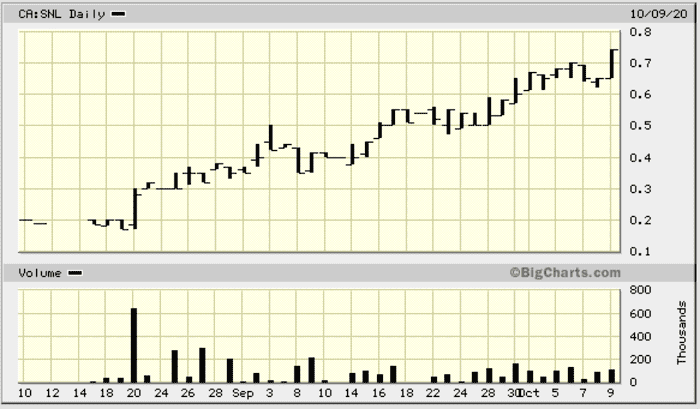

Though Sentinel Resources (SNL.C) has barely been trading for eight weeks, its price pattern shows impressive trajectory marked by steady, determined accumulation…

Earlier this summer, the company put boots to the ground on two highly prospective properties in B.C.—its Pass Property and its recently acquired Waterloo Property, both located in southern British Columbia.

Earlier this summer, the company put boots to the ground on two highly prospective properties in B.C.—its Pass Property and its recently acquired Waterloo Property, both located in southern British Columbia.

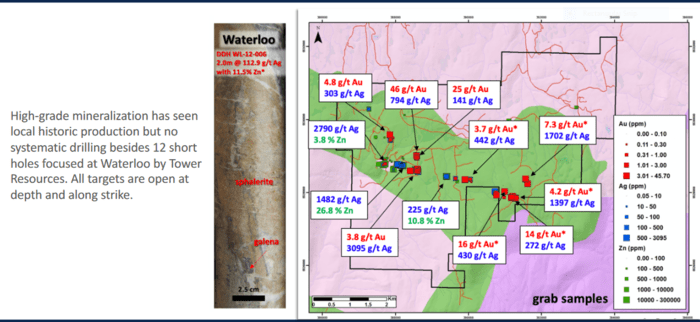

I could spend time, happily, covering both of these projects, especially Waterloo with its 4 kilometers of high-grade strike, a project that never been systematically probed with the drill bit.

Selected previously reported historical grab samples have returned very robust silver-gold sampling results from three separate areas on the project, including:

Waterloo Silver area:

2,790 g/t Silver and 25.4 g/t Gold, 3,095 g/t Silver and 45.0 g/t Gold

Forge East:

1,507 g/t Silver and 2.80 g/t Gold, 3,085 g/t Silver and 3.80 g/t Gold

AU Showing:

794 g/t Silver and 45.70 g/t Gold

But the company has much bigger quarry in its crosshairs. This, after announcing the appointment of a crack team of mine finders tasked with the acquisition (and exploration) of top-shelf gold and silver projects around the globe.

Sentinel already had a competent management team in place to begin with. But these new hires add considerable depth to the team.

Quoting directly from the Sep 30th PR:

Dr. Peter Pollard, PhD, B.Sc, B. App. Sci, MAusIMM (CP)

Peter brings more than 30 years of global research and mineral exploration consulting experience. He is a recognized expert in intrusion-related mineralized systems including copper-gold porphyry (e.g. Grasberg, Escondida Norte, Oyu Tolgoi, Ok Tedi, Sar Cheshmeh district), tin-tungsten-molybdenum-bismuth-gold (e.g. Herberton, Zaaiplaats, Timbarra, Mongolia), iron-oxide copper-gold-uranium (e.g. Olympic Dam, Carajas, Cloncurry, Chile, Mexico, Mauritania) and gold-silver systems (low-sulphidation, high-sulphidation, mesothermal).

Peter likes hunting elephants (editors note)

Peter has presented short courses on ore deposit geology to the industry for more than 25 years. He has been a regular speaker at major conferences and has significant experience presenting to analysts, shareholders and board members. He is qualified person (NI43-101 and JORC) with strong technical and scientific writing skills. Peter has been engaged as a reviewer of papers for international journals and has authored, or co-authored, over 70 peer-reviewed scientific publications. Dr Pollard has held a number of board positions in public and private companies.

Danny Marcos, B.Sc, MAIG, MSEG

Danny is a field-orientated exploration geologist with over 30 years of experience. This included responsibility for the review and prioritisation of precious and base metals projects for both major and junior companies — including the design and management of field mapping and geochemical programs, data compilation/review and target generation. He has strong focus on delivering results including completion of large drill programs from regional (greenfields) to advanced/resource stage.

Danny has specialist experience with porphyry Cu-Au systems; low, intermediate and high sulphidation Au-Ag epithermal deposits; orogenic Au; and base-metal and nickel mineralization. He was a key member of the WMC technical team that discovered the Tampakan Cu-Au deposit in the Philippines — a resource of 15 Mt Cu and 17.6 Moz Au.

That Cu-Au deposit in the Philippines—the largest of its kind in the South-East Asia Western-Pacific region—would stand out on any geo’s resume (editors note)

Danny has proven ability managing multi-disciplinary and multi-cultural, high talent teams under diverse cultural and physiographic regimes, having spent considerable time exploring in Australia and Asia-Pacific. Danny has a strong understanding of deposit models and key controls on mineralization — allowing for robust drill targeting of high priority targets. He has a strong economic focus and is experienced in identifying business development for potential growth opportunities.

Dr. Chris Wilson, B.Sc (Hons), PhD, FAusIMM (CP), FSEG

Chris is a commercially-driven and innovative exploration geologist with over 30 years of global experience in area selection and prospect generation, target generation, and the design and management of large resource definition drilling and pre-feasibility programs. He has worked in over 75 countries, on most commodities and deposit styles.

Chris has extensive project review and target generation experience, with ability to integrate complex multi-disciplinary datasets, and rapidly identify and test high value targets. A strong deposit model knowledge ensures key controls on mineralization are placed within the wider context of a projects geological, structural and hydrothermal evolution. Most recently Chris has been involved in global project valuation and fatal flaw analysis for high net-worth investors.

Chris is a Qualified Person for JORC and NI 43-10 compliant reporting and valuation. Chris worked for Ivanhoe Mines for 10 years — as Exploration Manager for Ivanhoe Mines Mongolia he was responsible he was responsible for an Exploration Portfolio of over 11 million hectares. He has extensive public market and public company experience including board of director positions.

Great combined skillsets, these three.

The first key acquisition by the new hires

Only days after the appointment of Pollard, Marcos, and Wilson, Sentinel dropped the following headline:

Sentinel Resources Acquires Salama Gold Project, Peru

Salama looks like an interesting acquisition.

Consisting of 2,700 hectares of western Peru, the Salama acquisition is highlighted by the following:

Consisting of 2,700 hectares of western Peru, the Salama acquisition is highlighted by the following:

- Potential for high and low sulfidation epithermal gold mineralization and breccia pipe stock-work style gold-silver deposits;

- Situated within the prolific gold-polymetallic Miocene skarn and porphyry belt — one of several coast-parallel metallogenic belts that host the larger and more significant deposits of Peru (above map). This includes Lagunas Norte Gold Mine, Rasario De Belen Gold Mine, La Arena Gold Mine, and La Virgen Mine that together host over 20 Moz gold within a 45 kilometer radius of the Salama Concessions;

- A highly experienced national and expatriate exploration team capable of carrying out exploration work on Salama are ready to go;

- A first reconnaissance visit is planned for the week of October 14, 2020. First pass mapping and sampling will concentrate on areas of alteration hosting quartz veins and silicified breccias;

- Previous work by artisanal and small-scale miners provides additional vectors to areas of higher-grade mineralization.

A word on these artisanal operators: often cast in a negative light, these hard-working, small-scale mining-types, in digging up the immediate subsurface layers of a project, can accelerate the learning curve by exposing the underlying geological controls of a prospective high-grade zone. If approached in a spirit of fairness and cooperation, this can evolve into a mutually beneficial relationship.

Rob Gamley, President & CEO of Sentinel:

“The acquisition of four prospective gold concessions in this historical gold-silver producing region in Peru shows the ability of our exploration team to identify and acquire key gold assets notwithstanding current https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative challenges in Peru. With the skill and local knowledge of our in-country team, we are well placed to quickly build a robust portfolio of gold focused assets in this region of Peru.”

The 2nd key acquisition by the new hires

This next headline, announced only a few days back (Oct 6th), revealed a weighty acquisition courtesy of Pollard, Marcos, and Wilson—an acquisition that immediately ascends to flagship prominence:

SENTINEL ACQUIRES EIGHT GOLD EXPLORATION CONCESSIONS IN NEW SOUTH WALES, AUSTRALIA

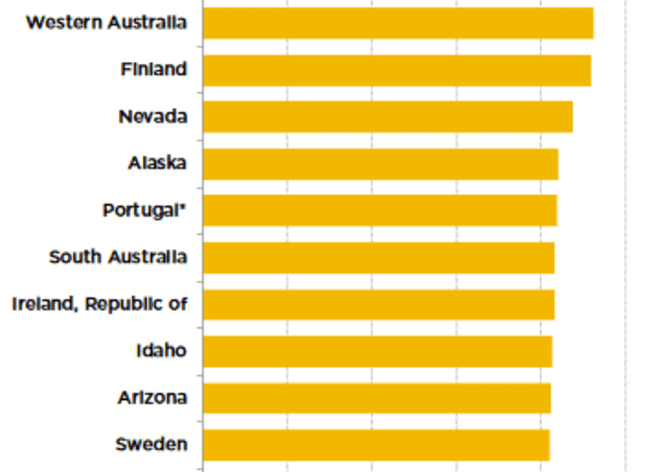

The continent, in general, has become THE premier mining destination on our tiny blue planet.

A recent mega-merger illuminates the rich mineral endowment of this island nation…

$11.5 Billion Australian Merger Could Trigger A Global Gold Rush

In terms of mining friendliness, the venerable Fraser Institute, according to their investment attractiveness survey, ranks this region solidly in the Top 10 mining destinations on the planet.

A quick review of the region

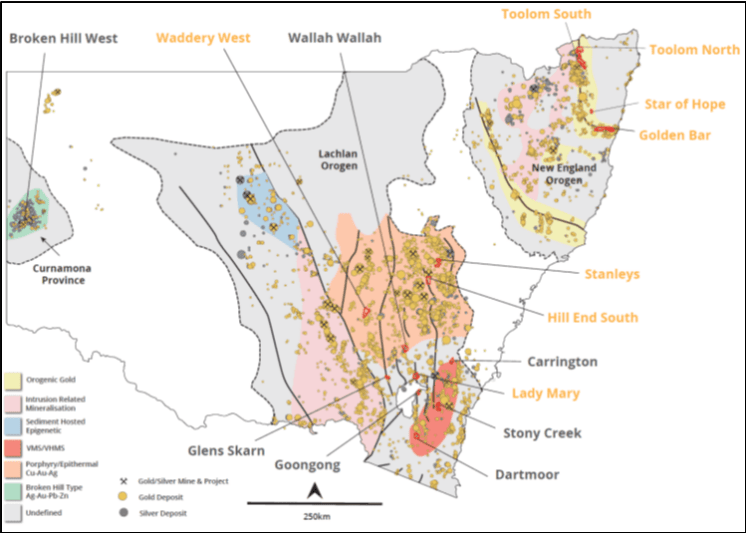

New South Wales (NSW), located in south-east Australia, boasts a significant endowment of precious metals within its subsurface layers.

NSW past production exceeds 40 million ounces.

Current in-ground NSW gold resources exceed 68 million ounces.

Gold production in this prolific region is sourced from a variety of geological settings and deposit types.

NSW is vastly under-explored but is primed for resource development via a network of infrastructure criss-crossing the region.

Abundant, extensive (and accessible) government databases—over 3,000 data points relevant to the region—offer reams of geological intel to give a project its first push along the curve.

8 separate projects, over 945 square kilometres in total area

- At least 198 historic gold mines and gold exploration prospects are present across 8 separate projects;

- Historic production records indicate that gold grades were often multi-ounce (see News South Wales Department of Planning, Industry and Environment);

- The licences are strategically located within the prolifically mineralized Lachlan and New England orogenic terranes;

- Sentinel applied to the Manager of Minerals Titles, New South Wales Department of Mining, Exploration and Geosciences for the concessions. The concessions will be 100% owned with no royalties or back-in rights, upon completion of the acquisition process.

- Sentinel has engaged a highly experienced exploration team to commence a reconnaissance work program on high-grade historic mines and showings this November 2020. The focus is to identify high-grade drill ready targets.

The vast majority of Sentinel’s resources (and exploration spending) will be focused on this newly acquired Australian project portfolio.

This is not an early-stage undertaking. These projects have been de-risked to a large degree owing to the numerous past-producing mines and high-grade showings in the region.

There’s some very decent detail in this October 6th press release regarding the geological settings, the major faults that influence the region’s mineralization, the potential for specific deposit types (orogenic raises this humble observer’s brow), the past-producing mines, and the number of showings present in the region.

Here’s an excerpt but I encourage you to explore the full body of the press release (fascinating stuff, this):

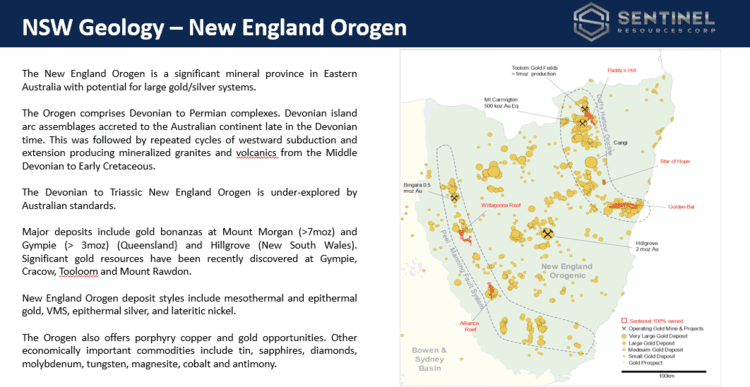

The New England Orogenic Terrane

The New England Orogen forms the basement throughout the northeast of New South Wales. It developed along the eastern margin of Gondwana as a result of convergent margin tectonic processes in the Paleozoic and early Mesozoic. The orogen was most likely island arc-related from the Cambrian to the Middle Devonian, changing to a continental margin magmatic arc from the Late Devonian onwards. Ophiolites — remnants of ocean floor — crop out along the regional Peel-Manning suture zone.

The presence of extensive alluvial gold fields and showings, coupled with the large number of historic underground gold and silver mines, and a variety of tectonic terranes including Andean-type continental arc, fore-arc, and accretionary wedge, indicates that the New England Orogen is high prospective for the discovery of gold and silver deposits. The Peel-Manning ophiolite zone, especially where altered to listwanite, is highly prospective for orogenic gold.

Five of the eight Gold Projects are located within the New England Orogenic terrane:

Five of the eight Gold Projects are located within the New England Orogenic terrane:

-

Toolom South (ELA 6061): This concession is located in the historic Toolom goldfield. It covers an area of 165.5 km2 and includes over 60 historic gold mines and high-grade gold showings. There are also potentially significant alluvial gold deposits.

-

Alliance Reef (ELA 6057): Alliance Reef comprises 102.5 km2 and is located in the western portion of the New England orogenic belt. The license covers 12 strike kilometers of the significantly gold mineralized regional Peel-Manning fault system. Mineralization is of an orogenic or lode gold type — characterized by quartz veins which may host high grade gold shoots. Orogenic systems typically have large vertical extent and mineralization may extend 100’s to 1,000+ metres down-dip.

CEO Gamley again:

“The acquisition of eight strategically located Gold Projects, within the prolifically mineralized Lachlan and New England orogenic belts, provides the Company with an extremely solid exploration portfolio on which to build. To acquire such a commanding land package, with numerous high-grade historic gold mines and showings, is a remarkable achievement given the large numbers of companies that are now focusing their acquisition and exploration activities in New South Wales. Our highly experienced team continues to review precious metal opportunities worldwide.”

Though ‘district scale potential‘ is trotted out all too frequently in the junior exploration arena, this acquisition is worthy of the lofty designation.

The company believes this property package will put them in the top five junior explorers in Australia. “These are high impact projects.”

The company is currently busy compiling its own extensive database that includes all historical work done on the properties (drilling, geochemistry, geophysics, and historical technical reports). This is the first stepping in pushing this acquisition further along the development curve—it begins the process of shortlisting high-priority drill targets, of which I’m sure there are many.

Since these projects can be worked year-round, newsflow will be steady.

I’m also told that there may be additional acquisitions in the not too distant future.

Final thoughts

Sentinel is in an enviable position—any one of the eight projects acquired via this recent acquisition could represent a company-maker.

To facilitate the need for exploration funds—kicking rocks is a capital intensive biz—the company announced a $1M PP just yesterday (Oct 8th).

Sentinel Resources Announces DTC Eligibility and Private Placement Financing of $1,000,000

“We envision Sentinel being the stock to New South Wales that Fosterville was to Victoria”, was the reply when I asked the company to characterize this acquisition.

The company’s cap structure is tight. Current shares outstanding = 20.55 million (35.42M f/d).

(Sentinel also trades on the OTC market in the US under the symbol SNLRF)

END

—Greg Nolan

Full disclosure: Sentinel is an Equity Guru marketing client.