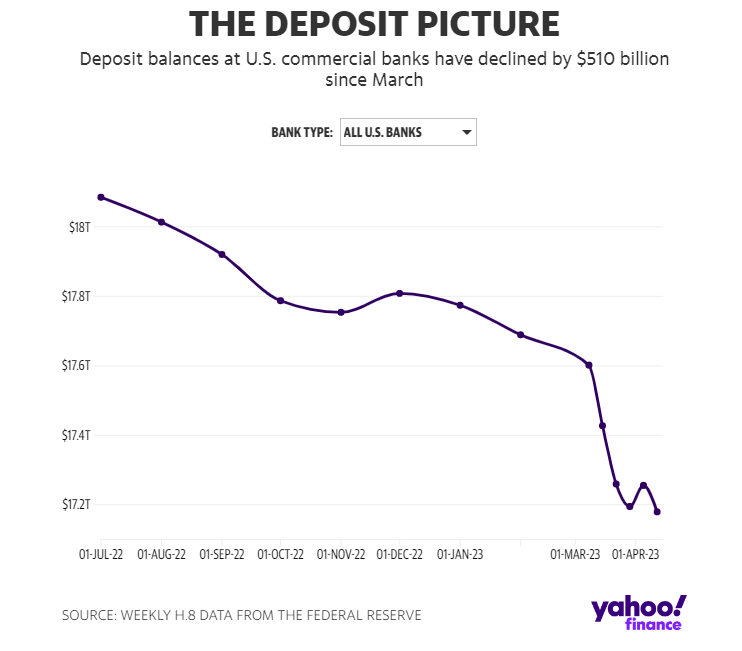

As earnings continue to come out mixed, and raising the probabilities of an upcoming recession, leave it to the regional banks to once again take center stage. Many analysts warned that the regional bank crisis is not over when you consider the fact that deposits are shrinking, lending (a bank’s primary business) is slowing, and banks cannot play treasuries by using cheap money to buy long term bonds. All of this exacerbated with inflation and rising interest rates, the regional banks are feeling the pain.

This past week saw bank earnings. The major US banks did well but Goldman Sachs was an outlier on its poor fixed income trading results. US regional banks were a different story.

Many reported deposit outflows for Q1 as customers moved funds to the larger banks on fears of a banking crisis. Shares of Fifth Third Bancorp, Comerica, Truist Financial Corp and Keycorp fell. Only Huntington Bancshares managed to grow total deposits by $472 million from the prior quarter.

But all eyes were on First Republic Bank earnings given the recent banking crisis headlines of early March 2023. The troubled regional bank said deposits fell 40.8% to $104.5 billion in Q1. This flight was worse than expected with analysts expecting the figure to be around $145 billion. First Republic then stated in their press release:

“Deposit activity began to stabilize beginning the week of March 27, 2023, and has remained stable through Friday, April 21, 2023. Total deposits were $102.7 billion as of April 21, 2023, down only 1.7% from March 31, 2023, primarily reflecting seasonal client tax payments that occur each April,”

It is important to note that the deposit figure included $30 billion in time deposits from 11 larger banks announced on March 16th in an attempt to stabilize the banking system. If those deposits were excluded, First Republic’s deposits would have fallen by more than 50%.

“I would also like to reiterate our appreciation for the group of America’s largest banks who placed $30 billion in uninsured deposits with us, as well as for our state and federal regulators who have continued to provide us with expert support,” CEO Michael Roffler said on the earnings call.

The bank however did beat Wall Street estimates on the top and bottom lines reporting $1.23 in earnings per share on $1.21 billion of revenue when estimates penciled in 85 cents of earnings per share on $1.15 billion of revenue.

The bank said it is now pursuing “strategic options” to improve its capital position, a plan that could include asset sales to raise money, or the creation of a so-called bad bank — where any toxic or money-losing assets would be carved off and placed into a new entity, leaving the remaining bank healthy.

What was the result of the stock price? Shares fell nearly 50% on the earnings report.

At time of writing, the stock is down -18.33% and sits at a market cap of over $1 billion.

You can see the breakdown began with the banking crisis, and then the stock began to range after quick action from the Fed and regulators alleviated banking fears. But the disappointing earnings has caused a breakdown.

I want to highlight something I told readers in my recent article regarding the increased short position on Canadian Bank Toronto-Dominion.

I highlighted the US Regional Banks ETF ticker IAT. Here is how the chart looks now post First Republic earnings:

We are still holding onto the bottom support of this range. In fact testing it on the day of writing.

Here is what I said in that article:

Individual regional bank stocks have the similar market structure to the US regional banks ETF, ticker IAT, which I have shown above. A major sell off and breakdown below support in early March due to the banking crisis headlines. Since then, regional banks have begun to range. A range generally is a sign of trend exhaustion, meaning in this case, the downside trend could be over. However, consolidation cannot be considered a bottoming until we see a breakout. Until then, the range could just be a pause in this downtrend.

This means that banking fears and more downside for US regional banks may not be over.

And banking fears seem to have returned after this move lower in First Republic Bank shares. What the bank does next is what investors are trying to figure out. Some say First Republic will try to persuade some of the banks which participated in the $30 billion rescue package in March to purchase First Republic’s underwater bonds at above market rates for a loss of a few billion. This means those rescue banks would have to eat and absorb some of the losses, but it would be less than what they would have to pay to the Federal Deposit Insurance Corporation if regulators were to seize First Republic.

According to Yahoo Finance, a source familiar with the matter told the financial website that First Republic has a potential to avoid being seized by regulators but it will require assistance from the US government:

“There is an open bank path solution here, but it’s a matter of the government needing to convene to bring all the parties together to make it happen,” this person said.

Pressure is mounting on First Republic Bank… and one can argue there is some pressure on the Federal Reserve who are expected to raise interest rates next week on May 3rd. A pause is expected at this meeting after a 25 basis point rate hike. But some say it might cause the Fed to rethink when they are hiking when regional banks and the banking system are wobbling.

For those in the Equity Guru discord group, I have talked about risk off assets moving, hinting at perhaps some trouble ahead. Most agree the trouble is recession, but the recent move in First Republic may exacerbate the fears.

The US stock markets continue to be held within their range. Tuesday April 25th saw the markets take a hit but the uptrends remain intact. It is worth noting the S&P 500 is battling at a major resistance zone. These zones are generally where a trend reversal begins. However a breakout would be very bullish and mean the continuation of the uptrend.

There was also a big move in bonds on April 25th causing fears of a risk off move. Bonds though are not being bid up the following day.

The US Dollar remains in a range at support and in a recent article, I highlighted the engulfing candle which could be hinting at a new Dollar uptrend. We still remain above the long zone meaning a new trend reversal could be in the cards. Some wonder what the catalyst would be given the moves in de-dollarization. Perhaps the Fed remains hawkish, or perhaps we see money run into the dollar due to a risk off move. When things around the world are crazy, and there is real fear, money runs into the US Dollar.

What gets me a bit intrigued is the move in the currencies people consider the safe haven from the safe haven.

The Swiss Franc has been incredibly strong against all currencies. It has actually printed new record highs against the Canadian Loonie and will soon against other currencies such as the Australian Dollar and the New Zealand Dollar. When I see wealth running into the Swiss Franc, I am on watch. Money runs to Switzerland when big things are coming. A few years ago we saw a big move in EURCHF and I told readers that something is coming as European wealth is running into Swiss bank accounts. The Russian invasion of Ukraine came shortly after.

The Japanese Yen has printed large engulfing candles at major resistance zones on multiple pairs. When we see fear or market sell offs, money runs into the Yen. This move could be due to some risk off fears, but we must remember there is also a huge Bank of Japan central bank meeting this week and traders could just be positioning themselves for it.