Two weeks ago, Canadian bank Toronto-Dominion (TD) became the world’s most shorted bank. Hedge fund bets against TD hit $4.2 billion.

This news raised some concerns for Canadians as hedge funds are clearly shorting TD for some reason. Is it a bet against the Canadian economy? Most analysts agree the short is a sympathy play to the recent US regional bank crisis. Others say this is a bet against Canadian real estate with Canadian banks being the play since mortgages are their top products.

In a previous article, I listed the major factors contributing to the short interest:

Factors Contributing to the Short Interest:

- Exposure to the U.S. regional lenders: The acquisition of First Horizon Corp has raised concerns about TD Bank’s exposure to the U.S. regional lenders, especially in light of the recent regional bank crisis.

- Slowing Canadian real estate market: Some analysts believe that the increased short interest in TD Bank is a bet against the slowing Canadian real estate market.

- Charles Schwab stake: TD Bank’s 10% stake in Charles Schwab, which recently lost a significant portion of its market value, has also contributed to the short interest.

Recently, hedge fund bets against TD hit $6.1 billion, a 45% increase from 14 days. James Shanahan, an analyst at Edward Jones had this to say:

“I think that short interest was elevated by arbitrage investors betting on the (First Horizon) deal … suggesting that the market believes that the deal is at risk of closing,”

“I think the biggest factor is noise around closing of First Horizon and what TD could be paying for it,” said Lemar Persaud, an analyst at Cormark Securities.

Arbitrage investors are event-driven hedge funds which bet on mergers and acquisitions by buying shares of the target and shorting the acquirer’s stock.

5.5% of TD’s outstanding shares were out on loan to hedge funds betting against the company, while the second-most shorted bank stock, Bank of America, only had $2.9 billion, or 1.2%, worth of short bets.

What about other Canadian banks? Bank of Montreal (BMO) and Royal Bank of Canada (RY) have exposure to the US banking system. They have around $2.1 billion and $2.2 billion worth of shares out on loan, respectively.

If the short bet was against Canadian real estate and the Canadian economy, one would expect the other Canadian banks to have larger short positions. This seems to be a case of TD and arbitrage investors, but we will continue to keep an eye on short positions in Canadian banks.

Canadian banks have historically been strong and stable, even during the 2008 financial crisis. Shorting Canadian banks is akin to a ‘widowmaker’ trade.

Credit Crunch?

Banking headlines are not as they were just a few weeks ago when the fear of the banking crisis going global was in the mind of the markets. Fast action by the regulators and the Federal Reserve has calmed fears.

The past week saw bank earnings. The major US banks did well but Goldman Sachs was an outlier on its poor fixed income trading results. US regional banks were a different story.

Many reported deposit outflows for Q1 as customers moved funds to the larger banks on fears of a banking crisis. Shares of Fifth Third Bancorp, Comerica, Truist Financial Corp and Keycorp fell. Only Huntington Bancshares managed to grow total deposits by $472 million from the prior quarter.

Individual regional bank stocks have the similar market structure to the US regional banks ETF, ticker IAT, which I have shown above. A major sell off and breakdown below support in early March due to the banking crisis headlines. Since then, regional banks have begun to range. A range generally is a sign of trend exhaustion, meaning in this case, the downside trend could be over. However, consolidation cannot be considered a bottoming until we see a breakout. Until then, the range could just be a pause in this downtrend.

This means that banking fears and more downside for US regional banks may not be over.

We all know that a bank’s primary business is to lend money. So I was surprised when I saw Morgan Stanley’s co-CIO Jim Caron saying he expects a credit crunch to occur over a long period of time.

“There’s going to be a credit crunch, not a credit crisis. But that credit crunch is going to take place over a long period of time. So, it’s not a sudden shock event that creates a sudden stop in markets, that creates that type of contagion effect that one would normally associate with a more systemic type of a problem,”

His statement is making headlines on financial media. What is a credit crunch? A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates, changes.

In the 1930s, a credit crunch led to a decrease in investment, an increase in unemployment, and a rapid increase in bankruptcies and defaults. The most recent credit crunch in 2007-2008 was caused by an increase in risky sub-prime mortgages, or some would say, predatory lending targeting low-income homebuyers. Excessive risk-taking by global financial institutions is usually a telling sign they are doing whatever necessary to make some money.

With interest rates high and banks not lending as much as before due to higher rates, inflation, uncertainty, and a possible recession, this could be a set up for a coming credit crunch. Some would argue a financial crisis given the derivatives large banks have now compared to the GFC, which would be compounded by less deposits and less lending.

TD Technical Analysis

In my first TD article, I told readers that I was intrigued by the weekly chart set up. Technical analysis is about price action. Looking at certain patterns and structure can give you a good idea where the markets are going and what big money is pricing in.

If big money knows something, then I, and many others, are not privy to this information. However, as I have explained in many of my technical analysis articles, the charts tend to tell us (rather show us) what big money is doing. And in a spooky way, can tell us the news before it happens.

The daily chart hasn’t changed much. Our top resistance level is still in play, and you can see that bulls have hit a wall of sellers as the stock has ranged around the $84 resistance zone for four trading days. At time of writing, we have a large red candle indicating the sellers are beating out the bulls and that the downtrend could continue.

But the weekly chart is where things get interesting:

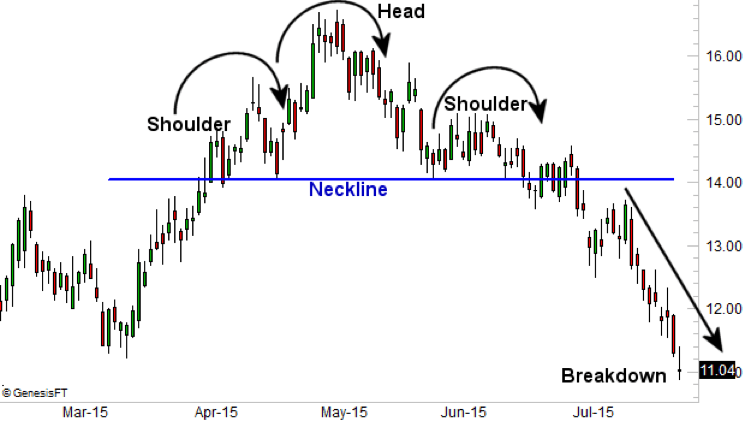

The weekly chart still shows a popular reversal pattern known as the head and shoulders being printed. This hints at a longer term move down to the $65 zone and then possibly $50. However, the pattern has not been triggered!

We did bounce at the neckline support, but the selling pressure here at the $84 zone could see TD testing the major support neckline once again. This time, sellers may have enough strength to cause the break.

Once we get a weekly candle close below $76.50, the short trade is on and the reversal pattern will be triggered.

In my opinion, the hedge fund traders likely see this reversal pattern as technical analysis is part of their routine when looking for opportunities in the markets. Technicals can map out good risk vs reward set ups, and this head and shoulders pattern provides a great set up for medium to long term based funds.

The TD Bank Was fined $1.5 billion for illegal trading in the U.S. markets. TD was likely also funding naked sellers of shares all over the security markets, the U.S. and Canada. Now they are probably being attacked by this same market makers and dealers the TD funded. There is no discloser required by market regulators on who is doing the naked shorting. No ability to defend yourself as a public company.

The naked shorters have no conscience nor concern for who they short. They provide corporate financing to help small market capital companies rejected by banks like TD and then they naked short this same company out of existence in many cases, reaping many times over the financing they put forward by their naked shorting that company.

Live by the sword and die by the sword are the business ethics in the United States.