Elon Musk recently built a large battery plant in South Australia that has stabilised the power grid by collecting and storing excess power when it is cheap and discharging it during demand spikes.

To achieve this end, Musk used lithium-ion battery technology.

The next time Musk builds a massive new battery, it’s likely that he’ll use a completely different technology.

As we wrote in a recent article about Vanadium Corporation, “Vanadium redox flow batteries (VRFB) are quickly becoming the Cadillac energy storage solution for “peak-shaving, load leveling, microgrids, wind and solar, off-grid power supplies, and uninterruptible power supplies.”

The most notable vanadium-flow battery is a 200 MW system being built on the Dalian peninsula in China, which will serve 7 million residents. The $500 million battery system will single-handedly triple China’s grid-connected battery storage capacity.

There are plenty of early warning signs that shit is getting real in the vanadium sector.

For instance, recent financial results of Canadian vanadium producer Largo Resources (LGO.TSX) revealed revenues of $91.0 million in Q1 2018, a 210% increase over Q1 2017.

What is so special about Vanadium batteries?

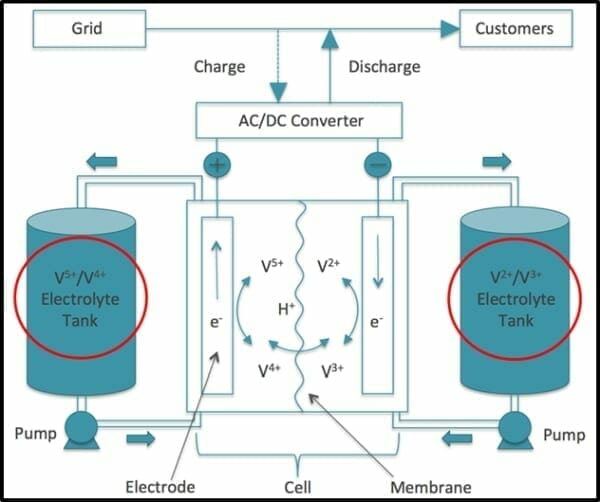

In a vanadium battery, V2+ is oxidized to V3+ in the negative half-cell and an electron is released to the external circuit. When vanadium is the only element present on both sides of the cell, “cross diffusion” does NOT result in permanent capacity loss.

If the science is spread too thick for you there: here’s the simple explanation:

Vanadium redox flow batteries last for 20 years, stay cool and retain their capacity even when fully discharged and they scale up easily to megawatt levels.

Today, about 85% of Vanadium production is used to harden steel. Battery vanadium demand is about to explode – although the metal is still little talked about among North American investors.

Elon Musk’s global celebrity status has catalysed Australians’ interest in mega-storage – which has lead investor eye-balls right to vanadium.

Examples:

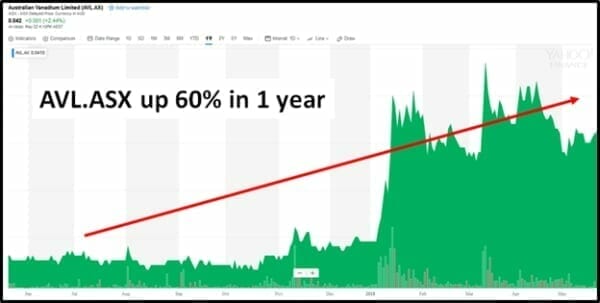

Australian Vanadium (AVL:ASX) Gabanintha deposit in Western Australia has a mineral resource 179.6 Mt at 0.75% vanadium pentoxide (V2O5).

AVL’s subsidiary VSun Energy is marketing vanadium flow batteries for grid storage connected to wind and solar.

VSun’s batteries are “safe, non-flammable and can be cycled many thousands of times with almost zero capacity degradation.”

Australian Vanadium’s initial objective is “to explore existing mining tenements focusing on the Gabanintha Vanadium deposit in Western Australia.

Australian Vanadium may also evaluate other prospective mining projects that would have the potential to contribute to Australian Vanadium’s future growth.”

AVL has a current market cap of $67 USD.

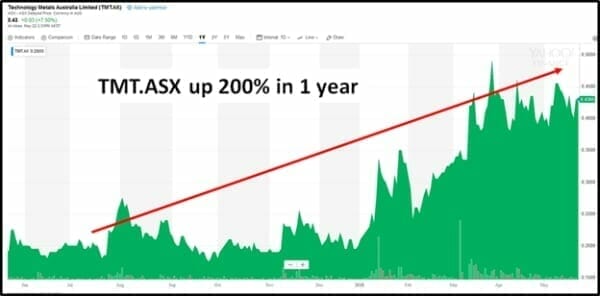

Technology Metals Australia (TMT.ASX) is developing its Gabanintha vanadium project in Western Australia.

The project’s Northern Block has an inferred resource of 62.8mt grading 0.8% V2O5.

A maiden resource estimate of 21.5mt grading 0.9% V2O5 for Gabanintha’s Southern tenement was published in 2017. This included a higher-grade section of 10.4mt grading 1.1% V2O5.

TMT recently reported it had recovered up to 97.8% vanadium from magnetic concentrates.

According to a March 18, 2018 research note, “Metallurgical test work to date has been very positive, highlighting the potential to produce a high grade vanadiferous titano-magnetite concentrate.”

TMT has a current market cap of $23 million USD.

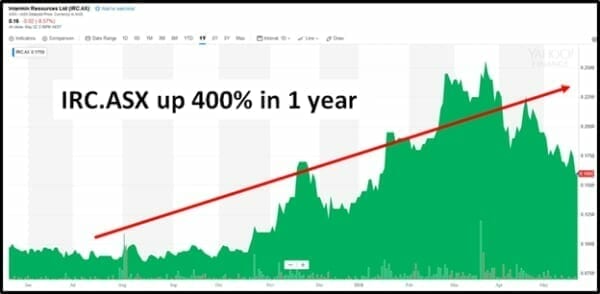

Intermin Resources (IRC.ASX) has an interest in the Richmond project in Queensland’s north west.

Richmond hosts a 2004 JORC resource of 3.3 billion tonnes with 0.40% V205 vanadium.

The company has collected about 1.2mt of vanadium ore for metallurgical testing, with results expected this summer.

According to a recent brokerage note: An update to the Mineral Resource for the Richmond project has moved it into the ‘world class’ category

“It’s a monster Resource and we have Chinese backing in our Joint Venture partners who can deal with taking it to that commercial level,” said Managing Director, Jon Price.

IRC has a current market cap of $36 million USD.

A recent Bloomberg article claimed that “Vanadium needs Elon Musk or another big player in the global battery market to get behind the metal in order to share center stage with other energy-storage components such as lithium and cobalt.”

Before that happens, there are some obstacles to overcome. Vanadium batteries are bulky, so they don’t work if there is a space crunch. Vanadium is also not cheap.

“Trying to sell a vanadium-flow battery to someone who only can think of lithium is very difficult,” stated Vincent Algar, managing director of Australian Vanadium.

As we see from the above charts, Australian investors believe in the future of mega vanadium batteries.

We think that belief is coming to the TSX.V.

That’s why we’re shouting “Vanadium” from the rooftops now.

Full Disclosure: We have no commercial relationship with any of the companies mentioned in this article.