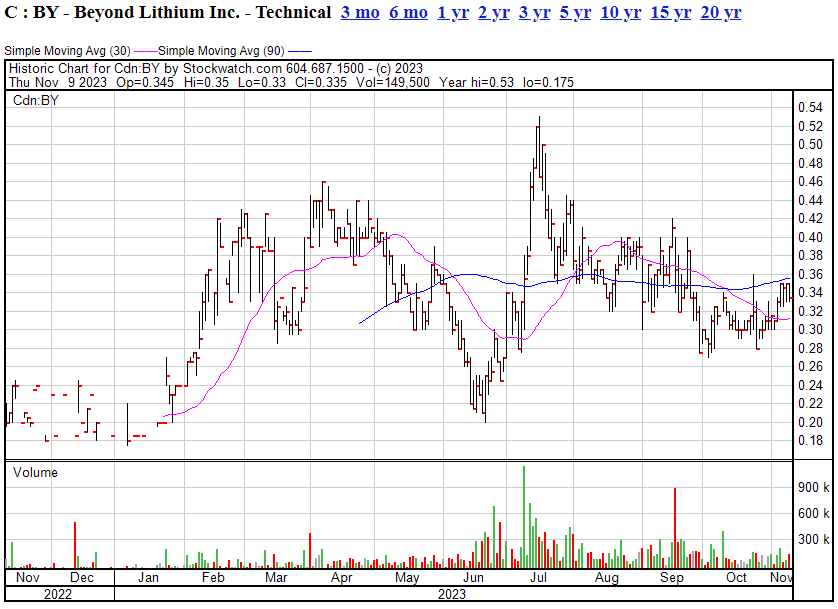

In the shadowy realms of the mining underworld, there’s a glimmer—a beacon, if you will—that’s starting to flicker with the kind of ferocity that catches the corner of a savvy investor’s eye. It’s Beyond Lithium (BY.C), folks, and they’ve just revved up their engines on a stripping and drilling escapade at the Ear Falls spodumene project.

Could this be the dawn of a lithium-laden renaissance in Ontario? Hold onto your hats; over the coming weeks, we’re about to find out.

Remember September? That was when the BY rock-huggers hit a geological jackpot with grab samples flaunting up to 4.54% Li2O. That’s lithium oxide for the uninitiated, and in the battery world, it’s the stuff you want.

Fast forward to the present, and they’re itching to strip back the Earth’s crust at Ear Falls in a tale as old as time: man vs. rock, with the spoils of war being a potential battery bonanza.

WHAT DO THEY DO?

In the grand chess game of mineral exploration, Beyond Lithium has carved out its plan for a kingdom with a strategy as shrewd as it is expansive. As the reigning monarch of Ontario’s greenfield lithium exploration realm, the company boasts a staggering 63 high-potential properties that spread over an impressive 195,000 hectares, but they’ve shunned the traditional spend-and-dilute playbook for a project generator business model.

This masterstroke keeps their coffers full and their shareholders smiling by maximizing exploration funds – the exploration team’s hands are deep in the mineral-rich soil of select projects, while other lands are parceled out to joint venture partners. These alliances are more than mere handshakes; they’re a conduit for non-dilutive capital, partner-funded exploration forays, and a lasting stake in the exploration jackpot.

But let’s not get too frothy here. Beyond Lithium isn’t just playing in the dirt for kicks. They’re on a mission to uncover the secrets of subparallel dykes and the density of the spodumene pegmatites as part of a full-on geological striptease, and they’ve got their sights set on a larger-than-life footprint of a system that sprawls over 13 kilometers, of which they’ve only skimmed the surface to date.

BUT ARE THEY REAL?

If your thinking is this is just another wild lithium chase, the sort that every second pretendsy lithium explorer has been spouting off about since the sector got interesting earlier this year, consider this: Beyond have already got a drone buzzing overhead, mapping the zonation of these pegmatites like a high-tech gold digger. And they’ve got more samples in the lab than an STD clinic at a naval base, with results that are hopefully just as positive.

Lithium exploration – REAL lithium exploration, that is – is a strategic dance, choreographed with military precision. They’re plotting to pummel the earth with a far more extensive drilling program, one that’ll have the Ministry of Mines in Ontario on speed dial for their permit approval.

And why? Because Beyond Lithium is gunning to be the largest greenfield lithium exploration player in Ontario, with 63 projects under their belt and three significant discoveries already notching up, they’re not just blowing smoke.

This isn’t some one-project-wonder operation. Beyond Lithium is playing the long game, with a portfolio of projects strategically sprinkled across Ontario’s lithium-rich domains, they’re poised to keep the news wires buzzing and the shareholders chomping at the bit with work after work, on project after project.

So those still wondering about the million-dollar question: Is Beyond Lithium the real deal or just another miner lost in the lithium fever dream? – I think it’s fair to say, with 50 of their 63 projects already explored and ten more waiting in the wings, they’re not just part time players. They’re not a sub-standard property supermarket. They’re actively turning the market on its head and demanding others follow their lead.

The long game is for Beyond Lithium to emerge as the lithium lord of the north. One thing that’s plain to see; They’re not going down without a drill, and their share price is holding investors’ interest, even as those around them slump.

— Chris Parry

FULL DISCLOSURE: Beyond Liuthium is an Equity.Guru marketing client, and we own the stock.