Palantir stock is still one of the most popular stocks among the retail crowd. Our videos regarding the stock has been seeing a lot of comments. People are bullish. They believe the stock is going to the mooooon.

For those that prefer a video format, take a look at the Technical Tactics covering Palantir stock.

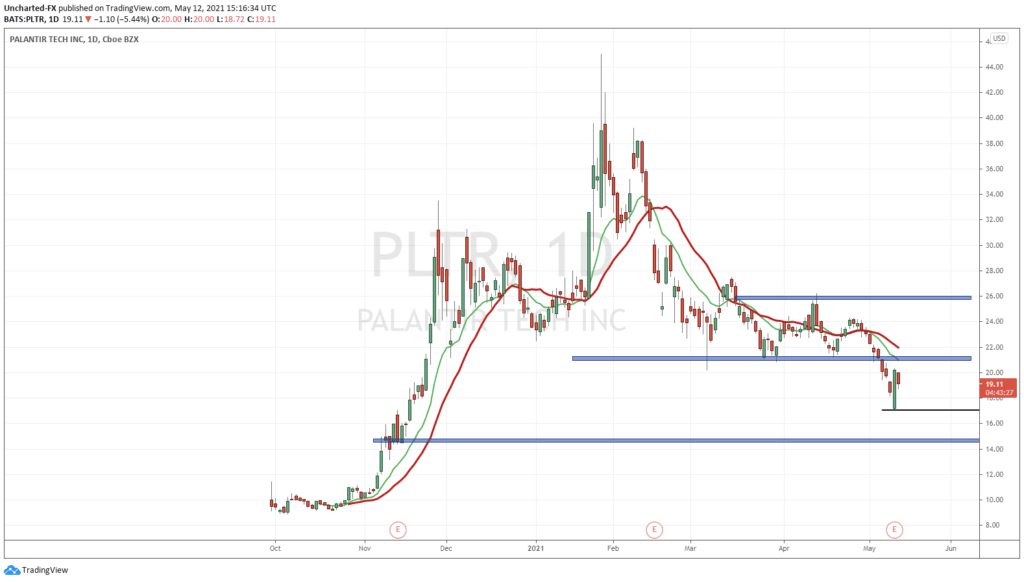

Regular readers of Palantir are familiar with the company, and its chart. It is seen by many as a great long term growth play. Earnings will determine whether that growth has begun.

Cathie Wood over at ARK likes the growth story. ARK’s recent 13F filing shows they increased their PLTR position. Cathie Wood bought the dip. ARK went from holding 18,632,471 shares to now holding 30,681,798 shares, an increase in ownership of 64.67%.

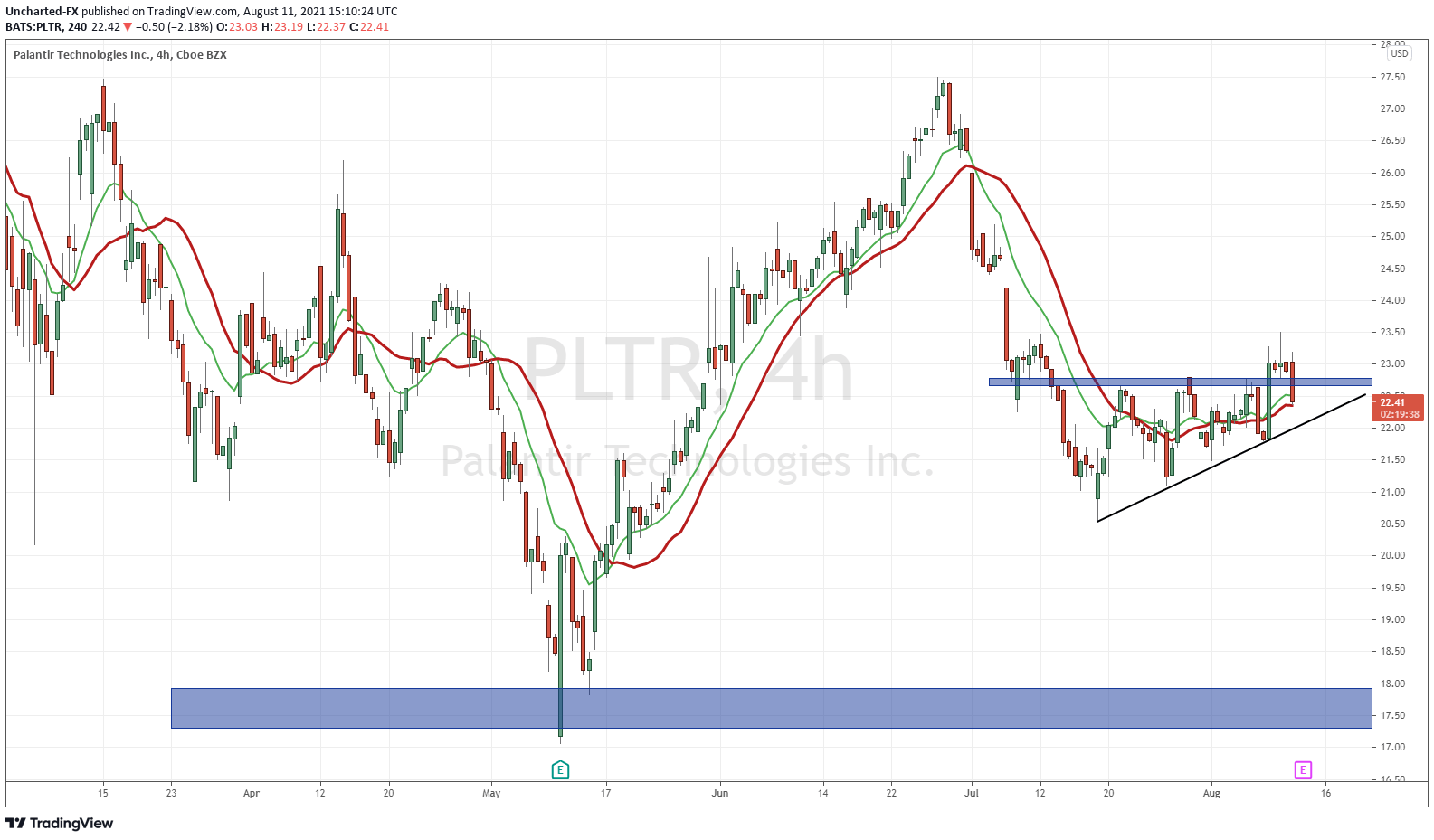

Q1 earnings showed strong growth momentum. You can see from my chart below the run up PLTR had after Q1 earnings. The story going forward is growth and improving economies of scale for profitability.

This is what the street expects:

Analysts expect Palantir to report second-quarter revenue of $361.1 million, up 5.8% sequentially. EPS are forecast to come in at $0.03, down a penny sequentially. For the full year, EPS are expected to total $0.15, down nearly 22% year over year. Revenue is expected to rise 35.6% to $1.48 billion.

Technical Tactics

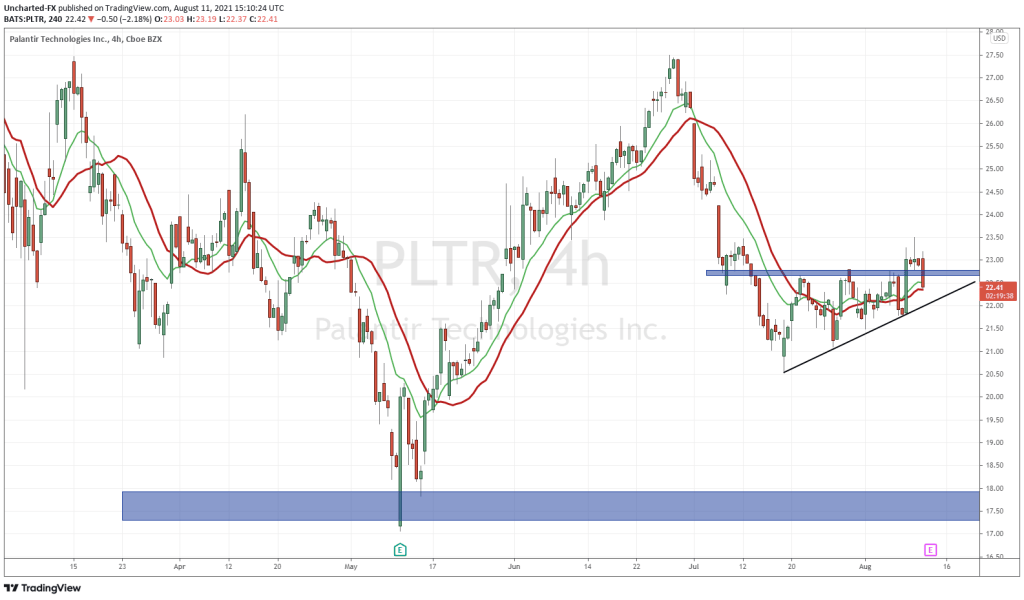

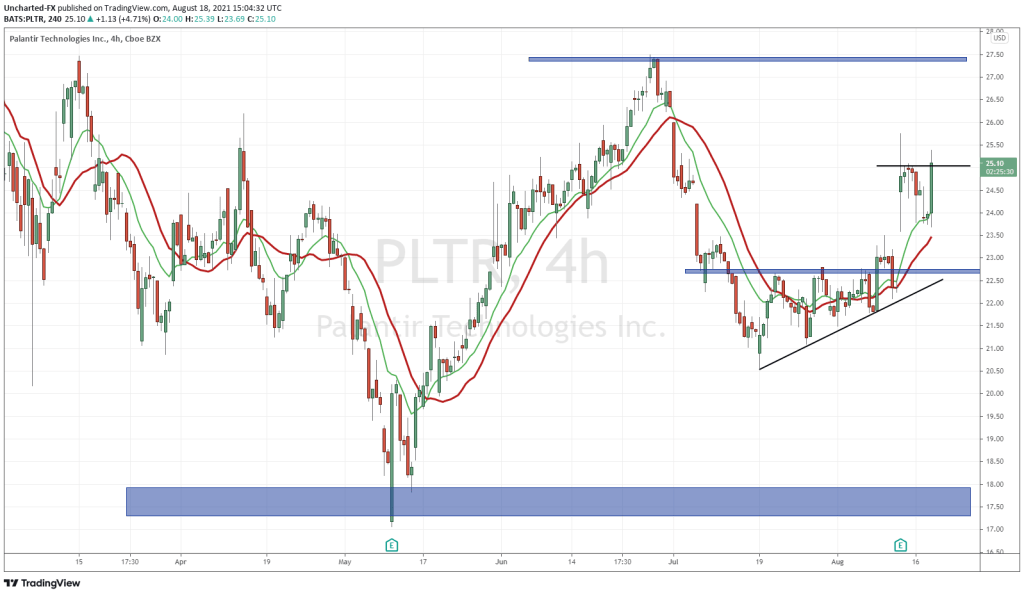

Over on Equity Guru’s Discord Channel, and through our Youtube videos, I have been speaking about this triangle pattern on Palantir stock. Above, I have the 4 hour chart. It is a timeframe I enjoy swing trading as it allows me to enter positions during market hours rather than waiting for daily closes.

Prices were constrained between the triangle levels. A break was imminent. We got that break to the upside earlier this week, but no momentum so far. It makes sense, earnings are on Thursday, so more prudent traders decide to wait until they are released. However, there is something called an earnings run up, where the market prices in earning expectations. In the case of the latter, expectations wouldn’t be too great. Currently, we are trading back BELOW the triangle breakout zone of $22.80. At time of writing, the 4 hour candle closes in 1 hour and 45 minutes. So we have plenty of time for price to reverse and take us back above $22.80.

If we close below the triangle uptrend line…then things start to look pretty bad. The Nasdaq isn’t helping either. The index still remains red while the S&P and Dow printed record highs at one point today. Tech stocks got shook on yesterday reports that SoftBank is dumping US tech shares.

I personally don’t play earnings. Why? Firstly, we never know what the numbers will be. Secondly, even if we can estimate the earning numbers, we never know how the stock price will react. I prefer to wait for the earnings to be released. This is when deciding to enter a new trade. Things are different if I have been holding the swing trade for sometime.

In summary, we had the breakout, but the momentum is not holding. As of now, this looks like a fakeout. The Nasdaq and other index weakness is not helping at all. If Palantir pulls off an earnings surprise, the stock can retake the $22.80 level if it hasn’t by the end of today’s trading day.