The Investment Industry Regulatory Organization of Canada (IIROC), “writes the rules” and “investigates misconduct” in the public markets.

When IIROC identifies a company with anomalous trading volumes and share price movement – it typically asks the company to issue a clarifying statement.

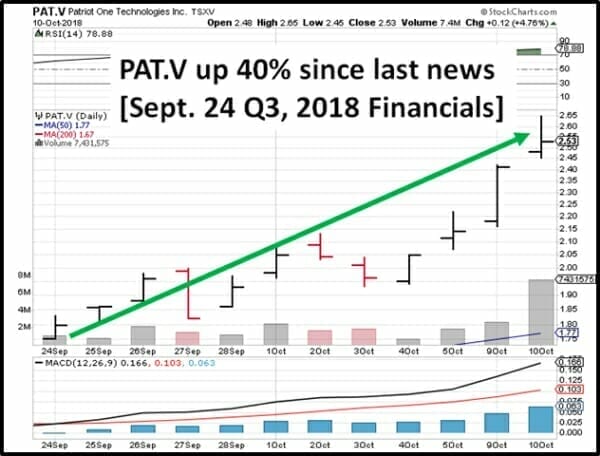

On October 10, 2018 Patriot One (PAT.V) issued a press release “at the request of the IIROC in regard to recent market activity.”

“Management is not aware of any material change in the Company’s business or affairs that would account for the recent share price movement or trading volume of the Company’s common shares,” stated PAT. “The Company has no material information to report at this time.”

Patriot One is a technology company that has developed “Cognitive Microwave Radar” which detects concealed weapons from a compact piece of hardware that can be embedded in wall cavities.

How did Patriot One get on IIROC’s radar?

By kicking some ass over the last three weeks – during a silent period.

If you look at the blue bars at the bottom of the above chart – you’ll see steadily rising volumes. It’s a classic case of investors flooding in – driving the price higher as they try to pry stock from existing shareholders who are not sharply motivated to sell.

PAT’s last news was CEO Martin Cronin’s Q3, 2018 update to “Shareholders & Partners”.

Q3, 2018 Highlights:

- Positive weapons-detection results within complex environments

- Successful human versus target-threat separation

- Identified market opportunities to expand algorithm-based software platform

- with multiple specialized sensors.

- Collaborated with The Westgate Las Vegas Resort & Casino

- Optimization and efficiency targets reached for the spec-6 antennae system

We will accept PAT’s assertion that there is “no material information to report”.

That said, we have identified three factors conspiring to drive PAT’s stock price up.

- Mainstream media coverage:

There are 1,600 companies listed on the TSX Venture Exchange. They are all in competition for investment dollars. To get those dollars, they must transmit their message above the ambient noise of the markets.

There are many ways of doing this: trade shows, e.mail blasts, print advertising etc.

Equity Guru’s Capital Markets Program is another mechanism, although it comes with a warning, “Every deal we do with a company buys our attention, not our favour. If your company hits its milestones, we’ll yell about it from the rooftops, but if it doesn’t, we’ll talk about that openly and honestly.”

We’re journalists that don’t just read your press releases and rewrite them. We come into the boardroom and talk to you about your news before it’s posted. Chris Parry, the founder of Equity Guru, has won two Webster Awards for Excellence in BC Journalism.

This pact is not for everybody – and we don’t pretend it is.

As much as we love our own cooking, there is no question for junior companies – the messaging holy grail is mainstream media attention. Because it’s free, it has reach, and (despite the notion of “fake news”) still has authority.

Cronin regularly talks to the mainstream media.

Just last week ABC affiliate KTNV Channel 13 Las Vegas, did a feature news piece on PAT’s weapons-detection technology.

“After months of testing and development inside the Westgate Hotel and Casino, employees from Patriot 1 Technologies were busy Tuesday demonstrating several products aimed at helping police and security identify potential threats,” stated KTNV.

- It’s no longer just about mass shootings:

According to an article in the Washington Post, “there are more than 393 million civilian-owned firearms in the United States – enough for every man, woman and child to own one and still have 67 million guns left over.”

In 2016 (the last year of accurate statistics) over 38,000 people were killed and 116,000 suffered non-fatal injuries due to firearms in the United States.

PAT “does not chase ambulances”.

In fact, PAT tends to go “radio-silent” after U.S. mass-shootings.

A September 12, 2018 Amnesty International Report made the remarkable assertion that “gun violence in the United States is a human rights crisis.”

Recently, investors have started to figure out that PAT’s technology is not dependent on an on-going parade of gun massacres.

There are simply too many hot-heads in the U.S. with guns.

Businesses and private citizens want to know who’s packing.

- The story, the story, the story:

Back in the day, when investor relations (IR) was called “stock promotion” we were taught to condense the pitch so that it could fit in someone’s hand, be transferred to another hand – without anything slipping between the knuckles.

“Our motto is also our goal,” stated Patriot One CEO Martin Cronin in our first ever interview, “We aim to deter, detect and defend against random acts of senseless violence anywhere innocent people work, live, and play.”

That already-polished pitch is now shined to the point of brilliance.

Beyond the pitch, CEOs need to have answers. Not just to the easy questions. But the hard ones.

At a recent “Future Investor Conference” in Vancouver – Equity Guru’s Chris Parry grilled a gaggle of tech CEOs including Sheldon Bennett from DMG Blockchain (DMGI.V), Ashish Malik from Bee Vectoring (TSXV: BEE.V), Philip Campbell from Ascent Industries Corp. (ASNT.C) and Tharmer Matar from SmartShare Solutions and Martin Cronin from Patriot One Technologies (PAT.V).

At 59:00 – one of the tech CEOs turns to Cronin and asks him about Patriot One’s tipping point.

At the end of the video, each of the six CEO’s is asked which of the other stocks they would invest in. Two of them chose PAT.

We have been tracking PAT for almost two years, writing 23 articles including;

- December 20, 2016 PAT signs on Homeland Security Boss

- February 22, 2017 PAT expands its proprietary database of weapons “signatures”

- March 15, 2017 PAT signs a deal with University of North Dakota for a pilot study

- May 15, 2018 PAT goes to Washington

- June 27, 2018 PAT is turning me into a love sick fool

- September 12, 2018 PAT biz model makes more and more sense

As PAT gets closer to a commercial roll-out, the stock is becoming de-risked.

“Patriot One is presently pursuing a number of acquisition transactions, at various stages of development,” stated PAT in response to the 3-week stock run up, “Any such transaction will be fully disclosed if and at such time as it becomes material information regarding the Company. Qq

So, there you have it IIROC.

PAT doesn’t know why the stock price is going up.

We do.

Full Disclosure: Patriot One is an Equity Guru marketing client, and we own stock.