According to Investopedia: “Contrarian investing involves buying and selling stocks against the grain of investor sentiment.”

The concept is simple: If you purchase stocks when investors are gloomy, and sell the same stocks when your investing peers are euphoric, you will make out like a bandit 100% of the time.

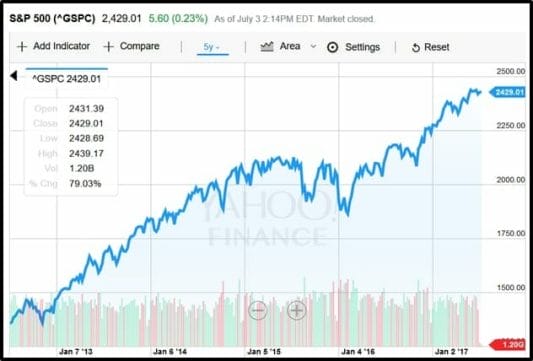

Recently, hanging with the herd has been pleasant and profitable. The S&P 500 is a leading indicator of U.S. equities. This is the 5-year chart:

Gold? Not so much.

As we write this article, North Korea just lobbed an intercontinental ballistic missile into the ocean. Kim Jong-un casually announced that – if he wanted to – he could arm it with nuclear weapons and make it land on second base at Wrigley Field, Chicago.

Gold shrugged its shoulders – rising 22 cents from $1,225.59 to $1,225.81.

So yes – despite a giddy run early in 2017 – at this moment gold is a contrarian play.

Are you brave enough to leave the warmth of the tribe?

If so, gold is calling you.

Historically, the biggest returns have come from junior explorers or miners, building resources in mining-friendly jurisdictions with low labour costs.

Today, we are going to focus on a brand new company, Ashanti Gold (AGZ.V) which has projects in Ghana and Mali.

Not sure where Ghana and Mali are?

Don’t feel bad.

Random adult U.S. citizens were recently given geography tests and the results looked like this:

Ghana and Mali are in North West Africa.

There is a shit-tonne of gold there, and this company is led by heavy weight mining dudes.

There is a shit-tonne of gold there, and this company is led by heavy weight mining dudes.

Ashanti is surgically targeting projects where it has a competitive advantage due to past work experience of the team and specific project know-how.

In Mali, Ashanti Gold has begun a big RC drill program on the Kossanto East project.

Kossanto East is a 66 km2 concession sitting in a major geological structure for gold mineralization. Since 1998, about 40 million ounces of gold has been discovered in this area resulting in the construction of dozens of mines.

Telling you the name of these African mines is like introducing your out-of-town cousin to your co-workers. Your cousin is not going to remember any of the names.

But you might remember that Kassanto East has been drilled and it is pregnant with gold.

If Kassanto East got any more pregnant you might assume it was just fat. Note: if you are unsure – do not enquire about the due date #Iloveyourcurves.

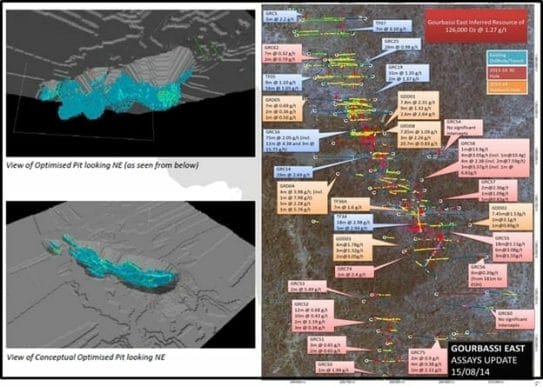

AGZ is going to punch 55 holes in the ground to depths of 150 meters. Drilling will test Gourbassi East, Gourbassi West, and two satellite targets. The objective is to expand the known areas of mineralization. The total program will be at least 6,000 meters.

That’s a big program. Big enough to move the stock price a long way north if the drill results are good.

Mali is red hot gold mining district. A couple of weeks ago, Hummingbird Resources (HUM.LSE) announced that it has raised $86 million to construct a gold mine 200 kilometres south of Malian capital Bamako. Most of the country is still unexplored.

Ashanti’s Ghana Projects are also interesting.

Gold-bearing Birimian greenstone belts are prolific in Ghana. In general, they run in a southwest to northeast direction. Most of the known gold is located at the edges of these belts.

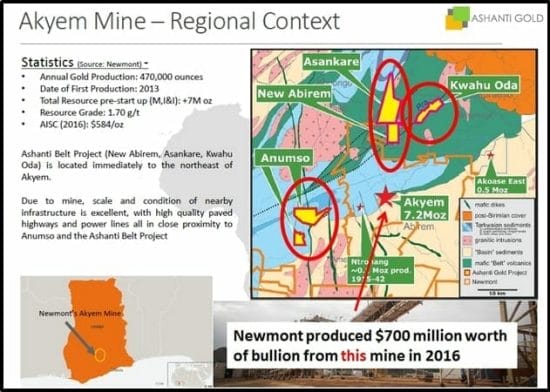

The Ashanti belt hosts world-class gold deposits including the Akyem Mine owned by Newmont (NEM.NYSE).

In junior mining circles there is a term called “close-ology”. It describes junior resource companies that own unexplored chunks of tundra. Since they have no geological information about their own properties, they brag about how close they are too big discoveries or profitable mines.

Ashanti Gold’s Ghana projects are close to the Akyem Mine.

And yes that matters. Not so much because of the proximity to this monster mine but because Ashanti CEO Tim McCutcheon is the ex-CEO of Abzu Gold in Ghana, and Ashanti’s Head Geologist, Dr. Paul Klipfel developed gold properties in the Ashanti belt area.

In other words, these dudes have had their boots all over Ghana – so their opinions and beliefs are, to put it mildly, “informed”.

Recent drill results from Anumso in Ghana include intersections of 9 meters @ 1.60g/t, 4 meters @ 1.73g/t and 3 meters @ 4.95g/t

“These results demonstrate the presence of gold over exciting intervals,” stated Tim McCutcheon, “With evidence of gold occurring along 2.6 km of Banket conglomerate, we are eager to assess the remaining ~8.4 km of the unexplored or under-explored Banket conglomerate.”

There may be evolutionary reasons why contrarian investing is so difficult.

10,000 years ago, inside the herd, you were anonymous and protected. To walk away from your community was to risk being predated. The dangers of being an independent thinker likely out-weighed the benefits.

But that was then, and this is now.

Keep your eye on Ashanti Gold.

FULL DISCLOSURE: Ashanti Gold is an Equity Guru marketing client. Our principal, Chris Parry owns a lot of stock.