You like lithium. You’re a green energy buff and you think there’s good things to be found in the lithium space so you’ve allocated some doughbucks to the salty stuff.

You’ve looked at a bunch of lithium plays in search for the one that’s right for you, and you’ve settled on the massive number of Ontario projects held by Beyond Lithium (BY.C) as a good place to dig in. Well done, you, we’ve donee same… But there’s a dilemma in buying BY right now.

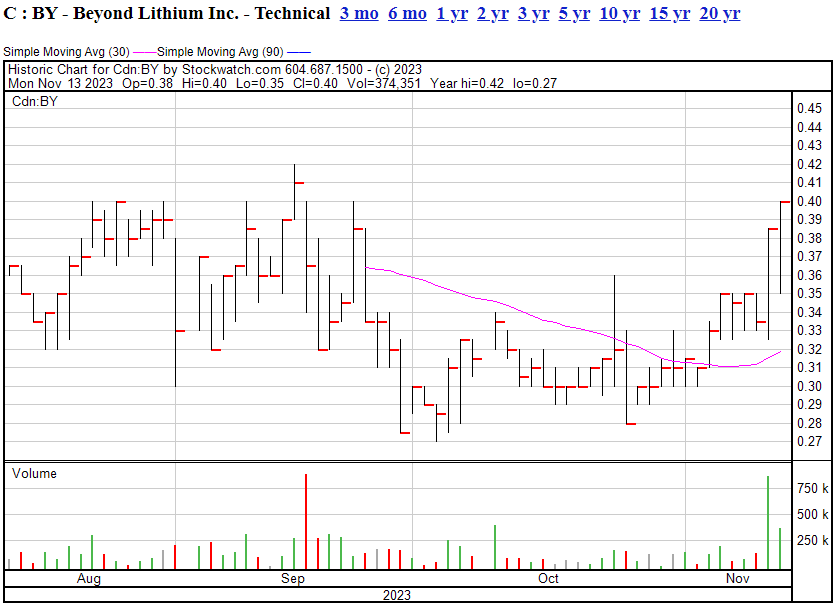

They’re in the middle of a raise at $0.30; a raise that’s drawn enough investor interest that they’ve already had to increase it’s size once.

Usually, if you’re not an accredited investor, you might hold off buying stock in the middle of a financing, because the price of the financing usually puts a temporary ceiling on the share pirce. Afterall, why would anyone pay $0.31 for a share that’s being sold to others for $0.30?

That’d be conventional wisdom; just chill for a bit and wait.

But conventinal wisdom goes out the window when investors are so keen to get in on a company they don’t care what the financing price is, and that’s what’s happening with Beyond Lithium right now. Dudes want their BY shares and will pay $0.40 for them, apparently, even if the big boys are getting it 25% cheaper.

A good deal is a good deal, and it would appear a lot of investors, accredited and otherwise, think Al Frame’s lithium roll-up is a good deal right now.

In fact, over the last two weeks, the share price on BY has run from $0.28 to $0.40, private placement be damned.

Paying $0.40 for a $0.30 stock isn’t just bullish, that’s elephantish.

So what’s getting people all excited? Here are the broad points:

- Spodumene Discoveries: Beyond Lithium has made two major discoveries of spodumene, a mineral rich in lithium, both in the same Ontario district. These discoveries are at the Ear Falls Spodumene Project and the Victory Spodumene Project, with eight additional projects in the district that can be worked, JVed, sold, or spun out.

- Exploration Progress: The company has quickly progressed in exploration, showing its cards to anyone who cares to look. In its first year, Beyond completed Phase 1 exploration on about 80% of its projects, with 18 projects moving into Phase 2. Drilling was scheduled to start again last month.

- Geographical Spread and Infrastructure: Beyond boasts a vast area of lithium projects, with Ear Falls covering over 20,000 hectares and Victory over 16,000 hectares. These areas have good infrastructure support such as major roads, power lines, local labor, and communication services.

- Technical Discoveries and Potential: At the Victory Spodumene Discovery, large spodumene-bearing pegmatites have been found, which are significant for their lithium content. The company has identified a 6 km long corridor for exploring similar sized spodumene pegmatites.

- Expansion and Sample Results: The Ear Falls Spodumene Discovery has expanded significantly, and the company has discovered spodumene-bearing pegmatites over a 1 km strike length with potential for further exploration. The lithium oxide (Li2O) content in the samples ranges from 0.76% to 4.54%.

- AG Pluton Discovery: A significant pluton, named the Allen Graeme Pluton (AG Pluton), has been discovered at their Cosgrave Lake Project. This pluton is over 320 hectares in size and is considered a source of lithium-cesium-tantalum (LCT) fractionation and mineralization.

- Capitalization and Market Position: Beyond Lithium is positioning itself as a significant player in the lithium exploration sector in Ontario, and has done so while maintaining a tight share structure, and a market cap of just $9.5 million.

All the pieces are here; management who have shown they’re advancing their plays, not just hoarding them, money rolling into the coffers from financiers, projects with real world commercial potential and hefty acreage, all close to infrastructure and accessible without an arctic expedition, a sector that has long term growth potential and end user dollars increasingly coming in to finance projects at the early stages, and it’s all right here in Canada. No AK-47s, no borders, no threat of nationalization.

- You want LCT? They have it.

- You want spodumene-bearing pegmatites? Got em.

- Regular newsflow? Check.

- Accredited investor interest? Yup.

- Retail investor interest? And then some.

Look man, I’d love to take the credit for the growing level of interest around this deal, but the fact of the matter is, it’s just being run right. At the operational end, at the markets end, at the geo end, Beyond Lithium is firing on all cylinders and has routinely done exactly what they said they would do.

- Acquire projects

- Work projects

- Advance projects

I’ve been at this for a while, and I can usually find a few places where, in a quieter moment, I might tell the exec team a few ways they could run things better.

Not here. They appear to have it locked in. I wouldn’t change a damn thing.

— Chris Parry

FULL DISCLOSURE: Beyond Lithium is an Equity.Guru marketing client, and we’ve bought a bunch of stock.