This will be a long read. Deal with it.

The reason it’s going to be long is we’ve identified a company that we believe is about to pop off, in an industry it’s growing quickly in, having lived through some growing pains and figured out a lot of things. and become better as an organization as a result.

This company’s stock has been steadily, quietly, growing as insiders gobble it up in what we believe is an indicator of what they see coming, and we even bought the company’s products to see if they are what they’re cracked up to be and let’s just say…

WE ARE BULLISH.

But before we get there, let’s go on a journey known as late stage capitalism – where the need to earn more and more money just to stay afloat in an industry causes that entire industry to consume itself in a quick race to the bottom, with lower quality products, copies, and planned obsolescence that, sure, makes a little money in the short term, but eventually kills consumer interest in the entire category.

New fridges used to last decades. Today, fridges have a 5 year lifespan.

Desktop printers are so disposable that it’s often cheaper to throw one out when the ink cartridge runs dry, and buy a new one just for the free printer cartridges that will come with it.

We’ve seen this in every industry of late – as technology and, increasingly, AI makes professions that once required extensive accreditation and fees, such as legal services, taxes, photography, design, and even basic healthcare, essentially free in return for quick growth in online market share.

Let’s take apparel.

- In the 1960’s, if your clothing company made jackets, you’d produce them locally and build a sales staff that would take them out to store owners and sell your products, and if those products were successful, you’d sell more and more jackets for many years. You’d run ads in magazines and TV like the one to the left. You’ might eventually become synonymous with your design.

- In the 1970’s, the concept of ‘fashion seasons’ showed up, and your coats may have needed to be updated every few years to stay relevant, but you could still do business over an extended period quite happily and profitably.

- In the 1980’s and 90’s, seasons became actual calendar seasons, you needed supermodels to flaunt your wares on the runway, and production moved off-shore where things could be made quickly and cheaply, as knock-offs of famous designers became a thing.

- In the 2000’s and 2010’s, the internet and online sales meant retail store sales plummeted, and your little product could now be knocked off quickly, and sold online by others, so much so that your initial design would be another company’s marketable success.

- Eventually, the corporations became the pirates. Retail chains like Zara, and online sellers like ASOS, Temu, and Shein, began using AI to scrape the internet of indie fashion designs, and utilized massive manufacturing networks that could make single items from tens of thousands of listed SKUs, as they’re ordered by customers, rather than needing to make 10,000 pieces of one SKU in advance in the hope they will be eventually sold.

The apparel business is now basically an oligopoly based on Alibaba Express and sweatshops, and the continuing need to beat prices down means most of it is of terrible quality, and even made using slave labour, at a horrendous environmental cost.

But if you think the apparel world is over, think again, because that race to the bottom eventually means high quality original clothing that elevates a person’s self esteem and demonstrates their high position in life, now commands a premium – such a premium in fact that high end luxury brands are where the growth is.

Louis Vitton Moet Hennesy (LVMH), which owns Tiffany, Dior, Fendi, Givenchy, Sephora, Princess Yachts, TAG Heuer, Bulgari and more, runs 75 luxury brands from over 60 subsidiaries, and is rapidly adding more by the year. While the rip-off artists at Shein have quickly grown to a $100 million company selling off-brand crap, LVMH is now a half trillion dollar company that consistently drives European market indexes higher selling the highest quality goods at prohibitive prices.

In short, a Tesla is faster than a Lamborghini, but boy howdy do people aspire to pay a fortune for a Lambo

Yes, there’s money – a lot of it – in stealing the designs of others, cutting corners on quality, using low quality materials, and pumping out lowest common denominator fodder to people who can’t afford better, but the other side of the spectrum is to provide the highest quality gear to people who can afford to pay more, want to own products that will provide a superior result, and have learned their lesson that cheaping out isn’t always a good economy in the long term.

Case in point: I bought a counter-top ice machine a few years back and really loved it initially, but quickly realized that it had a design flaw that rendered it useless inside a year. When I went looking for a superior product that wouldn’t have that same flaw, it became clear they all had it. The reason for this is, every other counter-top ice machine on the market was manufactured in the same factory, maybe in a different colour and with a different brand logo on the side, but essentially the exact same product.

The ENTIRE MARKET for this product was from that factory, and every brand was simply white labelling a shitty machine and being happy to own 2% of the market, rather than taking the chance and spending the money to make their own design, raise the standard, and compete for more.

If just one brand had bothered to create a better machine without this flaw, and even sold it for three times the price of the others, they’d have my business.

Like BEACN Wizardry and Magic (BEACN.V) does.

The microphone market hasn’t had a whole lot of ingenuity in it for a long time, at least until live-streaming showed up as a business.

Previously, your mic was more or less a hollow piece of hardware with a big XLR cable attaching it to a soundboard where the ‘art’ would take place at the hands of an engineer.

The internet era brought us cheap web mics, largely white labelled basic electronics at increasingly lower prices that plugged in to a USB slot and were fine for – at the time – low bandwidth online needs.

But, these days, the most desired job for teenagers in the world today is to be a content creator.

A broadcaster. An influencer. A streamer. A Youtuber.

And the tools of that trade are a high quality camera, computer, and a bad ass microphone.

Sure, you can buy a Blue Yeti mic for $150 at Best Buy and it’s fine, I guess. And pretty much every content creator does – at first. But at some point you realize your business requires something better.

Like we did.

We do a lot of video content and over the years, we’ve even moved offices to get away from the background noise of construction and traffic, air conditioning, and neighbouring offices.

What we never considered was changing our microphone. Then BEACN came along.

Why BEACN is the high end item of choice:

- ON-BOARD PROCESSING: Most mics require you to process sound either in your computer, which eats computer resources, or in a peripheral plug-in like a mixer that then leads to your computer. The BEACN mic processes your sound IN THE MIC, meaning the only data that goes out to your computer is finished sound.

- USB SLOT: In traditional high quality mics you need an XLR cable to connect to a mixer or your computer. As you can see to the right, the BEACN mic uses a USB slot, which means you can plug it right in to your computer with one cable without adapters and other hardware.

- ON-BOARD HEADPHONE OUTPUT: Because users want to hear the same sound their listeners hear, most headphones will plug into your computer, with wires snaking back through your gear and occasionally getting tangles and yanking your headphones off your head. Because the BEACN processes sound inside the mic, you only need to plug your phones into that. Shorter cables, less tangling, and life is good.

- TOP OF CLASS SOFTWARE PROCESSING: To process your sound, BEACN provides the easiest to use, most feature loaded free software you’ll ever find. Every option is clearly explained with tutorials aplenty, they’re easy to undo as needed, settings can be saved under different profiles, and you can hear exactly how much better your audio is sounding as you make the changes. We quickly eliminated our background traffic and air conditioning, without knowing anything about audio compression beyond what the software was suggesting.

But it goes deeper. The ambient lighting on the mic looks fantastic on-screen.

They’ve recently added a variety of colours to both the mic itself (black or white) and the available foam windscreens (red, purple, black).

There’s an audio control mixer that allows you to pipe in multiple sound sources and easily turn them up, down, or off, allowing you to bring in audio from games, mics, music, system sounds, audio calls, and pick which of the above comes to your headphones.

Then there’s the new mic arm – for a long time something that didn’t come with BEACN mics but which, in keeping with how they do things, has been designed from the ground up as a high quality piece specifically for creators, that works at varying angles, slides under monitors, etc etc, which should always have been standard in the industry but wasn’t til BEACN came along.

The mic stand is a new piece to the BEACN family, but is no doubt a high margin addition that helps the company avoid leaving money on the table when a new customer with the means makes their first purchase.

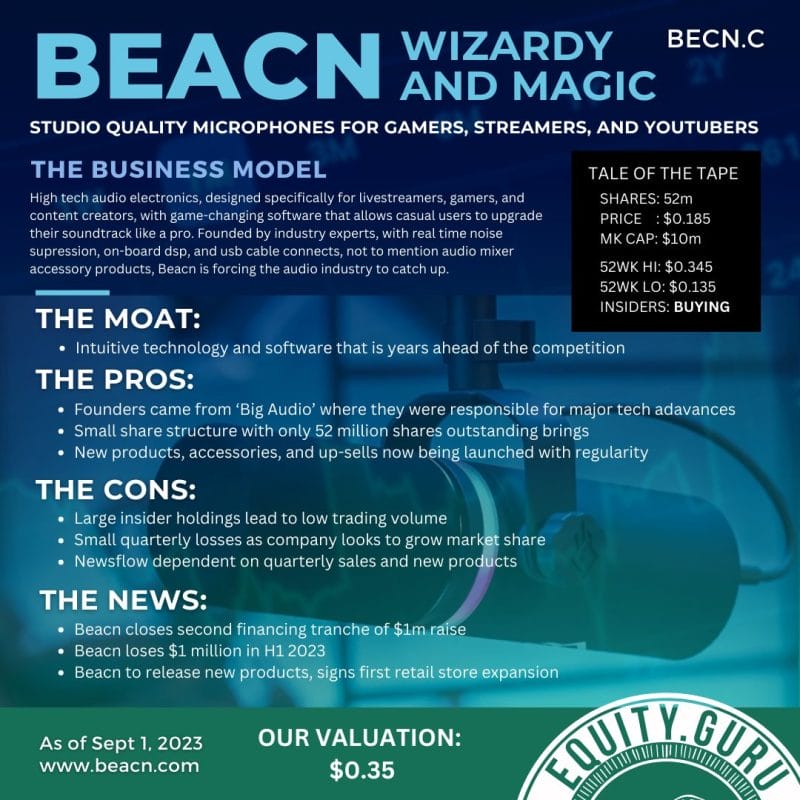

BEACN THE COMPANY:

BEACN is a BC-based electronics firm, which I personally love because we don’t do that a lot here, and the crew behind it were tech innovators with their previous employers, which were duly gobbled up by a larger company. Quickly realizing their good ideas would take forever to be enacted at the much larger, less innovative corporation, they struck out on their own with investment from some large local family office types.

The executive team understands the tech at a AAA+ level and, indeed, is personally responsible for many advances in that tech industry-wide. They may have benefited from having a more markets-focused leadership team around them over the last few years, to keep the markets enthused and apprised of what’s happening, but it’s understandable that a group that came together out of the frustration of a takeover would be inclined to focus on tech and keeping things in the family a little while it gets its feet wet.

In its first year, BEACN tried to ply its trade through direct-to-3consumer sales. This was a qualified success, but they soon switched to a B2B option, bringing them now into sales channels like London Drugs, Wal Mart, NewEgg, Amazon, and Best Buy. That switch saw a dip in sales initially, but the products are now in stores and selling, from what I can tell based on availability [see below].

Let’s be clear, BEACN came to the public markets way too early in their corporate lifetime, before they’d really figured out their best sales strategies. Personally, I’m not a fan of the ‘Wizardry and Magic’ part of their company name, because to me it sounds like they sell Magic: The Gathering box sets and not best-in-breed audio technology.

I’d call the company BEACN Streaming Audio if I had my druthers, to really zero in on both helping investors understand it from first glance AND helping potential customers find the product through search, but these are admittedly small complaints and, in actuality, help us right now in grabbing stock cheaply before the rest of the world figures out what’s coming.

BEACN THE STOCK:

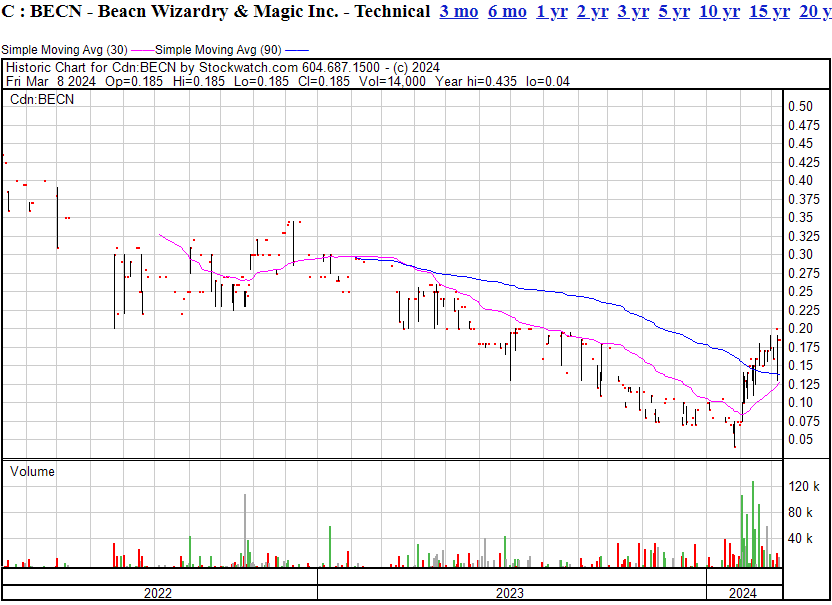

You can see the ‘development period’ of the company in its stock chart over the last two years, but you can also see something very interesting happening RIGHT NOW.

Since January, someone has been buying the stock whenever someone choose else has chosen to sell it.

And I only noticed this because I was one of those looking to sell it.

That’s a large ramp up in volume and liquidity, the likes of which haven’t been seen since BEACN’s inception.

I had personally listed some of our company-held stock for sale because the company had been markets-dormant for some time and I figured it was time to go. What I didn’t know was there’s a solid group of early stage investors behind the scenes that have been financing any raise the company has needed as it developed its product line, and are, if my guess is right, now buying up the cheap stock, incentivizing weak hands like mine to move on, and presumably waiting for something to happen that will make their investment prescient.

The increased trading volume – about a million shares over a month by my back of the cocktail napkin count – is by no means massive, but it’s a large swathe of the 50 milloon shares out, much higher than at any time previously, and has been consistent from day to day. Enough to swallow a lot of shares – about 2.5% of what’s outstanding – in a quick time without alerting casuals to what they’re doing.

As the stock has neared $0.20 (from $0.04 six weeks back), the buying has slowed to give sellers a chance to lower their expectations (indeed, I had some on the ask at $0.21 for a while that didn’t get taken, before I started wondering if I should hold the rest), but I can’t imagine that move was on the back of some random investor just guessing that the time was right to buy in. I think the big fish, that have kept this deal afloat while it figured out its business model, believe something bigger is happening.

The BEACN newsflow gives us some clues in that there’s been none. Not even a hand wave, a “hey guys we’re still here, please don’t sell” corporate note.

That said, back in October there was a $900k financing at – you guessed it – $0.20 per share. Those were Eligible Business Corporation shares which come with a healthy 30% tax credit as well as an extended hold so – strong hands. Indeed, half of the shares in that financing were bought by directors and officers of the company.

Employees also hold stock options at – you guessed it – $0.20 per share.

As for catalysts for the recent share price growth, it wouldn’t surprise if they announced new distribution agreements, new products, or new financials that show growth.

The only other news since the debut of the new mic stand product was the announcement of quarterly financialsm which showed a small loss in late November.

Those with basic math skills will be able to figure out when the next financials should be dropping.

For those without: THEY’RE DUE NOW.

— Chris Parry

FULL DISCLOSURE: Beacn is a former Equity.Guru marketing client and, as mentioned, we own stock in the company. Less stock than we once did, but our head is on a swivel and we may join the buyers on dips.