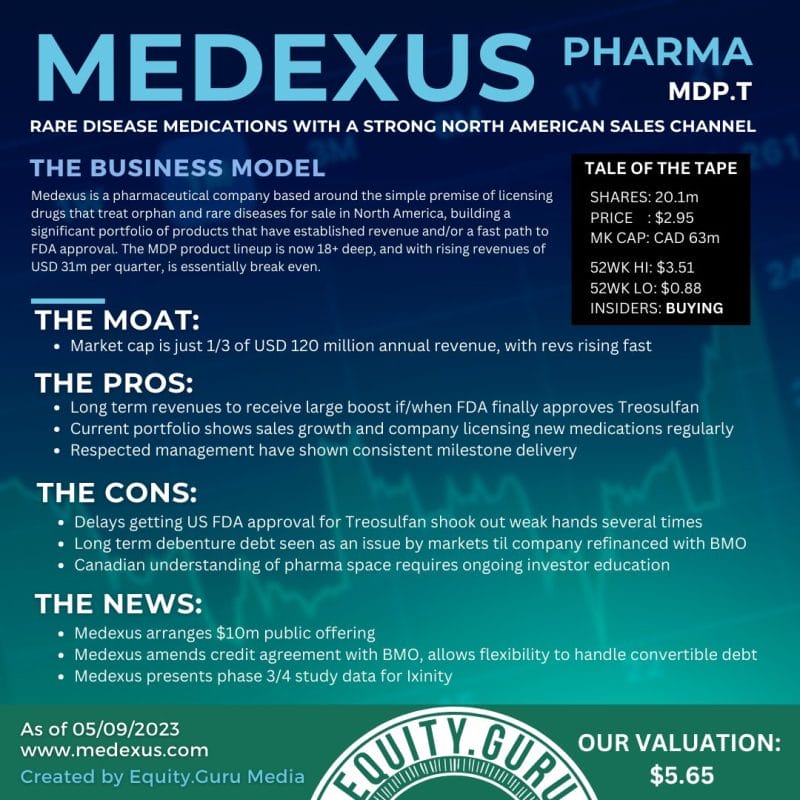

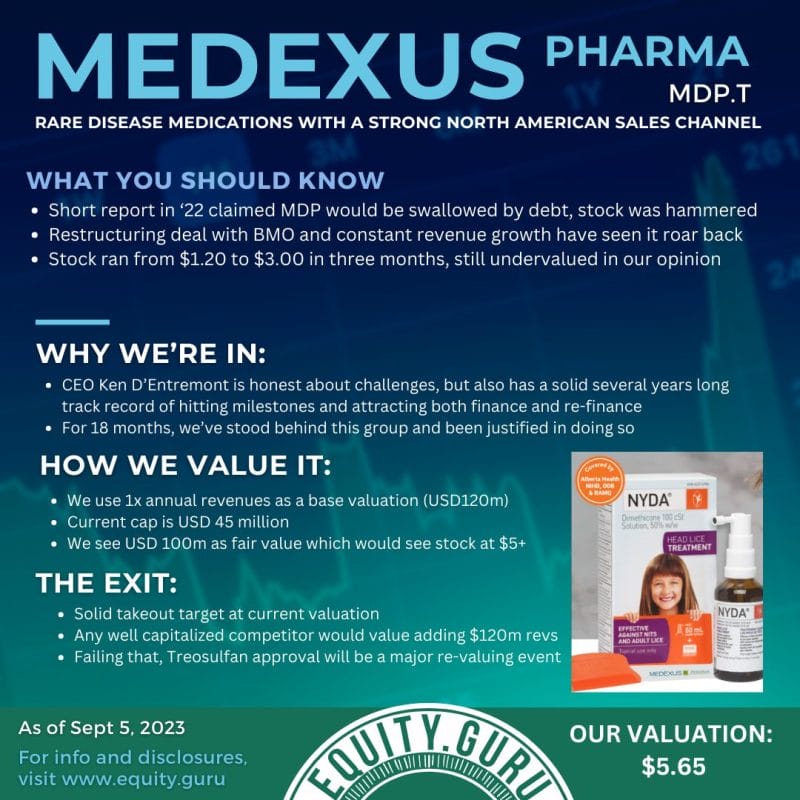

Specialty pharmaceuticals is a unique niche in the pharma sector. Where companies like Eli Lilly pour billions into developing a drug candidate from scratch with the very real possibility that the drug will fail during trials and never make it to market, specialty pharma companies, like Medexus Pharmaceuticals (MDP.T), find already approved drugs from other jurisdictions and bring them to the North America market. Drug development risk averted.

Today, Medexus announced that Health Canada recently accepted for review Medexus’s new drug submission, or NDS, for terbinafine hydrochloride nail lacquer to treat fungal nail infections.

“Health Canada’s commitment to review our NDS brings us a step closer to making topical terbinafine a viable treatment option for Canadians,” said Richard Labelle, Medexus’s General Manager-Canadian Operations. “Topical terbinafine is an excellent strategic fit for our leading allergy/dermatology business, and we look forward to putting our institutional knowledge to work as we target a commercial launch in the first half of calendar year 2025.”

Topical terbinafine has been widely used in other markets to treat fungal nail infections. Medexus’s NDS for topical terbinafine seeks Health Canada approval for a distinctive once-a week treatment regimen. If and when approved, the product will enter the Canadian topical fungicides market that is estimated to be C$88 million on an annual basis.

The stock is currently up over 5.20% on today’s news.

Very strong uptrend ever since the stock broke out above the resistance zone at $1.70. Note the bottoming pattern there as the stock stopped making lower lows. A new uptrend is in play and there really has not been much corrections. The next level of resistance comes in at the $3.40 zone. A breakout from this resistance would see the stock on track for targets above $5.00.

Medexus Pharmaceutical (MDP.T) readies for powerful year of growth in specialty pharma sector