We don’t cover resources so often at Equity.Guru, not because there’s no money to be made there, but because our readers skew younger, and mining has for a long time been an older investor’s game.

But that’s rapidly changing.

Sure, the gold miners aren’t bringing in the younger investor just yet, but technical metals are starting to really make a dent. There’s no question renewable energy, and the metals that make that sector possible, are much desired, even by millennial investors who don’t traditionally care for industries like mining, where the first victim of progress is often the quality of life of locals.

And cobalt is a great example of that.

THE HORROR THAT IS CONGOLESE COBALT

The Democratic Republic of the Congo is a desperate place, and its people do desperate things.

They plunge down into dark holes dug using sharpened metal sticks, in backyards and through kitchen floors and in alleyways and sewers, supported by wooden ledges made of scavenged 2x4s, crowding in with tiny headlamps that illuminate maybe a two-foot circle of the wall next to them.

They go as deep as they can in that cramped space, and they breathe in cobalt dust as they do it, scratching about with whatever they can find that might displace a little pink rock, and with bare hands or spoons or whatever they’ve got.

Kids are often sent down first, because they’re smaller and cost less and their families couldn’t afford school even if there were schools to be sent to. They’re not given a lot of choice in the matter, and often they’ll spend the bulk of their daylight hours in a 4 foot by 4 foot hole picking at rocks.

Cave-ins are common. The dead, left buried as a new hole is started.

In one Congolese village observed by Amnesty International, just about everyone has a hole, even if they don’t have a home. In the satellite image below, the green roofs of homes are outnumbered by the black holes around them.

The rocks they scrounge are brought up into the light, washed at the beach, and biked to a local cobalt market where Chinese companies buy them at rock bottom prices, ship them home for processing, then turn them into battery components for companies in America.

When you buy your Apple, Samsung, LG, and Microsoft phones, the makers of which claim they have no idea how that cobalt got to them and they’d be shocked – horrified – to learn kids as young as 7 were involved, you’re part of the problem.

This is blood cobalt, and it sucks. But we put up with it because there just isn’t that much of an alternative. Cobalt outside of the Democratic Republic of Congo is a by-product of nickel, zinc and silver mining, and those metals haven’t been in such great demand for the last few years, so battery manufacturers and companies with products that use rechargeable batteries (and more companies than ever fit that bill nowadays) will take what they can get.

Apologists for this will say, without artisinal mining, these communities would have nothing. The same arguments are often used in defense of human trafficking and sex work. We can do better, and increasingly even the mining companies themselves know this.

SO WHAT CAN WE DO ABOUT THIS?

Buy North American cobalt juniors, that’s what, and suck the air out of the blood cobalt industry.

The North American-based cobalt mining sector is suddenly in vogue, as experts realize the big manufacturers can only pretend they don’t know what’s happening in the Congo for so long. We’re basically one well organized protest or petition away from the big electronics manufacturers having to find new sources, and they know that moment is coming – the problem for them is, right now, they don’t have other options.

But other options are coming, and fast.

Lithium demand this past year has been going nuts as the world sees rechargeable batteries as the next big thing. But cobalt is needed by the Tesla’s of the world and the phone makers of the world and the laptop producers of the world just as much as lithium is. Maybe moreso, because while lithium is in under-supply, cobalt is in actively short supply, especially if you’d rather not be making money off the backs of buried children.

One of the first companies out there to act on this shortage (and I can tell you there are MANY more talking about it based on things I’ve heard in the last few weeks) is Cruz Capital Corp (CUZ.V).

Other companies are going out and finding a property or two and swinging a drill into position, but the properties they’re acquiring are properties farmed out by Cruz.

The company itself currently has 8 cobalt projects at the time of writing though, depending on when you read this, you might want to double check that number because they’re rolling and out with regularity. Essentially, Cruz is looking to corner the market in North American cobalt properties, and has quietly racked up a big number of them quickly.

A few months back, we were talking up Scientific Metals (STM.V) as a smart lithium play. But that company quickly realized lithium was a bottleneck, while cobalt was zooming upwards, with ore prices rising 30% since April of this year. So Scientific Metals got themselves a cobalt play, which they’re now focused on.

And where did they get that property from? They bought it off Cruz Capital.

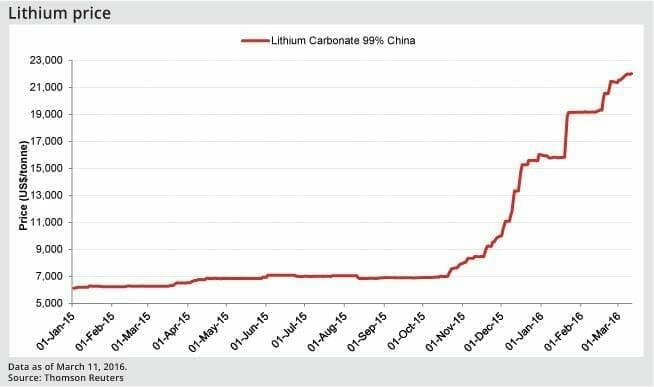

As a result of the renewed interest in cobalt, prices have begun to march upwards. We’ve all seen lithium’s big price spike on the back of the Tesla announcements – in fact, Cruz Capital was among the first movers in the lithium space when it acquired a Nevada lithium deal on the same day Pure Energy announced its Tesla deal.

It’s no secret lithium prices have gone nuts in the last year. But since March, lithium companies have started to see their share prices level off, and even drop, as buyers of lithium push back against the sort of rampant profiteering we’ve recently seen in the real estate market.

Cobalt hasn’t seen the same price spikes that lithium did, but as lithium has levelled off at a higher price than many think is unwarranted, that leaves a lot of eyeballs looking at cobalt as having a lot of room to run in order to catch up.

And recent prices show that’s starting to prove out.

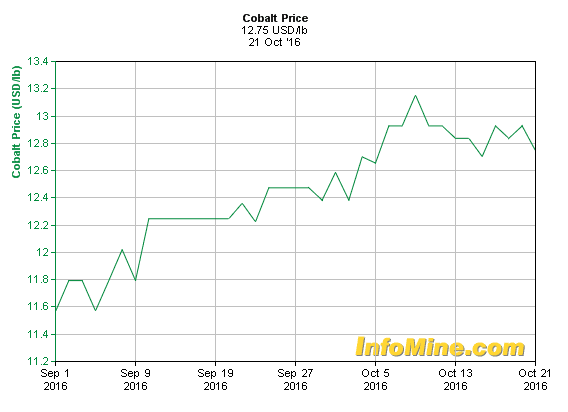

From April to June of this year, cobalt prices barely nudged, but the chart above shows a 10% jump in prices in just the last 6 weeks, and buzz I’m hearing about companies looking to get into that game is loud.

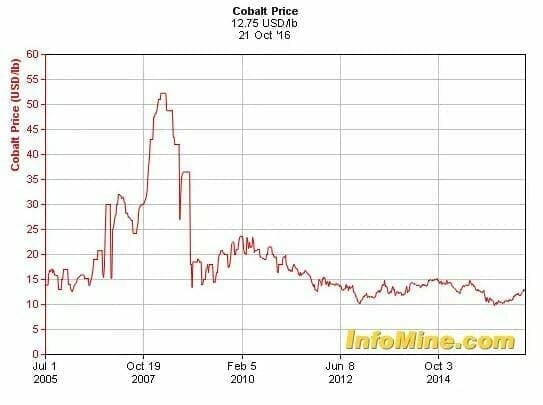

But this lift is pennies on the dollar compared to what has happened to cobalt prices historically when supply starts getting choked off. Check out what happened in 2007:

Could we have another triple in store over the next year?

It’s early, but at the far right of that chart above, you can see the uptick that is starting to build. In fact, we’re seeing the same sort of rush to cobalt right now that we saw when lithium screamed upwards in late 2015/early 2016. I’ve had several former clients call in the last month asking if I know anyone with a cobalt property to sell and others asking if anyone is interested in buying.

Sure, weed is hot right now, but cobalt is what’s next.

And here’s why:

- We’re powering EVERYTHING with it. Lithium ion batteries are in your car, phone, laptop, tablet, microwave, power tools, smoke alarms, they’re the thing that gave Best Buy it’s best results in years last financial quarter, based solely on the demand from Pokemon Go players buying lithium ion based power packs after watching their phone batteries run down every day. Homes will have lithium ion batteries going forward to store off-peak power. Solar panels need them and wind power turbines use them. Every electronic item that is or will be the next big must have purchase over Christmas will be lithium battery based, and each of those requires cobalt. It’s the new oil and gas.

- You can’t get cobalt right now unless you’re joining that filthy supply chain that starts out with desperate men and children plunging into home-made holes in Congo kitchens. And no large multinational corporation wants to be involved with that any longer than they have to. The big switch is necessary and coming, and may come quicker than expected if the notoriously unstable DNC government suddenly faces civil unrest..

- In most cases, mines churning out cobalt (legitimately) do so as a by-product of what they’re really focused on, such as nickel and copper. When nickel prices drop, nickel mines stop producing, and cobalt supple dries up alongside it.

- The Cruz properties have established data showing they feature cobalt proper. They’re not cow paddocks with yellow tape staked around them (what’s up, lithium), they’re actual mining prospects, many with historic production, showing substantial grades of cobalt.

Listing those properties here would be an exercise in futility, because there’s so many of the things and they’re in such a constant state of turnaround, that even the Cruz website doesn’t show them all. When I asked Cruz insiders for a summary, I got a few moments of silence as they tried to figure the best way to describe them… which ended with, “We’re just looking to corner the market. If someone wants cobalt, they’re coming to us.”

Bottom line: Cruz has become, in rapid time and with great success (both in terms of real world value and share price) a cobalt project generator.

Scratch that – THE cobalt project generator.

But there’s another element to this company that takes it far into the unique. And it’s an element that, frankly, I haven’t seen before.

Cruz Capital, currently priced at $0.67 per share, is looking to forward split its stock, offering 3 shares for every one you own mid-November.

Yes, you read that right – it’s not going to roll back the stock to try to tempt institutions into buying large chunks, it’s going to split the stock, to help people like you make multiples rather increments.

This is the opposite of, frankly, every smallcap company on the market. It’s bananas, but in a way that is likely to benefit shareholders of the small variety rather than the guys at the top end, and that makes it a primo Moneyball play. Cruz Capital doesn’t want your institutional knee-pad money, even though it has been steadily killing it on the charts for months, up from $0.10 in May to a six-bagger today.

The market cap on Cruz is still a beyond inexpensive $4.2 million, which points to great value to be had should just one of their properties get spun off to a buyer or JVed by a bigger player or worked proper by the crew in place now.

And, frankly, to see the cobalt jump coming was smart, and to get ahead of it cheaply was way smarter. To split the stock at $0.67, potentially? I honestly don’t know how the market will view that, but it’s going to be fun to watch and it’s most definitely something that will get investors taking notice.

In summary: Blood cobalt must end, cobalt demand will skyrocket on the back of that, North American cobalt is in short supply, and Cruz Capital has a lock on a basket of cobalt properties that other companies breaking late into the sector are going to pitch their entire tent around.

I have taken a position in CUZ. Bought the ticket, looking forward to the ride.

— Chris Parry

FULL DISCLOSURE: I have agreed to serve as a marketing consultant for Cruz and own stock in the company, because I’m always up for a spin of the wheel when every number comes up cobalt.

You want cobalt, here’s a tip. Global Cobalt Corporation. They were running up to a home run with roughly $400 million (targeted mining) to $1.2 Billion (open pit) at cobalt prices of yesteryear. Already had an offtake in place with Easpring metals, the guys who supply Panasonic with battery components. What happened? Some issues with subsurface rights, got late with financial documents and trading ceased. Good news though, they are on the way back to the venture and planning to trade any day. 3 cents a share for a company with a boatload of proven cobalt, a customer and strong local support to get a mine up and running. Keep your eye on it to hit the market again and it is going to be one crazy ride to the top.

Cheers and good luck to all

Yes I remember this company, the project is close to Mongolia and Chinese border. Tesla will need lots of cobalt but China will need a lot more with 8 new battery factories being built. It makes sense for the Chinese to source raw minerals as close to home as possible.