- $23.356M Market Capitalization

i3 Interactive Inc. (BETS.C) announced today that it has entered into an agreement to acquire the remaining equity in Mumbai-based LivePools Private Limited, a skill-based fantasy sports platform. The Company initially announced on January 25, 2021, that it had closed the first of three tranches of its previously announced acquisition of LivePools for USD$1,400,000.

“We are thrilled to have the opportunity to bring the LivePools entity entirely under our ownership and control, to focus on accelerating its growth and developing this business in our ecosystem of online gamers” said Troy Grant, CEO, and Director of the Company.

I am washed up. I stopped playing sports in high school, I can barely run for 20 minutes on a treadmill, and I’m only 25. However, online sports betting has an allure to it that pulls me in, allowing me to live vicariously through athletes unlike myself. Turns out I’m not alone seeing as at least 19.3 million Canadians were actively gambling online in 2021. With this in mind, following recent legislation changes, Canada’s betting market is in great shape.

The passing of Bill C-218 in August 2021, opened the door to legalized single-sport betting in Canada, allowing bettors to bet on events like the Grey Cup or the Super Bowl through regulated services. With this in mind, i3 Interactive is looking to capitalize on this market, providing customers with an online and mobile gaming platform. This platform will provide sports fans with social gaming, sports betting, and casino product offerings.

Latest News

Regarding i3 Interactive’s latest news, the Company has entered into an agreement to acquire the remaining equity in LivePools, which was recognized as one of the top 10 fantasy companies in India by both Silicon India and Start Up City in 2021. Furthermore, as of January 1, 2022, LivePools’ registrants have grown to over 4.5 million users, representing a 1.5 million increase over a 12-month period.

Throughout 2021, LivePools also established partnerships with over 12 brand ambassadors. Looking forward, with a growing number of T20/T10 leagues being announced in Sri Lanka, and Abu Dhabi as well as a T20 Cricket World Cup scheduled in Australia for October 2022, LivePools expects to participate in several events in 2022 including:

- the 22nd running of the FIFA World Cup competition in Qatar

- Kabaddi World Cup 2022, an indoor international competition

- T20 Cricket World Cup in Australia – October 2022

In case you didn’t know, T20 and T10 refer to different formats of cricket. T20 cricket is defined as a short cricket match limited to 20 overs of gameplay, lasting for about 80 minutes per innings, with a half-and-hour interval in between. For context, an over in cricket consists of six legal deliveries bowled from one end of a cricket pitch to the player batting at the other end. On the contrary, T10 cricket matches are 10 over-a-side and the duration of each match is approximately 90 minutes.

Details of Acquisition

Through its subsidiary Redrush Online Private Limited, i3 Interactive previously acquired 30.72% of LivePools and an option to acquire the remaining equity in various tranches. Under the new structure, the Company, through Redrush, has funded an additional USD$120,000, increasing its percentage ownership to 35.94%.

“We are very happy to have arrived at a deal whereby 100% of LivePools known as Blitzpools is being acquired by i3. We have no doubts that the new management will grow the business to new heights,” commented Vickram Assomull, previous CEO of LivePools.

Additionally, the Company has entered into a share subscription and share purchase agreement which provides Redrush the ability to fund an additional USD$380,000 to acquire additional equity shares of LivePools from the treasury, which upon funding will result in Redrush owning 48.08% of LivePools.

i3 Interactive has also entered into an option agreement with the current arm’s length owners of LivePools to purchase their equity shares of LivePools. According to this agreement, the Company will pay the owners a total of USD$3,200,000 for the option and the exercise price when exercising the option, however, the exact allocation between the option price and the exercise price is not yet known.

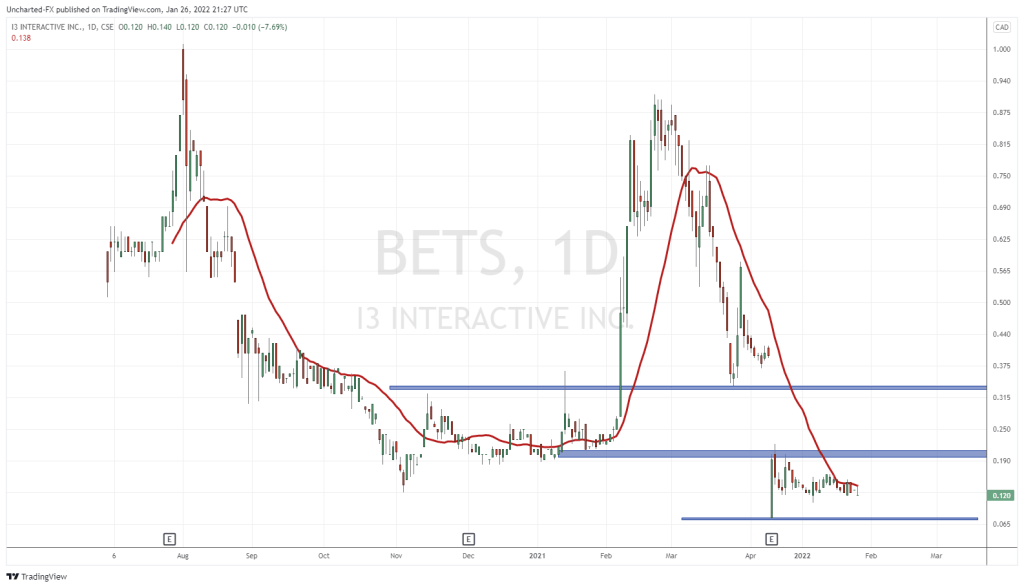

It is currently anticipated that the option consideration will be satisfied with up to USD$700,000 in cash with the balance in unsecured non-interest bearing convertible debentures, with a forced conversion on the one year anniversary, otherwise known as the maturity date, convertible into common shares of i3 Interactive at a deemed price of lesser of CAD$0.395 per share.

If automatically converted on the maturity date, the volume-weighted average trading price of the shares for the ten trading days immediately prior to the maturity date will be subject to a floor price of $0.14. The option will be exercisable for a period of twelve months from the effective date of the option agreement.

That being said, i3 Interactive has agreed to grant the owners an option to put to the Company the owner’s interest in LivePools at the same exercise price as the option. The put option will be exercisable by the owners for a period of one month following the expiry of the option. Upon exercise, the Company and Redrush will own 100% of the equity interest in LivePools.

In the future, i3 Interactive anticipates issuing the Canadian dollar equivalent of USD$2,500,000 of debentures to the owners on or before February 10, 2022, which will have a conversion price of CAD$0.395 until forced conversion upon maturity, and remain subject to statutory hold periods of four months and one day. For a closer look at i3 Interactive, check out this article!

i3 Interactive’s share price opened at $0.1050 on February 8, 2022. The Company’s shares were trading at $0.1050 as of 11:12 AM EST.

Full Disclosure: i3 Interactive Inc. (BETS.C) is a marketing client of Equity Guru.