‘-The grind goes on as gold and silver continue to consolidate. Over the past two weeks, gold is finding willing buyers below $1,900 and determined sellers above $1,920. This sideways price action may continue until the November U.S. election is in the rearview mirror. If the election is contested…? Let’s not go there.

Once again, this series of round-ups will play out over the next few weeks, starting near the bottom—the exploration and early-stage development Cos—and gradually work our way up the food chain to the advanced-stage development and producing entities sporting market caps well in excess of $100M.

Picking up where we left off earlier this week, our shortlist of sub-$20M ExploreCos…

Blue Star Gold (BAU.V)

- 164.79 million shares outstanding

- $14.01M market cap based on its recent close at $0.085

This one should’ve been added to part 1 in this roundup series. I’m tucking it in here and then moving on (to the Gs, alphabetically).

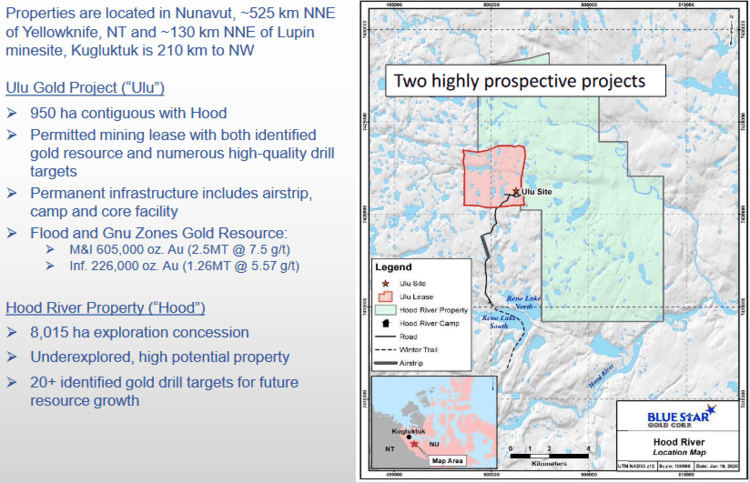

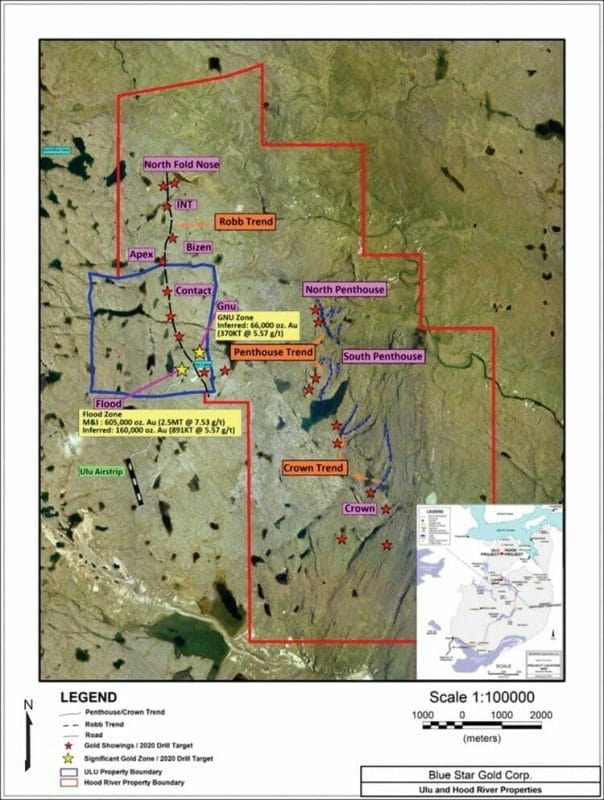

The Company’s Ulu and Hood River properties form a combined total of 9,000 hectares of highly prospective terra firma in Nunavut, a vast territory that stretches across much of the Canadian Arctic.

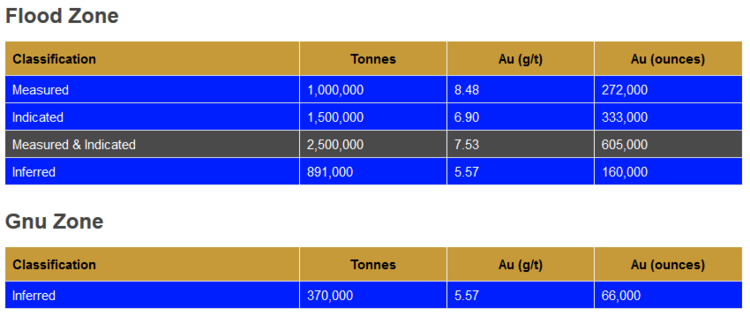

The Ulu Project (947 of the total 9k total hectares) sports a high-grade gold resource in two zones—Flood and Gnu—both of which are open for expansion.

The Ulu Project (947 of the total 9k total hectares) sports a high-grade gold resource in two zones—Flood and Gnu—both of which are open for expansion.

The Flood Zone lies between surface and a vertical depth of 525 meters. A drill hole probing material beneath this resource block, at a depth of 610 meters, tagged 14.9 g/t gold over 7.7 meters.

According to the Company’s project page…

According to the Company’s project page…

“The Ulu Property hosts an advanced gold project, which between 1989 and 2006 saw significant exploration and development. Past explorers include: BHP Billiton (1989 to 1993), Echo Bay Mines Ltd. (1995 to 2002), and Wolfden Resources Inc. and successor companies (2004 to 2011). Presently, Ulu is permitted for mining based upon past work that includes approximately 1.7 km of underground development and approximately 405 diamond drill holes that produced 97,820 metres of core pre 2019. Bulk sampling by Echo Bay produced a stockpile containing an estimated 2,227 tonnes of material, grading 13.8 grams per tonne (“g/t”) for an estimated 988 contained ounces of gold.”

Blue Star began a 7,000 meter drilling program at Ulu and Hood River back in mid-July, adding a 2nd rig to the campaign shortly after.

On September 30th, we got a look at the first drill results of the season.

A total of 7,624 meters were drilled in thirty-eight dd holes. Ten of these holes targeted Flood and Gnu to expand the known resources and confirm the current geologic model.

The remaining (twenty-eight) holes were drilled to test high priority exploration targets, fourteen of which tested the North Fold Nose zone.

Highlights from the Flood zone:

-

- BS2020ULU-002, (9 – 16m): 7 meters (m) of 13.42 g/t gold (Au)

- Including (12 – 13m): 1 m @ 31.5 g/t Au; and including (13 – 14m)—1 m @ 17.95 g/t Au; including (14 – 15m): 1 m @ 23 g/t Au; and including (15 – 16m)—1 m @ 13.65 g/t Au;

- BS2020ULU-003, (13 – 22m): 9 m of 8.67 g/t Au

- Including (19 – 20m): 1 m @ 11.05 g/t Au; and including (20 – 21m)—1 m @ 18.4 g/t Au;

- BS2020ULU-003, (110 – 118m): 8 m of 8.26 g/t Au

- Including (112 – 113m): 1 m @ 17.95 g/t Au; and including (113 – 114m)—1 m @ 12.45 g/t Au;

- BS2020ULU-003, (154 – 165m): 11 m of 4.24 g/t Au

- Including (160 – 164m): 4 m @ 8.16 g/t Au.

- BS2020ULU-002, (9 – 16m): 7 meters (m) of 13.42 g/t gold (Au)

Highlights from the North Fold Nose zone:

-

- HR20-013, (109 – 111m): 2 metres (m) of 13.18 g/t gold (Au)

- Including (109 – 109.5m): 0.5 m @ 50.8 g/t Au;

- HR20-014, (118 – 122m): 4 m @ 7.59 g/t Au

- HR20-016, (141 – 145m): 4 m @ 6.09 g/t Au

- Including (144 – 145m): 1 m @ 18.9 g/t Au;

- HR20-017, (164 – 167m): 3 m @ 13.87 g/t Au

- Including (164 – 165m): 1 m @ 16.35 g/t Au; and including (165 – 166m)—18.3 g/t Au

- HR20-020, (140 – 144m): 4 m @ 5.52 g/t Au

- Including (142 – 143m): 1 m @ 6.79 g/t Au.

- HR20-013, (109 – 111m): 2 metres (m) of 13.18 g/t gold (Au)

According to this Sep. 30th press release, plans are underway to update the Flood and Gnu resource estimates after all data from the 2020 drilling campaign have been tabled and assessed.

According to this Sep. 30th press release, plans are underway to update the Flood and Gnu resource estimates after all data from the 2020 drilling campaign have been tabled and assessed.

It’s anticipated that the Company will also table a maiden resource estimate for the North Fold Nose zone.

All in all, we could see a global ounce count in excess of 1 million ozs.

The Company says it’s planning an aggressive 2021 exploration campaign of up to 15,000 meters to further expand the resource base and test numerous high priority drill targets region-wide.

Golden Arrow (GRG.V)

- 119.51 million shares outstanding

- $20.91M market cap based on its recent $0.175 close

Note Golden Arrow’s current market cap ($20.91M) and compare it to the $25M in cash & equivalents the Company has on its books. The ‘equivalents’ component includes a large equity holding in SSR Mining (SSRM.T).

Golden Arrow has three main projects in its portfolio, one in Argentina (Flecha de Oro), one in Paraguay (Tierra Dorada), one in Chile (Rosales), and the way I see it, all three are vying for flagship status.

All three are near-surface and should surface values extend into that all important third dimension—depth—they’ll be advanced quickly.

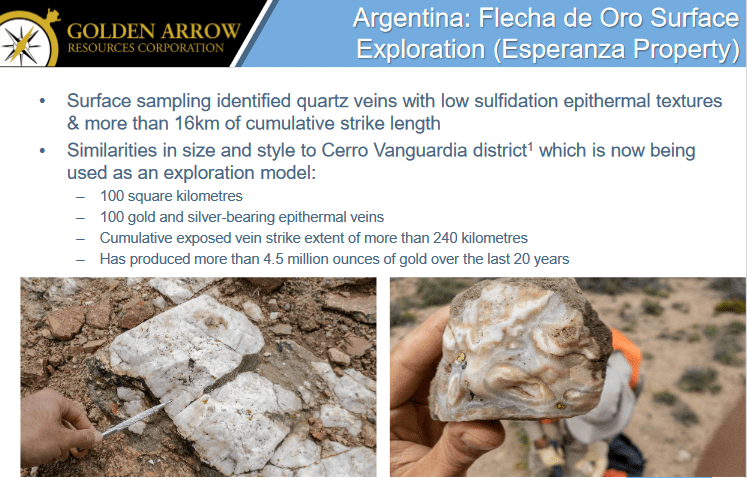

The Flecha de Oro Gold Project, Rio Negro Province, Argentina

Flecha de Oro encompasses three properties including Puzzle (1,952 hectares), La Esperanza (9,968 hectares), and Maquinchao (2,000 hectares). All three enjoy easy road access and are located below 1,000 meters elevation allowing for year-round exploration.

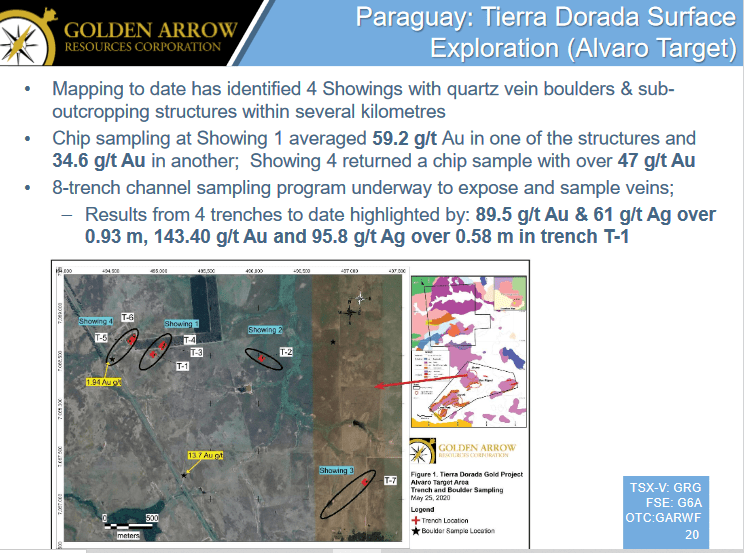

The Tierra Dorada Project, Paraguay

The Tierra Dorada Project, Paraguay

Tierra Dorada consists of two separate property blocks (34,566 hectares and 29,288 hectares) positioned six kilometers apart. Flat topography, road-accessible, power is within easy reach.

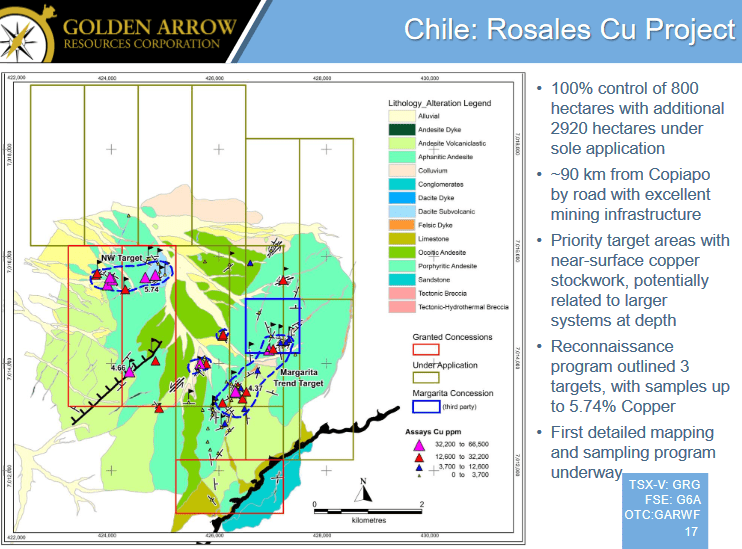

The Rosales Copper Project, Atacama Region, Chile

The Rosales Copper Project, Atacama Region, Chile

Rosales is a recent acquisition:

July 20, 2020 news: Golden Arrow Acquires Rosales Copper Project, Chile

Several high priority targets at Rosales are characterized by zones of near-surface copper stockwork mineralization, with the potential for a larger system at depth. The area is surrounded by infrastructure.

The last news out of the Company was on September 14th, updating developments on all three projects.

The last news out of the Company was on September 14th, updating developments on all three projects.

At the Rosales Copper Project in Chile, the company initiated a soil sampling and geological mapping campaign along the Margarita Trend and the NW targets.

At the Tierra Dorada Gold Project in Paraguay, a 500-meter (shallow-hole) diamond drilling campaign was initiated at the Alvaro target.

Alvaro assays are pending.

Regarding Flecha de Oro Gold Project in Argentina, the Company stated the following…

“Field work at Flecha de Oro has been suspended since the spring due to COVID-19 travel and work restrictions. In anticipation of a possible prolonged suspension, Golden Arrow has negotiated amendments to the option agreements for the Esperanza and Puzzle properties that delay 50% of the upcoming September payment to July of next year, and extend the subsequent payment to July 2022. Over the last few months, the technical team has undertaken data processing of results received in the early summer to refine targets for follow-up when field work resumes. In addition, the team will soon be submitting an Environmental Impact Report (EIR) for the new Maquinchao property, a required step in the permitting process for exploration.”

Golden Lake Exploration (GLM.C)

- 28.57 million shares outstanding

- $5.71M market cap based on its recent $0.20 close

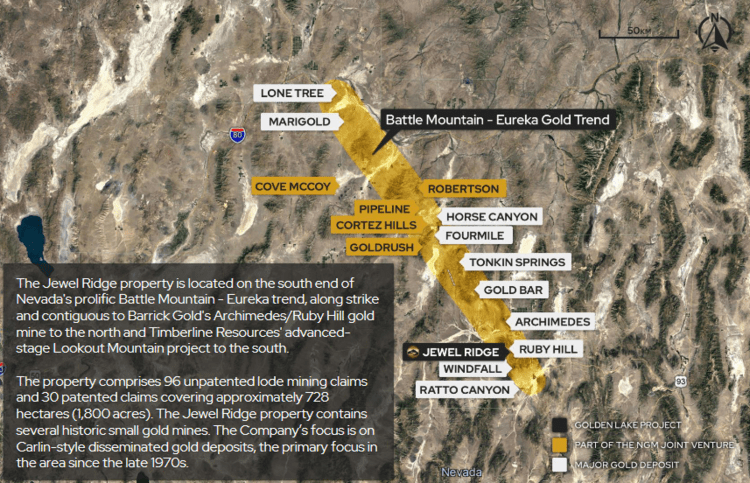

Golden Lake’s flagship asset is Jewel Ridge, located at the south end of Nevada’s prolific Battle Mountain—Eureka trend. The property lies strategically along strike and contiguous to the Barrick Gold’s (former) two million ounce Archimedes/Ruby Hill mine to the north, and Timberline Resources’ (TBR.V) advanced-stage Lookout Mountain project to the south.

The quarry at Jewel Ridge is a Carlin-style gold deposit…

Nevada’s Carlin-style deposits have a combined mineral endowment of more than 250 million ounces, all concentrated along four main trends: Carlin, Cortez (Battle Mountain-Eureka), Getchell, and Jerritt Canyon.

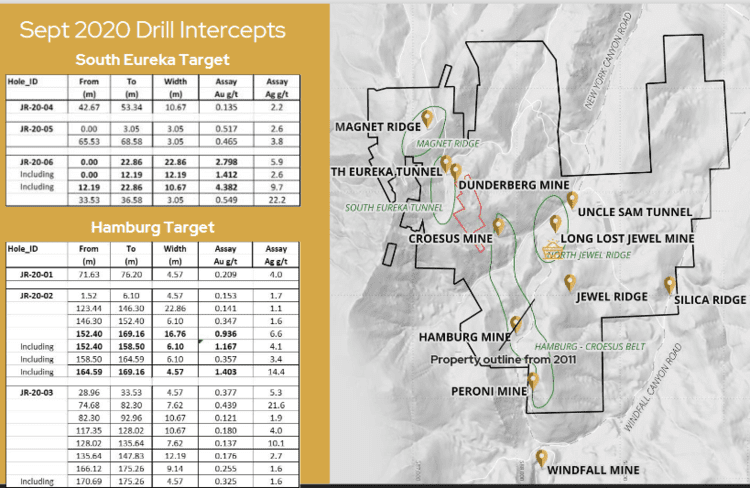

The Company initiated a drilling campaign at Jewel Ridge earlier this summer. We got our first look at the first six holes on September 24th.

The Company initiated a drilling campaign at Jewel Ridge earlier this summer. We got our first look at the first six holes on September 24th.

The headline interval—2.80 g/t Au and 5.9 g/t Ag over 22.86 meters (from surface)—was pulled from the Eureka Tunnel oxide zone. Results reported from the Hamburg zone were a bit of a mixed bag.

Additional assays will flow from Jewel Ridge… eventually—the labs in Nevada are backed up, big time (delays have impacted nearly everyone delivering RC chips and DD core).

Additional assays will flow from Jewel Ridge… eventually—the labs in Nevada are backed up, big time (delays have impacted nearly everyone delivering RC chips and DD core).

On October 20th, the Company announced commencement of a phase two drilling campaign.

“This phase 2 diamond drill program continues on from the summer Phase 1 drilling starting from a prepared drill pad on patented mineral claims located near the Eureka Tunnel adit area. The first angled hole is designed to test for oxide Carlin type oxide near the adit and CRD style replacement west of the adit portal. Additional drilling will focus on the Eureka Tunnel area for approximately a month, followed by drilling in the Hamburg Mine area.”

Mike England, Golden Lake CEO:

“We have switched to diamond drilling for Phase 2 and are aiming to get to depths not accomplished on Phase 1 due to tougher drilling conditions. Results to date have been very encouraging and we look forward to seeing the final 4 hole assays from Phase 1 as we now test deeper and outwards from the initial program coverage.”

The Company has also been active on the acquisition front. The first purchase, announced earlier this summer, was covered by our own Lukas Kane via the following piece:

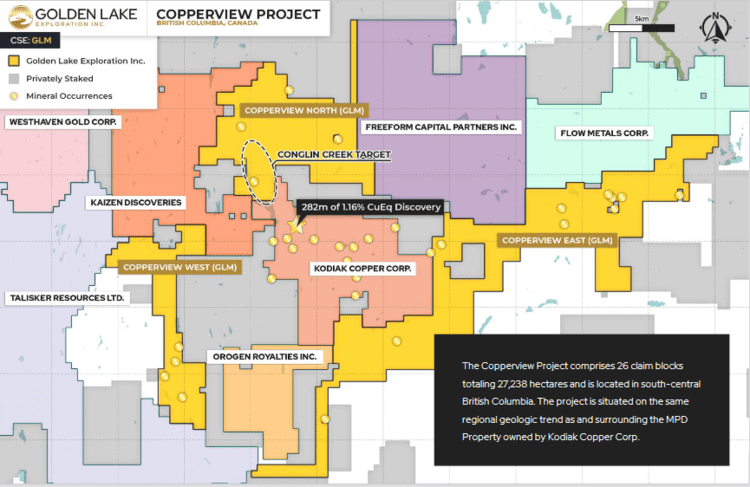

Read: Golden Lake (GLM.C) buys a new gold project in British Columbia

The Copperview Project is located…

“… on the same regional geologic trend as, and surrounding the “MPD Property” owned by Kodiak Copper (KDK.V). Kodiak recently reported an intercept in drill hole MPD-20-004 of 282 meters averaging 0.70 percent copper and 0.49 grams gold per tonne (see PR Kodiak, September 3, 2020). Kodiak indicates this intercept represents a “significant high-grade copper-gold extension of the recently discovered Gate zone”, located in the well-known, prolific southern portion of the Quesnel trough, host to numerous producing, past-producing and advanced development stage copper-gold porphyry deposits.”

282 meters of .70% Cu and .49 g/t Au is a fat hit. Easy to see why Golden Lake management is attracted to the area.

A reconnaissance exploration program was announced shortly after the acquisition, followed by the announcement that their regional land position grew in size.

A reconnaissance exploration program was announced shortly after the acquisition, followed by the announcement that their regional land position grew in size.

Then, on October 22nd, the Company dropped the following headline:

This region in south-central British Columbia will be bustling with activity next field season.

Golden Sky Minerals (AUEN.V)

- 9.54 million shares outstanding

- $4.63M market cap based on its recent $0.485 close

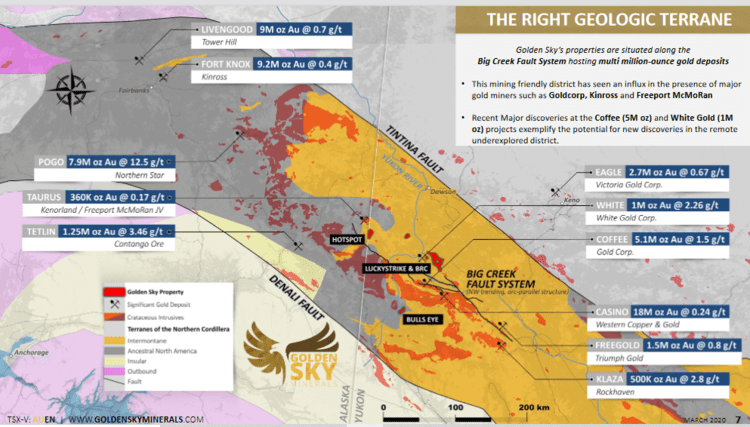

Golden Sky’s property positions along the prolific White Gold District in Canada’s Yukon keeps this one on my radar.

The Company’s super-tight, post-consolidation share structure is another reason I keep an eye on it.

The Company’s super-tight, post-consolidation share structure is another reason I keep an eye on it.

The Luckystrike property currently bears flagship status.

Lucky Strike is located 25 kilometers north of Newmont-Goldcorp’s (NGT.T) Coffee Gold deposit (Probable Reserve of 2.16 M oz Au) and 15 kilometers east of White Gold’s (WGO.V) Golden Saddle deposit (Indicated resource of 1.04 M oz Au).

The Monte Carlo Zone (MCZ) is an area of interest.

Trenching at MCZ uncovered: 0.76 g/t Au over 78 meters (including 2.73 g/t Au over 12 meters).

Drill hole highlights include:

- 5.36 g/t Au over 22 meters incl. 18.79 g/t Au over 5.72 meters, near surface (13 – 35 meters);

- 4.55 g/t Au over 7.6 meters, at depth (176.9 – 184.5 meters).

The MCZ zone is open in multiple directions with only a portion of the 1500 x 450 meter gold-in-soil anomaly having received a proper probe with the drill bit.

A 1.8 kilometer long IP target remains largely under-explored.

The company is also exploring its Hotspot Project located along the Yukon-Alaska border.

Positioned along the Big Creek Fault, Hotspot hosts a 1.7-kilometer-long mineralized structure with gold-in-soil values of up to 4.1 g/t Au. This structure is associated with a pathfinder signature indicative of a low-sulphidation epithermal system.

A 2018 trenching campaign at Hotspot returned 0.42 g/t Au over 44 meters (see September 10, 2018 news release).

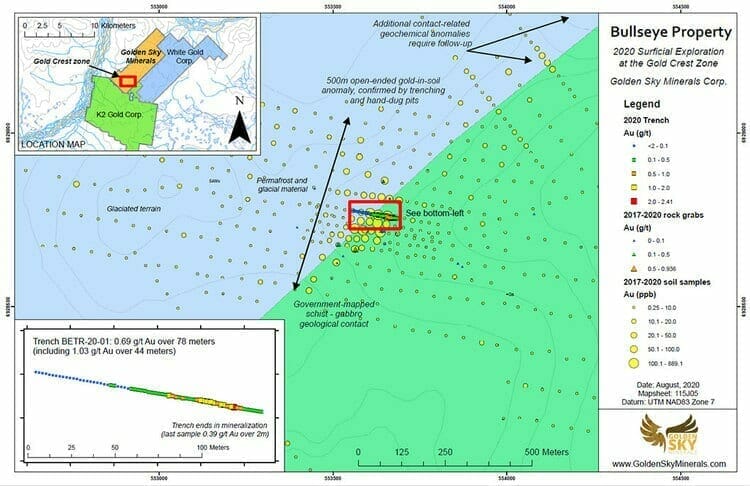

The Bull’s Eye property, located 50 kilometers south of the Coffee Gold deposit, is where a 2017 surface program identified an open-ended 200 x 250-meter geochemical anomaly with gold-in-soil values of up to 0.22 g/t Au. Rock grab samples assayed up to 0.25 g/t Au.

Bull’s Eye sits adjacent to K2 Gold’s (KTO.V) Wels Gold project where K2 tagged 2.37 g/t Au over 28.5 meters and 0.76 g/t Au over 97.5 meters.

Earlier this summer, the company mobilized a field crew to Bull’s Eye.

On July 20th, the company put boots on the ground at Hotspot.

This Phase 1 program will involve soil sampling to expand the Sure Bet zone, and preparation for a Phase 2 inaugural drill program to be conducted in September, 2020. The Hotspot property is located 25km southeast of the Taurus copper-molybdenum-gold (Cu-Mo-Au) porphyry deposit (located in Alaska) which has an inferred resource of 68.3 million tonnes grading 0.275% Cu, 0.032% Mo, and 0.166 g/t Au.

Situated along the Big Creek Fault, the Hotspot property hosts a 1.7-kilometer-long mineralized structure with gold-in-soil values up to 4.1 g/t Au and a pathfinder signature indicative of a low-sulphidation epithermal system. A short trenching program in 2018 returned values of 0.42 g/t Au over 44 meters.

On August 31st, the Company dropped the following headline:

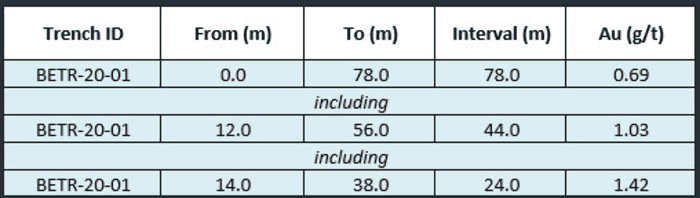

The discovery trench at the Gold Crest zone tagged the following values…

“The trenching results from Bull’s Eye are very encouraging. The fact that mineralization is open-ended gives even more ‘blue sky’ to the potential width of this zone. On top of this, the soil sampling has demonstrated 500m of open-ended strike length at the Gold Crest zone as well as plenty of new targets for follow-up along the regional geological contact.

CEO Newll again:

Soil sampling and trenching have been prime tools in locating mineralized areas in the White Gold district, and results from the trench at the Gold Crest zone are similar to the initial discovery trenches at both Coffee Creek and the Golden Saddle that led to the drilling of those deposits. Building upon this, I believe we have a drill-ready target at the Gold Crest zone with enormous potential to expand further along strike.”

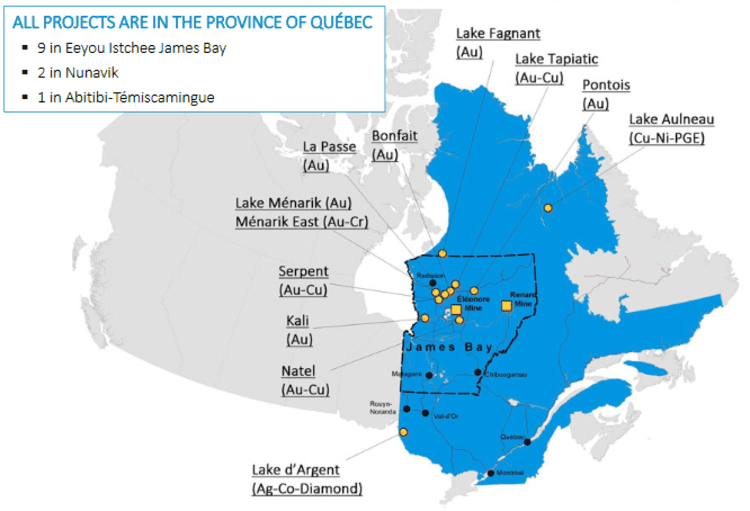

Harfang Exploration (HAR.V)

- 48.79 million shares outstanding

- $19.52M market cap based on its recent $0.40 close

If you perused the About link on the Highballer website, you’ll know that I was positioned in André Gaumond’s Virginia Gold prior to the world-class Eleonore discovery, and hung on for the fat takeover bid that followed.

I’m a big André Gaumond fan.

Gaumond is Chair of the Harfang Board.

I count twelve, the number of properties in Harfang’s project portfolio.

The Company’s Serpent Project bears flagship status.

The Company’s Serpent Project bears flagship status.

Serpent appears to be evolving rapidly.

Project highlights:

- 28,565 hectares, 100% owned by Harfang;

- No underlying royalties;

- Accessible by ground, air, or by boat from lake Sakami;

- Located 80 kilometers southeast of Radisson and 60 kilometers from the La Grande airport;

- Adjacent to the paved James Bay road;

- Two powerlines run through the property;

- The eastern limit of the property is next to the Sakami Gold Project operated by Quebec Precious Metals (QPM.V);

- The project is located in an under-explored area outside the known greenstone belts, near the contact between the La Grande and Opinaca subprovinces;

- Archean basement intruded by felsic to ultramafic magmas – minor discontinuous highly-deformed and metamorphosed volcano-sedimentary horizons (including the Apple Formation);

- Elongated mafic and ultramafic dykes intruded into a major pluri-kilometric East-West deformation corridor.

The Serpent Project boasts the discovery of at least 15 orogenic gold and intrusion-related Cu-Au-Ag mineralized occurrences, 14 of which are hosted in quartz veins…

- 14 gold-rich occurrences hosted in quartz veins (up to 186 g/t Au and 200 g/t Ag—grab samples at Lawr), 79 g/t Au over 1.25 meters (channel sample at Lawr), 91.48 g/t Au over 0.45 meters (channel sample at Langelier);

- 1 Cu-Au-Ag prospect (Mista) running over at least 350 meters laterally with up to .99% Cu, 0.20 g/t Au, and 7.7 g/t Ag over 11.7 meters (channel sample);

- Very high gold grain counts in till samples (up to 324 gold grains), gold-in-till anomaly covering 4 km2 in a yet unexplored part of the property.

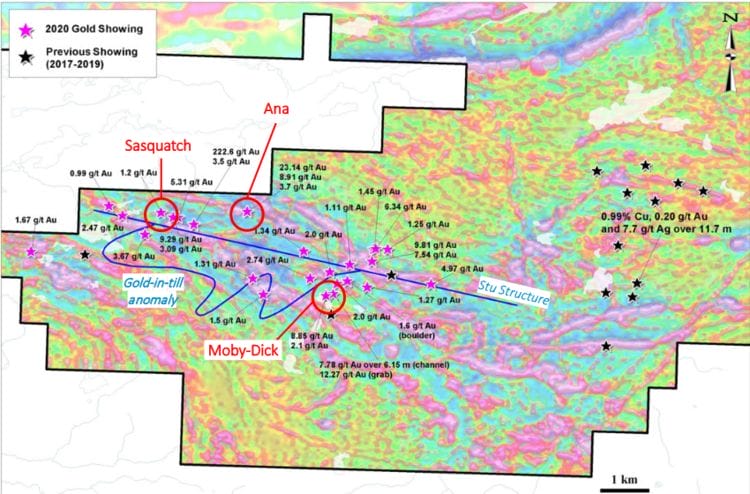

On September 22nd, the Company reported results from mechanical trenching and prospecting.

This was part of an aggressive summer field campaign focused on an unexplored area of the property (highlighted by the >4 square kilometer gold-in-till anomaly noted above).

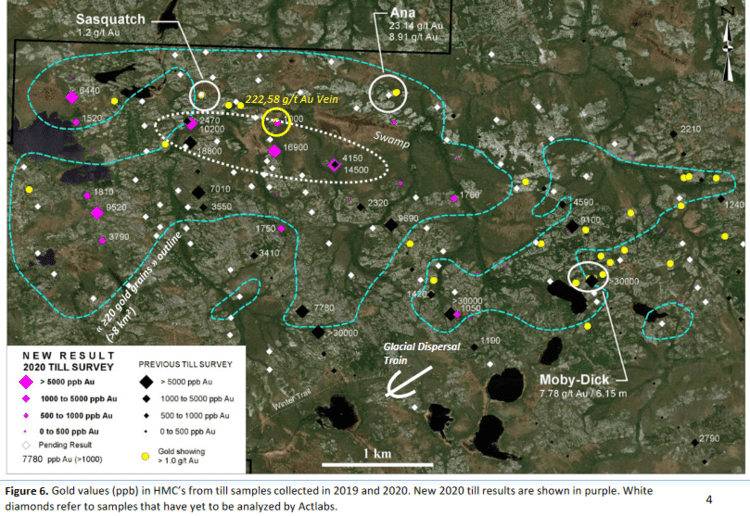

Work included an induced polarization survey (34 linear kilometers), 14 mechanical trenches in three specific areas (Moby-Dick, Ana, and Sasquatch), and the collection of 855 grab, 458 channel, 90 till, and 50 soil (B-Horizon) samples.

This recent fieldwork revealed more than 20 new gold showings (>1 g/t Au).

This recent fieldwork revealed more than 20 new gold showings (>1 g/t Au).

When combined with previously discovered showings, gold occurrences now cover an East-West strike length of at least 12 kilometers.

Quoting this September 22nd press release…

Located 100 meters from the exploration camp, the Moby-Dick structure was channelled and returned up to 7.78 g/t Au over 6.15 meters, including 24.06 g/t Au over 1.80 meters and 2.00 g/t Au over 2.25 meters (Figs. 4 and 5). Visible gold was observed in one sample along this channel (61.06 g/t Au over 0.50 meters). Trenching conducted on this structure exposed the vein over more than 350 meters. The easternmost part of the structure returned 8.95 g/t Au over 0.45 meters (TR-SER-20-005). Gold content in other channels is limited to anomalous values showing its coarse nature (nugget effect). Grab samples returned up to 12.27 g/t Au (TR-SER-20-001), and 8.85 g/t and 2.10 g/t Au (TR-SER-20-007). The Moby-Dick structure is characterized by shear zone-hosted quartz veins up to 10 meters wide. It stretches over a strike length of at least 350 m in a N250° direction, dipping moderately to abruptly to the northwest.

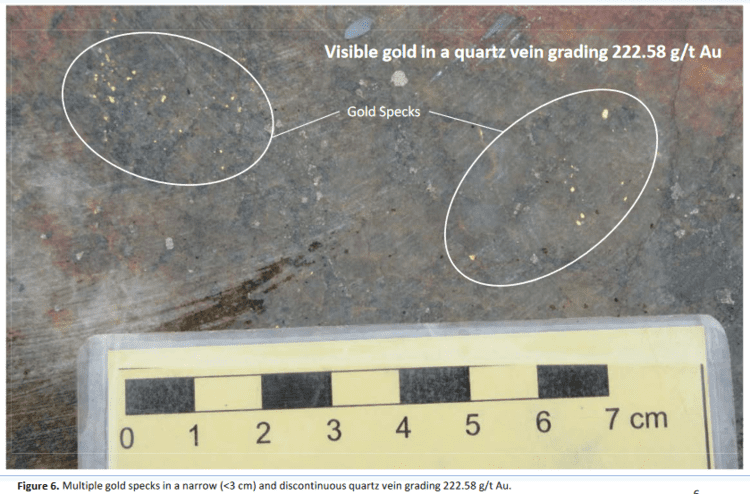

The Ana structure is characterized by a 4-meter wide shear zone filled with quartz veins exposed over 25 meters long (Figs. 6 and 7). The shear zone strikes into a N245° direction and dips abruptly to the northwest. It is developed in the old Archean tonalitic basement (Langelier Complex) and pyroxenite and gabbro dykes. The shear zone appears to continue to the northeast. Grab samples reached up to 23.14 g/t Au in the most mineralized part of the shear zone where visible gold was observed (Fig. 6). Channel sampling results are pending. Sulfide content (pyrite, ± pyrrhotite) reaches up to 5% locally. Calc-silicate and potassic alterations are described together with intense silicification. A parallel structure is located 25 meters to the southwest.

The Sasquatch structure is located 3.8 kilometers northwest of Moby-Dick. It is characterized by an 8-meter wide shear zone filled with quartz veins striking into a N245° direction, dipping abruptly to the northwest (Figs. 8 and 9). Its lateral extension is at least 80 meters and remains open at both extremities. A grab sample collected in a portion of the vein with 3-5% pyrite returned 1.20 g/t Au. Channel sampling results are pending. Sheared pyrite-bearing gabbro and several smaller quartz veins, which graded 3.50, 5.31, 9.29 and 222.58 g/t Au, were found southeast of Sasquatch along potential parallel structures.

On October 20th, adding momentum to the exploration push over the past few months, the Company dropped the following headline:

Doubling the size of a geochemical anomaly is always a good thing.

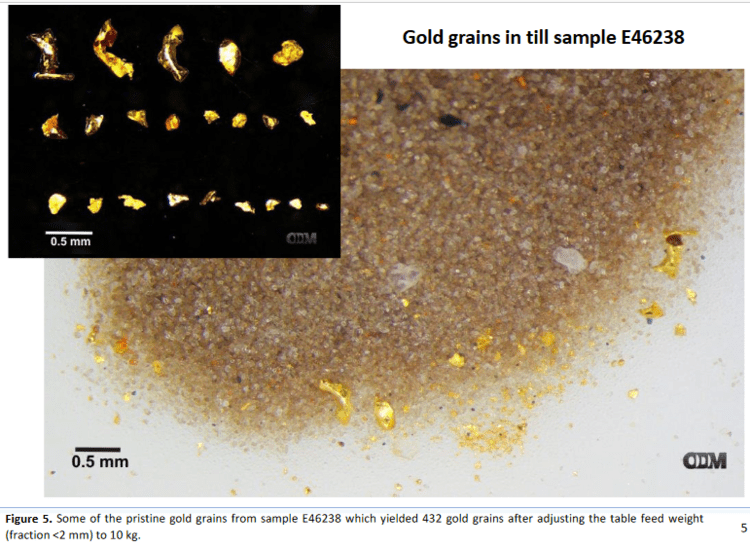

Preliminary highlights from this summer-of-2020 till survey include:

- 3 till samples containing above 100 gold grains (432, 308, 141) among which 69, 47, and 50% of the grains, respectively, bear a pristine shape;

Pristine grains are delicate pieces of free gold that are generally interpreted to have been derived from bedrock sources close to the sampling sites.

Pristine grains are delicate pieces of free gold that are generally interpreted to have been derived from bedrock sources close to the sampling sites.

- Heavy Mineral Concentrate (HMC) from 5 samples returning gold values above 5 g/t Au (16.90, 14.50, 10.20, 9.52, 6.44 g/t Au);

Samples containing more than 100 gold grains, 47% of which are pristine, form a clear dispersal train aligned into the main glacial direction.

Partial HMC results from 2020 include 12 samples above 1 g/t Au.

“Four contiguous samples distributed over a strike length of 1.3 km returned more than 10 g/t Au (18.8, 16.9, 14.5 and 10.2 g/t Au). The high HMC and gold grain counts values are located at the proximity and down-ice of major structures and near newly-discovered gold showings. Figure 6 (below) shows many gold specks in a narrow (<3 cm) and discontinuous quartz vein located up-ice that graded 222.58 g/t Au. Visible gold was observed in quartz veins, gabbros and pyroxenites at several localities inside the anomaly.”

“Four contiguous samples distributed over a strike length of 1.3 km returned more than 10 g/t Au (18.8, 16.9, 14.5 and 10.2 g/t Au). The high HMC and gold grain counts values are located at the proximity and down-ice of major structures and near newly-discovered gold showings. Figure 6 (below) shows many gold specks in a narrow (<3 cm) and discontinuous quartz vein located up-ice that graded 222.58 g/t Au. Visible gold was observed in quartz veins, gabbros and pyroxenites at several localities inside the anomaly.”

- 50 till samples returned 20 gold grains or more now form a gold-in-till anomaly covering an area at least 8 km2.

The high gold grain counts, high ratios of pristine gold grains, and high-grade values in the HMC’s, indicate that the bedrock source of this anomaly is close by.

Harfang is a prospect generator (PG) by design. But like Virginia Gold during the previous gold-bull-cycle (2001 to 2011), Harfang may elect to drop the PG business model if the Serpent Project continues to demonstrate world-class potential.

That’s it for part deux.

Partie trois in this series of roundups should surface by the end of next week.

END

—Greg Nolan

Full disclosure: Golden Lake is an Equity Guru marketing client. We own shares in Golden Lake and Harfang.