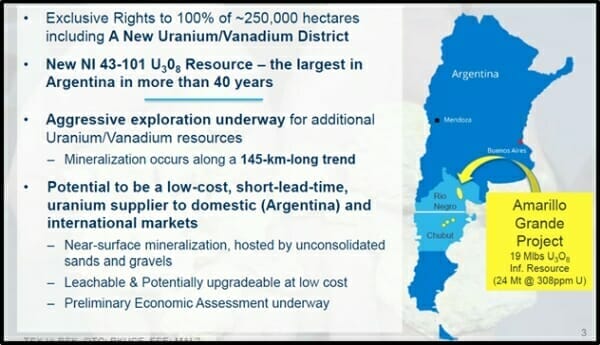

Blue Sky Uranium (BSK.V) is developing the Ivana deposit in Argentina. It aims to be “the first domestic uranium supplier for Argentina.”

If BSK achieves this objective, it will be salad days for early investors.

But there is a subplot brewing that could have even bigger upside.

To understand what is happening, let’s look at a BSK press release from October 26, 2011.

“This is an exciting new discovery at IVANA and to date these are the highest uranium grades we have encountered in Argentina,” stated BSK.

Although you can see the vanadium assay results, there is no mention of vanadium’s economic value other than a dismissive note that, “Vanadium pentoxide (V2O5) can be produced from carnotite and is mainly used as an alloy of steel.”

Flash forward 7 years: On Oct. 09, 2018 BSK announced news: “The Ivana deposit NI 43-101 Inferred Resource estimate includes 10.2 million pounds of V2O5.”

BSK is now, “advancing towards production a portfolio of uranium & vanadium projects.”

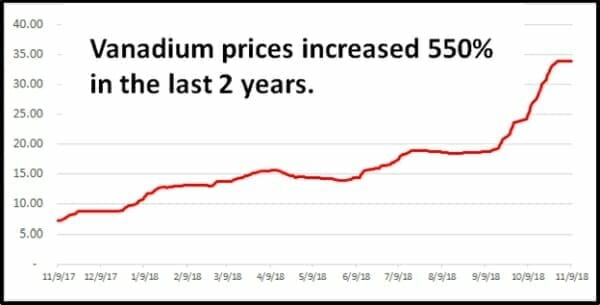

The energetic red line on the graph below explains why BSK is now highlighting its vanadium assets:

Traditionally, Vanadium has been used in the manufacturing industry owing to its malleable, tensile and corrosion-resistant qualities.

Vanadium prices are surging because “Vanadium redox flow batteries (VRFB) are quickly becoming the Cadillac energy storage solution for “peak-shaving, load leveling, microgrids, wind and solar, off-grid power supplies, and uninterruptible power supplies.”

A $500 million, 200 MW system being built on the Dalian peninsula in China, will serve 7 million residents – single-handedly tripling China’s grid-connected battery storage capacity.

Vanadium redox flow batteries last for 20 years, stay cool and retain their capacity even when fully discharged and they scale up easily to megawatt levels.

Investing News Network recently conducted an excellent interview with BSK CEO Nikolaos Cacos, in which he expounded on the significance of BSK’s vanadium in Argentina:

“Blue Sky is a uranium-vanadium exploration company,” stated Cacos, “Our first resource estimate contained 19.1 million pounds of uranium oxide and 10.2 million pounds of vanadium oxide.”

“Our vanadium results were discovered alongside our uranium showings,” explained Cacos, “In the past, we’ve encountered a pound of vanadium for every pound of uranium. Now, in some targets, we’ve encountered four or five pounds of vanadium for every pound of uranium.”

“A few years ago, vanadium was selling on the international markets for $4 per pound. Within the past year and a half, however, we’ve seen the price of vanadium rise to $33.50 per pound. Currently, vanadium is worth more than uranium and this is having a positive impact on the potential economics for our deposits.”

BSK is working towards completing a Preliminary Economic Assessment (PEA). “With the price of vanadium and uranium on the rise, we believe that we can demonstrate the robustness of this project,” stated Cacos.

It isn’t just Mondo-Battery demand pushing the vanadium spot price higher.

Little reported events in China are catalyzing further increases.

After a series of deadly building collapses, the Standardization Administration for the People’s Republic of China, recently announced a new rebar standard – requiring the use of vanadium.

“Rebar” is used to give internal structure to poured concrete.

China produces about 200 million metric tons of rebar each year. Argentina is one of China’s main trading partners in South America. $13 billion of goods move between the two countries.

Read more Equity Guru Blue Sky commentary here:

Blue Sky Uranium (BSK.V): Exploration blue sky at Ivana deposit – assays pending

Blue Sky Uranium (BSK.V): Advancing Amarillo Grande to the PEA stage – Update

Blue Sky Uranium (BSK.V) ups financing as vanadium draws interest and trading starts to roar

Blue Sky Uranium (BSK.V) Concentrating U308 with a significant Vanadium kicker

https://equity.guru/2018/04/19/blue-sky-bsk-v-announces-resource-estimate-global-metal-prices-surge/

To be clear, BSK is not pivoting away from uranium.“Argentina currently imports 500,000 to 1 million pounds of uranium annually from either Canada or Kazakhstan,” explains Cacos, “We intend to be the first domestic uranium supplier for Argentina and also a net exporter of uranium.”

But the vanadium is no longer just a “kicker” (a secondary metal that creates a small additional revenue stream).

It has the potential to radically change the economics of the Amarillo Grande project.

The rally in vanadium prices is accelerating with V2O5 flake recently leaping to $27.50/pound in China.

Full Disclosure: BSK is an Equity Guru marketing client, and we own stock.