In the total lifespan of a public company, when we look back at their origin story, it’s almost always true that mistakes were made, promises broken, errors of judgement abounded, and sometimes crimes were even committed, deliberately or otherwise. There are very few who dodge this reality, even with the best of intentions, pockets filled with cash, and ‘the best board in the world’ behind them.

Side note: Every company has ‘the best board in the world’. Nobody ever says ‘Yeah, our board is fine I guess, they’ll do.’

So when I look at a stock chart, I don’t fear a long hard price drop off, or a one-day cratering. I don’t flee at the sight of legal troubles or busted deals. And I don’t write a company off for getting it wrong, even if their version of getting it wrong is stepping on a long line of rakes over several weeks.

To be clear, i3 Interactive (BETS.C) stepped on so many rakes when they started out, they could have pivoted their business model into a rake resale business and done nicely out of it.

The reason I’ll shrug at troubles in a pubco’s early days are that, frankly, they’re unavoidable. Unless the company has been at it for several years before it went public and has a mature customer base and a solid set of financials and market share (in which case they’ll IPO with the value already taken up by deal guys – hard pass), those first three months are going to be bumpy.

I mean, imagine you’re that new pubco CEO. You’ve spent a few years putting together the deal, you’ve brought in early money and some big investors, you’ve done the roadshow of brokers and pored over marketing presentations and gone through it with the regulators and the exchange and the lawyers.. and now you’re public.

Now, every hour of the trading day, you’re being judged, while trying to build a company largely from the ground up. Make a mistake opening a laundromat and nobody is around to notice. Make one with a public company and you’ve got investors calling you up and barking down the phone at you, your board wondering if you’re the person for the job, and guys like me taking a victory lap on social media, telling the world you’re an asshole.

Wouldn’t wish it on my best enemy.

So when things go wrong and the initial plans don’t work, and the business model has to pivot, and the guy you’ve sold folks on as your leader turns out to be bananas, and it all happens in public with other peoples money on the line…

Well, THAT’S WHEN I COME INTO THE PICTURE.

As an investor, I want no part of your IPO. I’m not interested in chasing a rise that’s already happened. I couldn’t care less about your three-day rally. I want your tired, your dirty, your huddled masses yearning for yield.

I want an absolute disaster that has been recognized as such, punished on the markets, but is in the act of turning it around. I want your business model v2.0 while you’re still being punished for v1.0. I want to know you’ve felt the imprint of the market’s boot on your ass, you’ve heard their grumbling loud and clean, and you have a strategy for getting the fuck back up off the deck. I want the actress coming out of rehab, taking a part for cheap, and determined to show the naysayers up.

I want ‘good bones’. I want to be able to still smell the sulphur. I want to see the janitor hosing blood off the back docks when I show up and a construction team repairing punched holes in the wall and a new receptionist learning the phone system because ‘Janice is taking stress leave’.

Because when the smoke clears, THAT’S WHEN THE GLORY HAPPENS.

i3 Interactive came out of the gates with an idea that sports betting was going to be the next big thing (it is), that India was the place to make it happen (it is), and that Dan Bilzerian, social media influencer, was the guy to make it happen.

This is where, if it were 1992, we’d put the record scratch sound.

Because Dan Bilzerian is, to put it politely, bananas.

Here’s how Wikipedia describes him.

Daniel Brandon Bilzerian is an Armenian-American poker player, businessman, and social media influencer.

You could add(according to the wiki) trust fund kid who once paid $1 million to get a speaking part in a movie, Joe Rogan guest, and cannabis company CEO who took Ignite Brands from $9.00 to $0.40 to that bio. You could also add ‘has had lawsuits filed for allegedly kicking a model in the face in a brawl, for illegal poker winnings, for throwing a porn actress off a roof towards (but sadly, not quite into) a swimming pool during a photo shoot (breaking her foot), and for wrongful dismissal after firing an employee who criticized him for charging personal expenses to his company.

Oh yeah. He was also once arrested on bomb-making charges, and was placed on the international wanted list after an incident in Armenia.

So, yeah. Poker player. Businessman. Influencer.

What was then known as Interactive Games Technologies (now i3) needed a way to differentiate themselves in a crowded sports betting space in 2020 and decided Bilzerian’s 32 milli9on Instagram followers were the way to do it. I can’t say I don’t see the logic in that line of thinking. Bilzerian certainly knows how to make a splash. But a look over his Instagram profile doesn’t give up much evidence that he knows anything else. He appears to live in an Ignite-branded combo mansion/party estate, he exists in a Hugh Hefner-like bikini fugue state where there’s never less than one, usually more than six, bikini models within reach, and there seldom appears a moment where he doesn’t have a photographer or videographer following him.

As a non investor in BETS when it landed on the public markets, I loved this, because it had all the earmarks of a slow motion train wreck.

And it was.

Is.

Bilzerian sued i3 saying his contract was bogus, then that they breached the contract which was I guess not bogus.

But I’m not here to roll around in Bilzerian musky sweat trail. The fact of the matter is, if he’d never darkened i3’s door, the company would likely not be a BUY for me today. It would have been all about the business model, which is a good one, in a place where that business model makes a lot of sense.

Today, with Bilzerian in the rear mirror, a name change, and some added elements to the business model, i3 is an inexpensive way into a burgeoning market that I think is ripe for serious merger and acquisition activity.

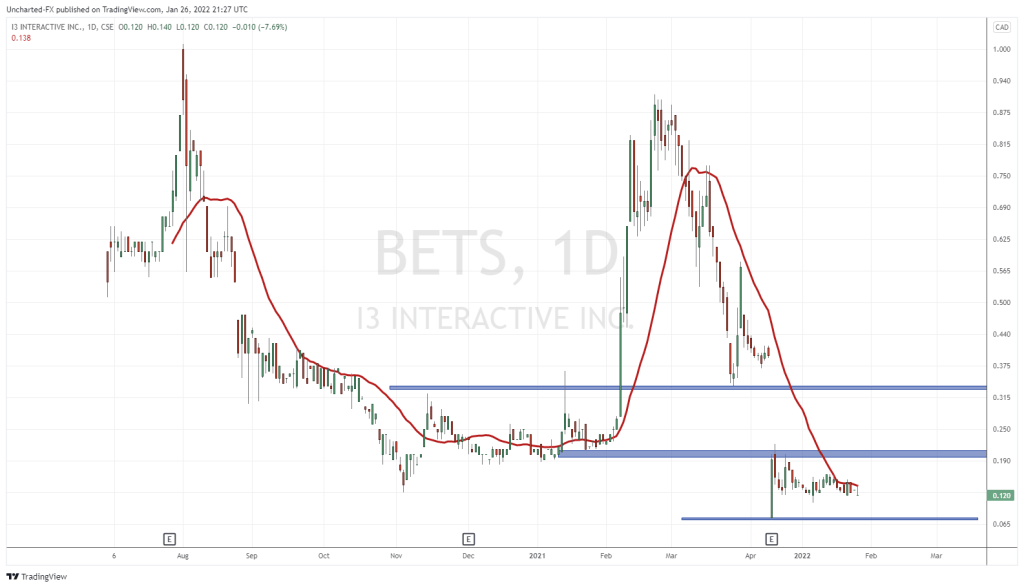

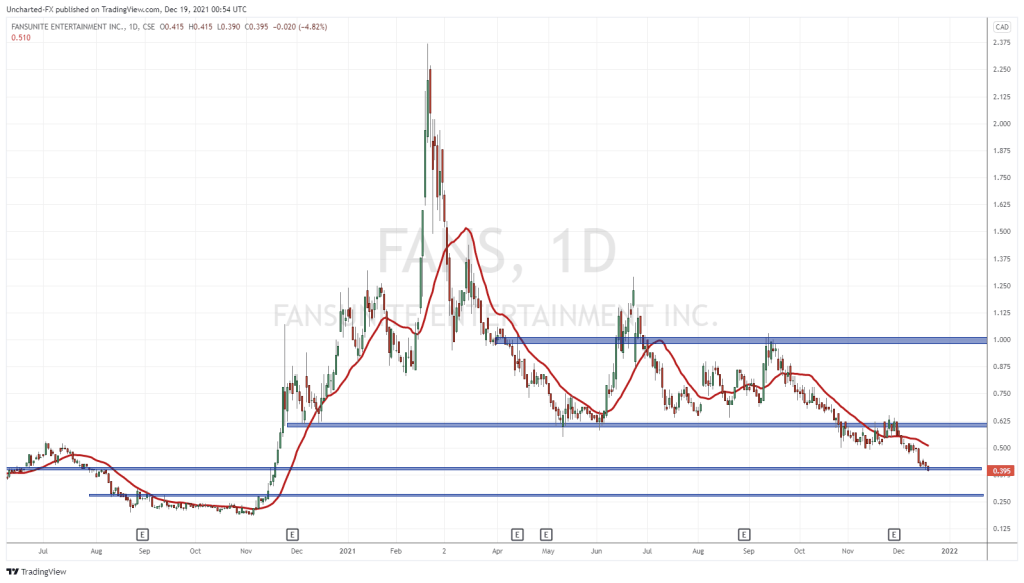

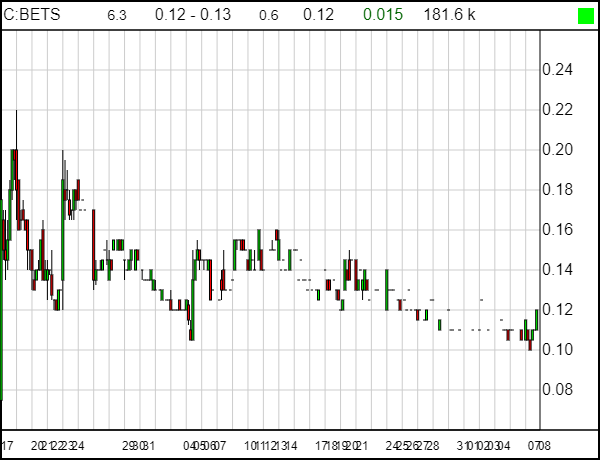

When folks look at the stock chart today, here’s what they see:

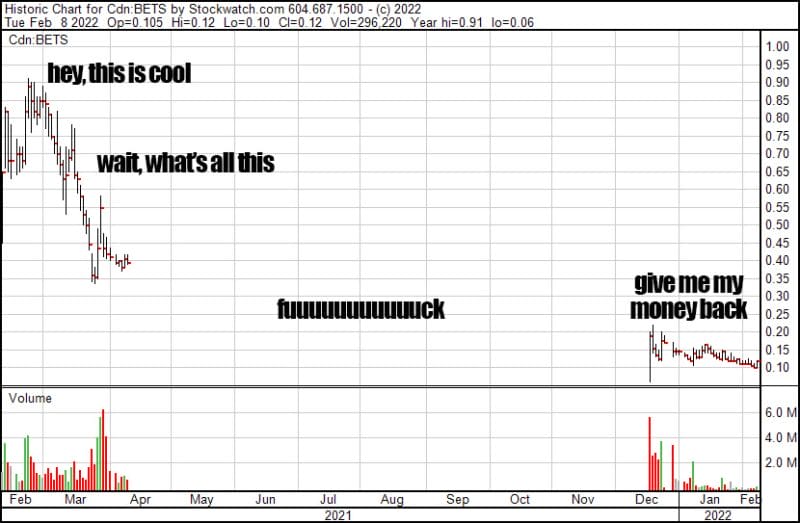

What *I* look at the same stock chart, here’s what I see.

That $0.91 high, with the Bilzerian problem in full swing, had BETS’ value at $195 million.

That $0.12 today, with Bilzerian gone, acquisitions in, and lots of fresh ground to hoe, values BETS at just $22 million.

Admittedly, current CEO Troy Grant isn’t out on Instagram shooting military weapons with topless women this morning, he’s just running his public company, but I think that and a 90% discount on price makes BETS a better prospect than it was way back when.

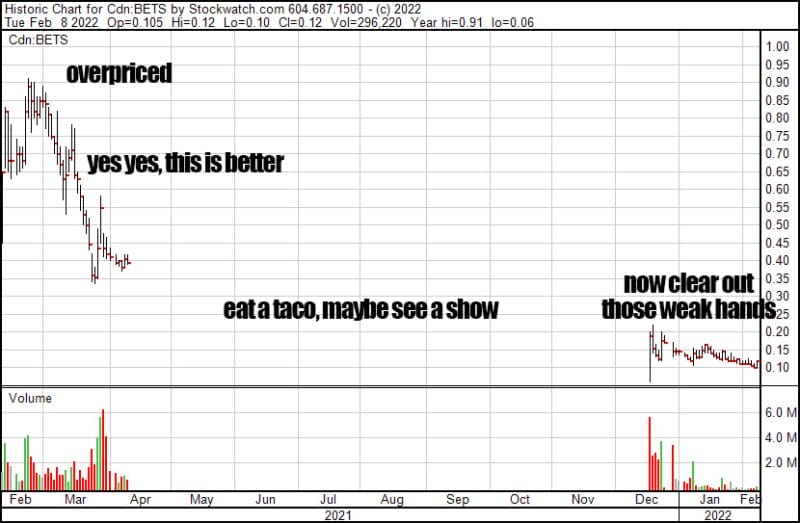

Here’s the thing: In two months, this is what folks will see on that stock chart.

That whole earlier episode, that’ll be wiped from the common memory, like a Men in Black character had wandered into scene.

All folks will see is a tight little market cap, a stock with a decent base, and the potential to elevate.

SO WHAT DOES BETS OWN THAT WILL ELEVATE?

ACQUISITION: Livepools, now known as BLITZPOOLS, opens up the fantasy sports market in India, where cricket is king.

For those who don’t know their cricket from their rogan josh, think baseball in the round, in games that can take up to five days, and which generally see a good 30 seconds between each play – the perfect amount to allow for play by play betting.

Each ball poses multiple possibilities beyond the end result: Will it be a hit or not? Will that hit score 1, 2, 3, 4 or even six? Will that batter get to 50 runs? Will that bowler take a wicket?

Football is a good betting sport for many, but play by play isn’t really workable like it is in cricket, and Indian folks do love a bet.

Blitzpools has grown to 4 million users strong at the time of writing.

SUBSIDIARY: BLITZBET

Through a partnership with global gaming platform Amelco, Blitzbet aims to deliver sports betting in newly opening jurisdictions as they happen, with a focus on Canada.

They ain’t there yet, but the status evolves every month.

SUBSIDIARY: BLITZPOKER

Back in the ’90’s, this would have been enough to see i3 Interactive valued at a billion dollars and seen on every sports network at 2am.

Today, it’s a nice lure to get folks invested in the i3 platform, with over 75,000 active monthly users and a million+ registrations.

ACQUISITION: LINEMOVEMENT.COM

In a bid to drive traffic to their various sports betting offerings, i3 Interactive secured LineMovements.com, and the streaming services of Canadian hockey legend Nick Kypreos.

The concept here is to get the punters coming back every day for content and finding their way over to other channels as they go. Each shows being around 10,000 views, which is pretty good organic growth.

There’s also content in golf, MMA, esports and betting education. Frankly, it’s decently polished stuff.

INVESTMENT: BAAZI GAMES

i3 thought they were going to grab the entirety of Baazi but the company is growing so quickly, by the time due diligence was done (and i3’s trading halt was lifted) the thing was worth way more, so i3 has made a $5 million investment into the deal that will supercharge its growth. Baazi has lined up a monster skill-based game, rummy, fantasy sports, and gaming platform that has

So how does it all fit together?

Look, it’s still early days. The betting scene is moving quickly in India and North America, with Europe already gigantic, so i3 is where I’d want it to be. The Indian government will be forced to allow sports betting across the board soon enough as illegal betting is rampant, so i3 has done well to lay out some real estate before the rush hits.

None of this would have looked better with a GigaChad CEO in charge, posting close-ups of women’s butts on Instagram every day. i3 is better off today than they were when they put a foot into the Bilzerian hot tub.

Is it all clear and plain sailing from here? Unlikely. The thing with the dust settling is, sometimes the dust reveals more things that need to be fixed. Or, in Bilzerian’s case, smothered in antibiotics.

I’m just saying it looks to me like we’re getting this newly sober, fully rehabbed actress cheap, and that she’s got her eyes on Oscar.

— Chris Parry

FULL DISCLOSURE: I own stock in i3 Interactive, because duh.