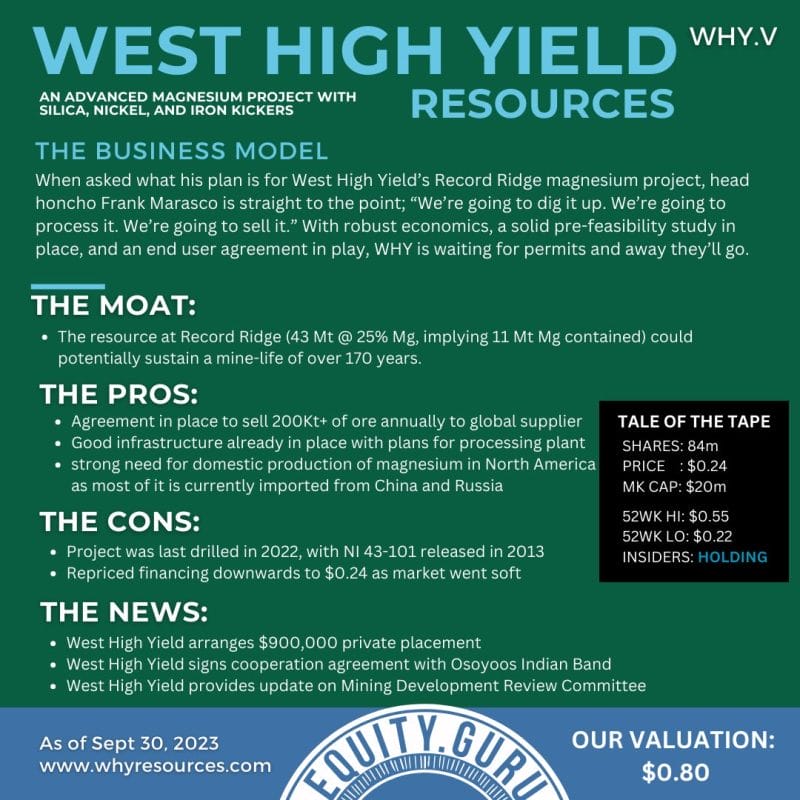

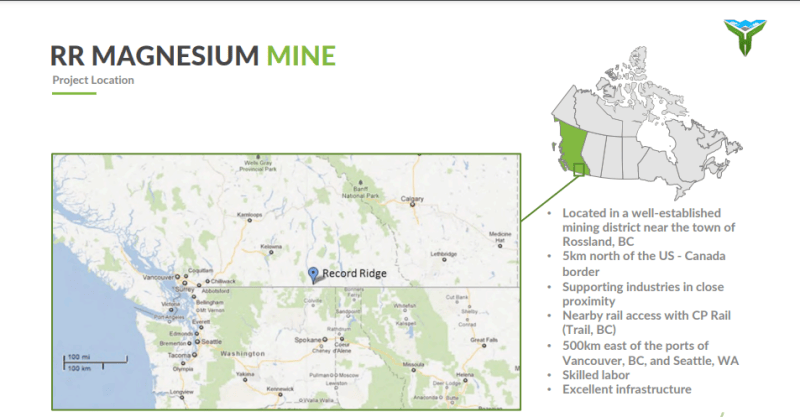

West High Yield resources (WHY.V) is a company with the objective to bring into production one of the world’s largest, greenest deposits of high-grade magnesium. The Record Ridge magnesium deposit is located 10 kilometers southwest of Rossland, British Columbia has approximately 10.6 million tonnes of contained magnesium based on an independently produced preliminary economic assessment technical report.

Full infrastructure is in place with roads, highways, nearby rail, electrical power, water, and natural gas. The Record Ridge deposit is located 2 miles North of the US Border with supporting industries and a nearby rail hub and seaport. This is definitely an advantage, and in my opinion, increases the interest and likelihood of this asset going into production.

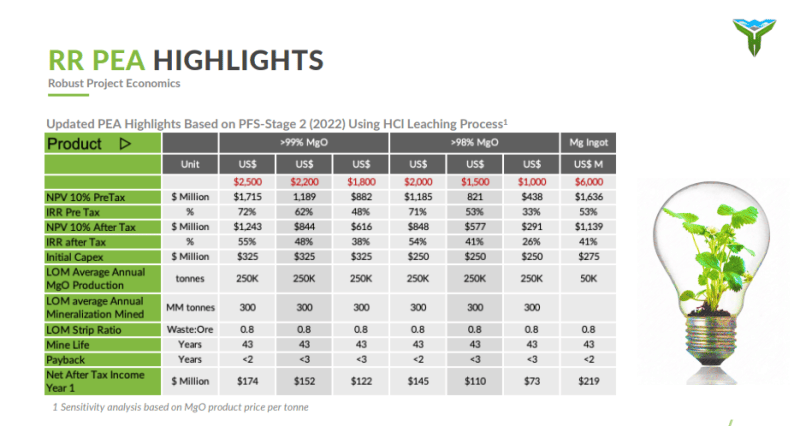

In 2019, West High Yield Resources completed an Environmental Assessment and Environmental Baseline study and also submitted its Mine Plan Permit Application. Micro-plant process testing was also conducted to evaluate alternative processing methods which have yielded positive results that will significantly reduce the capital project costs and therefore improve on the project economics.

A major upcoming catalyst is incoming! West High Yield Resources expects a mine permit in Q4 2022.

What is the major investor takeaway? This is a company with an advanced project which is quite de-risked and has economics to support it. It is all about getting the mine into production. Management will be key, but investors should understand the opportunity in magnesium.

Admit it. Most of you think about magnesium supplements when it comes to magnesium. However, it is a traded commodity and has important uses. Magnesium has various uses in the automotive, cement, aerospace and agriculture industries.

Magnesium is also a US strategic metal and North American magnesium compounds markets depend on imports which represent over 50% of the demand. According to West High Yield’s latest corporate presentation, the current global annual market for all magnesium products exceeds 29M tonnes and demand is growing!

The West High Yield chart may not be too exciting right now, but it has some important technical market structure to consider. Yes, the stock has been in a downtrend, but it has begun a narrow range between $0.22-$0.235. A range after a downtrend can often be a strong sign that the selling pressure has exhausted and a new uptrend is about to begin. We just need the breakout to confirm a move higher. The next major resistance comes in at $0.30.

But I want to draw your attention to the chart of magnesium itself.

The daily chart of magnesium is also ranging just as West High Yield Resources.

If we zoom out to the weekly charts:

Look at that similarity in structure. West High Yield Resources moves with the magnesium price, so investors want to keep their eyes on the commodity.

If we zoom out to the monthly chart of West High Yield Resources, we have a pretty important story to tell.

The chart has price action going back to 2007. As you can see, the stock has been ranging between $0.08 to the downside and $0.95, just under the $1.00 zone, to the upside.

For investors, the support zone is important since it is a major price floor which has held for over a decade. That’s what you call a strong support level!

If the daily range breaks down further, then investors should watch for the price to potentially head towards this decade long support. Remember: support are zones and not just one price level. As you can see from the monthly chart above, the price has sometimes based just above the major support zone. This is common as many technical traders tend to jump in before support so they can nestle their stop losses below the support zone and don’t miss out on the bounce.

Overall, you have a stock here with promising technicals and a great fundamental story with an advanced shovel ready project with great economics. Magnesium isn’t a market as popular and trendy as other commodities, but it is worth paying attention to especially for prudent investors as the commodity is a strategic/critical metal.