InnoCan Pharma Corporation, trading on the Canadian Securities Exchange under the symbol INNO, FSE: IP4, and OTC: INNPF, is a pharmaceutical technology company that has garnered attention in the investment community. This article evaluates its potential as an investment option in the pharmaceuticals space, considering both its recent achievements and challenges.

Business Model and Strategic Focus

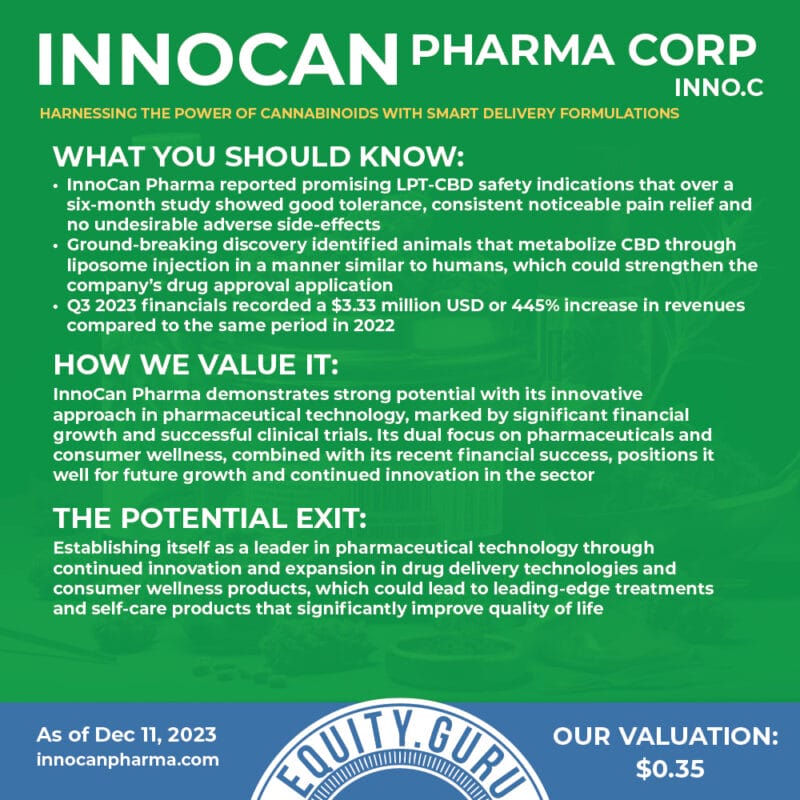

InnoCan Pharma operates in two main segments: Pharmaceuticals, focusing on developing drug delivery technologies using cannabinoids for conditions like epilepsy and pain management, and Consumer Wellness, which markets a range of self-care products. The company’s unique approach combines pharmaceutical technology with cannabinoid science.

Recent Financial Performance

In Q3 2023, InnoCan Pharma reported a significant revenue increase, with US$4.083M compared to US$749,000 in Q3 2022, an increase of 445%. The gross profit for the same period was US$3.664M, compared to US$715,000 in Q3 2022. This growth is primarily attributed to robust sales performance of its subsidiary, B.I. Sky Global Ltd.

What we think

Pharmaceuticals in Canada

The Canadian pharmaceutical market is showing positive signs of growth and presents intriguing opportunities for investors with company’s like Medexus Pharmaceuticals making consistent gains in revenue. This sector growth is being driven by several factors. One of the most significant is the rising prevalence of chronic diseases, particularly among the aging population. This increase in chronic conditions like cardiovascular diseases, diabetes, and neurodegenerative disorders necessitates a greater need for pharmaceutical interventions. Additionally, advancements in medical technology, such as genomics and molecular diagnostics, are enabling more personalized and targeted pharmaceutical treatments.

Over-the-counter (OTC) pharmaceuticals are expected to see significant growth, largely due to increased demand during the COVID-19 pandemic and the rising prevalence of conditions like atopic dermatitis and melanoma. Furthermore, the Canadian government’s focus on the pharmaceutical industry, including increased funding for research, is expected to contribute to market growth.

However, the market also faces challenges. The regulatory environment in Canada is stringent, with Health Canada’s Therapeutic Products Directorate overseeing the approval of pharmaceutical drugs and medical devices. Drug pricing and reimbursement pressures, patent expirations, and rising R&D costs are other significant challenges that could impact the market’s expansion.

Conclusion

InnoCan Pharma Corporation presents an interesting option for investment in the pharmaceuticals space, with notable financial growth and promising clinical trials. However, investors should weigh these positives against the financial challenges and stock value fluctuations the company has faced. As with any investment, it is crucial to consider the broader economic and market conditions, alongside the company-specific factors, before making an investment decision.