If you’ve been following the uranium market and uranium juniors, you probably have less hair on your head due to pure stress or simply pulling it out with your bare hands.

It hasn’t been easy.

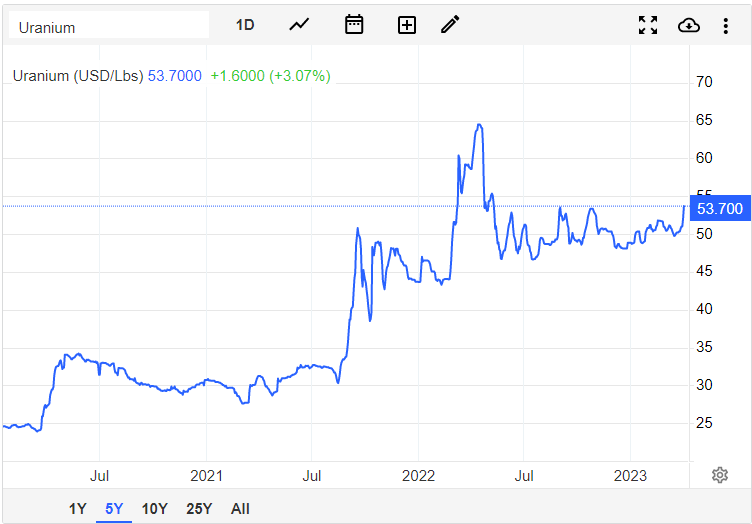

First, the commodity traded sideways for what seemed to be an eternity, not being able to lift off from the $50/lb of U3O8 level. The equities traded lower and lower at the lack of new money into the space.

This has created a fire sale and possibly the opportunity of a lifetime to enter partner companies such as Skyharbour Resources (SYH.V), Azincourt Energy (AAZ.V) and Standard Uranium (STND.V) – if you’ve been following them from the sidelines and they tick your boxes.

But this opportunity may not last that long.

The uranium market

In the uranium space, the good news keeps on flowing. First, long-term contracting is picking up pace. It’s reported that about 88m lbs of uranium has been contracted so far only in 2023. Compare this to the 100m lbs that was traded in all of 2022 and you start getting a feel for this acceleration.

We also see producers filling up their books. Cameco has been on a roll, doing deals left and right and their latest financials contain comments such as “we now have contract commitments of approximately 215 million pounds of uranium and more than 70 million kgU of UF6 conversion services with deliveries spanning more than a decade.”

It’s important to note that for a lot of these contracts, part of the contract is tied to the spot price. So we’re not saying that it’s in the producer’s best interest to bid up the price of the spot market for their own benefit, but for those of you who cannot read between the lines, yes, that’s exactly what we’re saying.

With all of this happening all at once, naturally, the spot price, which in this environment is expected to follow the contracting price, has finally seen a bit of a move. From $50 to $53.50 in a few days.

Is this all? Definitely not. It’s not known when the Swiss investing vehicle will actually start buying up lbs or if they’re in the market already, but word on the street says this bump has been due to traders front-running their purchases. At a certain point, the increased price should put the Sprott Uranium Trust in positive NAV territory, which may get a flywheel effect running where one spurs the other, trending in an upward spiral.

I’m going to go out on a limb and say it: I believe this is the bottom for the uranium market. We’ve been pounding the table for several months on the fundamentals taking place backstage which would, eventually, show up in the price.

I believe this is now.

Newer projects have been struggling with financing and costs, not to mention difficulty in sourcing manpower and materials. Supply is seriously constrained. The Kazhaks, who hold immense control of the market with approximately 40% market share, have tried and failed multiple times at ramping up production.

And demand is coming, with further news of countries going nuclear, such as the US planing to triple capacity in the next 30 years. The US is currently the world leader in nuclear generation and tripling capacity would make most uranium demand models look completely ridiculous. And that’s not even considering other countries’ appetite for small modular reactors.

The great news just keeps on coming and it’ll be bumpy due to the volatile nature of this tiny market, which altogether is smaller than Hershey’s the chocolate company, but unless humanity is willing to go through a literal dark ages, we’re in for quite a ride with uranium.

Technically speaking with Vishal Toora

In recent weeks, I have been very critical of the price action I am seeing on uranium. As a long term investment and play, I remain bullish, but the charts were saying something different when it came to the short or medium term. In those recent articles, I have said now would be a good time to buy, or initiate new positions in uranium stocks you like.

My bearishness came from witnessing reversal price action in the energy sector. We have seen huge drops in energy, and it seems markets are pricing in a recession or some other sort of demand killing event. When oil dumped, uranium did initially fall with it.

And there is real cause for concern if oil closes below $60 in the coming weeks. It would trigger a dirty looking head and shoulders pattern on the weekly timeframe. More lows could be in store for oil and energy. By the way, the head and shoulders pattern has been printed AND triggered on many uranium stocks. Which I will address in just a bit.

With a recession or economic slowdown being priced in, oil won’t be in much demand as before. But of course uranium has its own fundamentals. We have the geopolitical stuff with Russia… and things may be escalating with the Kremlin being attacked by a drone. There is the real chance that Europe and the West will ban all Russian uranium. This would definitely shake up the uranium markets.

Then there is the long term play which is why most of us are uranium bulls. To address climate change, nuclear energy will be required to handle baseload power as it does not release CO2. Governments around the world are changing their stance towards nuclear energy, and this will lead to more modern reactors being built which means an increase in demand for uranium requiring more supply.

In a previous article, I highlighted the $50 zone as an important support area for uranium. Here is the update:

What a response at $50. The major support level held and buyers have pumped up the price. The catalyst?

Uranium prices surged to above $53.5 per pound in early May, the highest in one year, amid optimistic demand and persistent concerns of threats to supply.

The Chinese Nuclear Association stated it is building 24 nuclear reactors, set to expand the 54 commercial reactors currently in operation as the country ramps up efforts to achieve carbon-cutting goals. Nuclear energy output is also expected to pick up elsewhere after the US, France, Japan, UK, and Canada, agreed to form an alliance and leverage resources to jointly shun Russian fuel producers from the global nuclear fuel market. Despite no formal restrictions against the trade of Russian nuclear fuel, utilities have opted for long-term contracts with Western miners, enrichers, and converters to hedge against the possibility of incoming sanctions. Consequently, Canadian Cameco recorded more than doubled its earnings in the first quarter of 2023.

When we zoom out, the uranium chart looks even more interesting. We are testing a resistance zone. This is where profits would be taken and then see a move lower in uranium. However, there is a chance we get a breakout instead. If so, uranium is then on track to test the previous recent highs from April 2022 around $65.

But just wait… I did just say uranium is at a resistance zone. Other uranium charts are also at major resistance. If these charts sell off from here, it is likely uranium prices will do the same.

I have highlighted this chart in previous articles. A head and shoulder was formed and triggered on the Sprott Physical Uranium Trust back on March 7th 2023. Recently, we have pulled back to retest the $16.50 zone but have seen sellers jump in. In order to nullify the current downtrend and reversal pattern, U.UN will need a candle close above $16.50. This has not happened yet which means price could still head lower.

The same can be said about the Global X Uranium ETF. Its neckline comes in much higher at $21.50, but it appears to have set an interim resistance zone around the $20.25 zone. URA is in no man’s land with the stock awaiting a break to give direction.

A stock which has been the centre of attention for current uranium shorts is Uranium Royalty Corp. It is traded on both the US and Canadian exchange.

A major breakdown occurred with a close below $2.20. Now, $2.00 has been taken out with a strong rejection on the retest. More lows look likely and take a look at this:

We have a lot of room to the downside when it comes to the next support level. Bulls would really want $2.00 being recovered. Oh and do you see it? Another head and shoulders reversal set up… which has seen a breakdown and trigger.

So in summary, the technicals remain in a downtrend unless certain price levels are taken out. The head and shoulder patterns remain in play as long as resistance zones hold. Fundamentally, any major geopolitical news can get uranium popping, but one must consider that an economic slowdown may put the building and development of nuclear reactors on hold.

More on the players

Standard Uranium, a Canadian junior uranium exploration company, is focused on discovering high-grade uranium in the Athabasca Basin region of northern Saskatchewan, Canada. Its flagship Davidson River Project, located in the southwest Athabasca uranium district, is in close geological proximity to other major uranium discoveries like Nexgen’s Arrow and Fission’s Triple R. The company aims to find big, high-grade U3O8 resources in the Athabasca Basin, which is known for its significantly higher uranium grades compared to other regions worldwide.

Standard recently announced promising results from geophysical surveys conducted on its three eastern Athabasca basin projects: Atlantic, Canary, and Ascent. The surveys included high-resolution ground gravity, induced polarization (IP)/direct current (DC) resistivity, and airborne time domain electromagnetic (TDEM) surveys. Key drill target areas have been defined for each project based on the positive survey results and historical exploration data. Sean Hillacre, VP Exploration for Standard Uranium, has expressed excitement about the growing discovery potential in the eastern Athabasca projects and the anticipation for drill testing.

Standard Uranium’s exploration strategy involves aggressive drilling campaigns on the Davidson River Project as well as other promising projects like Sun Dog, Atlantic, and Canary. As part of their approach, Standard Uranium is collaborating with Goldspot Discoveries and using their machine learning technology to refine drill targets. At its current price and market cap of $5.58 million CAD, if Standard Uranium successfully discovers high-grade uranium mineralization, the company’s value could skyrocket.

Skyharbour Resources, a leading uranium exploration company with a strong presence in the Athabasca Basin, is well-positioned to take advantage of the anticipated upswing in the uranium market. The company has a diverse portfolio of uranium exploration projects, as well as strategic joint ventures with prominent industry players, making it an attractive investment for those looking to benefit from the increasing demand for nuclear power. Skyharbour’s extensive project list, which includes eighteen projects covering over 460,000 hectares of mineral claims, sets the stage for the company to become a significant force in the uranium mining sector.

One of Skyharbour’s key projects is the Moore Uranium Project, which has demonstrated high-grade uranium mineralization in the Main Maverick Zone and significant discovery potential along the 4.7-kilometer Maverick structural corridor. The project has undergone extensive exploration, with more than $45 million invested and over 150,000 meters of diamond drilling in over 390 drill holes. In 2016, Skyharbour acquired an option to obtain the project from Denison Mines, and it has since fulfilled its earn-in requirements.

In addition to the Moore Uranium Project, Skyharbour has secured the option for the Russell Lake Uranium Project from Rio Tinto, located adjacent to the Moore Project, offering further exploration potential. The company also maintains joint ventures with Orano Canada at the Preston Project, Azincourt Energy at the East Preston Project, and multiple other active option partners. These strategic partnerships enable Skyharbour to leverage the expertise and resources of its collaborators while retaining a carried interest and upside exposure in the uranium exploration projects.

Azincourt Energy Corp. is a Canadian-based resource exploration and development company focused on acquiring, exploring, and developing alternative energy resources. The company’s primary objective is to provide a sustainable, clean energy supply that is both economically viable and environmentally responsible. Azincourt Energy is dedicated to playing a pivotal role in the global shift towards green energy by investing in various projects, including lithium, uranium, and cobalt. These elements are essential components for the production of electric vehicle batteries, solar panels, and nuclear power generation – all of which are integral to the future of clean energy production.

The company’s flagship projects are located in prime regions with a history of resource extraction and exploration. Azincourt Energy’s most notable project is the East Preston Uranium Project, located in the western Athabasca Basin of Saskatchewan, Canada.

In addition to uranium, Azincourt Energy is also focused on lithium exploration and development, an element that is essential for the rapidly growing electric vehicle (EV) industry. The company’s recently acquired Big Hill Lithium Project is a 7,500-hectare Lithium-Cesium-Tantalum (“LCT”) exploration property located in southwestern Newfoundland, Canada, along the south side of the Hermitage Flexure, approximately five kilometres south of the Benton/Sokoman JV partnership discovery of the Kraken Lithium Pegmatite Field.

The Benton/Sokoman JV partnership has also discovered the cesium-tantalum-rubidium-lithium Hydra Dyke which is located 12 kilometres northeast of the Kraken Lithium Pegmatite Field.

The Kraken Lithium Pegmatite discovery features numerous granitic dykes and unmapped pegmatites in a variety of rock types with a strike length up to 40 kilometres in length. The Big Hill Lithium Property is hosted primarily in the Burgeo granite with large enclaves of older mafic paragneiss.

Recent preliminary prospecting at Big Hill has identified four known target areas. Similar structural elements are observed in the Kraken Lithium Pegmatite field although host rocks differ. These targets are known as the River, Road, MK, and Ridge Targets and will be the focus of the initial exploration.

*Full disclosure: Standard Uranium, Skyharbour Resources and Azincourt Energy are Equity Guru marketing clients