E3 Metals Corp (ETMC.V) is all about Petro-Lithium.

Petro-Lithium is a source of Li contained within petroleum brine, a potentially mineral rich solution brought to the surface along with oil and gas during production.

Typically, oil producers treat this petroleum brine – this Petro-Lithium – as a waste product, often reinjecting it back into the subsurface chamber from which it emerged.

Atypically, E3 Metals is treating this mineral rich brine as a resource – a commodity – one which could represent a massive source of highly sought after lithium.

Why Lithium? A brief summary for those uninitiated, untutored, unfamiliar…

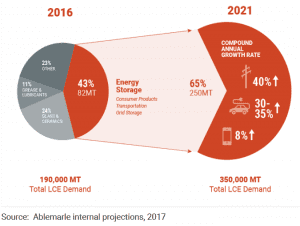

Lithium demand is expected to go on a serious tear over the medium term, due in large part to all things mobile and electric.

Significant growth is expected to continue in the production of EV’s (electric vehicles), mobile device batteries, and grid-scale energy storage projects.

It’s a fine time to be in the battery metals space.

E3’s Resource…

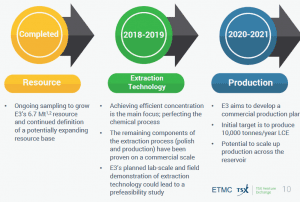

E3 Metals boasts some 6.7 million tonnes of LCE (lithium carbonate equivalent) at an average grade of 75 milligrams per litre in the inferred category.

Three separate resources have been defined to date:

- Clearwater – 1.9 million million tonnes of LCE

- Rocky – .93 million tonnes of LCE

- Exshaw West – 3.9 million tonnes of LCE

This vast resource lies within the prolific Leduc Reef Trend in South-Central Alberta. Access is good through and through. Infrastructure is ample.

Significantly, only 34% of its landholdings have been explored and sampled thus far. E3’s Li resource could grow… perhaps substantially so.

The Advantages…

E3 enjoys a host of advantages:

It’s first entry ~ early mover inside track allowed the company to lock-up up lithium permits covering 1.4 million prospective acres in the prolific Leduc Reef Trend making the company the largest contiguous landholder in South-Central Alberta.

The costs to define E3’s inferred lithium resource – 6.7 million tonnes of LCE – were extremely modest. Producing and suspended wells are spread out all across E3’s landscape. Samples of petroleum brines were simply collected from said wells. The company didn’t need to drill a single hole.

It’s important to note that E3 has nurtured a number of collaborative alliances with oil and gas operators across the region. This allows the company easy unfettered access to its underlying subsurface resource.

The company also has a distinct advantage when it decides to make a move to increase the confidence level in its 6.7 million tonne Li resource (from the inferred to indicated category). A broader sampling campaign can be run using the same collection protocol and infrastructure as before. Easy Peasy ya’ll…

The Extraction and Concentration Process…

This is the area where the company is currently focusing the majority of its energy. It’s where the rubber meets the road.

Substantially concentrating lithium at a grade of 75 milligrams per litre, and removing the majority of impurities along the way, is a tall order.

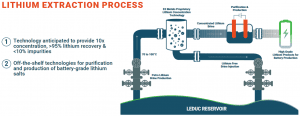

Pictured below is a simplistic view of what E3 is ultimately attempting to achieve…

The company already sports a lithium resource so vast, it can rest on its laurels and never lift another finger on the exploration front. Of course, we all know that that’s not likely, especially if this team can develop an efficient concentration process and build-out that technology on a commercial scale.

To that end, E3 has been busy.

The company already possesses a proprietary concentration technology.

The question is: does it work?

On May 29th, the company appeared to knock one out of the park in response to the above query.

E3 Metals achieves fast & efficient concentration of lithium from its petro-lithium brine.

Highlights from that watershed piece of news…

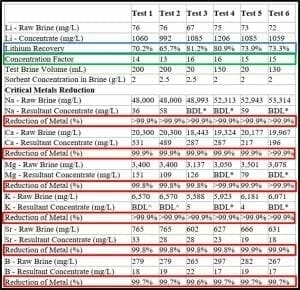

- E3 Metals successful in concentrating raw brine from 75mg/L to 1206mg/L Li in less than 3 hours.

- Concentration process removes over 99% of critical metal impurities.

- Lithium recoveries run as high as 81%.

Three hours… and no evaporation-time to generate a concentrate that can be purified with existing methodologies. Cool Beans. Seriously.

Though the lithium recovery rates were not what the company envisaged, falling 9% short of their initial 90% objective, this is all part of it… part of the tweaking process as they work to improve efficiencies and performance.

Drop the mic E3. We’re impressed over here at Equity Guru…

These metallurgical tests, run at the university level with its U of A partner, consisted of six samples of raw brine. The results were verified by an independent mineral processing company.

To delve deeper into this important fundamental development, Equity Guru’s Lukas Kane gave the news a thorough probe, here and here.

Another Collaboration…

This time it’s on the engineering front. This relationship will likely prove instrumental as the company advances their proprietary concentration technology, moving it from the lab to the field where they can begin developing (commercial) scale.

E3 METALS CORP is pleased to announce that the Company has established a cooperative relationship with Calgary based Scovan Engineering Inc. (Scovan) to help advance engineering elements of its Alberta Petro-Lithium Project. This engagement, provided to the Company on a collaborative basis, will include high-level technical scoping of the Project’s brine extraction and disposal requirements and of the Company’s proprietary lithium concentration technology. The engagement is a result of Scovan’s commitment to developing business opportunities and engineering solutions through innovative collaboration. The Company has not entered into any agreements or commitments to award Scovan current or future work.

It’s all about vision, passion, and buying local.

A scoping study is a major step in assessing the economic viability of a project. It’s where innovations and efficiencies are unlocked and discovered. It’s where the future development of a project is mapped out, where plans are drawn up. It also telegraphs to the market that the company is determined to move things forward.

Chris Doornbos, E3 Metals CEO, commented on this recent collaboration, stating…

E3 Metals is excited to partner with an experienced Calgary based engineering firm to develop innovative design solutions to advance its Petro-Lithium project. We are committed to engaging with local partners who share our passion and vision for growing Alberta’s clean energy economy.

Timelines n such…

E3 wants to set up a micro-pilot facility by the end of 2018 with an aim of demonstrating the efficacy of their proprietary concentration technology.

If (when) they are successful in producing measurable quantities of high purity LiOH from their Leduc Reef Petro-Lithium brines via this micro-pilot facility, things will progress to the field for up-scaled testing.

Additional funding and expertise…

The idea of developing petro-lithium resources is still a relatively new concept. As companies like E3 Metals push their technologies along the development curve, they’d be wise to consider input and resources from multiple founts.

On June 28th, the company announced the following…

E3 Metals awarded Government of Canada funding for advancement of lithium concentration technology

Highlights of this news release include:

- E3 Metals has been awarded up to $56,000 from the National Research Council of Canada Industrial Research Assistance Program towards the advancement and scale-up of its proprietary lithium concentration technology.

- Work on the Company’s lithium selective sorbent will be conducted in collaboration with the National Research Council’s Energy Storage Materials Formulation and Optimization Group in Ottawa, Ontario.

The funding will support a portion of the Company’s lithium extraction technology work with the NRC Energy Storage Materials Formulation and Optimization Group in Ottawa, Ontario. This group has extensive experience in research, development and validation of materials across the entire energy storage value chain. E3 Metals will be matching the NRC IRAP funding which will continue to support the advancement of the Company’s promising lithium concentration technology throughout 2018.

This is solid progress IMO. Super-solid progress.

Final Thoughts…

The company is obviously pulling out all the stops to position its Leduc Reef lithium resource for production. You really gotta take your hat off to this team.

E3 management, led by CEO Chris Doornbos, boast solid technical backgrounds in the oil and gas sector.

The company’s share-structure is tight. With only 17.3M shares outstanding, E3 sports a very modest market-cap of $5.7M.

At current prices, the company looks like exceptional value.

END

~ ~ Dirk Diggler

Full disclosure: E3 Metals is an Equity Guru client. We own the stock.