in size, with plans to grow that to 40,000 sq. ft, which would be capable of annual production of $150 million in USD product. It has forklifts and legal teams and, oh yeah, it’s FULLY FUNDED following it’s IPO.

In essence, PLUS is coming to market in the same way TGOD did, with a a broad shareholder base, the same minimum six month lock-up of shares, and with some held until December 2019.

I’m in. The conversation I had with the CEO was one of the best I’ve heard. The professionalism and promise of this play is that they want to be the biggest, most acquisition-likely edibles outfit in the USA, and be ready for a big player to come swallow them for loads of dough, when the rules allow.

PLUS has opened on the markets at $4.00 per share, nicely above the IPO price, on a day when Canadian weed stocks continue to face headwinds.

— Chris Parry

FULL DISCLOSURE: Plus Products and Green Organic Dutchman are Equity.Guru marketing clients. The author has invested in both.

Good article Chris,

But it leaves a couple questions with your reference to TGOD ventures finding Plus gummies, does TGOD ventures own a piece of Gummies ?

Is TGOD ventures an early reference to their planned SPINCO which lacks a whole lot of detail for TGOD shareholders to make a rounded decision with the general area showing lots of value at current prices ?

Perhaps you should do an article on Spinco to shed a little light on its merits for TGOD holders ?

Regards Macloed

My thoughts exactly. I’m left assuming that spinco owns a piece of this company? maybe?