i3 Interactive (BETS.CN) is all about transforming the future of online and mobile gaming with entertainment-based products designed for sports betting, poker, and casino players. The company is fully supported by a network of digital content and affiliate web properties.

The stock was halted on April 9th 2021, and resumed trading eight months later, on December 17th 2021.

The company has been doing things while the stock has been halted. Management has acquired the remaining equity of Livepool, and have entered into a non-binding letter of intent to acquire an industry leading online gaming operator with a well established brand.

i3 has invested $5 million for a minority stake in Baazi Games, a leading online gaming conglomerate in India. Here is some info on Baazi:

As a pioneer in India’s now burgeoning online gaming industry, Baazi has been in business for over 7 years. Baazi has steadily grown into what now is one of India’s biggest and best online gaming destinations, with an ecosystem that caters to gamers of fantasy sports, poker, rummy, and a host of other skill-based games both for real money as well as in a free and social environment. Recently, Baazi’s growth has accelerated, coinciding with the launch of new products, increased marketing spends, which increased player acquisition and in turn revenue. Baazi currently has over 10 million active users across its products, and it offers players a unique experience across the Baazi’s suite of products with unparalleled loyalty programs and user experience. Baazi has one of the biggest and best prize pools in all of India and a world class team operating the business, which has i3 very pleased with its investment and potential future partnerships with the Baazi team and suite of products.

Recently, I have seen a lot of betting companies focusing and getting excited about the market opportunity in India. Definitely a big market for sports betting. Cricket comes to mind.

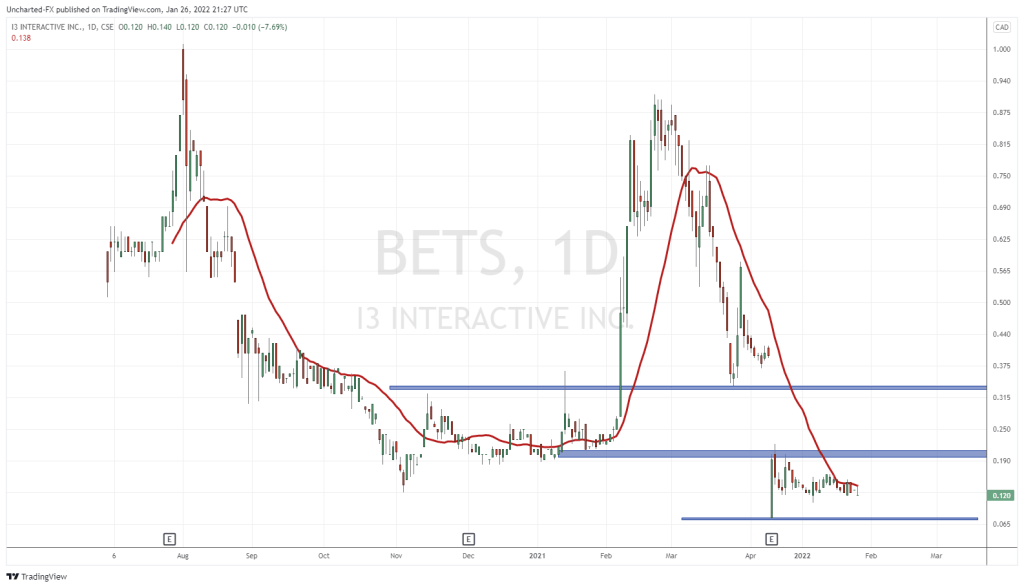

On the charts, the levels are clean. Support and resistance levels are obvious. Let’s talk about the elephant in the room and that is the huge gap between $0.20-$0.33. When a stock resumes trading after a halt, gaps tend to form. In this case, we gapped down to print new all time record lows.

The stock is currently basing. The range is obvious. I should mention we saw big volume on January 7th 2022 and December 29th 2021 with over 1,000,000 shares traded on both days. People, or someone, is accumulating at these lows. This is a good sign.

My breakout trigger would be a close above $0.20. Note my moving average. We are drifting below it, but in the next few trading days, could see a close above. That would be a positive sign that the resistance at $0.20 will be tested. However, the resistance breakout is required to start discussing any new uptrend.

According to market structure, we have a downtrend, a range, and then the uptrend. Currently, i3 Interactive is in its range portion. This is why technically, I like what I am seeing. I prefer waiting for the breakout because the range could continue for awhile. If you don’t mind holding for the long term, this is definitely a great area to enter.

I should mention that gaps tend to act as resistance. We can expect selling pressure in the gap up to $0.33. i3 Interactive really needs to fill this gap for the real bull run to get going. Management is doing their thing after a stock halt, and all the stock requires is a major catalyst to give us the breakout. Keep this on your radar.