When the phone rings and I’m writing, I’ll almost never answer it. My mother knows, and is constantly frustrated, by this. If I’m writing, researching, storytelling, conjuring humour, figuring out marketing strategies, the last thing I need is one of my sales guys using me as Google.

There are two exceptions to this rule; Chinese telemarketers that I can torture (“Nihao huandan!”) for a while and Frank Marasco Jr.

Because I’m a professional storyteller, and Frank puts me to shame.

After 45 years of building and selling businesses, from hotels to trailer parks, liquor stores and nightclubs, shopping malls and real estate developments, Marasco is the big man in town.

Town, in his case, is Red Deer Alberta, where his Big Mountain Development Corp has been a prominent piece of the growth story of that city.

I’ve long been a fan of the nutbars of the public markets; the guys who forge a path all their own and innovate sometimes by accident, by engaging in businesses that others fear, in ways that aren’t down to conventional wisdom. Generation Z knows it as Moneyball, where you zero in on things the market has overlooked, as the majority of your competitors seek the sanctity of what everyone else is doing.

Frank Marasco got into the magnesium game long enough ago that many of the uses for the mineral that drive the market today didn’t exist when he signed on the dotted line.

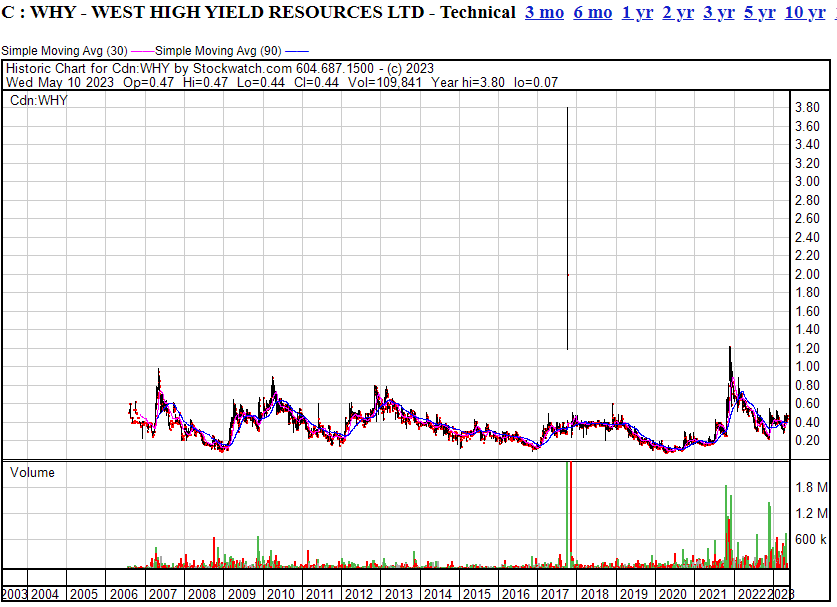

If you want to see his track record you have to hit the “20 year” tab on your stock chart app. I don’t know about you, but I think I’ve hit that tab twice ever.

That’s a hell of a long run for a company that, according to Marasco, has never experienced a day where he’s sold a share since 2006. Never had a rollback. Never gone under.

Just a long road of exploring, raising, exploring, raising, exploring, exploring, exxploring.

To be fair to Frank, over a long enough timeline almost every public company goes to zero, or becomes a different company in a different sector, or drops to a half cent for five years while insiders figure out what to do with it.

But Frank has just moved the ball forward, relentlessly, while the world figured out not only that magnesium is a good thing, but a potentially great thing.

The front of Frank’s website goes into great detail about it – magnesium oxide is a hell of a supplement to keep you healthy. Magnesium inindustry is the lightest structural metal in popular use, magnesium batteries are a cost effective option and easier to source than lithium ion batteries, magensium board is simiilar to drywall but more fireproof, stronger, and has more resistance to moisture and mould. Magnesium fertilizer improves a plant’s ability to bloom and produce fruit.

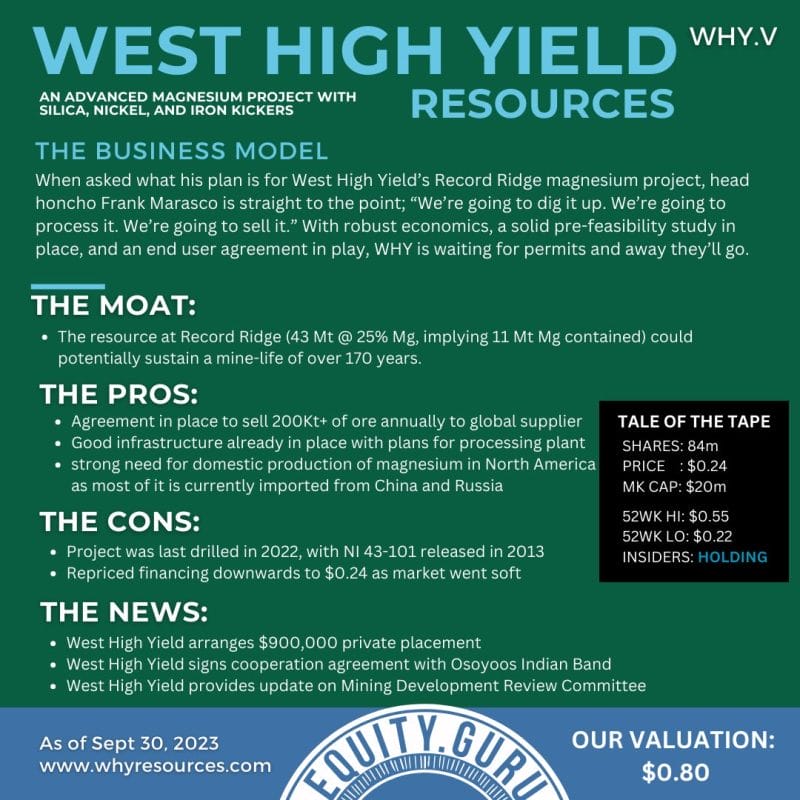

Magnesium is tasty business., if you can find enough of it, and at a grade that’s economic. Traditionally you’re looking at 1% or so on grade, whereas the Record Ridge property Frank is sitting on has hit 25% grade, and it would appear there’s some 10 million tonnes of the stuff.

At this point, we can kind of wrap all this up, can’t we? Multiple end uses, all in keeping with sustainabile needs, all profitable, all beneficial. Plenty of it and at high grade. Long term history of not succumbing to risk, failing markets, or local outrage. Share price that’s held up for almost 20 years. while the company is finally getting into the permitting process.\

To be sure, that process can put a sleeperhold on a lot of companies, especially in BC. Some people won’t invest in BC-based resources because, though there’s plenty of ore around to dig up, the local government hasn’t always been amenable. If you can survive the local population’s fears, and indigienous negotiations, and do enough drilling to make a case that there’s something underground worth digging up, government permitting is almost always a dice roll.

It’s not that you can’t get a mine up in B.C., it’s that the threshold is high. You’ve got to be a good neighbour, a reliable steward of the land, yoiu’ve got to have your ducks in a row on the admin side, and you’ve got to have, more than anythign else, the patience of a saint.

Did I mention Frank’s been at this nearly 20 years?

Now, you’d be within your rights to look at that 20 year span and say, not tonight Josephine. Who’s to say it won’t take 21 years? Who’s to say you won’t get the stock for half the $0.47 it costs today, if you just wait a week, or a month, or a year? What’s the likelihood that the train is leaving the station?

Well, I’m glad you asked. This is us, in November of last year.

The West High Yield chart may not be too exciting right now, but it has some important technical market structure to consider. Yes, the stock has been in a downtrend, but it has begun a narrow range between $0.22-$0.235. A range after a downtrend can often be a strong sign that the selling pressure has exhausted and a new uptrend is about to begin. We just need the breakout to confirm a move higher. The next major resistance comes in at $0.30.

The VERY NEXT DAY:

BOOM. Range broken and we are testing the first resistance zone at $0.30 with the stock up over 45%. Volume is strong with over 615,000 shares traded, well above the daily average of 51,000. It is still early in the trading day, so the stock could actually confirm a close above $0.30 by the end of the day! This would be an important breakout, and the next resistance would come in at the $0.45-$0.475 zone.

That $0.45 zone was not only hit, butWest High Yield largely held that level for the next four months before a lack of news saw it slide to $0.28 in April. But true believers held on and were rewarded when it briefly touched just under $0.50 a few weeks later.

Why the renewed interest?

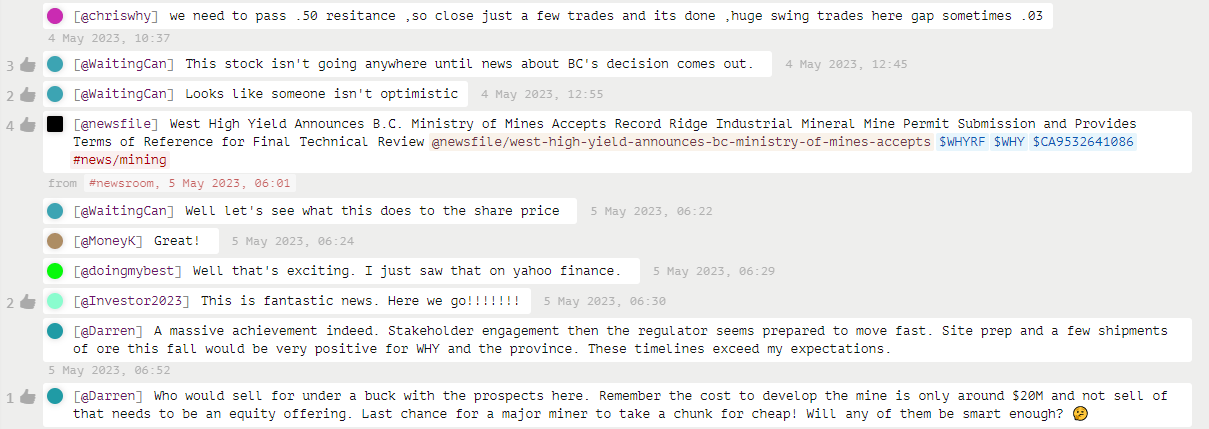

Because after several years of working the government side of things, it appeared maybe, just maybe, news of mining permits was imminent. The company promised it in Q4. Retail investors took note, but not everyone was optimistic. And then.. [hat tip to CEO.CA]

Frank Marasco Jr. can see the finish line on the ultramarathon he’s been running since I’ve been allowed to drink.

On May 3, 2023, the British Columbia Ministry of Mines, having completed the screening process of the company’s initial RRIMM permit application of Feb. 14, 2019 (inclusive of the company’s amended permit application of Feb. 15, 2022), accepted the company’s screened permit submissions and issued the terms of reference and work plan (the TOR and proposed work plan) required for the company to proceed into the final review for the permit. The TOR and proposed work plan timeline indicates a starting date of May 24, 2023. A final recommendations report will be submitted by the committee to the statutory decision-makers for a potential final permit decision as early as Aug. 24, 2023.

[..] the company submitted all material information, mine site engineering designs and corresponding reports requested by the ministry in response to its questions and comments of July, 2022, stemming from its amended permit application for the project.

[..] Upon the permit being granted, the company plans to expedite mine site development for the project and begin mining the ore from RRIM to fulfill the terms contemplated in the letter of intent it signed with APA Galaxy Trade and Technology LLC (as previously news released on Dec. 7, 2021) and to generate cash flow.

Layman’s terms: Shit just got real.

“After years of exploration, detailed analysis, engineering, economic evaluation, consultation and environmental due diligence, we believe that the project at Record Ridge has the potential to deliver much-needed critical minerals that underpin modern society. Upon satisfying all requirements set forth by the ministry and obtaining the permit, the company will move forward in mining ore from RRIM with the hope of providing economic stability with a robust and industry-standard level of safety and environmental stewardship. We also understand the importance of engaging the community, indigenous groups, stakeholders, partners, consultants, shareholders and employees to ensure that the benefits of the project are shared by all. We look forward to moving with the next phase of the project, and serving the current and future generations with the utmost responsibility,” said Frank Marasco, West High Yield’s chief executive officer and president.

Hot damn.

Reports on the ground near Rossland BC state there’s considerable community interest in the open house consultations planned as part of this process, with some of it negative, as is almost always the way. The company understands the importance of that outreach and, in talking to Frank several times leading up to today, I can confirm that he has no interest in pushing forward with anything less than a project that involves and benefits the entire community around the mine.

“Every single business I’ve ever operated has been beneficial to the surrounding area, been overseen by local government and governed in accordance with whatever regulations have been deemed necessary, and ultimately succeeded because of that,” says Frank. “If you’re not a community guy, especially in small towns, the community will almost always show you the road out. We’re going to bring jobs, we’re going to look after the land, we’re going to do more than is asked of us in ensuring the entire community embraces this project for a long time to come.”

“They’ll judge us not on our words, but on our works.”

Back in November, Frank told us he expected this to be the year West High Yield finally showed its colours, and it has done exactly that. With Record Ridge’s resource implying nearly 11 million tons of magneisum is contained, analysts suggest it can potentially support a mine-life of 170 years or more, which is why WHY has already entered into a letter of intent to sell at least 200k tons of ore per year to a global supplier.

The analyst at Fundamental research made a great point that the project economics being used to show a very high IRR of 72%… was conservative.

A recently completed Preliminary Feasibility Study (PFS) returned robust economics, with an AT-NPV5% of US$872M, and a very high AT-IRR of 72%, based on US$1,500/t MgO-98% (in line with spot prices). WHY is trading at just 3% of AT-NPV5%. We believe the PFS was highly conservative as it was based on just 8% of the project’s resource.

Side note worth mentioning: The company has two other BC-based projects in a pair of projects that are JV-ready, and there’s also talk of an in-house process to produce high-quality Magnesium Oxide with zero carbon dioxide emissions, but I like to keep those kinds of side hustles out of my math until I see the whites of their eyes.

Judging West High Yield just ont he progress of Record Ridge, the potential of its magnesium lode, the existing agreement to sell to a global supplier, and the very much increasing trade volume as more people lkearn about the story, this one is an EASY recommend for me.

If you like the jockey, add it to your watchlist.

If you prefer the horse, add it to your watchlist.

And if you just like technicals and can see this is a really interesting set-up, with long-holding stock price, plenty of growth potential on the $37 million market cap, and multi-sector end user exposure that makes this a super green play, roll with us, lads.

— Chris Parry

FULL DISCLOSURE: West High Yield is an Equity.Guru marketing client, and we’re buying.