This year, one of the largest sector momentum trades was/is AI. The US markets saw AI stocks pop to kick off 2023. Take for example C3.ai under the ticker AI:

BigBear.ai under the ticker BBAI:

We saw the same pop move in Canadian AI names such as FOBI AI:

Big pops at the beginning of the year, and then traders taking some profits leading to a retracement, and you can add market uncertainty as a reason as well.

But if you look at the AI and robotics ETFs, many of them look like this:

These ETFs are composed of big names and players in the sector, and the uptrend continues, proving that long term investing in AI is still a trend.

With AI being a hot theme going forward, it comes as a bit of a surprise for some that the AI company with the most retail trader interest is not surging. Some say this is because most of that retail crowd that piled in when WallStreetBets was making headlines have been destroyed. Others say that the fundamentals of this growth company, especially the earnings part, limits the share price.

Well, things have changed after Palantir’s recent Q1 2023 earnings, which beat analyst estimates.

- EPS: 5 cents adjusted vs. 4 cents expected by analysts, according to Refinitiv

- Revenue: $525 million vs. $506 million expected by analysts, according to Refinitiv

Palantir’s revenue for the quarter increased 18% year over year, and its U.S. commercial revenue grew 26%. The software company, which is known for its work with the government, said its U.S. commercial customer count increased 50% year over year, growing from 103 customers to 155.

But the big news? Profitability. The company reported its second-ever quarter of positive net income on a GAAP basis, at $17 million. Furthermore, Palantir CEO Alex Karp said the Company expects to remain profitable “each quarter through the end of the year”. The stock is popping on the prediction of full-year profitability.

Last quarter, Palantir marked its first-ever quarter of positive net income on a GAAP basis, at $31 million.

Palantir said it expects to report between $528 million and $532 million in revenue during its second quarter and between $2.19 billion and $2.24 billion for the full year.

Maybe something investors already know, but Karp also said that demand for Palantir’s new AI platform is “without precedent”. The platform allows commercial and government sectors to use large language models based on their own private data sets, and it will be available to “select customers” this month.

“We have already had hundreds of conversations with potential customers about deploying the software and are currently negotiating terms and pricing for access to the components of the platform,”

“Every one of those clients needs an AI strategy,” Karp said. “We have unique software for that.”

The first version of Palantir’s AI platform will be made available only to select customers this month. Palantir recently won deals with the US State Department to modernize data management for medical services and with the Australian government to investigate financial crimes. The company will also assist Ukraine’s prosecutor general with the investigation of alleged Russian war crimes.

At time of writing, the stock is up over 22% with a nice post earnings gap up. Volume is huge with over 158,000,000 shares traded on the day. Palantir usually has an average volume of 39,000,000.

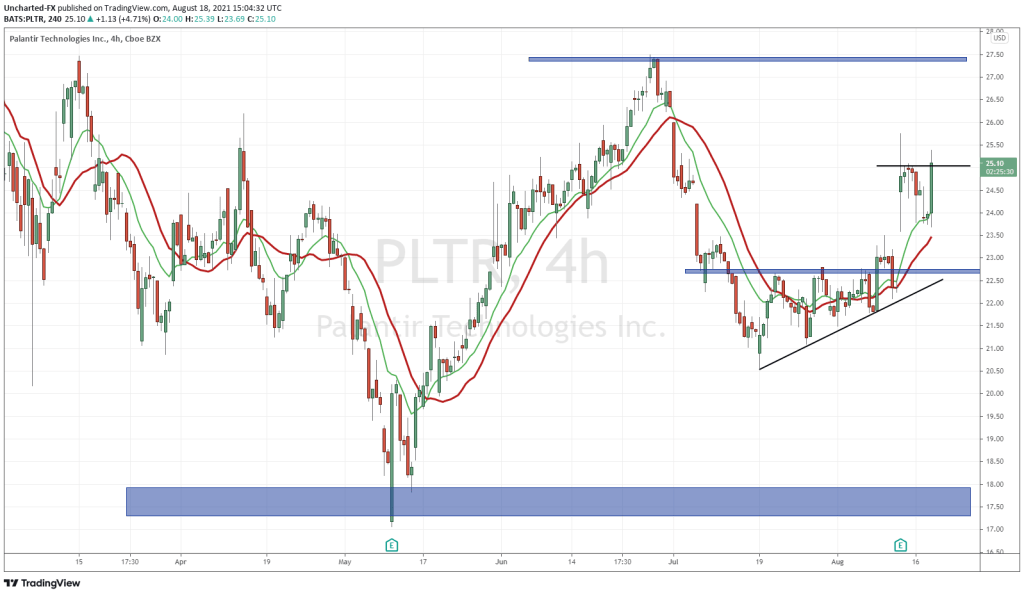

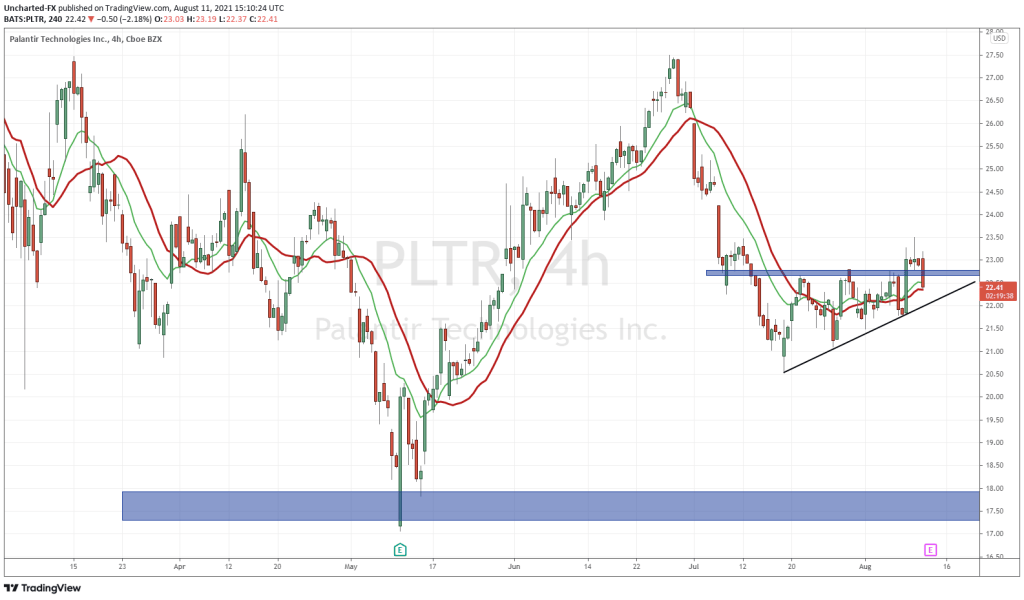

This occurred at a major support zone around the $7.50 zone. In the past, this support printed an engulfing candle which led to a rise starting in mid March 2023. With this pop, the stock is now above the recent highs at $9.00. This can turn out to be an important technical break, but most eyes will be on the $10.00 zone, a major psychological zone for Palantir.

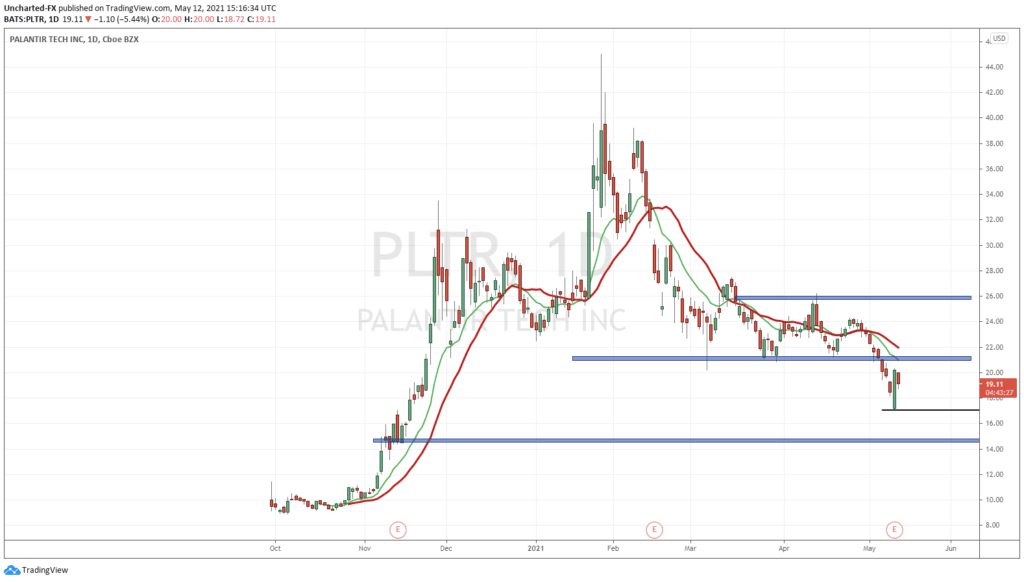

This being said, it appears as if Palantir is now in a new uptrend. Looking to the left of the chart, you can see clearly the stock was in a major downtrend with lower highs and lower lows. Things shifted after the stock printed all time record lows to end off 2022, and then the AI run to kick off 2023. The stock closed above the 50 day moving average, signaling an important trend shift. Now, the Palantir market structure is higher lows and higher highs. A breakout above $10 should be expected if this market structure holds.