If E3 Metals (ETMC.V) was an insect, it would be a Callidosoma Cassiculophylla – an ingenious Brazilian mite that uses the infrastructure of a recluse spider to gain access to valuable nutrients.

The mite hangs out, watches the spider build its web, waits for the spider to catch something, then charges forward.

E3 is a Petro-Lithium company aiming to produce commercial grade lithium from the Leduc reservoir formation, in Alberta.

Like the clever mite, E3 watched the oil and gas companies do the hard work (drilling) before moving in to claim its reward.

As Equity Guru’s Greg Nolan recently explained:

The oil and gas sector is said to produce more lithium than any other sector on the planet. Not by choice. It does so via the sheer volume of lithium-enriched brine it pumps to the surface along with its oil and gas.

Typically after the oil has been separated, the wastewater (and lithium) is re-injected back into the sub-surface chamber from which it emerged. A push is being made to recover the condemned lithium before it’s flushed back underground.

Getting the brine to the surface requires the same equipment, expertise and knowledge as the oil and gas industry.

The spider web has already been built. The challenge is to figure out how to digest the prey.

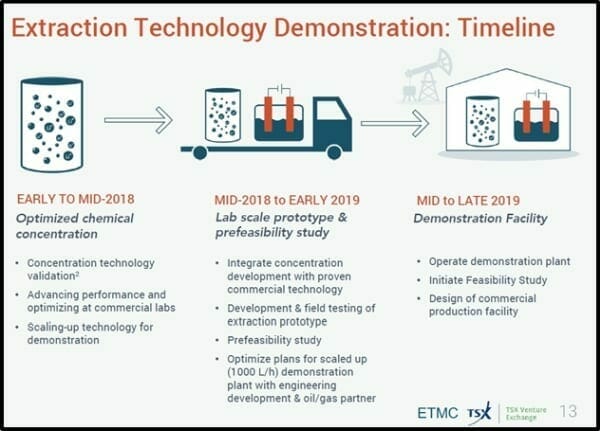

E3 is currently developing extraction technology with The University of Alberta to develop a chemical process that has a “high selectivity of lithium”

This low-energy concentration step will require no evaporation and provide a concentrate that can be purified by most off the shelf technologies available on the market.

Alberta’s hydrocarbon reserves contain reservoirs ideal for lithium production – typically at depths of 1,500 – 3,500 meters.

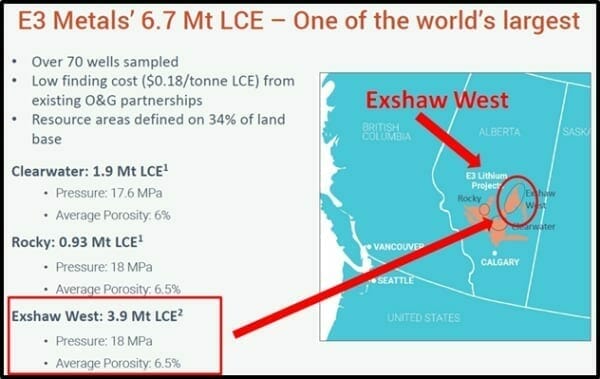

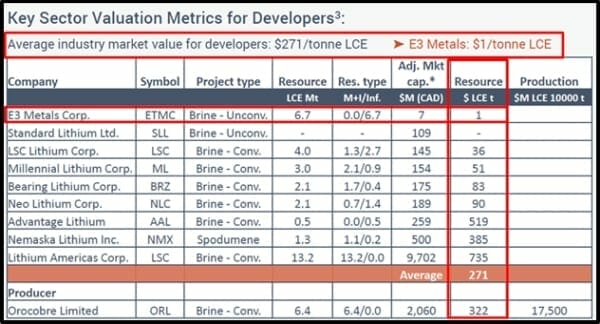

E3 Metals has defined a combined inferred resource of 6.7 million tonnes (Mt) of lithium carbonate equivalent (LCE) from three resource areas.

On June 19, 2018, E3 filed the NI 43-101 technical report for its Exshaw West property [highlighted above].

The report details “the addition of 3.9 million tonnes of Lithium Carbonate equivalent (LCE) resource (inferred) and includes the results of recent metallurgical testing of the Company’s proprietary lithium concentration technology.

NI 43-101 Exshaw West key takeaways:

- 9 million tonnes LCE inferred resource

- Concentration technology confirmed

- 16 X lithium concentration

- Removal of over 99% metal impurities

The 80-page 43-101 report confirms the viability of E3’s stated business objectives.

“The data sources used for the mineral resource include well data from historical oil and gas operations and brine samples collected from currently operating Leduc wells by E3 Metals,” stated the report, “It is reasonably expected that the majority of the Inferred Mineral Resource Estimate could be upgraded to Indicated Mineral Reserves with continued exploration, enhanced reservoir resolution and sampling.”

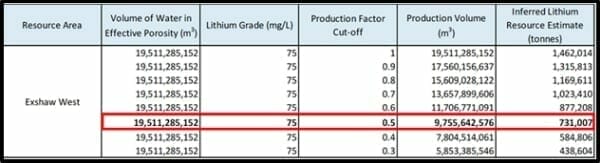

The data in the above table can be converted from Lithium metal (tonnes) to Lithium Carbonate Equivalent.

“As a producer of raw materials, E3 Metals will not be able to sell Lithium directly to an off-taker,” stated the report, “It is useful for the company to convert lithium to lithium carbonate equivalent using the following equation:

Lithium Carbonate Equivalent (LCE), tons = Lithium (tons) x 5.323

The Inferred Lithium Resource Estimate of 730,000 tonnes equates to 3.9 million tonnes of Lithium Carbonate Equivalent (LCE).

The LCE contract price in North America is currently about CAD $20,000 per tonne.

3.9 X $20,000 = $78 billion.

Let’s be clear. This back-of-the-napkin math is based on an “inferred” resource, which has lower standards of verification then the “indicated” category.

We are not suggesting E3 is worth $78 billion.

But E3 has locked-down the rights to whack-load of lithium, and its pathway to cash-flow is much shorter (quicker) than a traditional mineral explorer.

E3’s Petro-Lithium Advantages

- Large resource 6.7 Mt1,2 (inferred)

- Low cost exploration advantage

- Extraction technology removes 99% of impurities

- Commercial production on the horizon

- Rapid advancement of the extraction technology

- Reduces environmental footprint

- Lower development costs and risk

- Mature jurisdiction for resource development

- Geothermal energy available in high temperature brine

- Kick-ass management team.

- Undervalued relative to resource size

With high porosity and permeability, the Leduc Formation has demonstrated the ability to deliver high volumes of hot brine.

According to the The New Scientist, the Brazilian mites are “too small to be useful prey for the spiders, and are not large enough to be a potential predator.”

E3 is a micro-cap stock, with a current market cap of $6.8 million.

If E3 can extract and process economic quantities of lithium from these Alberta wells, the company will transform from a mite into something bigger.

We’ve been writing about E3 Metals for fun because we believe in what they’re doing.

Now they’re a client.

As always, if we think they’ve gone off track, we’ll tell you.

Full Disclosure: E3 Metals is a new Equity Guru client, and we own stock.