In a world grappling with climate change and striving to shift towards green energy, nuclear power has emerged as a key player. This clean, efficient, and potent form of energy is increasingly needed to help us move away from fossil fuels. Central to this transformation is uranium, the fuel used in nuclear power generation. However, as the global uranium market tightens, it has become ensnared in a web of geopolitical tensions that threaten to influence its price and availability.

In recent years, demand for uranium has surged. Since 2020, the spot price of this radioactive metal has risen by nearly 40 percent, from $40 to $56.25 a pound, according to market research firm UxC. However, this pales in comparison to the uranium price peak of $140 per pound back in 2007. This year alone, the price has gone up nearly 40 percent, indicating a tightening market that could have significant implications for nuclear power generation.

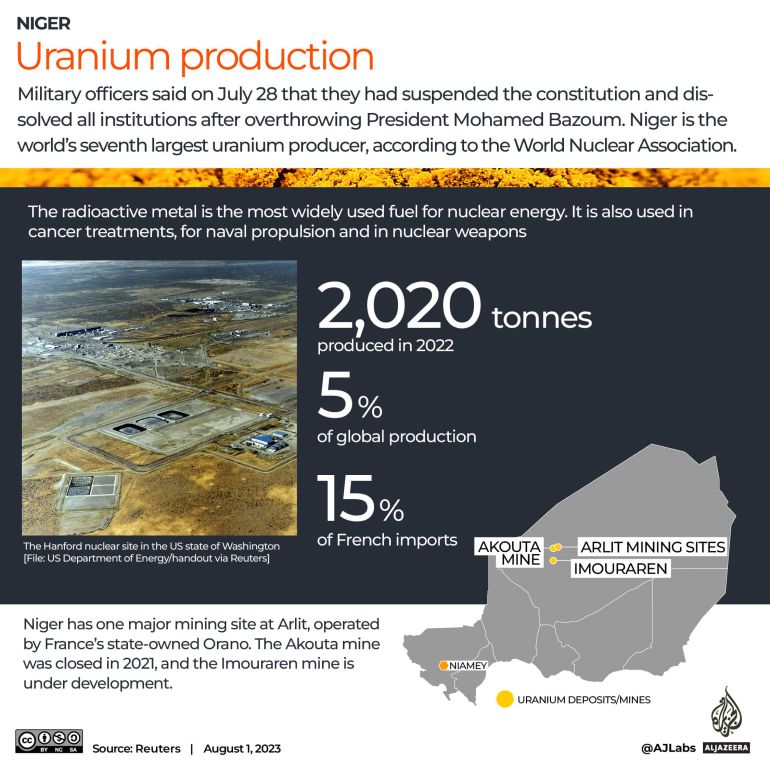

In particular, geopolitical events in Niger, the world’s seventh-largest producer of uranium, are threatening to destabilize the uranium market. The recent military coup has sparked fears of potential supply disruptions, as the country produces 4 percent of the world’s uranium supply. While mining operations are continuing for now, recent plans by France to evacuate its citizens from Niger and cut aid have raised further concerns. French nuclear fuels company Orano, which operates uranium mines in Niger, has assured that its operations continue unaffected.

The United States has taken definitive action in response to Niger’s political upheaval, with the Pentagon announcing the suspension of its security cooperation with Nigerien military forces. This move underscores the gravity of the situation on the ground.

Meanwhile, China has become increasingly invested in Niger, particularly in the exploration of oil and uranium. In 2007, the state-owned China National Nuclear Corporation (CNNC) formed a joint venture with the Nigerien government to develop the Azelik uranium mine located in the center of the country. In 2019, PetroChina, one of China’s largest oil and gas companies, entered into an agreement with the Nigerien government to build a 2,000-km pipeline between the Agadem field and the port city of Cotonou in Benin. China is Niger’s second-largest foreign investor after former colonial power France. Since the coup, China has urged parties in Niger to maintain stability, underscoring its vested interest in the country’s uranium supply.

Furthermore, rising tensions in Niger and the potential suspension of uranium exports to France could force European governments to rethink their relationships with other uranium exporters, like Russia. Such a development could have significant implications for the uranium market and the global nuclear power industry. Granted the party line in the EU is that Niger’s troubles will have little or no effect on the Union’s uranium supply chain. One is left to wonder if the EU is posturing in order to keep Niger’s uranium exports in play.

Technical Implications by Vishal Toora

In my most recent analysis of the uranium market, I told readers that the uptrend remains intact as long as spot uranium stays above $53.30. This remains the higher low and key support zone uranium bulls and traders need to watch.

The chart above shows that higher low and how it printed at the retest of a recent breakout. The technicals remain bullish and the next wave is set to take us to the $60 zone. Check out my article titled, “Uranium to $65 by year end?” for more bullish sentiment.

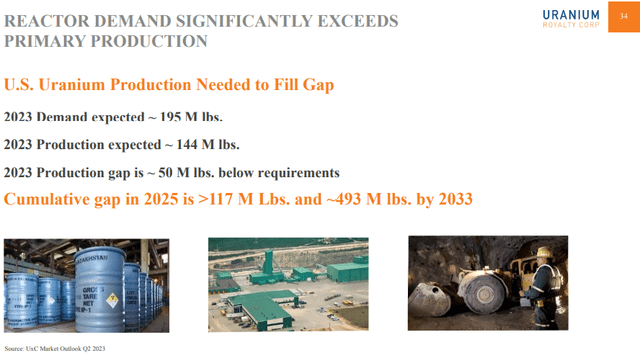

But what about the fundamentals? Well, much of it remains the same: nuclear energy is reliable and produces the least amount of CO2 and will be central to addressing climate change, Russia and geopolitics, and the current supply and demand setup. For more details on these topics, check out this article.

Speaking on geopolitics, it isn’t just Russia we need to worry about now… I am sure you have all heard the news regarding the coup in Niger. The country accounts for about 5% of global nuclear fuel production. They are the world’s seventh largest uranium producer.

Several uranium miners active in Niger issued updates to reassure investors that everything is fine and their operations remain unaffected. Companies such as GoviEx Uranium (GXU.V) and Global Atomic (GLO.TO). Here’s how their charts look:

A quick glance at current price action will tell you that investors are not resting assured that the situation in Niger is stable. There are US and French troops in the country. A small contingent, but France has been making headlines. The European country relies on nuclear energy and the French nuclear fuels company, Orano, has operations in the country.

There have been rumors that the French may intervene militarily. Many have made the assumption that this is to protect the supply of uranium to France. Niger supplies about 15% of France’s uranium needs and accounts for one-fifth of the European Union’s (EU) total uranium imports.

However, the EU nuclear agency Euratom has stated there is no immediate risk to nuclear power production in Europe, and that the EU utilities hold sufficient uranium inventories to last for three years.

Uranium market followers should keep their eyes on the situation in Niger.

Now let’s take a look at a few other charts:

The Sprott Physical Uranium Trust (U.UN) has broken out of an interim range and is now testing a key resistance zone. A breakout above this would be super bullish. Although it appears sellers are stepping in. But there is a real chance for another higher low to be made as long as the stock remains above $16.70.

Meanwhile URA is holding a support zone. Buyers are stepping in and keeping URA above $21.50. A breakout attempt occurred on July 31st 2023, but there was no momentum, and instead, URA dropped confirmed a false breakout. This means there is likely more weakness ahead for URA.

Meanwhile Canada’s largest uranium producer, Cameco, continues its uptrend. A critical support zone being tested currently on this retracement move. If Cameco holds above, the uptrend remains intact.

Global Demand for Nuclear Power

Regardless, all of these factors highlight the growing need for nuclear power to facilitate the transition to green energy. For example, Ontario is on the verge of launching Canada’s first large-scale nuclear project since the early 1990s. The province is bracing for a significant uptick in electricity demand due to an increasing number of electric vehicles and a gradual shift away from fossil fuels in homes and businesses. With a projected requirement of 88.4 gigawatts, nearly double its current capacity, by 2050, Ontario is expected to invest about C$400 billion ($303 billion) in the expansion of its electric grid.

Ontario is already home to 18 out of Canada’s 19 existing nuclear reactors. The province’s two new projects at the Bruce and Darlington nuclear generating stations will add an extra 6,000 megawatts of capacity to the grid once finished. These projects will play a crucial role in meeting Canada’s goal for an emissions-free grid by 2035, provided they stay on schedule.

The United States is making significant strides in the realm of nuclear power, with projects such as the Natrium demonstration plant project underway. The project features a 345 MWe sodium-cooled fast reactor that has a molten salt-based energy storage system. This storage system can temporarily enhance the system’s output to 500 MWe as required, helping the plant to adapt to daily electric load changes and integrate smoothly with inconsistent renewable resources. The chosen site for this demonstration project is Kemmerer, Wyoming near the Naughton power plant due for retirement in 2025. Kemmerer was selected after thorough evaluation and discussions with community leaders and members.

Progress is also being made at the Vogtle site in Georgia, where the first newly constructed nuclear power plant in the US in over 30 years has officially begun generating electricity. Work began on two Westinghouse AP1000 pressurized water reactor units at the Vogtle site in 2013, and the project was taken over by Southern Nuclear and Georgia Power following Westinghouse’s Chapter 11 bankruptcy in 2017. Unit 3 of the Vogtle plant has now reached first criticality, has been connected to the electricity grid, and is currently generating power for customers. Unit 4 of the plant, which has been authorized for fuel loading and operation commencement, is expected to enter service either later this year or in early 2024. Upon completion, the Vogtle site will become the largest generator of clean energy in the US.

In a notable step forward in its nuclear power efforts, China’s State Council has sanctioned the construction of six nuclear power units. These units comprise units 5 and 6 at the Ningde plant in Fujian Province, units 1 and 2 at the Shidaowan plant in Shandong Province, and units 1 and 2 at the Xudabao plant in Liaoning Province. The green light for these projects, which were approved at a State Council executive meeting chaired by Premier Li Qiang on 31 July, represent the first approvals for Chinese nuclear power projects in 2023. This follows the approval of a total of 10 new reactors in the previous year, indicating a continuous commitment to expanding China’s nuclear energy infrastructure.

The United Arab Emirates has made significant strides in its nuclear energy program, with its Barakah nuclear plant playing a key role in ensuring that 25% of global clean energy came from atomic power in 2022, as per a report by the World Nuclear Association. The Barakah power plant, located 230 km west of Abu Dhabi, saw its third unit come online in October 2022. The unit was one of six reactors worldwide that started generating power last year, joining two in China and one each in Finland, Pakistan, and South Korea.

Pakistan reached a notable milestone in its nuclear energy program, with the Executive Committee of the National Economic Council (ECNEC) officially approving the construction of unit 5 of the Chashma nuclear power plant. This approval comes two weeks after Prime Minister Shehbaz Sharif attended the ground-breaking ceremony for the reactor. The new 1200 MWe Hualong One reactor, which is being added to the Chashma site in Punjab, also known as Chasnupp, is already home to four operating Chinese-supplied CNP-300 pressurized water reactors.

Uranium will be in global high demand, which necessitates secure domestic supply chains of the fissionable material. Canada is lucky to have the storied Athabasca Basin which is leading source of the planet’s high-grade uranium and currently supplies about 20% of the market. But we will need more and these Canadian junior uranium explorers could be the ones to give it to us.

The Players

Skyharbour Resources (SYH.V)

Skyharbour Resources (TSX-V: SYH), a uranium exploration company with prime assets in the Athabasca Basin, is poised to capitalize on the anticipated resurgence in the uranium market. The company’s extensive portfolio of uranium exploration projects and strategic joint ventures with industry leaders make it a wise investment for those seeking to benefit from the rising demand for nuclear power. With twenty-four projects covering over 504,000 hectares of mineral claims, Skyharbour is well-positioned to become a major player in the uranium mining industry.

The company recently announced it has acquired by staking seven new prospective uranium exploration claims in Northern Saskatchewan increasing the Company’s total land package to 518,302 hectares across 24 projects. Skyharbour is focused on the co-flagship Russell Lake and Moore Projects, and the new properties will be a part of Skyharbour’s prospect generator business as the Company seeks partners to advance these projects.

The stock is coiling.

The stock remains in a range with support coming in at $0.325 and resistance at $0.365. The bounce at $0.325 is significant given this was a major support zone for the stock. Support is where buyers tend to be and is where the trend shifts.

Skyharbour could be about to see some upside momentum with the stock testing the $0.365 resistance zone right now. A break and close would be the trigger which could set the stock up for a technical move up to the $0.425 zone.

Standard Uranium (STND.V)

Standard Uranium (STND.V), a renowned uranium exploration company, is amplifying its growth strategy. Transitioning from its original exploration-only business model, the company has embraced a wider project generator model. This evolution will enable Standard Uranium to achieve capital efficiency and speed up the development of its exploration projects through joint-venture collaborations, while ensuring upside potential from any new discoveries.

This new trajectory allows Standard Uranium to diversify and bolster its portfolio. Now holding ownership interests in six projects spanning over 65,205 hectares across the uranium-laden Athabasca basin, the company has positioned itself to capitalize on the richness of the region’s resources. With the most recent acquisition of the Rocas project in Northern Saskatchewan, the company is inviting strategic partners to further accelerate progress across its asset portfolio.

The stock has recently printed all time record lows at $0.02. We are now developing a range indicating that the selling pressure is exhausted. This is one to watch for bottom pickers as a range is the technical market structure they look for. A strong close above $0.03 is required to confirm a breakout and momentum. The next resistance zone would come in at the $0.06 zone.

Azincourt Energy (AAZ.V)

Azincourt Energy (AAZ.V) is a Canadian-based resource exploration and development company focused on the alternative fuels/alternative energy sector. Their core projects are in the clean energy space, with uranium exploration projects in the prolific Athabasca Basin, Saskatchewan, Canada, and lithium/uranium projects on the Picotani Plateau, Peru.

The company recently announced its acquisition of the Big Hill lithium project in Newfoundland, signaling a strategic expansion of its portfolio beyond uranium. As the world moves towards a green energy revolution, the demand for both lithium and uranium surges, highlighting the importance of addressing fragile supply chains and resource concentration.

Another one to watch for bottom pickers. The stock has recently printed new all time record lows hitting $0.03. A range is developing which once again, signals the selling exhaustion. The stock must close above $0.045 to trigger a breakout and upside momentum.

As the world marches towards a green energy future, the state of the uranium market will be pivotal in determining the speed and success of this transition. However, navigating the geopolitical landscape will be a significant challenge. This challenge serves as a potent reminder that the shift towards green energy is not only a technological or economic undertaking but also a geopolitical one. It is good to know that explorers like Skyharbour Resources, Azincourt Energy and Standard Uranium are working to develop a secure uranium future.

*Full disclosure: Skyharbour Resources, Azincourt Energy and Standard Uranium are Equity Guru Media marketing clients